1 Second Quarter 2022 Corporate Update August 12, 2022

2 Forward-Looking Statements Certain statements in this Presentation contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including statements about the financial condition, results of operations, earnings outlook and prospects of PureCycle Technologies, Inc. (“PCT”). Forward-looking statements generally relate to future events or our future financial or operating performance and may refer to projections and forecasts. Forward-looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions (or the negative versions of such words or expressions), but the absence of these words does not mean that a statement is not forward-looking. The forward-looking statements are based on the current expectations of the management of PCT and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of this presentation. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section of PCT’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021 entitled “Risk Factors,” those discussed and identified in public filings made with the U.S. Securities and Exchange Commission (the “SEC”) by PCT and the following: PCT's ability to meet, and to continue to meet, applicable regulatory requirements for the use of PCT's UPR resin in food grade applications (both in the United States and abroad); PCT's ability to comply on an ongoing basis with the numerous regulatory requirements applicable to the UPR resin and PCT's facilities (both in the United States and abroad); expectations and changes regarding PCT's strategies and future financial performance, including its future business plans, expansion plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and PCT's ability to invest in growth initiatives; PCT's ability to scale and build the Ironton facility in a timely and cost-effective manner; PCT's ability to complete the necessary funding with respect to, and complete the construction of the Augusta facility, its first U.S. cluster facility located in Augusta, Georgia, in a timely and cost-effective manner; PCT's ability to sort and process polypropylene plastic waste at its plastic waste prep ("Feed PreP") facilities; PCT's ability to maintain exclusivity under the Procter & Gamble Company license; the implementation, market acceptance and success of PCT's business model and growth strategy; the success or profitability of PCT's offtake arrangements; the ability to source feedstock with a high polypropylene content; PCT's future capital requirements and sources and uses of cash; PCT's ability to obtain funding for its operations and future growth; developments and projections relating to PCT's competitors and industry; the outcome of any legal or regulatory proceedings to which PCT is, or may become a party, including the securities class action case; geopolitical risk and changes in applicable laws or regulations; the possibility that PCT may be adversely affected by other economic, business, and/or competitive factors; turnover or increases in employees and employee-related costs; changes in the prices and availability of labor (including labor shortages), transportation and materials, including significant inflation, supply chain conditions and its related impact on energy and raw materials, and PCT's ability to obtain them in a timely and cost-effective manner; any business disruptions due to political or economic instability, pandemics, armed hostilities (including the ongoing conflict between Russia and Ukraine); the potential impact of climate change on PCT, including physical and transition risks, higher regulatory and compliance costs, reputational risks, and availability of capital on attractive terms; operational risk; and the risk that the COVID-19 pandemic, including any new and emerging variants and the efficacy and distribution of vaccines, and local, state, federal and international responses to addressing the pandemic may have an adverse effect on PCT's business operations, as well as PCT's financial condition and results of operations. Should one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of PCT prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. All subsequent written and oral forward-looking statements or other matters attributable to PCT or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Presentation. Except to the extent required by applicable law or regulation, PCT undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date of this Presentation or to reflect the occurrence of unanticipated events.

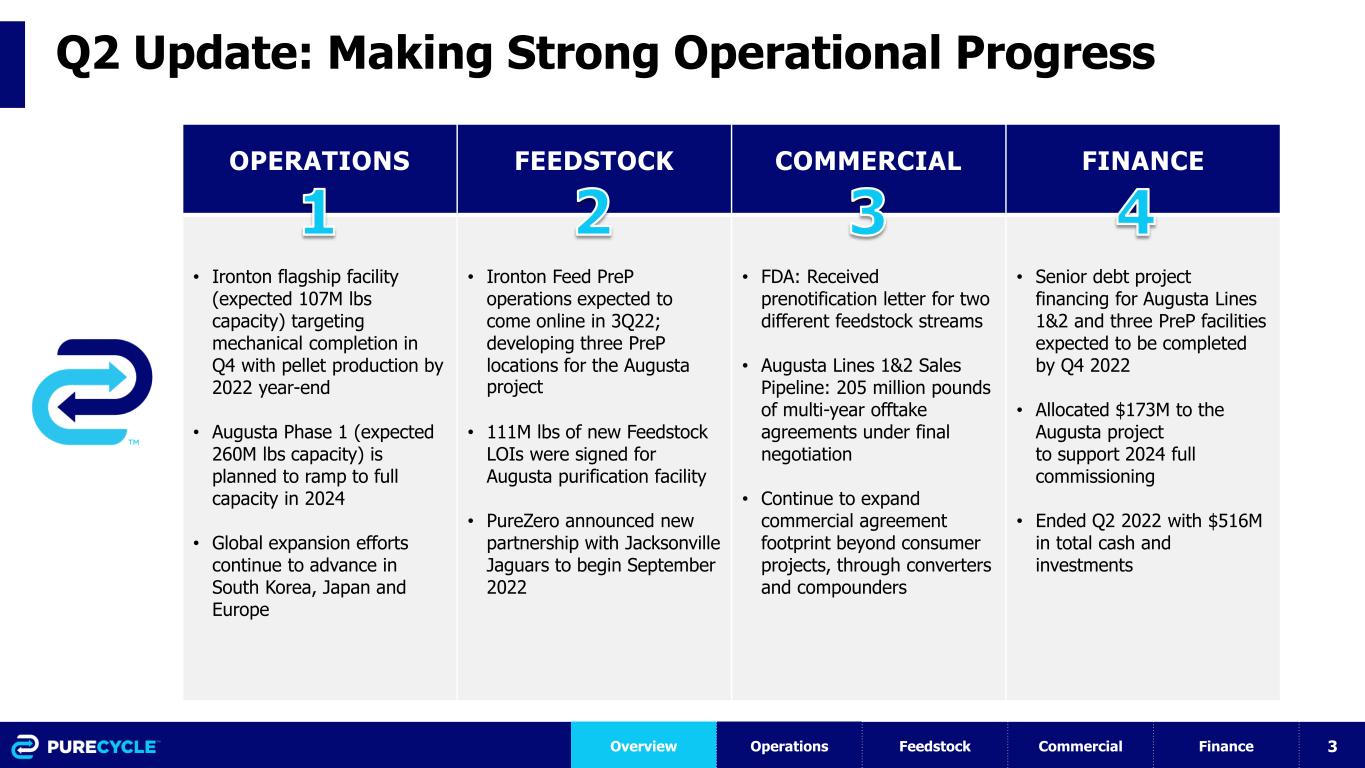

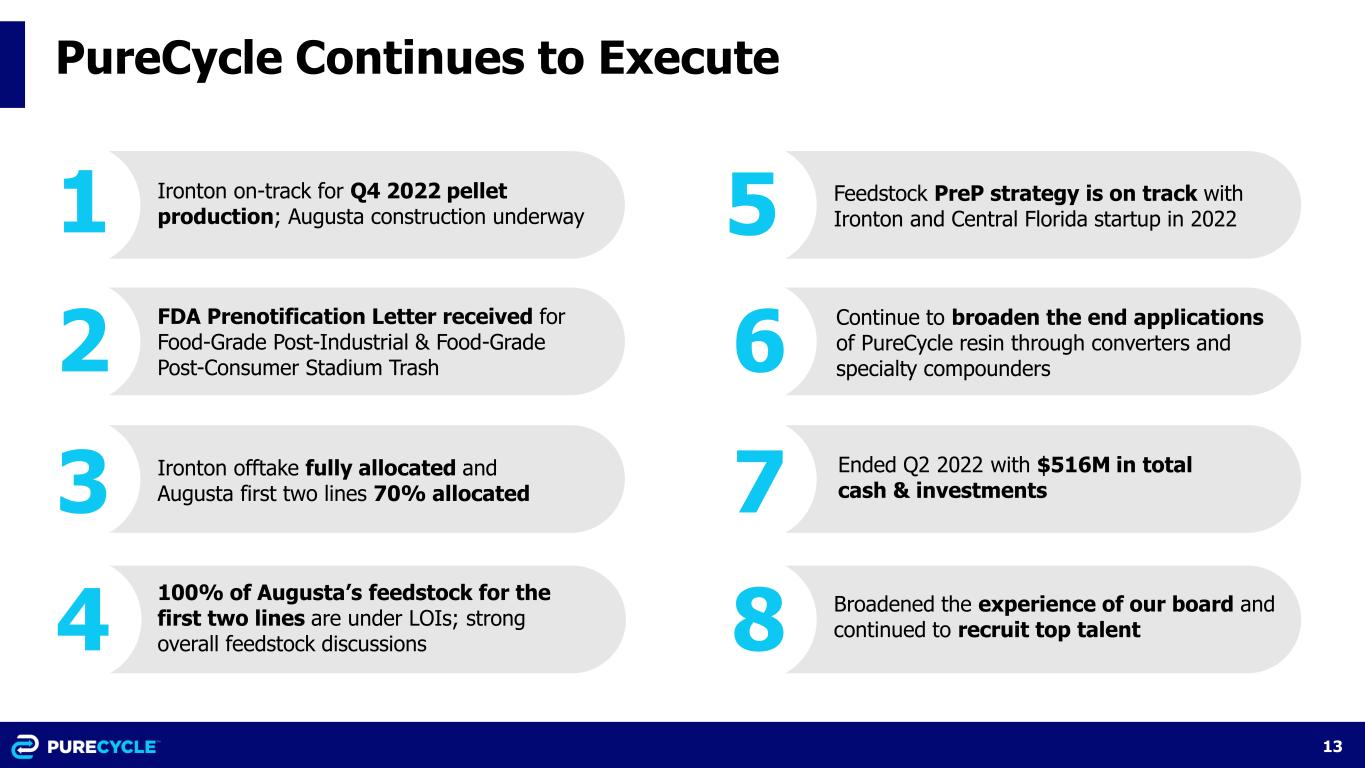

3 Q2 Update: Making Strong Operational Progress OPERATIONS FEEDSTOCK COMMERCIAL FINANCE • Ironton flagship facility (expected 107M lbs capacity) targeting mechanical completion in Q4 with pellet production by 2022 year-end • Augusta Phase 1 (expected 260M lbs capacity) is planned to ramp to full capacity in 2024 • Global expansion efforts continue to advance in South Korea, Japan and Europe • Ironton Feed PreP operations expected to come online in 3Q22; developing three PreP locations for the Augusta project • 111M lbs of new Feedstock LOIs were signed for Augusta purification facility • PureZero announced new partnership with Jacksonville Jaguars to begin September 2022 • FDA: Received prenotification letter for two different feedstock streams • Augusta Lines 1&2 Sales Pipeline: 205 million pounds of multi-year offtake agreements under final negotiation • Continue to expand commercial agreement footprint beyond consumer projects, through converters and compounders • Senior debt project financing for Augusta Lines 1&2 and three PreP facilities expected to be completed by Q4 2022 • Allocated $173M to the Augusta project to support 2024 full commissioning • Ended Q2 2022 with $516M in total cash and investments Overview Operations Feedstock Commercial Finance

4 Continuing Our Global Path to a Billion Pounds per year 627 130 130 Completion dates for all manufacturing based on current expectations and are subject to delays Timeline is contingent on completing agreement on schedule All references to capacity are in millions lbs / yr * ** *** Ironton Augusta #1 Augusta #2 Augusta #3 Augusta #4 Europe Ulsan, SK Japan (Mitsui) Installed Capacity 107 367 887 Mechanically Complete Resin Production (Ramp to Full Scale) 2023 2024 2025

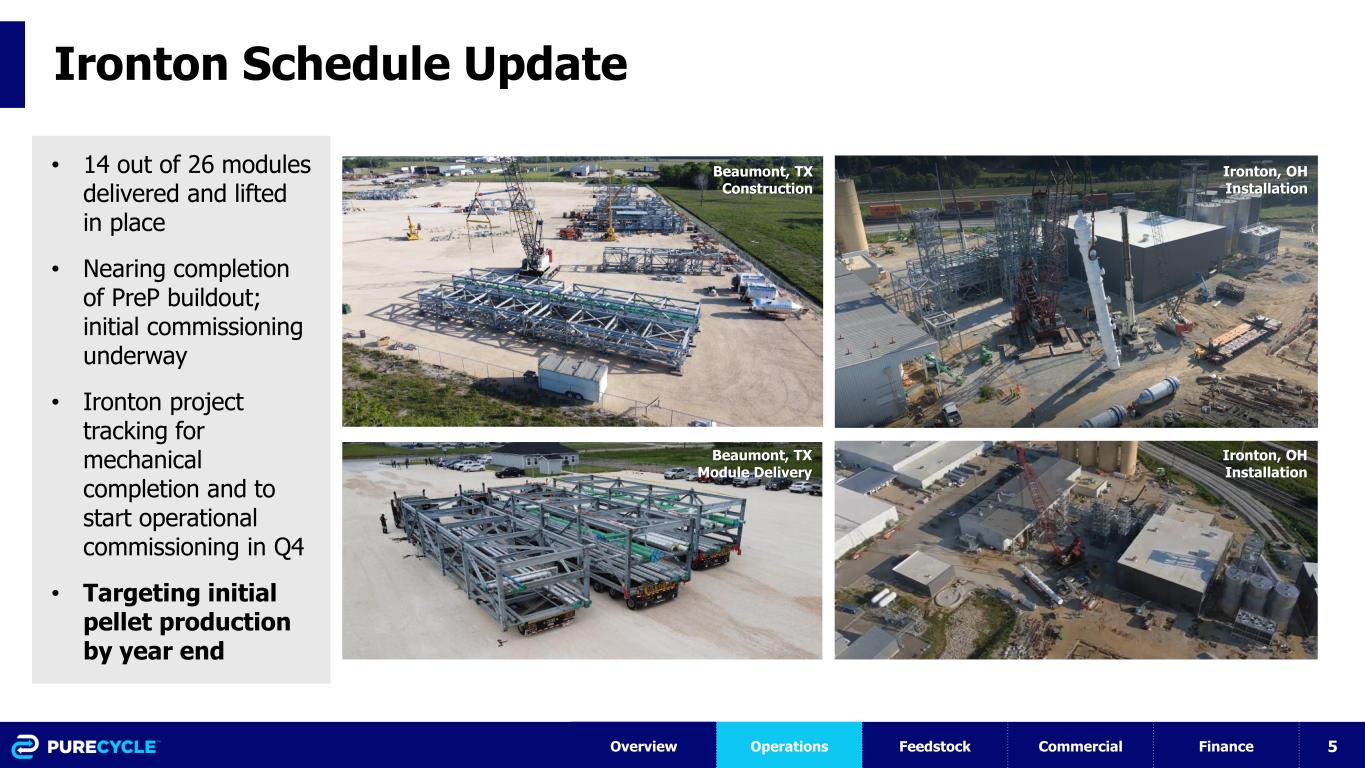

5 Ironton Schedule Update Overview Operations Feedstock Commercial Finance • 14 out of 26 modules delivered and lifted in place • Nearing completion of PreP buildout; initial commissioning underway • Ironton project tracking for mechanical completion and to start operational commissioning in Q4 • Targeting initial pellet production by year end Beaumont, TX Module Delivery Beaumont, TX Construction Ironton, OH Installation Ironton, OH Installation

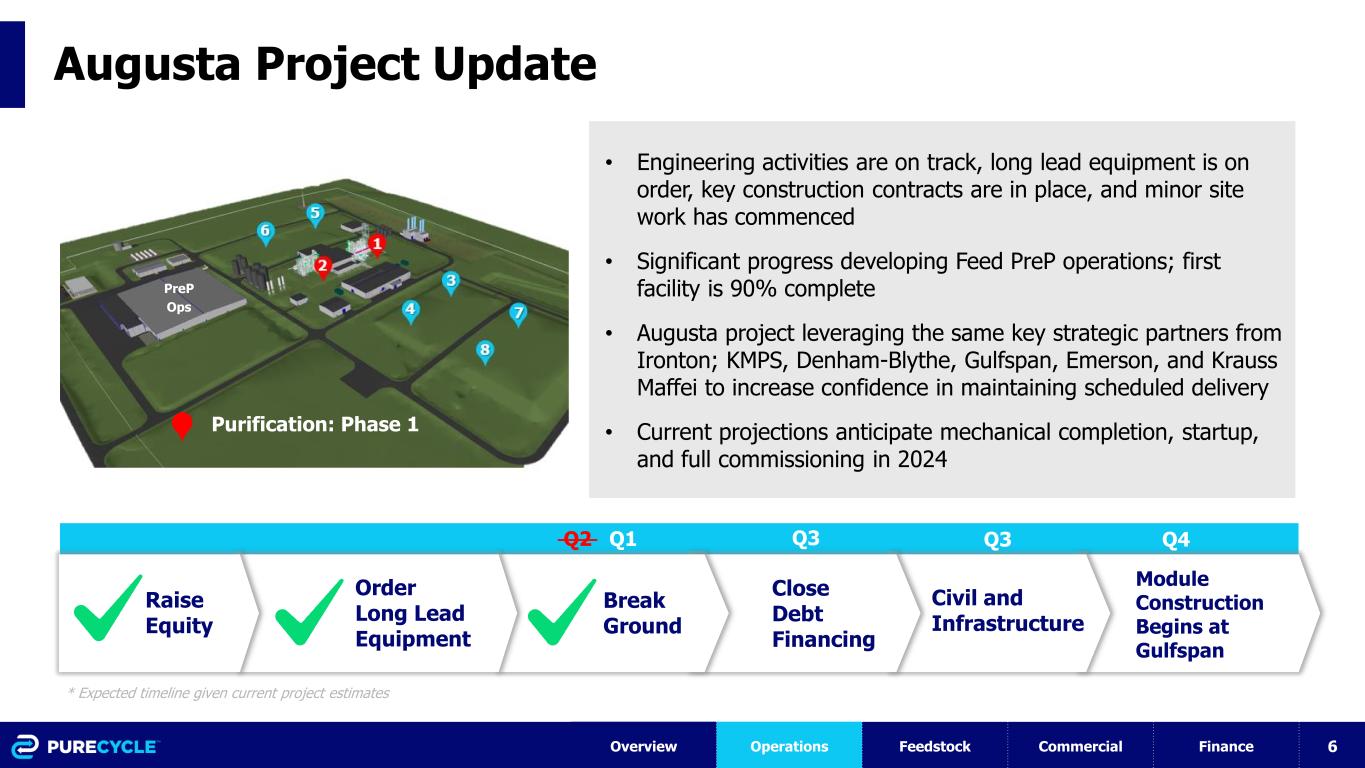

6 Augusta Project Update Overview Operations Feedstock Commercial Finance • Engineering activities are on track, long lead equipment is on order, key construction contracts are in place, and minor site work has commenced • Significant progress developing Feed PreP operations; first facility is 90% complete • Augusta project leveraging the same key strategic partners from Ironton; KMPS, Denham-Blythe, Gulfspan, Emerson, and Krauss Maffei to increase confidence in maintaining scheduled delivery • Current projections anticipate mechanical completion, startup, and full commissioning in 2024 Raise Equity Order Long Lead Equipment Break Ground Civil and Infrastructure Q2 Q1 Q3 Q4 * Expected timeline given current project estimates Module Construction Begins at Gulfspan Close Debt Financing Q3 Purification: Phase 1 PreP Ops

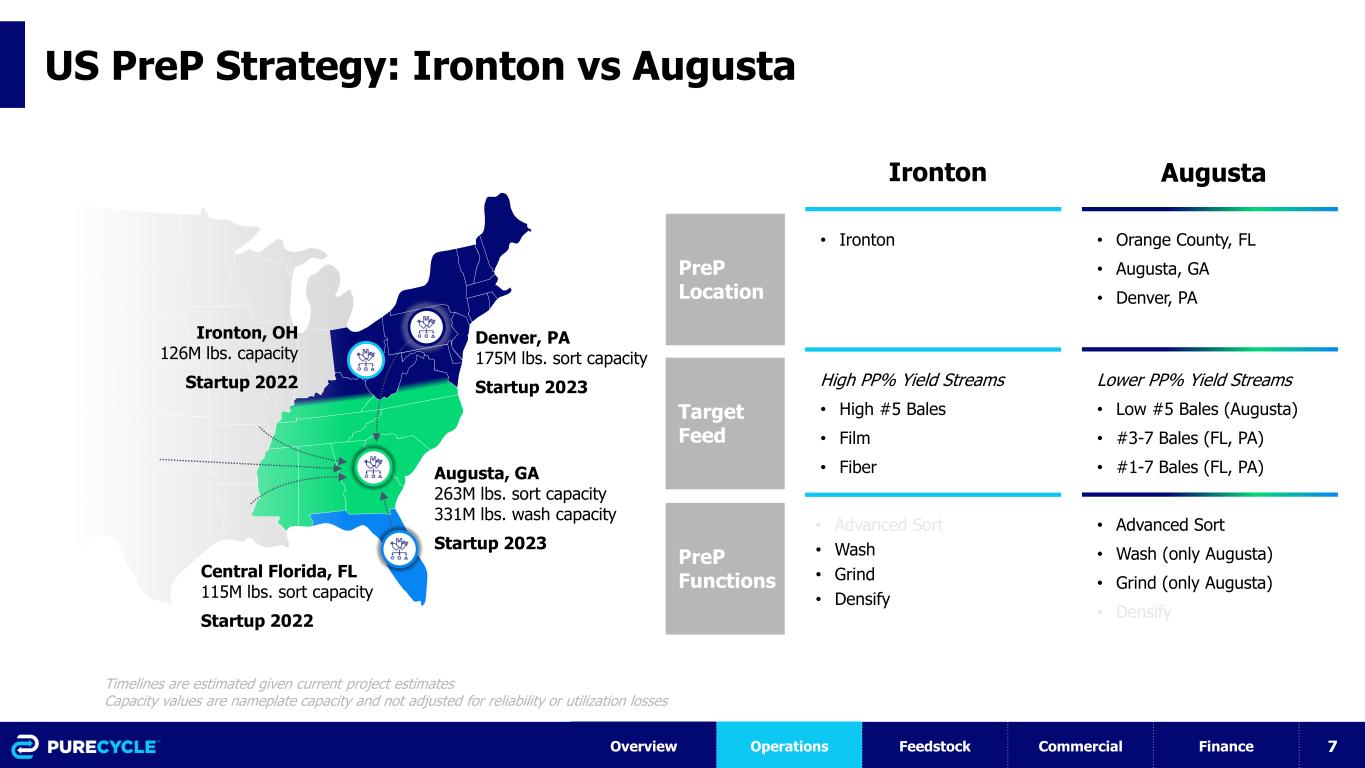

7 US PreP Strategy: Ironton vs Augusta Denver, PA 175M lbs. sort capacity Startup 2023 Augusta, GA 263M lbs. sort capacity 331M lbs. wash capacity Startup 2023 • Ironton Overview Operations Feedstock Commercial Finance Ironton, OH 126M lbs. capacity Startup 2022 Central Florida, FL 115M lbs. sort capacity Startup 2022 Ironton Augusta PreP Location Target Feed • Orange County, FL • Augusta, GA • Denver, PA High PP% Yield Streams • High #5 Bales • Film • Fiber PreP Functions Lower PP% Yield Streams • Low #5 Bales (Augusta) • #3-7 Bales (FL, PA) • #1-7 Bales (FL, PA) • Advanced Sort • Wash • Grind • Densify • Advanced Sort • Wash (only Augusta) • Grind (only Augusta) • Densify Timelines are estimated given current project estimates Capacity values are nameplate capacity and not adjusted for reliability or utilization losses

8 Executing on Our Feed PreP Strategy 2023 2024 FL PA GA OH Overview Operations Feedstock Commercial Finance

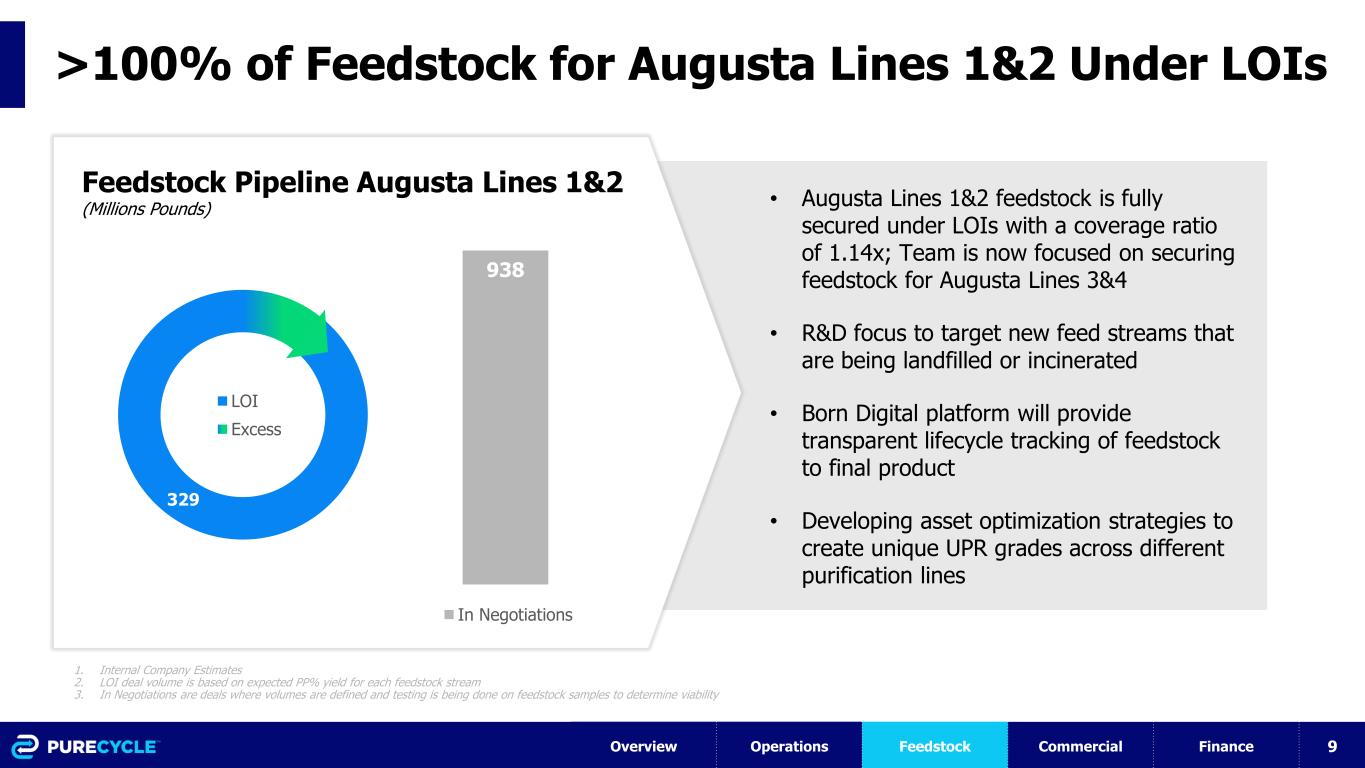

9 >100% of Feedstock for Augusta Lines 1&2 Under LOIs 1. Internal Company Estimates 2. LOI deal volume is based on expected PP% yield for each feedstock stream 3. In Negotiations are deals where volumes are defined and testing is being done on feedstock samples to determine viability Overview Operations Feedstock Commercial Finance Feedstock Pipeline Augusta Lines 1&2 (Millions Pounds) • Augusta Lines 1&2 feedstock is fully secured under LOIs with a coverage ratio of 1.14x; Team is now focused on securing feedstock for Augusta Lines 3&4 • R&D focus to target new feed streams that are being landfilled or incinerated • Born Digital platform will provide transparent lifecycle tracking of feedstock to final product • Developing asset optimization strategies to create unique UPR grades across different purification lines 938 In Negotiations 329 LOI Excess

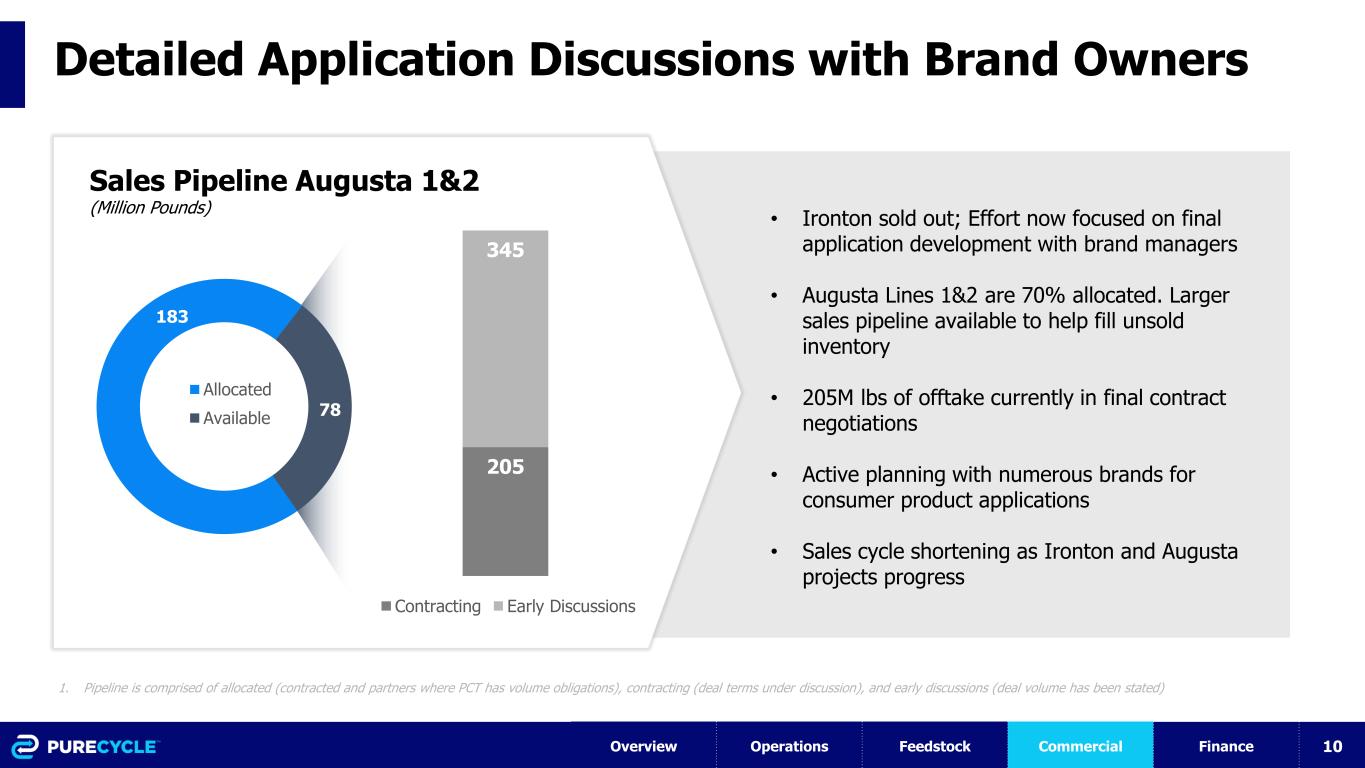

10 Detailed Application Discussions with Brand Owners 1. Pipeline is comprised of allocated (contracted and partners where PCT has volume obligations), contracting (deal terms under discussion), and early discussions (deal volume has been stated) Sales Pipeline Augusta 1&2 (Million Pounds) • Ironton sold out; Effort now focused on final application development with brand managers • Augusta Lines 1&2 are 70% allocated. Larger sales pipeline available to help fill unsold inventory • 205M lbs of offtake currently in final contract negotiations • Active planning with numerous brands for consumer product applications • Sales cycle shortening as Ironton and Augusta projects progress Overview Operations Feedstock Commercial Finance 183 78 Allocated Available 205 345 Contracting Early Discussions

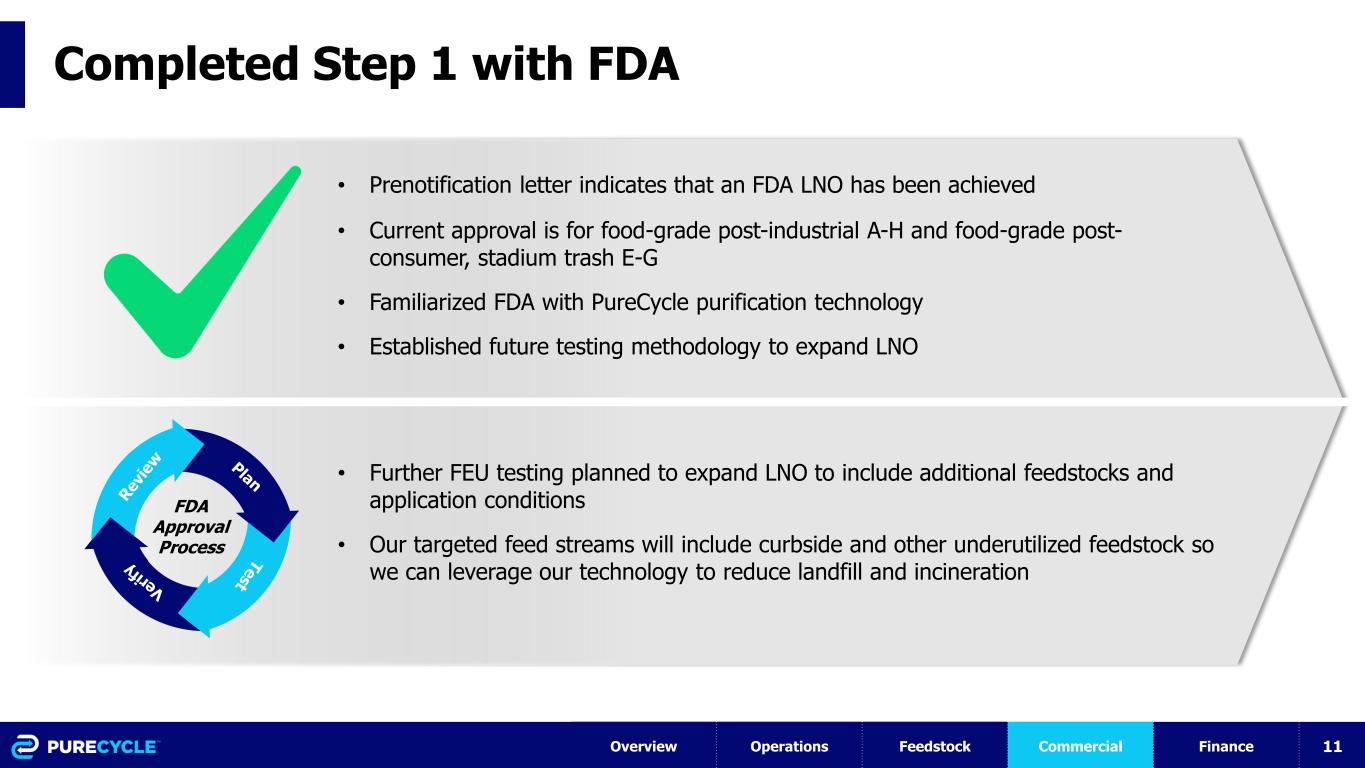

11 Completed Step 1 with FDA Overview Operations Feedstock Commercial Finance • Further FEU testing planned to expand LNO to include additional feedstocks and application conditions • Our targeted feed streams will include curbside and other underutilized feedstock so we can leverage our technology to reduce landfill and incineration • Prenotification letter indicates that an FDA LNO has been achieved • Current approval is for food-grade post-industrial A-H and food-grade post- consumer, stadium trash E-G • Familiarized FDA with PureCycle purification technology • Established future testing methodology to expand LNO FDA Approval Process

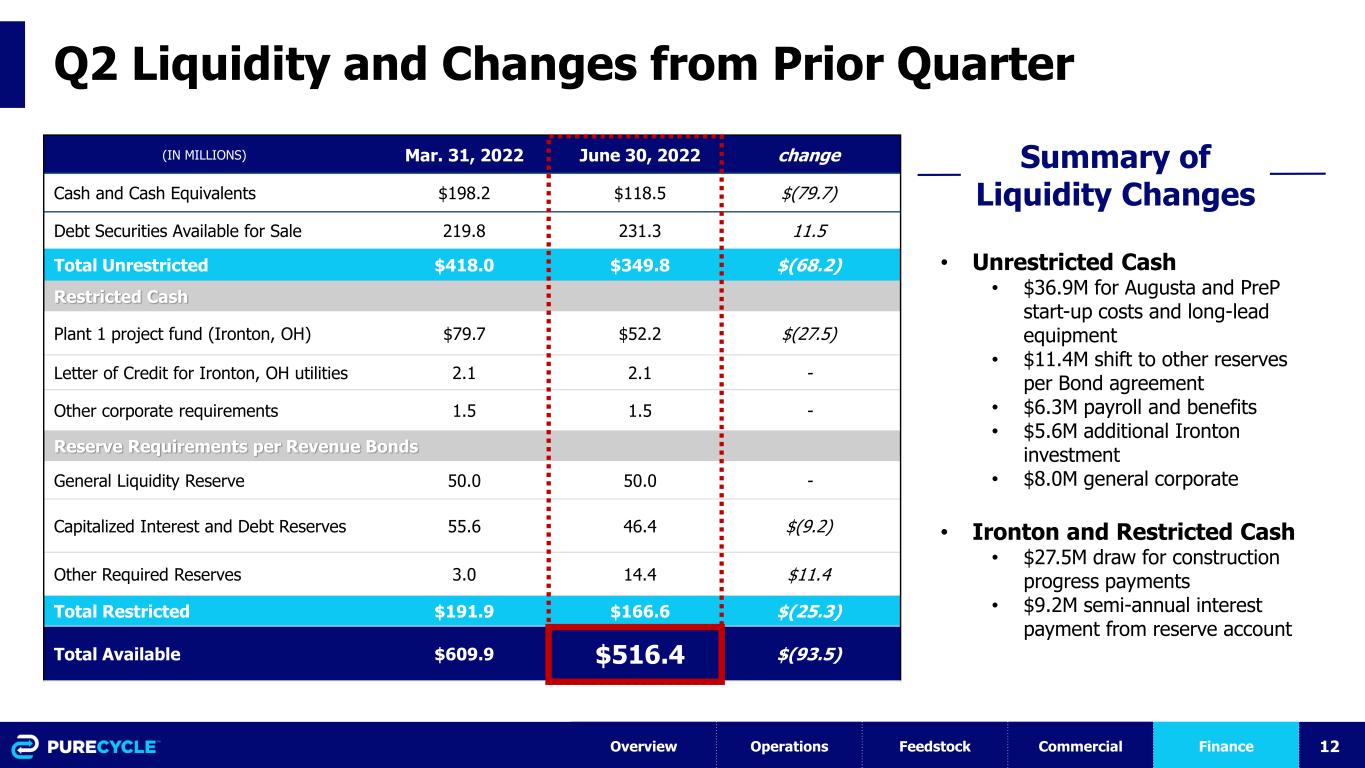

12 Q2 Liquidity and Changes from Prior Quarter (IN MILLIONS) Mar. 31, 2022 June 30, 2022 change Cash and Cash Equivalents $198.2 $118.5 $(79.7) Debt Securities Available for Sale 219.8 231.3 11.5 Total Unrestricted $418.0 $349.8 $(68.2) Restricted Cash Plant 1 project fund (Ironton, OH) $79.7 $52.2 $(27.5) Letter of Credit for Ironton, OH utilities 2.1 2.1 - Other corporate requirements 1.5 1.5 - Reserve Requirements per Revenue Bonds General Liquidity Reserve 50.0 50.0 - Capitalized Interest and Debt Reserves 55.6 46.4 $(9.2) Other Required Reserves 3.0 14.4 $11.4 Total Restricted $191.9 $166.6 $(25.3) Total Available $609.9 $516.4 $(93.5) Summary of Liquidity Changes • Unrestricted Cash • $36.9M for Augusta and PreP start-up costs and long-lead equipment • $11.4M shift to other reserves per Bond agreement • $6.3M payroll and benefits • $5.6M additional Ironton investment • $8.0M general corporate • Ironton and Restricted Cash • $27.5M draw for construction progress payments • $9.2M semi-annual interest payment from reserve account Overview Operations Feedstock Commercial Finance

13 PureCycle Continues to Execute 1 2 3 6 7 FDA Prenotification Letter received for Food-Grade Post-Industrial & Food-Grade Post-Consumer Stadium Trash Ended Q2 2022 with $516M in total cash & investments 5Ironton on-track for Q4 2022 pellet production; Augusta construction underway Feedstock PreP strategy is on track with Ironton and Central Florida startup in 2022 4 8 Ironton offtake fully allocated and Augusta first two lines 70% allocated Broadened the experience of our board and continued to recruit top talent 100% of Augusta’s feedstock for the first two lines are under LOIs; strong overall feedstock discussions Continue to broaden the end applications of PureCycle resin through converters and specialty compounders

14 Second Quarter 2022 Corporate Update August 12, 2022