1 Ironton Operating Budget 2023 March 2023 Updated Forecast Exhibit 99.1

2 Disclaimers Forward-Looking Statements: Certain statements within this presentation contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including statements about financial condition, results of operations, earnings outlook and prospects of PureCycle Technologies, Inc. (“PCT”). Forward-looking statements generally relate to future events or PCT’s future financial or operating performance and may refer to projections and forecasts. Forward-looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions (or the negative versions of such words or expressions), but the absence of these words does not mean that a statement is not forward-looking. The forward-looking statements are based on the current expectations of the management of PCT and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of this presentation. There can be no assurance that future developments will be those that have been anticipated. These forward- looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section of PCT’s Annual Report on Form 10- K entitled “Risk Factors,” those discussed and identified in public filings made with the U.S. Securities and Exchange Commission (the “SEC”) by PCT and the following: PCT's ability to obtain funding for its operations and future growth and to continue as a going concern; PCT's ability to meet, and to continue to meet, applicable regulatory requirements for the use of PCT’s UPR resin (as defined below) in food grade applications (both in the United States, Europe and internationally); PCT's ability to comply on an ongoing basis with the numerous regulatory requirements applicable to the UPR resin and PCT’s facilities (both in the United States, Europe and internationally); Expectations and changes regarding PCT’s strategies and future financial performance, including its future business plans, expansion plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and PCT’s ability to invest in growth initiatives; PCT’s ability to scale and build its first commercial-scale recycling facility in Lawrence County, Ohio (the “Ironton Facility”) in a timely and cost-effective manner; PCT’s ability to complete the necessary funding with respect to, and complete the construction of, its first U.S. multi-line facility, located in Augusta, Georgia (the “Augusta Facility”), in a timely and cost-effective manner; PCT’s ability to sort and process polypropylene plastic waste at its plastic waste prep (“Feed PreP”) facilities; PCT’s ability to maintain exclusivity under the Procter & Gamble Company (“P&G”) license (as described below); the implementation, market acceptance and success of PCT’s business model and growth strategy; the success or profitability of PCT’s offtake arrangements; the ability to source feedstock with a high polypropylene content at a reasonable cost; PCT’s future capital requirements and sources and uses of cash; developments and projections relating to PCT’s competitors and industry; the outcome of any legal or regulatory proceedings to which PCT is, or may become, a party including the securities class action case; geopolitical risk and changes in applicable laws or regulations; the possibility that PCT may be adversely affected by other economic, business, and/or competitive factors, including rising interest rates; turnover or increases in employees and employee-related costs; changes in the prices and availability of labor (including labor shortages), transportation and materials, including significant inflation, supply chain conditions and its related impact on energy and raw materials, and PureCycle’s ability to obtain them in a timely and cost-effective manner; any business disruptions due to political or economic instability, pandemics, armed hostilities (including the ongoing conflict between Russia and Ukraine); the potential impact of climate change on the company, including physical and transition risks, higher regulatory and compliance costs, reputational risks, and availability of capital on attractive terms; operational risk; and the risk that the COVID-19 pandemic (“COVID-19”), including any new and emerging variants and the efficacy and distribution of vaccines may have an adverse effect on PCT’s business operations, as well as PCT’s financial condition and results of operations. PCT undertakes no obligation to update any forward-looking statements made in this presentation to reflect events or circumstances after the date of this presentation or to reflect new information or the occurrence of unanticipated events, except as required by law. Should one or more of these risks or uncertainties materialize or should any of the assumptions made prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. You should not rely upon forward-looking statements as predictions of future events.

3 Disclaimers Non-GAAP Financial Measures: The Company supplements its financial measures that are determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”) with certain non-GAAP measures: EBITDA, EBIT, EBT and EBITDA Margin. This supplemental information should not be considered in isolation or as a substitute for the GAAP measurements presented herein. All such measures, EBITDA, EBIT, EBT and EBITDA Margin, are calculated using figures prepared in accordance with GAAP and a reconciliation of each of these figures is included on Slide 10. EBITDA is calculated using Net Loss plus (i) taxes, (ii) interest expense, and (iii) depreciation & amortization. EBIT is calculated using Net Loss plus (i) taxes and (ii) interest expense. EBT is calculated using Net Loss plus taxes. EBITDA Margin is calculated by dividing EBITDA from Revenue.

4 Table of Contents • Summary • Material Assumptions • Profit and Loss • Balance Sheet • Cash Flows • Financial Covenants

5 Summary • Ironton scheduled for mechanical completion in April and full commissioning in June to Sept • Full commissioning includes running for 5 days at capacity • Plan to ramp operations over the 6 months beginning April of 2023 • Full year operations expected to generate a Net Loss of $19.3 million and EBITDA of $7.9 million, including $7.0 million of corporate shared services management fees in the 2nd half of 2023 (“2023H2”). • Management fees for support services will be charged beginning in July 2023 (the agreement will be drafted and negotiated during 2023H1. • When fully ramped, Gross Margins will be ~44% and EBITDA Margins will be ~24% by the end of 2023, including corporate shared services management fees; EBITDA Margins excluding the management fee will be ~34% when fully ramped • Capitalized Interest and the Contingency accounts have enough reserves to service all 2023 interest payments and Debt Service Reserve funding requirements in 2023 • Current pricing used in the forecast model is conservative and may not be indicative of pricing PCT will realize upon commissioning

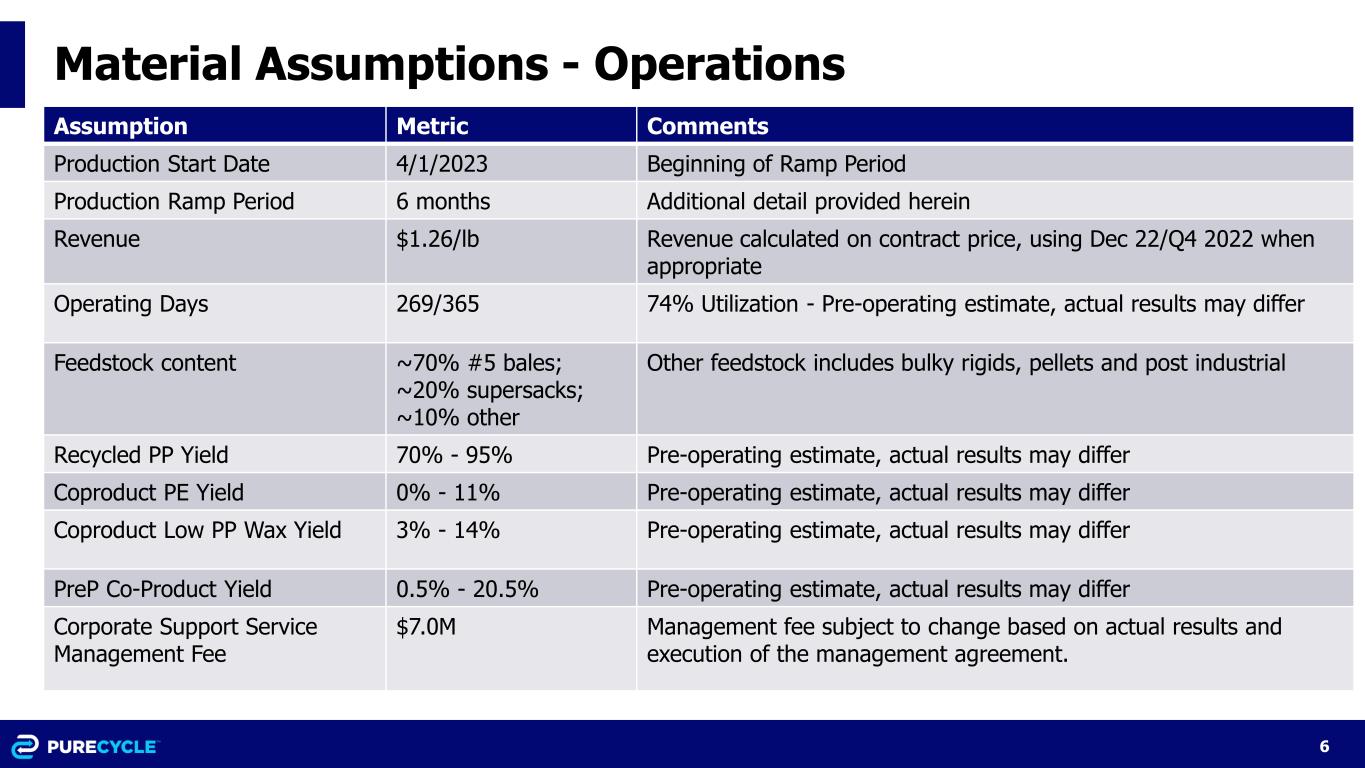

6 Material Assumptions - Operations Assumption Metric Comments Production Start Date 4/1/2023 Beginning of Ramp Period Production Ramp Period 6 months Additional detail provided herein Revenue $1.26/lb Revenue calculated on contract price, using Dec 22/Q4 2022 when appropriate Operating Days 269/365 74% Utilization - Pre-operating estimate, actual results may differ Feedstock content ~70% #5 bales; ~20% supersacks; ~10% other Other feedstock includes bulky rigids, pellets and post industrial Recycled PP Yield 70% - 95% Pre-operating estimate, actual results may differ Coproduct PE Yield 0% - 11% Pre-operating estimate, actual results may differ Coproduct Low PP Wax Yield 3% - 14% Pre-operating estimate, actual results may differ PreP Co-Product Yield 0.5% - 20.5% Pre-operating estimate, actual results may differ Corporate Support Service Management Fee $7.0M Management fee subject to change based on actual results and execution of the management agreement.

7 Material Assumptions – Ramp of Operations Month Ramp Schedule Jan-23 0% Feb-23 0% Mar-23 0% Apr-23 10% May-23 25% Jun-23 50% Jul-23 60% Aug-23 75% Sep-23 100% Oct-23 100% Nov-23 100% Dec-23 100%

8 Material Assumptions – Working Capital / CapEx Assumption Metric Comments DSO 45 days Days sales outstanding DPO 30 days Days payables outstanding (trade payables) DIO 45 days Days inventory on hand Total Ironton Cost Estimate $324M $12M $336M - $361M Original Project Scope: Estimated total cost Born Digital, Safety and Other Operational Efficiencies Revised Project Estimated Investment (range dependent on successful resolution of various contract contingencies) Interest/Cash Investment N/A Not forecasted/Immaterial to results Spare Parts Inventory $2.0MM

9 Material Assumptions – Other Assumption Metric Comments Release of remaining project funds Feb 2023 ~$13.2MM reimbursement to PCT Inc for withheld vendor payments following reimbursement request on 10/24/22 Use of capitalized interest reserves Jun 2023 & Dec 2023 Cover full interest payment ($9.2MM) in Jun 2023 with projected remaining funds (~$7.2MM) used to cover majority of Dec 2023 payment Use of contingency account All of 2023 Funds assumed to be used to cover debt service requirements, unless used to cover qualified incurred but unpaid project costs Taxes N/A No taxable income expected to be attributed in 2023 Remaining Cash Investment $80MM Estimated remaining project payments inclusive of bond funds above

10 Budgeted Profit & Loss by Month – 2023 (in $ ‘000s)

11 Budgeted Balance Sheet by Month – 2023 (in $ ‘000s)

12 Budgeted Cash Flows by Month – 2023 (in $ ‘000s)

13 1. Cash on Hand includes unrestricted cash from the budgeted balance sheet, plus $50 million in liquidity reserves Budgeted Financial Covenants – 2023 (in $ ‘000s)