1 Third Quarter 2022 Corporate Update November 10, 2022

2 Forward-Looking Statements Certain statements in this Presentation contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including statements about the financial condition, results of operations, earnings outlook and prospects of PureCycle Technologies, Inc. (“PCT”). Forward-looking statements generally relate to future events or our future financial or operating performance and may refer to projections and forecasts. Forward-looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions (or the negative versions of such words or expressions), but the absence of these words does not mean that a statement is not forward-looking. The forward-looking statements are based on the current expectations of the management of PCT and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of this presentation. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section of PCT’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021 entitled “Risk Factors,” those discussed and identified in public filings made with the U.S. Securities and Exchange Commission (the “SEC”) by PCT (including PCT’s Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2022) and the following: PCT's ability to meet, and to continue to meet, applicable regulatory requirements for the use of PCT's UPR resin in food grade applications (both in the United States and abroad); PCT's ability to comply on an ongoing basis with the numerous regulatory requirements applicable to the UPR resin and PCT's facilities (both in the United States and abroad); expectations and changes regarding PCT's strategies and future financial performance, including its future business plans, expansion plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and PCT's ability to invest in growth initiatives; PCT's ability to scale and build the Ironton facility in a timely and cost-effective manner; PCT's ability to complete the necessary funding with respect to, and complete the construction of the Augusta facility, its first U.S. cluster facility located in Augusta, Georgia, in a timely and cost-effective manner; PCT's ability to sort and process polypropylene plastic waste at its plastic waste prep ("Feed PreP") facilities; PCT's ability to maintain exclusivity under the Procter & Gamble Company license; the implementation, market acceptance and success of PCT's business model and growth strategy; the success or profitability of PCT's offtake arrangements; the ability to source feedstock with a high polypropylene content; PCT's future capital requirements and sources and uses of cash; PCT's ability to obtain funding for its operations and future growth; developments and projections relating to PCT's competitors and industry; the outcome of any legal or regulatory proceedings to which PCT is, or may become a party, including the securities class action case; geopolitical risk and changes in applicable laws or regulations; the possibility that PCT may be adversely affected by other economic, business, and/or competitive factors; turnover or increases in employees and employee-related costs; changes in the prices and availability of labor (including labor shortages), transportation and materials, including significant inflation, supply chain conditions and its related impact on energy and raw materials, and PCT's ability to obtain them in a timely and cost-effective manner; any business disruptions due to political or economic instability, pandemics, armed hostilities (including the ongoing conflict between Russia and Ukraine); the potential impact of climate change on PCT, including physical and transition risks, higher regulatory and compliance costs, reputational risks, and availability of capital on attractive terms; operational risk; and the risk that the COVID-19 pandemic, including any new and emerging variants and the efficacy and distribution of vaccines, may have an adverse effect on PCT's business operations, as well as PCT's financial condition and results of operations. Should one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of PCT prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. All subsequent written and oral forward-looking statements or other matters attributable to PCT or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Presentation. Except to the extent required by applicable law or regulation, PCT undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date of this Presentation or to reflect the occurrence of unanticipated events.

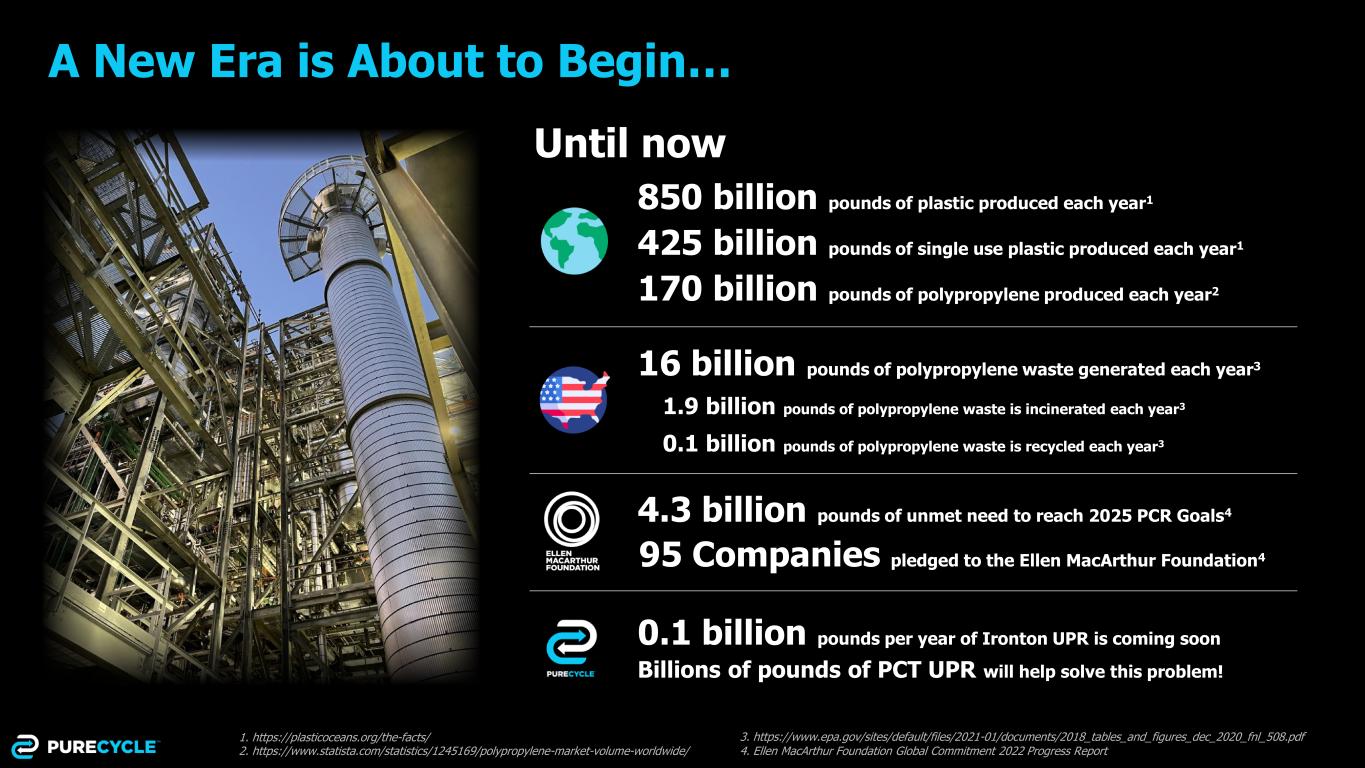

3 A New Era is About to Begin… Until now 170 billion pounds of polypropylene produced each year2 16 billion pounds of polypropylene waste generated each year3 0.1 billion pounds of polypropylene waste is recycled each year3 0.1 billion pounds per year of Ironton UPR is coming soon 850 billion pounds of plastic produced each year1 425 billion pounds of single use plastic produced each year1 Billions of pounds of PCT UPR will help solve this problem! 1. https://plasticoceans.org/the-facts/ 2. https://www.statista.com/statistics/1245169/polypropylene-market-volume-worldwide/ 1.9 billion pounds of polypropylene waste is incinerated each year3 3. https://www.epa.gov/sites/default/files/2021-01/documents/2018_tables_and_figures_dec_2020_fnl_508.pdf 4. Ellen MacArthur Foundation Global Commitment 2022 Progress Report 4.3 billion pounds of unmet need to reach 2025 PCR Goals4 95 Companies pledged to the Ellen MacArthur Foundation4

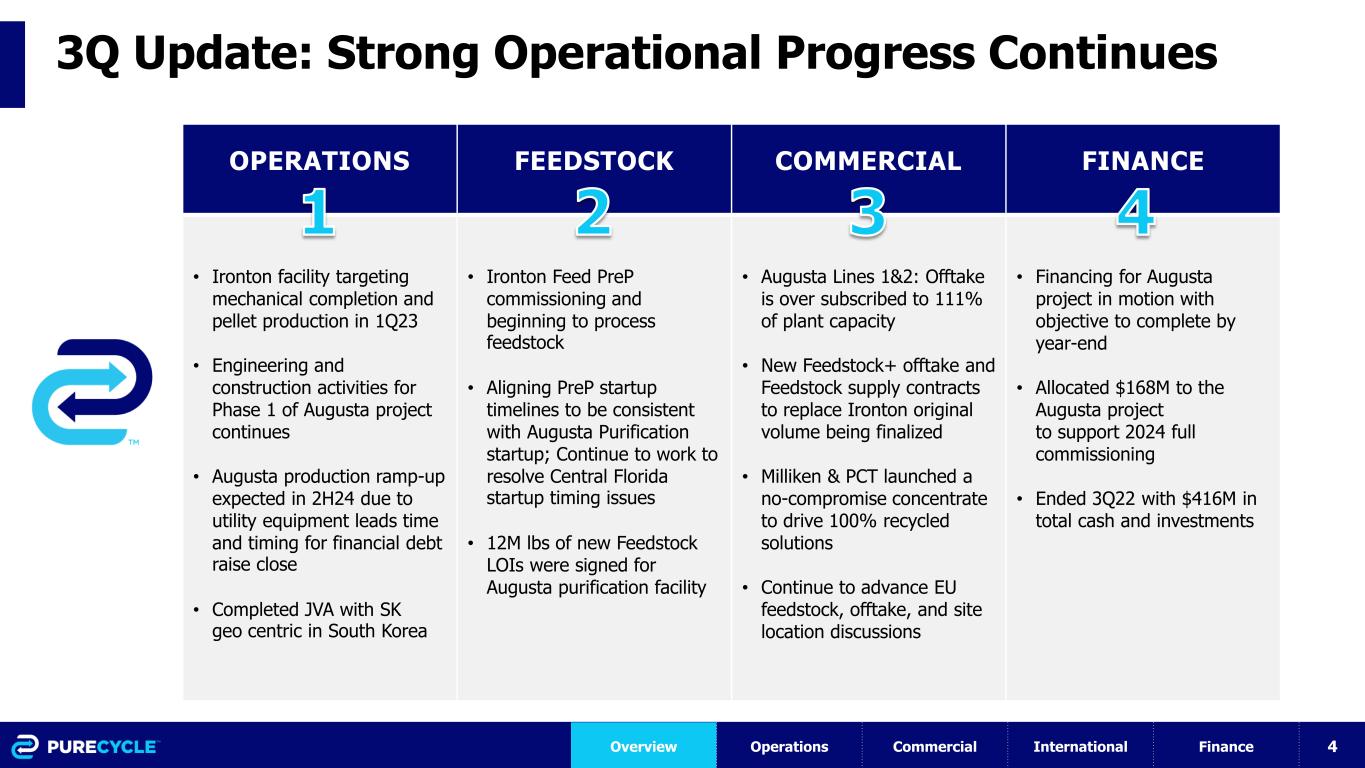

4 3Q Update: Strong Operational Progress Continues OPERATIONS FEEDSTOCK COMMERCIAL FINANCE • Ironton facility targeting mechanical completion and pellet production in 1Q23 • Engineering and construction activities for Phase 1 of Augusta project continues • Augusta production ramp-up expected in 2H24 due to utility equipment leads time and timing for financial debt raise close • Completed JVA with SK geo centric in South Korea • Ironton Feed PreP commissioning and beginning to process feedstock • Aligning PreP startup timelines to be consistent with Augusta Purification startup; Continue to work to resolve Central Florida startup timing issues • 12M lbs of new Feedstock LOIs were signed for Augusta purification facility • Augusta Lines 1&2: Offtake is over subscribed to 111% of plant capacity • New Feedstock+ offtake and Feedstock supply contracts to replace Ironton original volume being finalized • Milliken & PCT launched a no-compromise concentrate to drive 100% recycled solutions • Continue to advance EU feedstock, offtake, and site location discussions • Financing for Augusta project in motion with objective to complete by year-end • Allocated $168M to the Augusta project to support 2024 full commissioning • Ended 3Q22 with $416M in total cash and investments Overview Operations Commercial International Finance

5 Continuing Our Global Path to a Billion Pounds per year 627 130 130 Completion dates for all manufacturing based on current expectations and are subject to delays Timeline is contingent on completing agreement on schedule All references to capacity are in millions lbs / yr * ** *** Ironton Augusta #1 Augusta #2 Ulsan, SK Augusta #3 Augusta #4 Europe Japan (Mitsui) Installed Capacity 107 367 887 Mechanically Complete Resin Production (Ramp to Full Scale) 2023 2024 2025 Project Defined & Financed Project Defined – Financing In Progress Project in Development – No Financing Yet

6 June 2021 October 2022 We Have Come a Long Way…

7 Critical Path • Dependent on final extruder delivery timeline. Impacted by Mississippi River levels, Germany COVID breakout, and Ukraine war. • Industry references show our project should be delayed by 12 months. We are not. • PCT will rush to finish and then we will slow down during startup. Ironton Nears Completion • All 26 modules delivered and lifted in place • PreP facility in commissioning and beginning to process feed • Greater than 1.3 million pounds of feedstock already in Ironton • Mechanically complete with pellet production 1Q23 Central Utilities Expected Mechanically Complete end-November Final commissioning complete by end-Nov Feed PreP Mechanically Complete In final commissioning Control Room, Offtake, & Rail Ops Expected Mechanically Complete end-November Final commissioning in Dec Purification & Co-products Mechanically Complete 1Q23 Depends on 2 critical path items Overview Operations Commercial International Finance

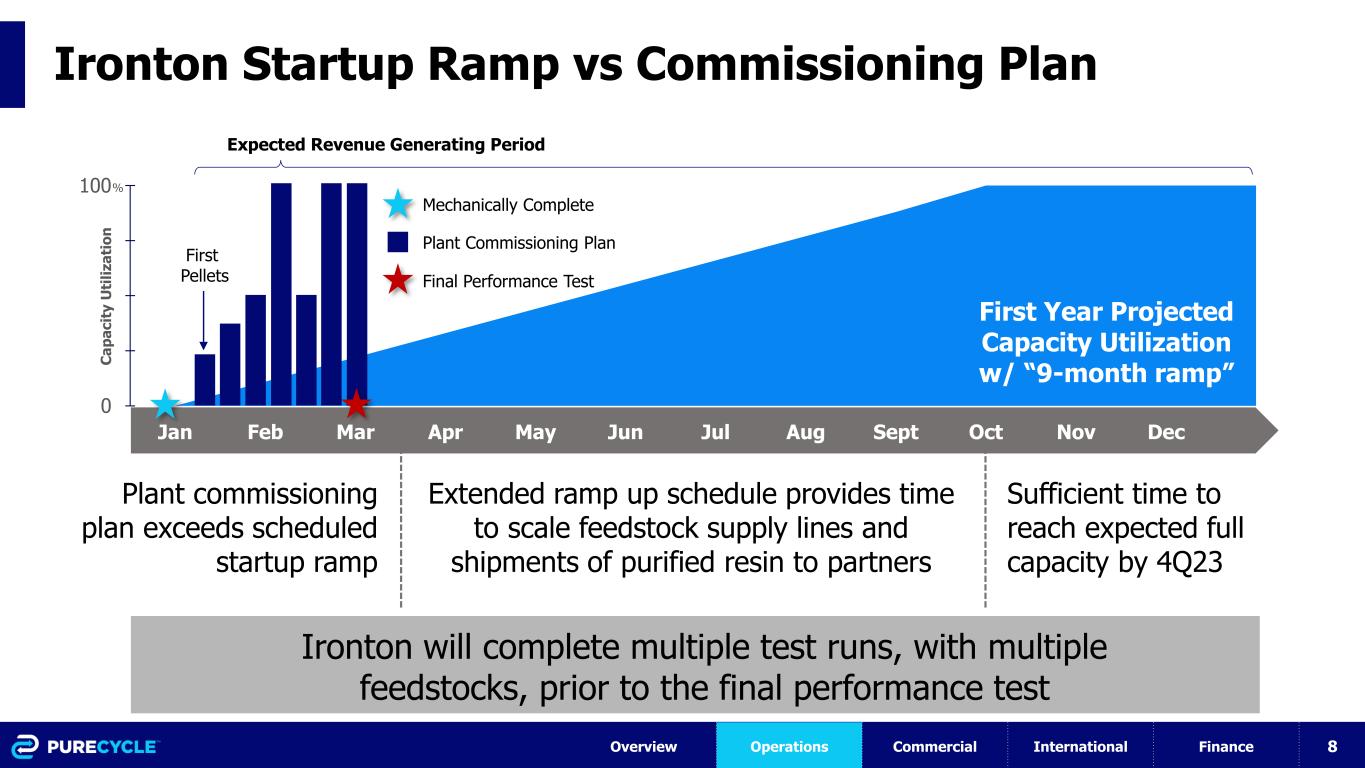

8 Ironton Startup Ramp vs Commissioning Plan 0 100 Jan Feb Mar Apr May Jun Jul Aug Sept Oct Nov Dec Plant commissioning plan exceeds scheduled startup ramp Extended ramp up schedule provides time to scale feedstock supply lines and shipments of purified resin to partners Mechanically Complete Plant Commissioning Plan Sufficient time to reach expected full capacity by 4Q23 First Year Projected Capacity Utilization w/ “9-month ramp” Ironton will complete multiple test runs, with multiple feedstocks, prior to the final performance test Expected Revenue Generating Period Overview Operations Commercial International Finance Final Performance Test C a p a c it y U ti li z a ti o n % First Pellets

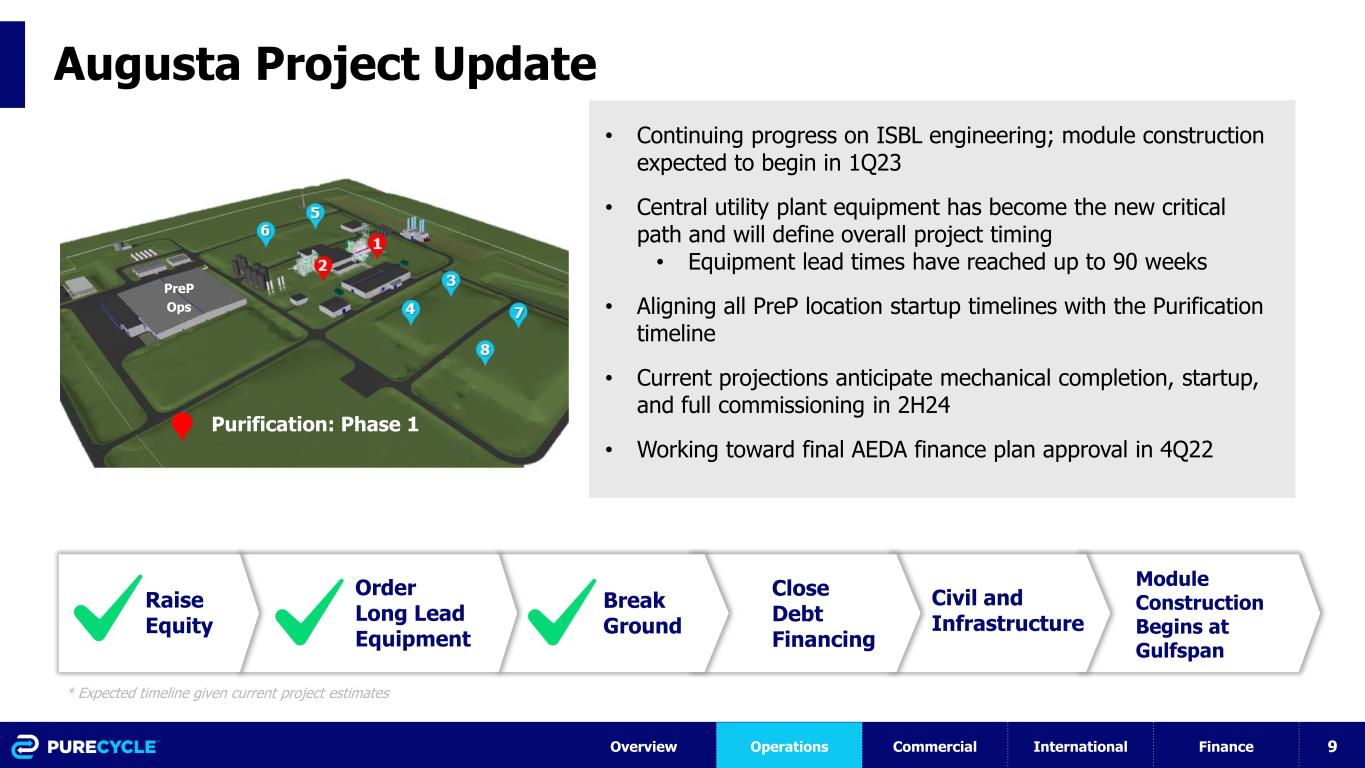

9 Augusta Project Update • Continuing progress on ISBL engineering; module construction expected to begin in 1Q23 • Central utility plant equipment has become the new critical path and will define overall project timing • Equipment lead times have reached up to 90 weeks • Aligning all PreP location startup timelines with the Purification timeline • Current projections anticipate mechanical completion, startup, and full commissioning in 2H24 • Working toward final AEDA finance plan approval in 4Q22 Raise Equity Order Long Lead Equipment Break Ground Civil and Infrastructure * Expected timeline given current project estimates Module Construction Begins at Gulfspan Close Debt Financing Purification: Phase 1 PreP Ops Overview Operations Commercial International Finance

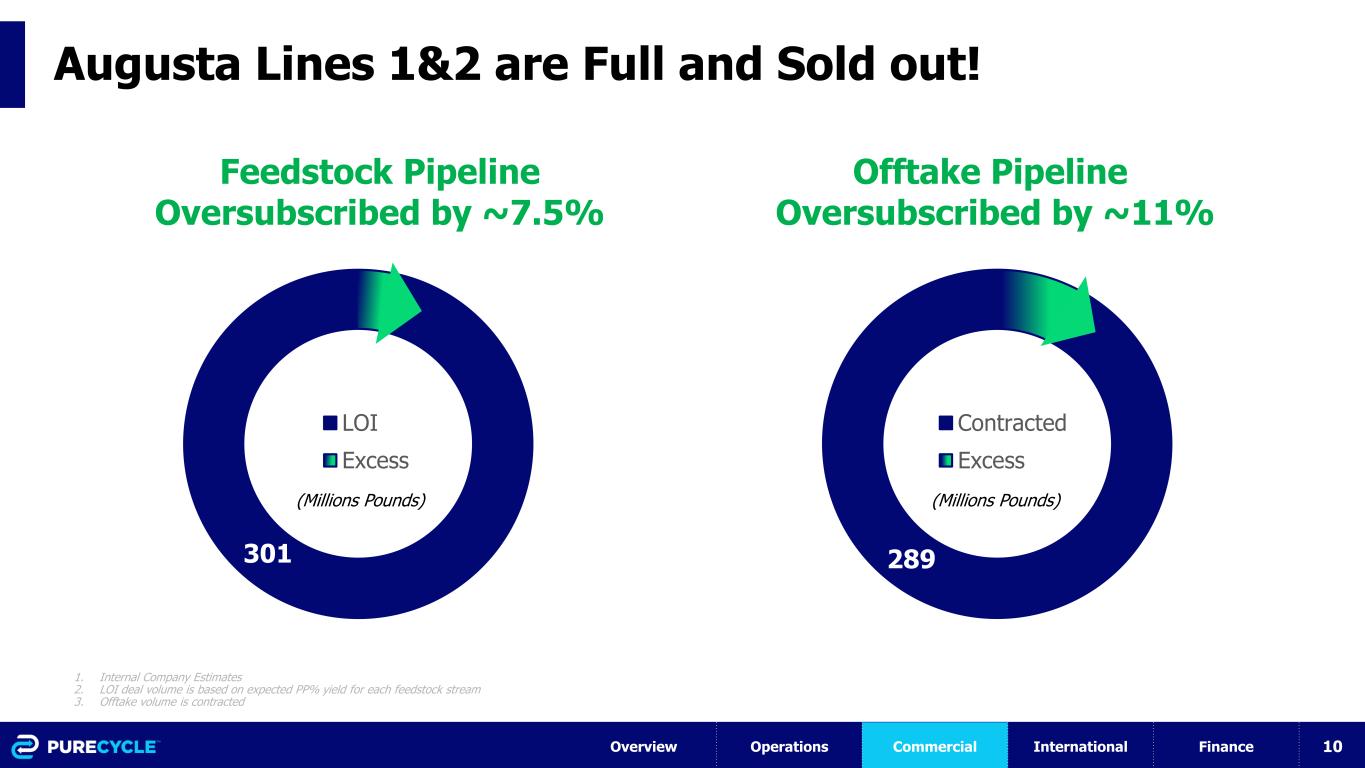

10 Augusta Lines 1&2 are Full and Sold out! 301 LOI Excess 289 Contracted Excess Feedstock Pipeline Oversubscribed by ~7.5% Offtake Pipeline Oversubscribed by ~11% (Millions Pounds) 1. Internal Company Estimates 2. LOI deal volume is based on expected PP% yield for each feedstock stream 3. Offtake volume is contracted Overview Operations Commercial International Finance (Millions Pounds)

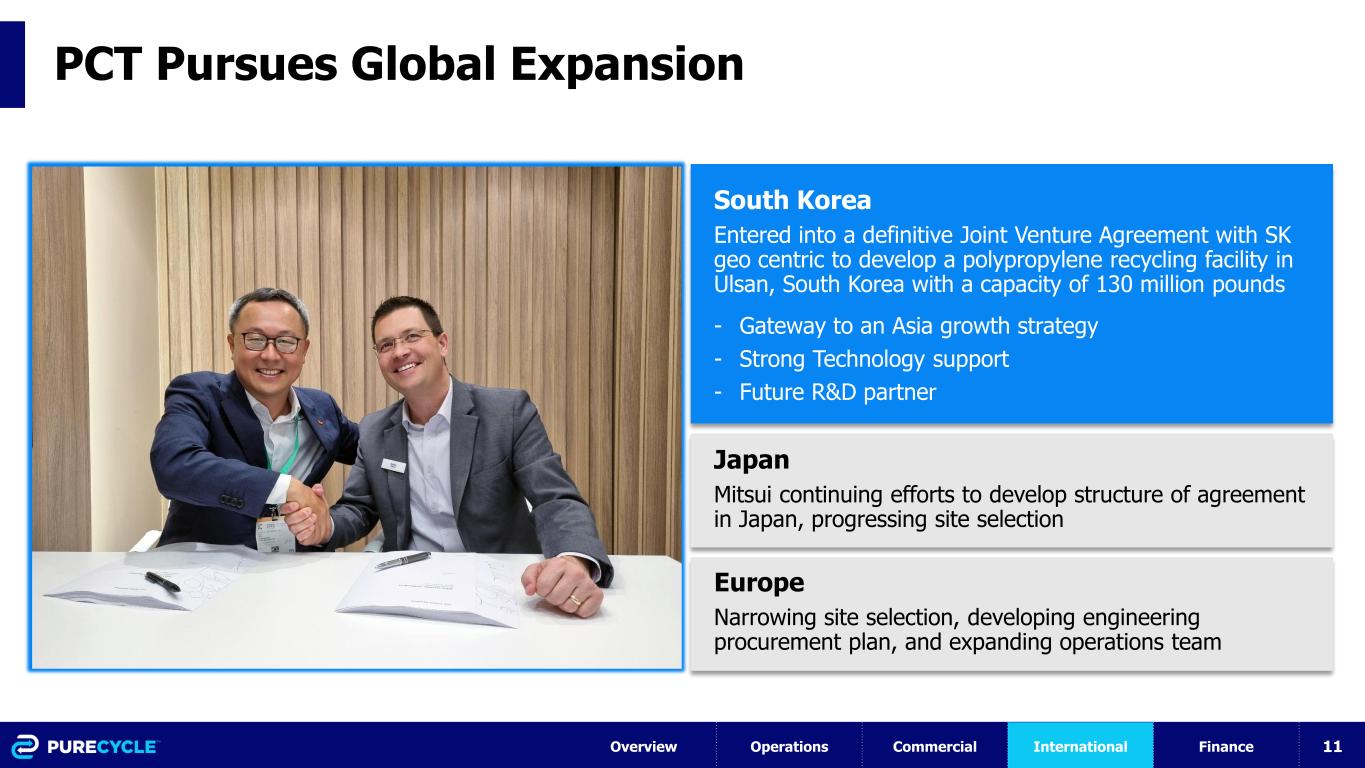

11 PCT Pursues Global Expansion South Korea Entered into a definitive Joint Venture Agreement with SK geo centric to develop a polypropylene recycling facility in Ulsan, South Korea with a capacity of 130 million pounds - Gateway to an Asia growth strategy - Strong Technology support - Future R&D partner Overview Operations Commercial International Finance Europe Narrowing site selection, developing engineering procurement plan, and expanding operations team Japan Mitsui continuing efforts to develop structure of agreement in Japan, progressing site selection

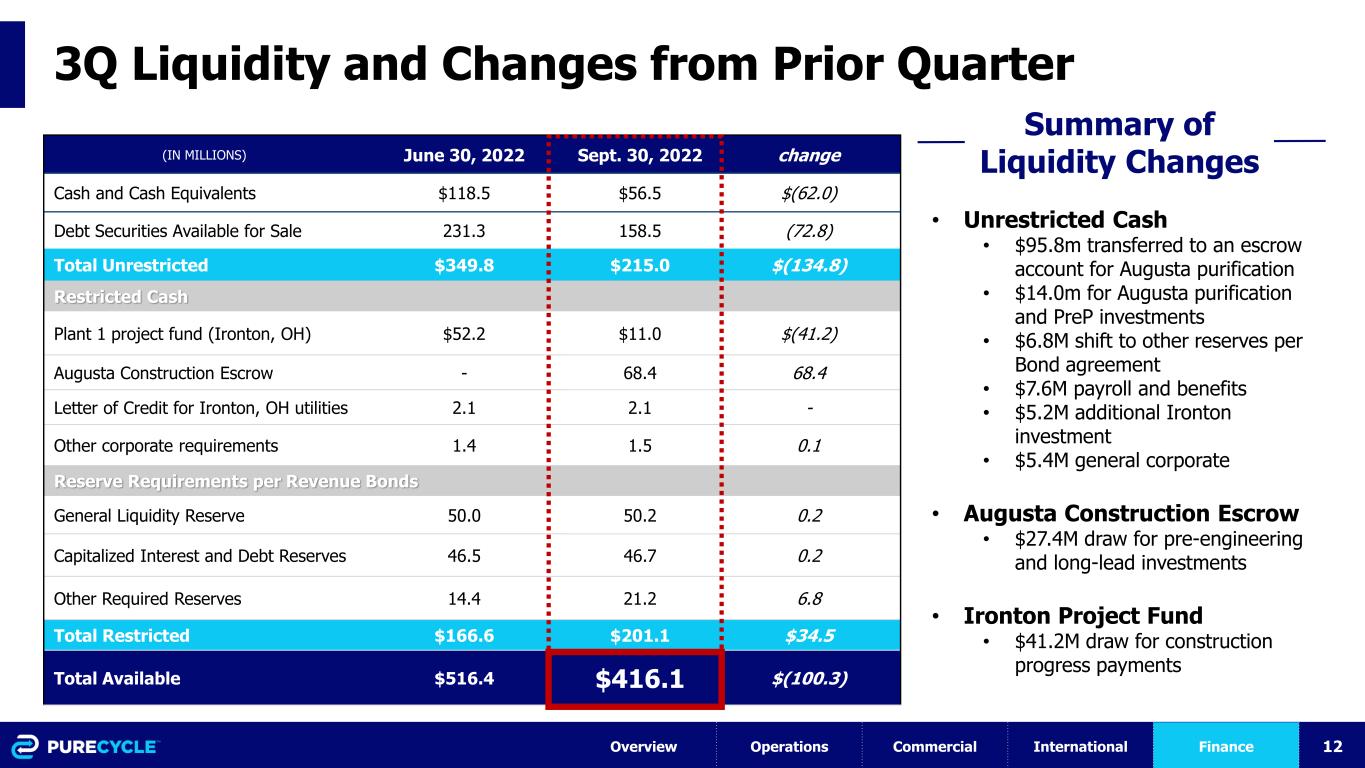

12 3Q Liquidity and Changes from Prior Quarter (IN MILLIONS) June 30, 2022 Sept. 30, 2022 change Cash and Cash Equivalents $118.5 $56.5 $(62.0) Debt Securities Available for Sale 231.3 158.5 (72.8) Total Unrestricted $349.8 $215.0 $(134.8) Restricted Cash Plant 1 project fund (Ironton, OH) $52.2 $11.0 $(41.2) Augusta Construction Escrow - 68.4 68.4 Letter of Credit for Ironton, OH utilities 2.1 2.1 - Other corporate requirements 1.4 1.5 0.1 Reserve Requirements per Revenue Bonds General Liquidity Reserve 50.0 50.2 0.2 Capitalized Interest and Debt Reserves 46.5 46.7 0.2 Other Required Reserves 14.4 21.2 6.8 Total Restricted $166.6 $201.1 $34.5 Total Available $516.4 $416.1 $(100.3) Summary of Liquidity Changes • Unrestricted Cash • $95.8m transferred to an escrow account for Augusta purification • $14.0m for Augusta purification and PreP investments • $6.8M shift to other reserves per Bond agreement • $7.6M payroll and benefits • $5.2M additional Ironton investment • $5.4M general corporate • Augusta Construction Escrow • $27.4M draw for pre-engineering and long-lead investments • Ironton Project Fund • $41.2M draw for construction progress payments Overview Operations Commercial International Finance

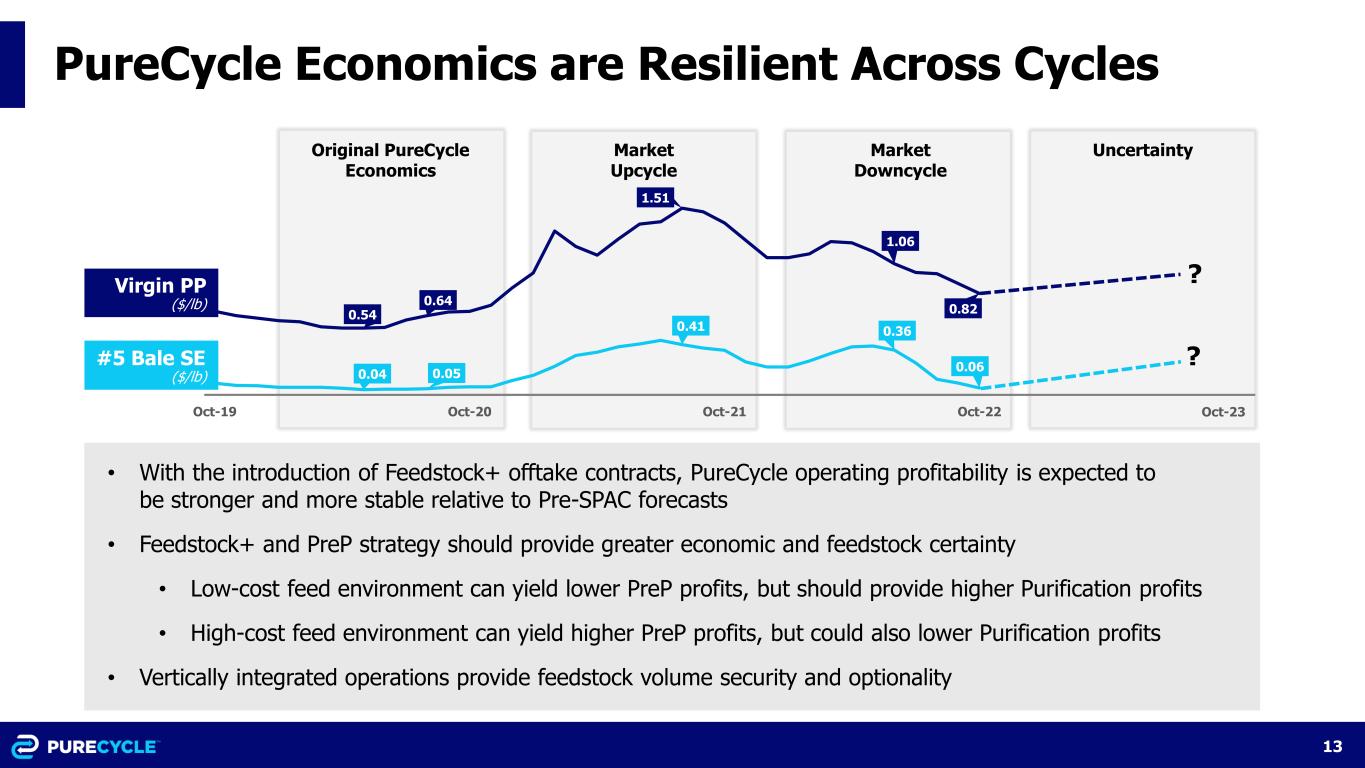

13 PureCycle Economics are Resilient Across Cycles 0.54 0.64 1.51 1.06 0.82 0.04 0.05 0.41 0.36 0.06 Oct-19 Oct-20 Oct-21 Oct-22 Original PureCycle Economics Market Upcycle Market Downcycle Virgin PP ($/lb) #5 Bale SE ($/lb) • With the introduction of Feedstock+ offtake contracts, PureCycle operating profitability is expected to be stronger and more stable relative to Pre-SPAC forecasts • Feedstock+ and PreP strategy should provide greater economic and feedstock certainty • Low-cost feed environment can yield lower PreP profits, but should provide higher Purification profits • High-cost feed environment can yield higher PreP profits, but could also lower Purification profits • Vertically integrated operations provide feedstock volume security and optionality Uncertainty ? ? Oct-23

14 PureCycle Continues to Execute 1 2 3 6 7 Ended 3Q22 with $416M in total cash & investments 5Ironton mechanical completion and initial pellet production in 1Q23 Feedstock PreP strategy is on track with Ironton beginning to process feedstock 4 8 Strong growth in contracted offtake; Augusta offtake is over subscribed by 11% Signed Joint Venture Agreement with SK geo centric 107% of Augusta’s feedstock for the lines 1&2 are under LOIs Announced first fully sustainable PP concentrate developed with Milliken & Co Financing for Augusta project in motion with the objective of completion by year-end

15 Third Quarter 2022 Corporate Update November 10, 2022