1 Third Quarter 2023 Corporate Update November 8, 2023 Exhibit 99.2

2 Forward-Looking Statements Certain statements in this Presentation contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including statements about the financial condition, results of operations, earnings outlook and prospects of PureCycle Technologies, Inc. (“PCT”). Forward-looking statements generally relate to future events or our future financial or operating performance and may refer to projections and forecasts. Forward-looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions (or the negative versions of such words or expressions), but the absence of these words does not mean that a statement is not forward-looking. The forward-looking statements are based on the current expectations of the management of PCT and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of this presentation. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section of PCT’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 entitled “Risk Factors,” those discussed and identified in other public filings made with the U.S. Securities and Exchange Commission (the “SEC”) by PCT and the following: PCT’s ability to obtain funding for its operations and future growth and to continue as a going concern; PCT's ability to meet, and to continue to meet, applicable regulatory requirements for the use of PCT's UPR resin in food grade applications (including in the United States, Europe, Asia and other international locations); PCT's ability to comply on an ongoing basis with the numerous regulatory requirements applicable to the UPR resin and PCT's facilities (including in the United States, Europe, Asia and future international locations); expectations and changes regarding PCT's strategies and future financial performance, including its future business plans, expansion plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and PCT's ability to invest in growth initiatives; the ability of PCT's first commercial-scale recycling facility in Lawrence County, Ohio (the “Ironton Facility”) appropriately certified by Leidos Engineering, LLC, following certain performance and other tests, and commence full-scale commercial operations in a timely and cost-effective manner; PCT's ability to complete the necessary funding with respect to, and complete the construction of t, (i) its first U.S. multi-line facility, located in Augusta, Georgia (the “Augusta Facility”); (ii) its first commercial-scale European plant located in Antwerp, Belgium and (iii) its first commercial-scale Asian plant located in Ulsan, South Korea, in a timely and cost-effective manner; PCT's ability to sort and process polypropylene plastic waste at its plastic waste prep ("Feed PreP") facilities; PCT's ability to maintain exclusivity under the Procter & Gamble Company license; the implementation, market acceptance and success of PCT's business model and growth strategy; the success or profitability of PCT's offtake arrangements; the ability to source feedstock with a high polypropylene content at a reasonable cost; PCT's future capital requirements and sources and uses of cash; developments and projections relating to PCT's competitors and industry; the outcome of any legal or regulatory proceedings to which PCT is, or may become a party, including the securities class action case; geopolitical risk and changes in applicable laws or regulations; the possibility that PCT may be adversely affected by other economic, business, and/or competitive factors, including rising interest rates, availability of capital, economic cycles, and other macro-economic impacts; turnover or increases in employees and employee-related costs; changes in the prices and availability of labor (including labor shortages), transportation and materials, including significant inflation, supply chain conditions and its related impact on energy and raw materials, and PCT's ability to obtain them in a timely and cost-effective manner; any business disruptions due to political or economic instability, pandemics, armed hostilities (including the ongoing conflict between Russia and Ukraine); the potential impact of climate change on PCT, including physical and transition risks, higher regulatory and compliance costs, reputational risks, and availability of capital on attractive terms; and operational risk. Should one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of PCT prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. All subsequent written and oral forward-looking statements or other matters attributable to PCT or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Presentation. Except to the extent required by applicable law or regulation, PCT undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date of this Presentation or to reflect the occurrence of unanticipated events.

3 Ironton Plant Update IRONTON FACILITY PROGRESS • Core operations are improving daily; Utilities uptime is averaging 97%, Solvent circulation uptime increased from 47% in July, to 96% in late October • Tech works at scale; despite mechanical challenges, we’ve successfully run 409k lbs feedstock • Achieved these unit operations rates during commissioning: PreP Feed: 14.0k lbs/hr (93%) Feed extruder: 9.4k lbs/hr (77%) Final Product: 13.4k lbs/hr (109%) * Rate percentages are referenced to 107MM/yr capacity • Processed 4 separate PIR feedstocks (MFI 5, 10, 15, 20) and 2 types of PCR (PreP Agglomerate and PreP Flake) • On-test product quality performance w/ removal of co-product #1; running various PIR feeds with varying levels of PCR content • Early utility usage appears significantly better than design premise • Attractive core business economics; low #5 bale price, low variable costs, differentiated product Overview Ironton Growth Finance

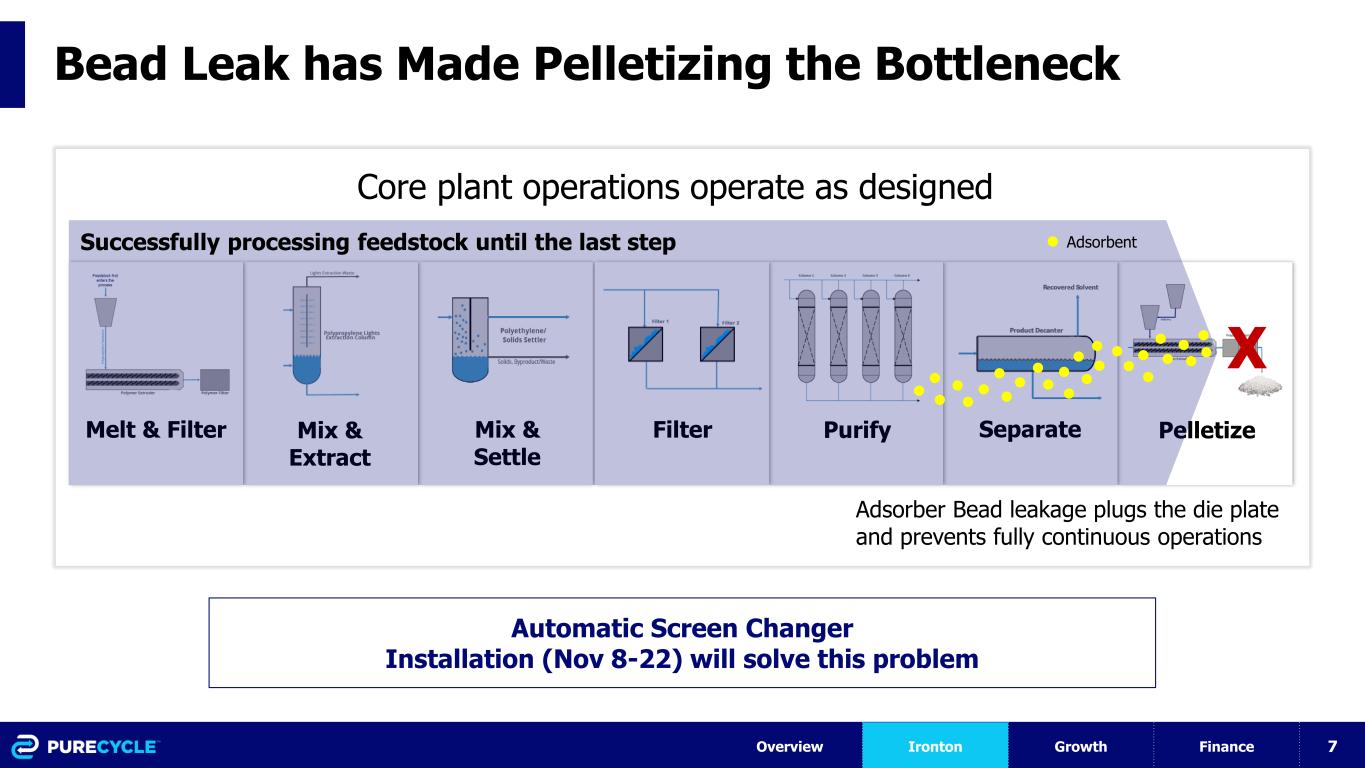

4 Ironton Plant Update IRONTON FACILITY CHALLENGES • Replaced numerous design and installation challenges with permanent solutions • Ironton continuous operations were primarily impaired due to persistent adsorber bead plugging of the final product extruder pelletizer; this requires the installation of a screen changer • Executing 2-week outage planned for November 8-22 to implement the final product screen changer and other reliability projects Overview Ironton Growth Finance

5 Ironton Plant Update IRONTON OPERATIONAL TARGETS • Complete 2-week outage • Plan to initiate plant restart procedures immediately following the outage • Start rates @50% and ramp to 100% • Complete the 4.45MM lbs milestone (December) • Targeting 7-Day performance test prior to the February deadline Overview Ironton Growth Finance

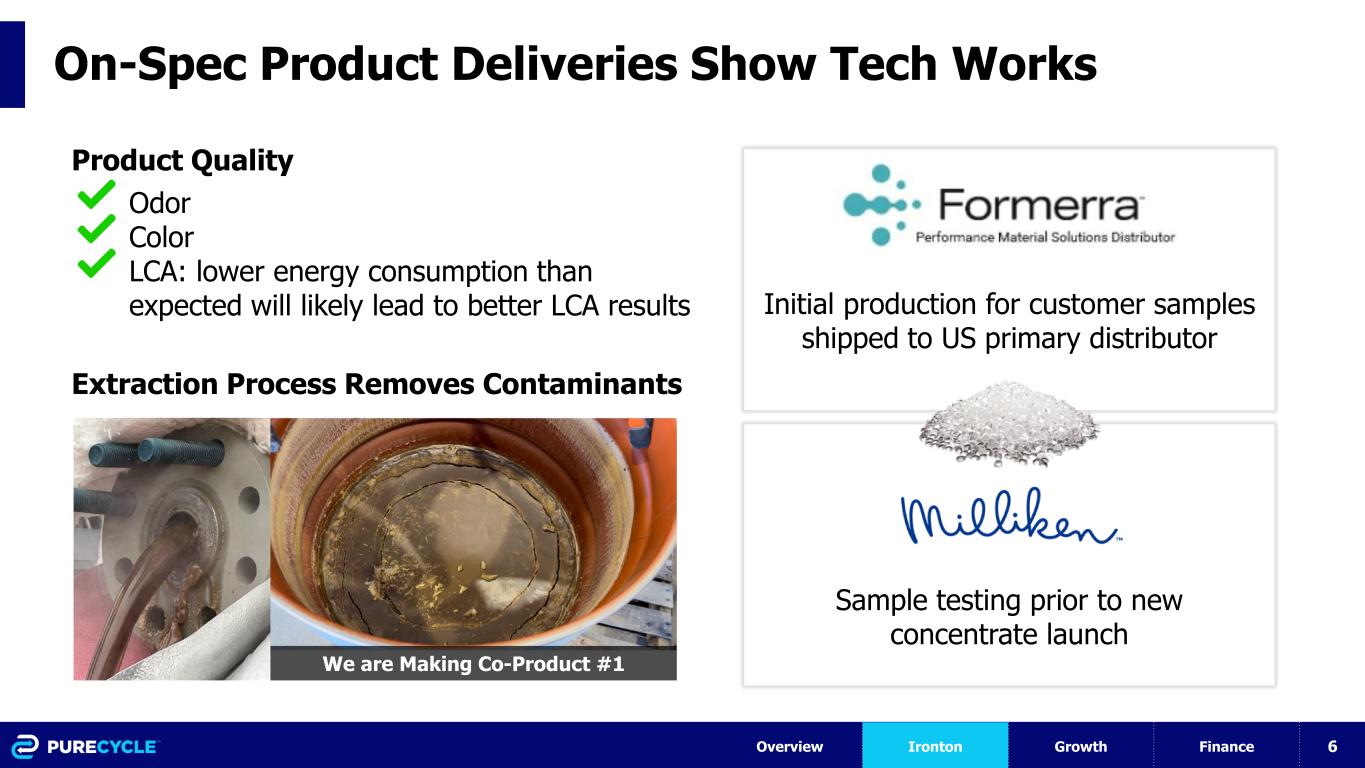

6 On-Spec Product Deliveries Show Tech Works Overview Ironton Growth Finance Initial production for customer samples shipped to US primary distributor Product Quality • Odor • Color • LCA: lower energy consumption than expected will likely lead to better LCA results Extraction Process Removes Contaminants We are Making Co-Product #1 Sample testing prior to new concentrate launch

7 Melt & Filter Mix & Extract Mix & Settle Purify Separate Pelletize z Filter Bead Leak has Made Pelletizing the Bottleneck Overview Ironton Growth Finance X Adsorber Bead leakage plugs the die plate and prevents fully continuous operations Successfully processing feedstock until the last step Adsorbent Core plant operations operate as designed Automatic Screen Changer Installation (Nov 8-22) will solve this problem

8 Persistent Leaking Beads Took Time to Solve Overview Ironton Growth Finance Prototype #1 Initial Problem Interim Solutions Install automated screen changer during outage Prototype #2: attempted in Oct; Unsuccessful test run and returned back to prototype #1 Solution Purging to remove beads New screen changer is onsite and scheduled for installation during the November outage Beads behind leaking weld Significant bead leakage

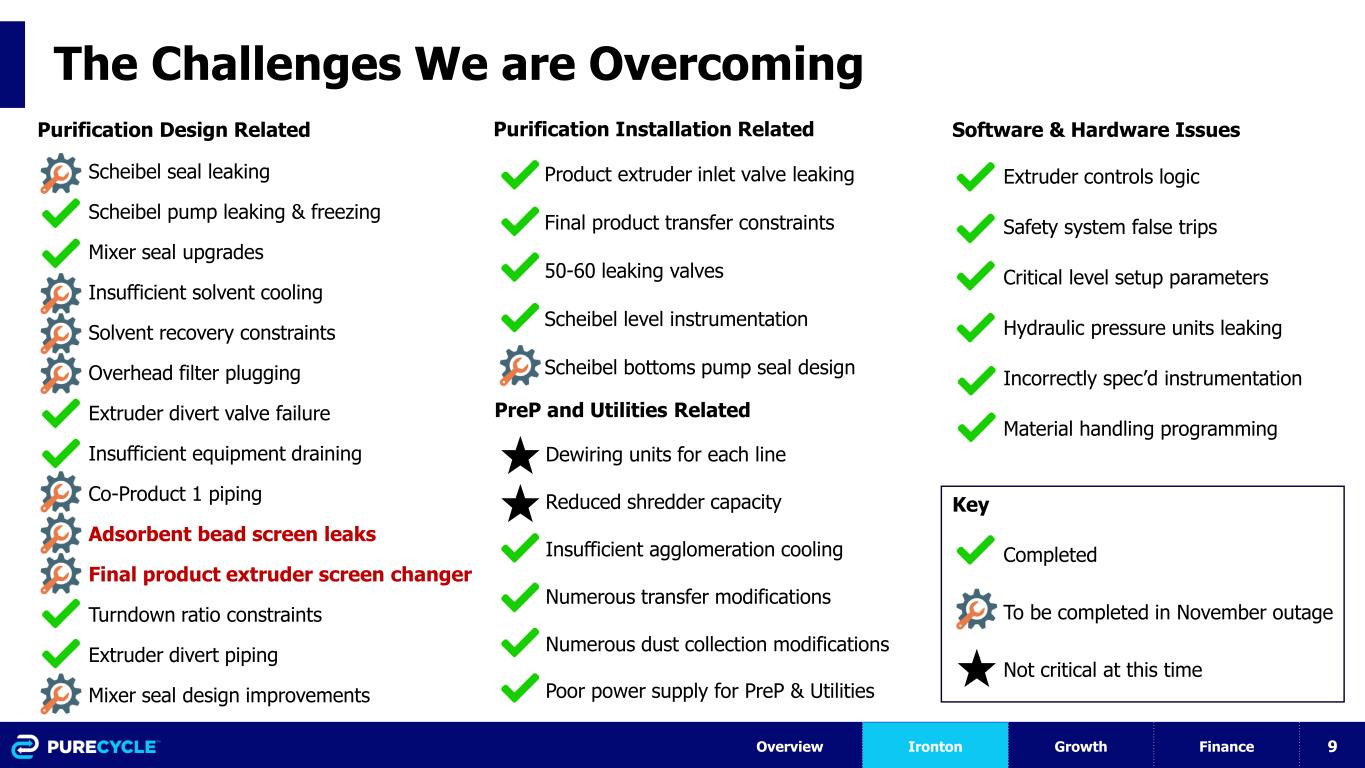

9 The Challenges We are Overcoming Purification Design Related Scheibel seal leaking Scheibel pump leaking & freezing Mixer seal upgrades Insufficient solvent cooling Solvent recovery constraints Overhead filter plugging Extruder divert valve failure Insufficient equipment draining Co-Product 1 piping Adsorbent bead screen leaks Final product extruder screen changer Turndown ratio constraints Extruder divert piping Mixer seal design improvements Purification Installation Related Product extruder inlet valve leaking Final product transfer constraints 50-60 leaking valves Scheibel level instrumentation Scheibel bottoms pump seal design Software & Hardware Issues Extruder controls logic Safety system false trips Critical level setup parameters Hydraulic pressure units leaking Incorrectly spec’d instrumentation Material handling programming PreP and Utilities Related Dewiring units for each line Reduced shredder capacity Insufficient agglomeration cooling Numerous transfer modifications Numerous dust collection modifications Poor power supply for PreP & Utilities Key Completed To be completed in November outage Not critical at this time Overview Ironton Growth Finance

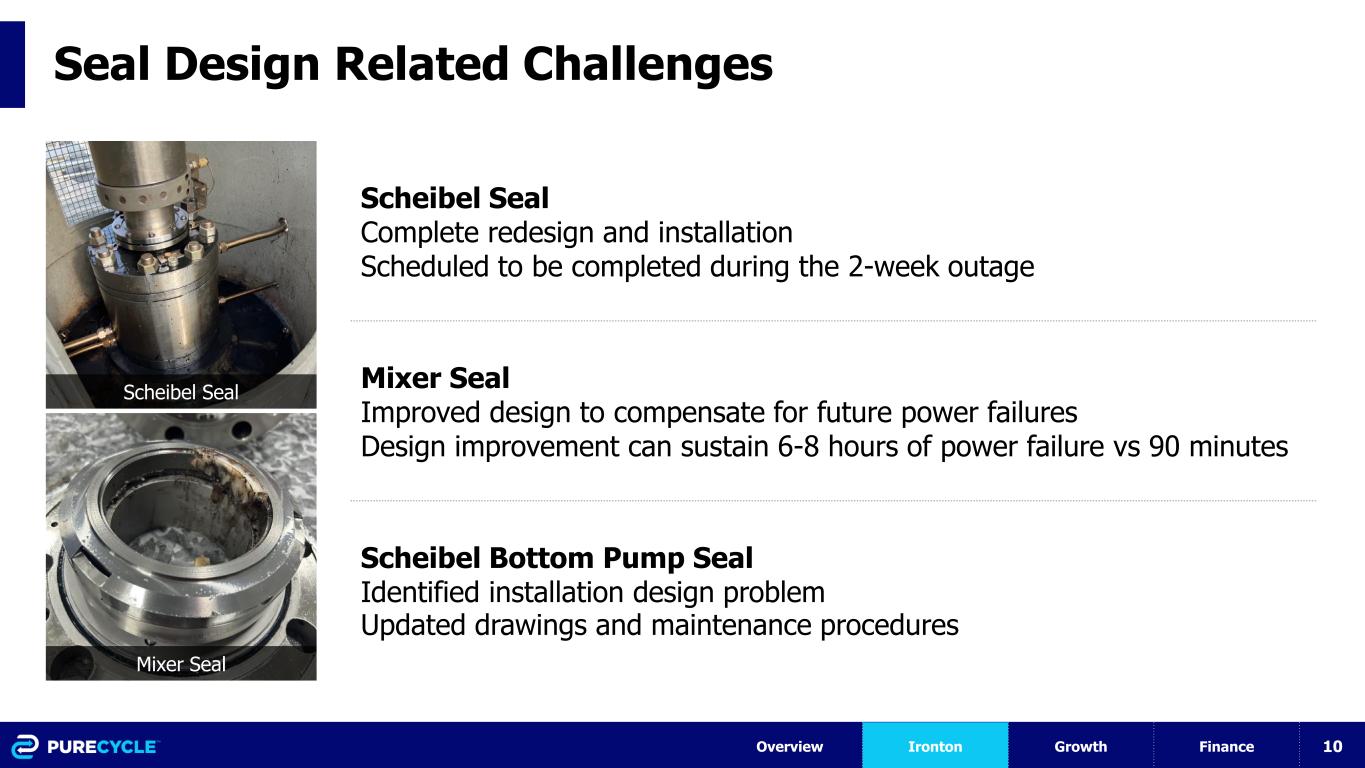

10 Seal Design Related Challenges Scheibel Seal Complete redesign and installation Scheduled to be completed during the 2-week outage Mixer Seal Improved design to compensate for future power failures Design improvement can sustain 6-8 hours of power failure vs 90 minutes Scheibel Bottom Pump Seal Identified installation design problem Updated drawings and maintenance procedures Scheibel Seal Mixer Seal Overview Ironton Growth Finance

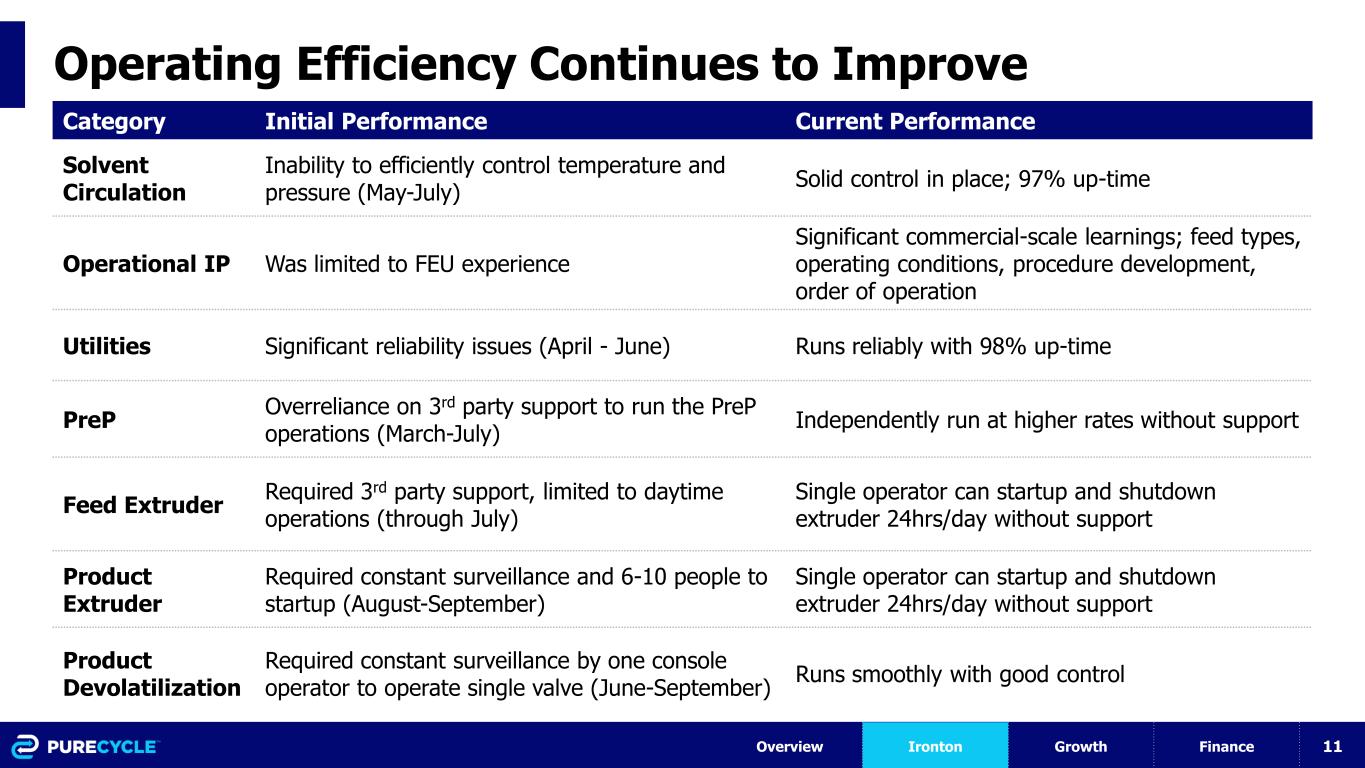

11 Operating Efficiency Continues to Improve Category Initial Performance Current Performance Solvent Circulation Inability to efficiently control temperature and pressure (May-July) Solid control in place; 97% up-time Operational IP Was limited to FEU experience Significant commercial-scale learnings; feed types, operating conditions, procedure development, order of operation Utilities Significant reliability issues (April - June) Runs reliably with 98% up-time PreP Overreliance on 3rd party support to run the PreP operations (March-July) Independently run at higher rates without support Feed Extruder Required 3rd party support, limited to daytime operations (through July) Single operator can startup and shutdown extruder 24hrs/day without support Product Extruder Required constant surveillance and 6-10 people to startup (August-September) Single operator can startup and shutdown extruder 24hrs/day without support Product Devolatilization Required constant surveillance by one console operator to operate single valve (June-September) Runs smoothly with good control Overview Ironton Growth Finance

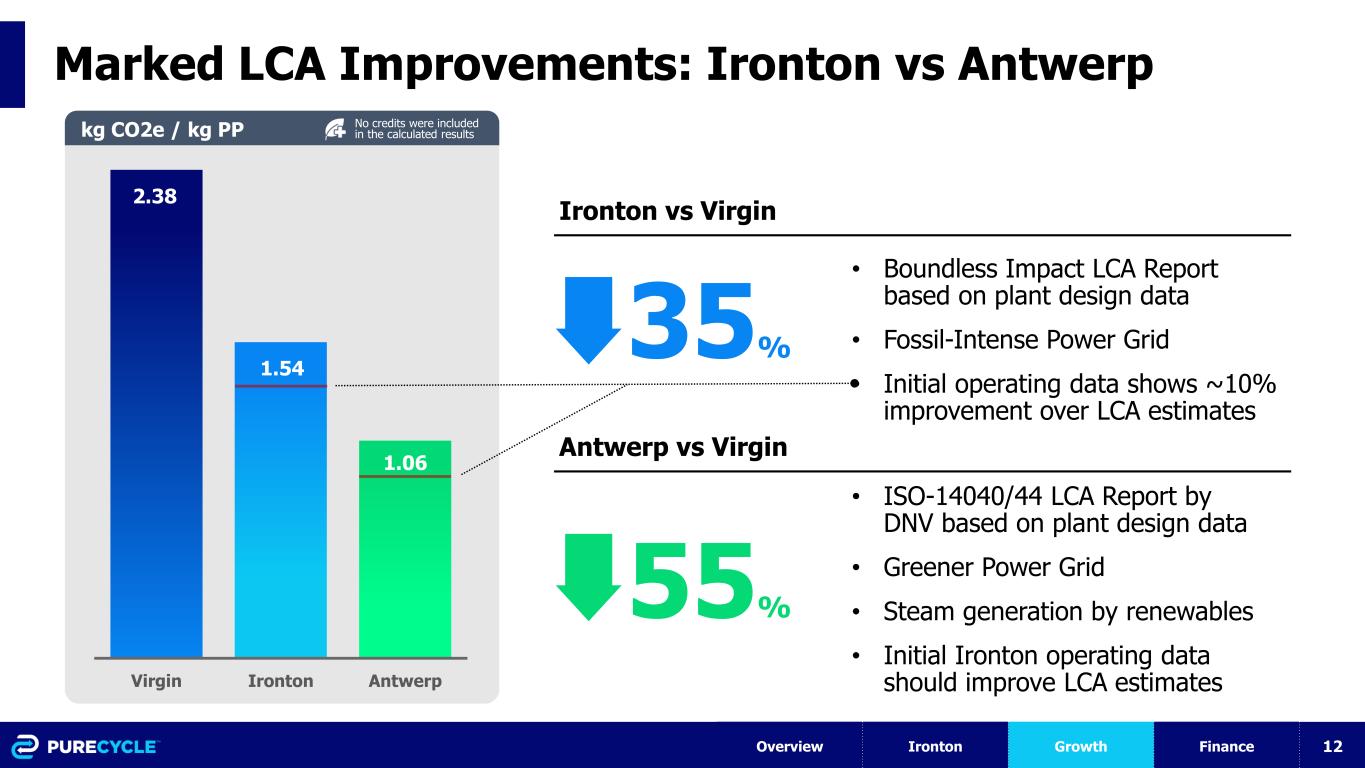

12 Marked LCA Improvements: Ironton vs Antwerp Overview Ironton Growth Finance 2.38 1.54 1.06 Virgin Ironton Antwerp kg CO2e / kg PP 35% 55% Ironton vs Virgin Antwerp vs Virgin • Boundless Impact LCA Report based on plant design data • Fossil-Intense Power Grid • Initial operating data shows ~10% improvement over LCA estimates • ISO-14040/44 LCA Report by DNV based on plant design data • Greener Power Grid • Steam generation by renewables • Initial Ironton operating data should improve LCA estimates No credits were included in the calculated results

13 PCT Financial Update •Agreed in principle to waiver with revised terms including extensions on existing milestones; execution expected later this week •Completed the convertible bond offering for $250M Overview Ironton Growth Finance

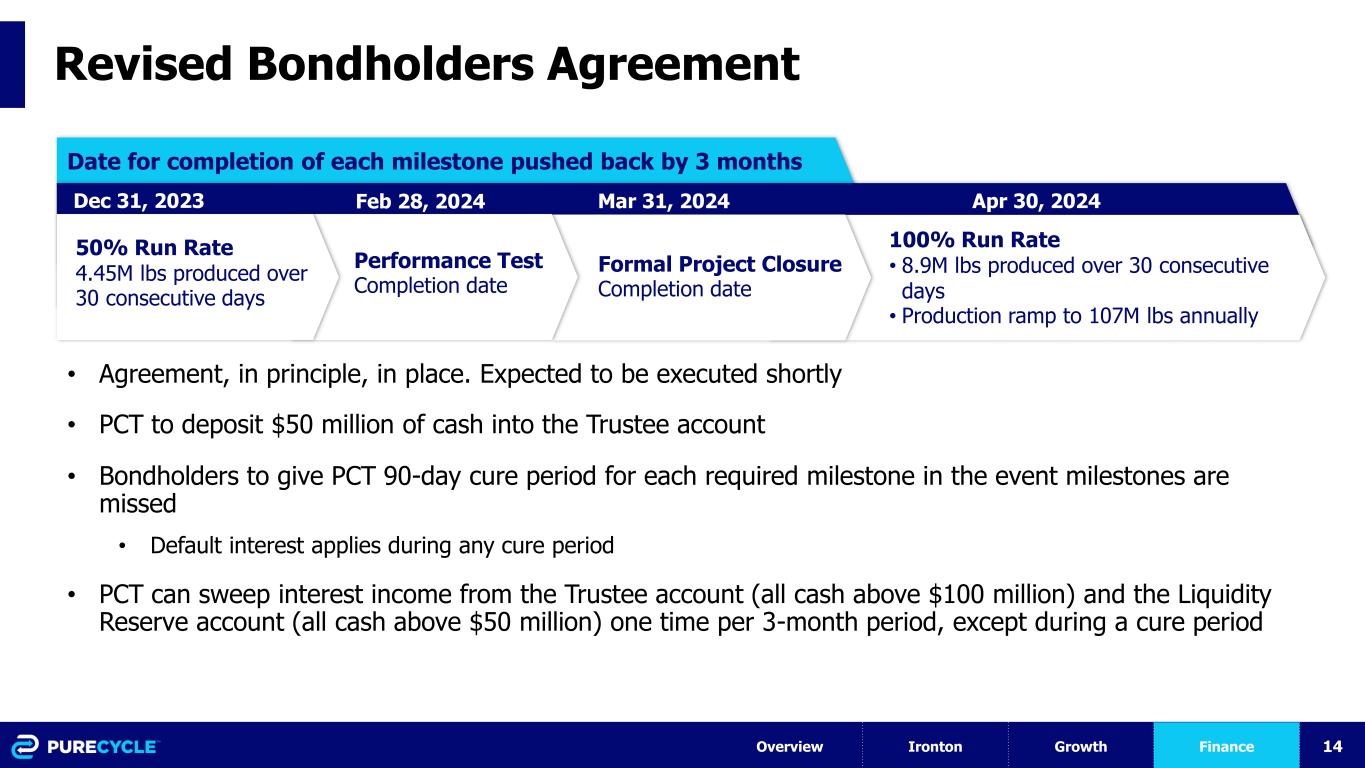

14 Revised Bondholders Agreement Overview Ironton Growth Finance Dec 31, 2023 Feb 28, 2024 Mar 31, 2024 Apr 30, 2024 Performance Test Completion date 50% Run Rate 4.45M lbs produced over 30 consecutive days Formal Project Closure Completion date 100% Run Rate • 8.9M lbs produced over 30 consecutive days • Production ramp to 107M lbs annually Date for completion of each milestone pushed back by 3 months • Agreement, in principle, in place. Expected to be executed shortly • PCT to deposit $50 million of cash into the Trustee account • Bondholders to give PCT 90-day cure period for each required milestone in the event milestones are missed • Default interest applies during any cure period • PCT can sweep interest income from the Trustee account (all cash above $100 million) and the Liquidity Reserve account (all cash above $50 million) one time per 3-month period, except during a cure period

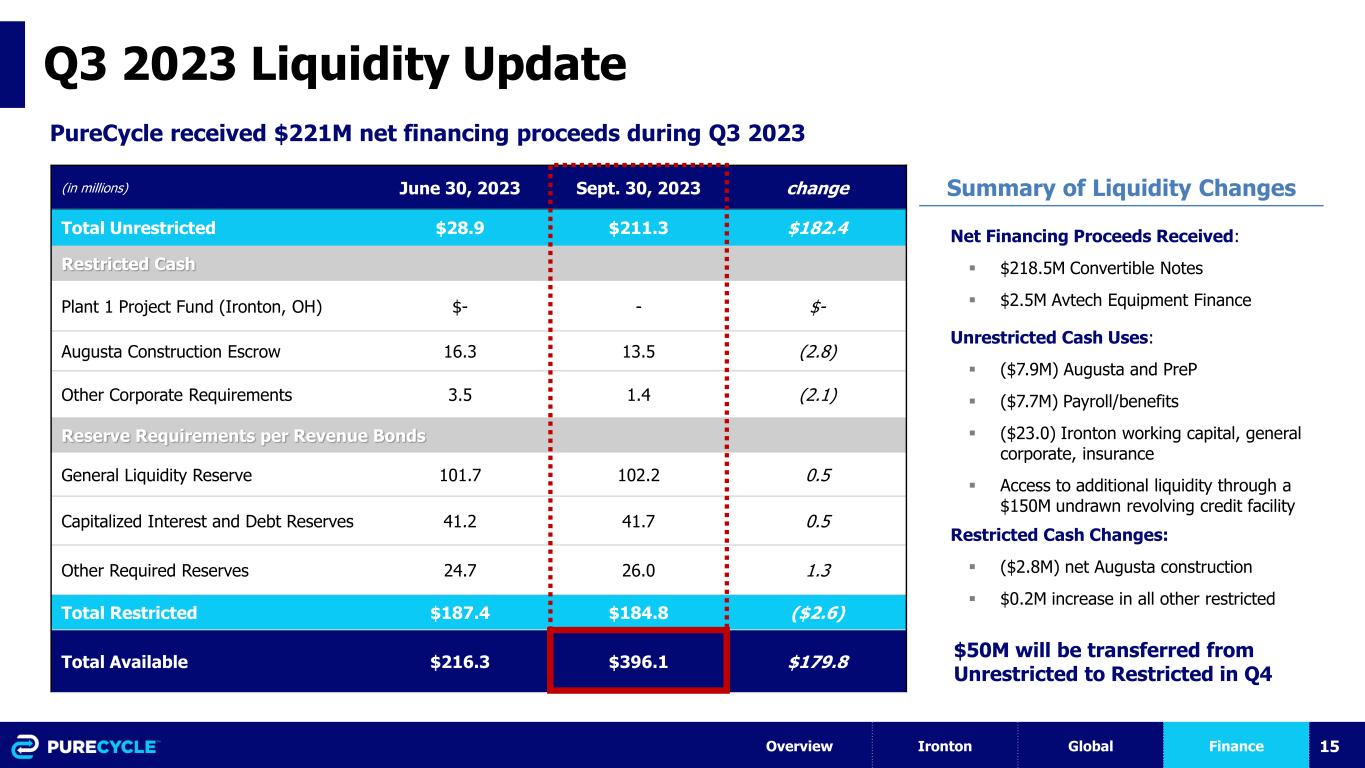

15 Q3 2023 Liquidity Update Net Financing Proceeds Received: ▪ $218.5M Convertible Notes ▪ $2.5M Avtech Equipment Finance Unrestricted Cash Uses: ▪ ($7.9M) Augusta and PreP ▪ ($7.7M) Payroll/benefits ▪ ($23.0) Ironton working capital, general corporate, insurance ▪ Access to additional liquidity through a $150M undrawn revolving credit facility Restricted Cash Changes: ▪ ($2.8M) net Augusta construction ▪ $0.2M increase in all other restricted Summary of Liquidity Changes PureCycle received $221M net financing proceeds during Q3 2023 (in millions) June 30, 2023 Sept. 30, 2023 change Total Unrestricted $28.9 $211.3 $182.4 Restricted Cash Plant 1 Project Fund (Ironton, OH) $- - $- Augusta Construction Escrow 16.3 13.5 (2.8) Other Corporate Requirements 3.5 1.4 (2.1) Reserve Requirements per Revenue Bonds General Liquidity Reserve 101.7 102.2 0.5 Capitalized Interest and Debt Reserves 41.2 41.7 0.5 Other Required Reserves 24.7 26.0 1.3 Total Restricted $187.4 $184.8 ($2.6) Total Available $216.3 $396.1 $179.8 Overview Ironton Global Finance $50M will be transferred from Unrestricted to Restricted in Q4

16 PureCycle is Focused on Making Ironton a Success