1 Fourth Quarter 2021 Corporate Update March 9, 2022

2 Forward-Looking Statements Certain statements in this Presentation contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including statements about the outcome of any legal or regulatory proceedings to which PureCycle Technologies, Inc. (“PCT”) is, or may become a party, and the financial condition, results of operations, earnings outlook and prospects of PureCycle Technologies, Inc. (“PCT”). Forward-looking statements generally relate to future events or our future financial or operating performance and may refer to projections and forecasts. Forward-looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions (or the negative versions of such words or expressions), but the absence of these words does not mean that a statement is not forward-looking. The forward-looking statements are based on the current expectations of the management of PCT and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of this Presentation. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section of the Company’s to-be-filed Annual Report on Form 10-K (the “Form 10-K”) entitled “Risk Factors,” those discussed and identified in public filings made with the SEC by PCT, and the following: PCT’s ability to satisfy all conditions to the recently announced $250 million private placement and to consummate the transaction in a timely manner, or at all; PCT's ability to meet, and to continue to meet, applicable regulatory requirements for the use of PCT’s ultra-pure recycled (“UPR”) in food grade applications (both in the United States and abroad); PCT's ability to comply on an ongoing basis with the numerous regulatory requirements applicable to the UPR resin and PCT’s facilities (both in the United States and abroad); Expectations and changes regarding PCT’s strategies and future financial performance, including its future business plans, expansion plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and PCT’s ability to invest in growth initiatives; PCT’s ability to scale and build the Ironton plant in a timely and cost-effective manner; PCT's ability to complete the necessary financing with respect to, and complete the construction of, its first U.S. cluster facility, located in Augusta, Georgia (the "Augusta Facility"), in a timely and cost-effective manner; PCT’s ability to sort and process polypropylene plastic waste at its plastic waste prep (“Feed PreP”) facilities; PCT’s ability to maintain exclusivity under The Procter & Gamble Company license; the implementation, market acceptance and success of PCT’s business model and growth strategy; the success or profitability of PCT’s offtake arrangements; the ability to source feedstock with a high polypropylene content; PCT’s future capital requirements and sources and uses of cash; PCT’s ability to obtain funding for its operations and future growth; developments and projections relating to PCT’s competitors and industry; the outcome of any legal or regulatory proceedings to which PCT is, or may become a party, including the recently filed securities class action case; the ability to recognize the anticipated benefits of the Business Combination; geopolitical risk and changes in applicable laws or regulations; the possibility that PCT may be adversely affected by other economic, business, and/or competitive factors; labor shortages and turnover or increases in employees and employee-related costs; the potential impact of climate change on PCT, including physical and transition risks, higher regulatory and compliance costs, reputational risks, and availability of capital on attractive terms; operational risk; and the risk that the COVID-19 pandemic, including any variants and the efficacy and distribution of vaccines, and local, state, federal and international responses to addressing the pandemic may have an adverse effect on PCT’s business operations, as well as PCT’s financial condition and results of operations. PCT specifically disclaims any obligation to update this Presentation. These forward-looking statements should not be relied upon as representing PCT’s assessments as of any date subsequent to the date of this Presentation. Accordingly, undue reliance should not be placed upon the forward-looking statements. Estimates for EBITDA are preliminary estimates and are subject to risks and uncertainties, including, among others, changes in connection with quarter-end and year-end adjustments. Any variation between PCT's actual results and the preliminary financial data set forth herein may be material.

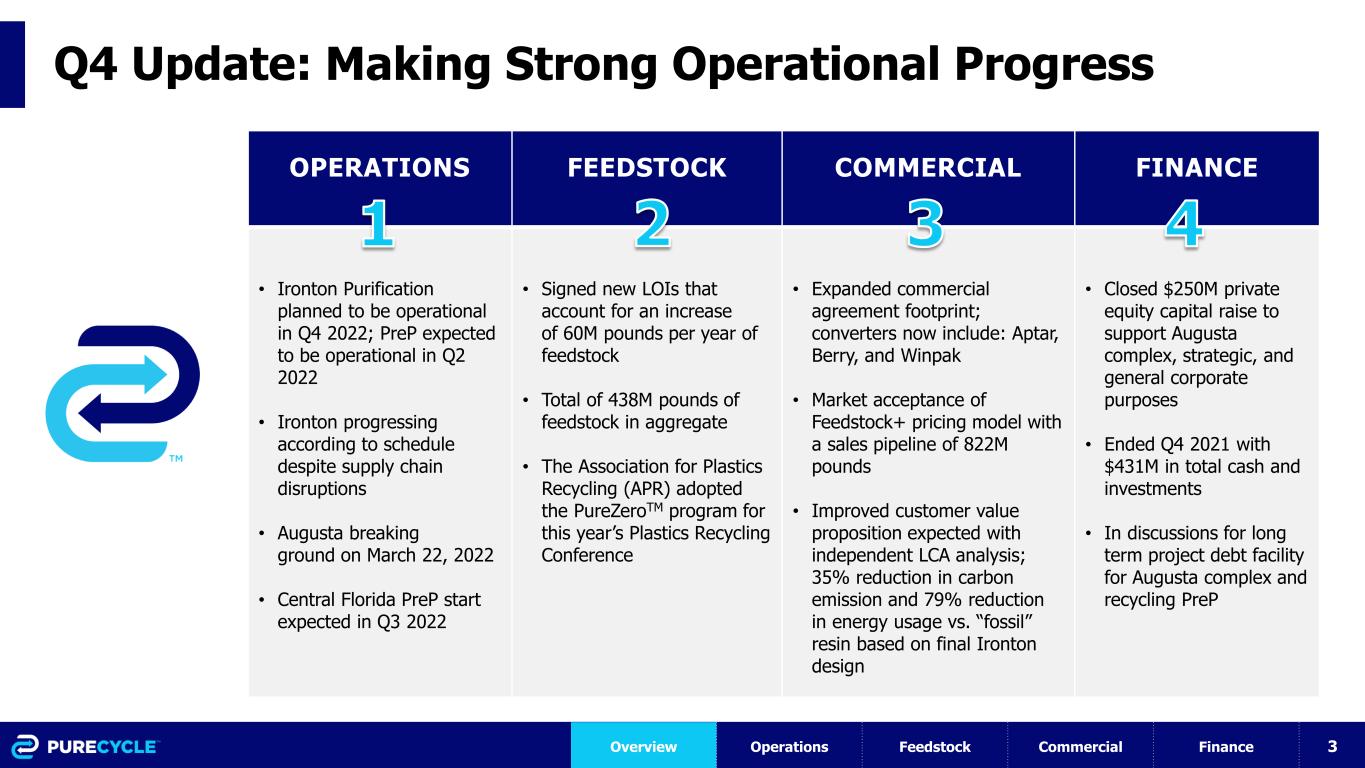

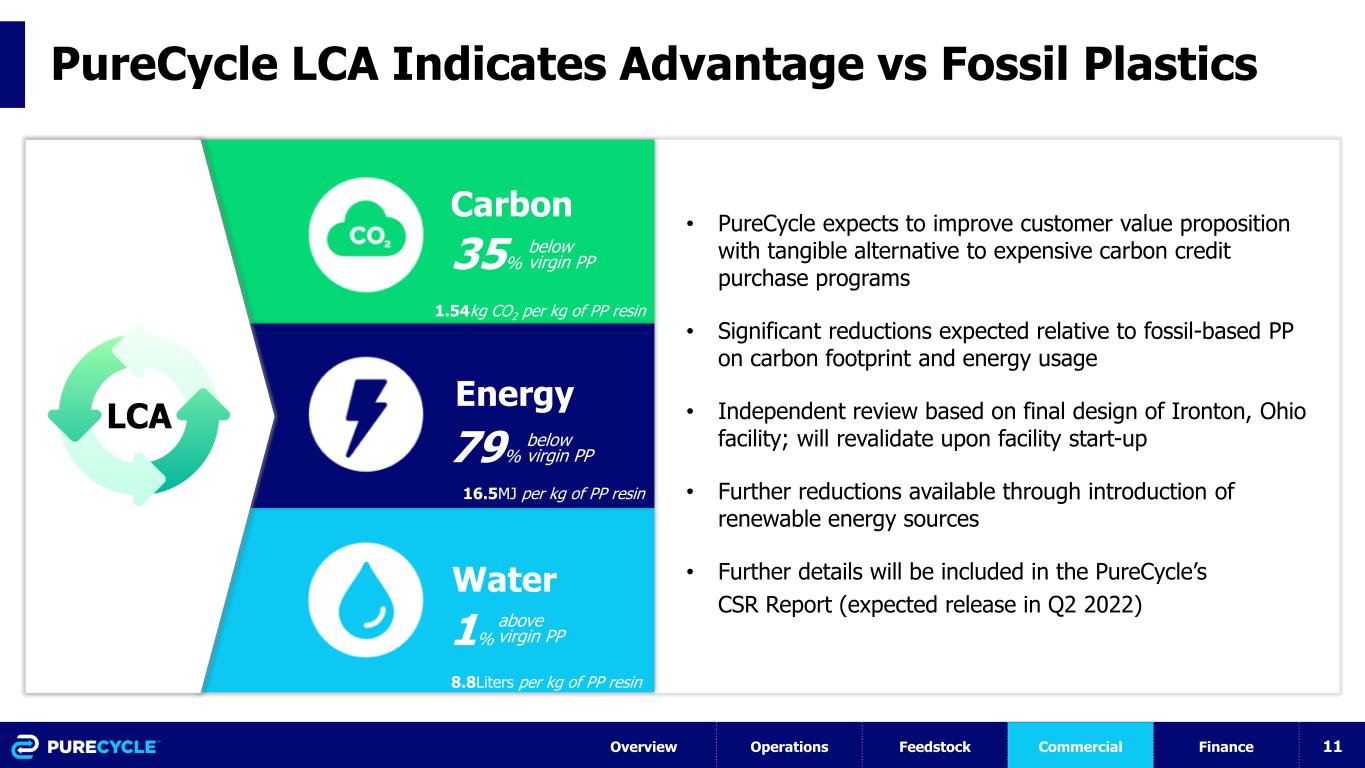

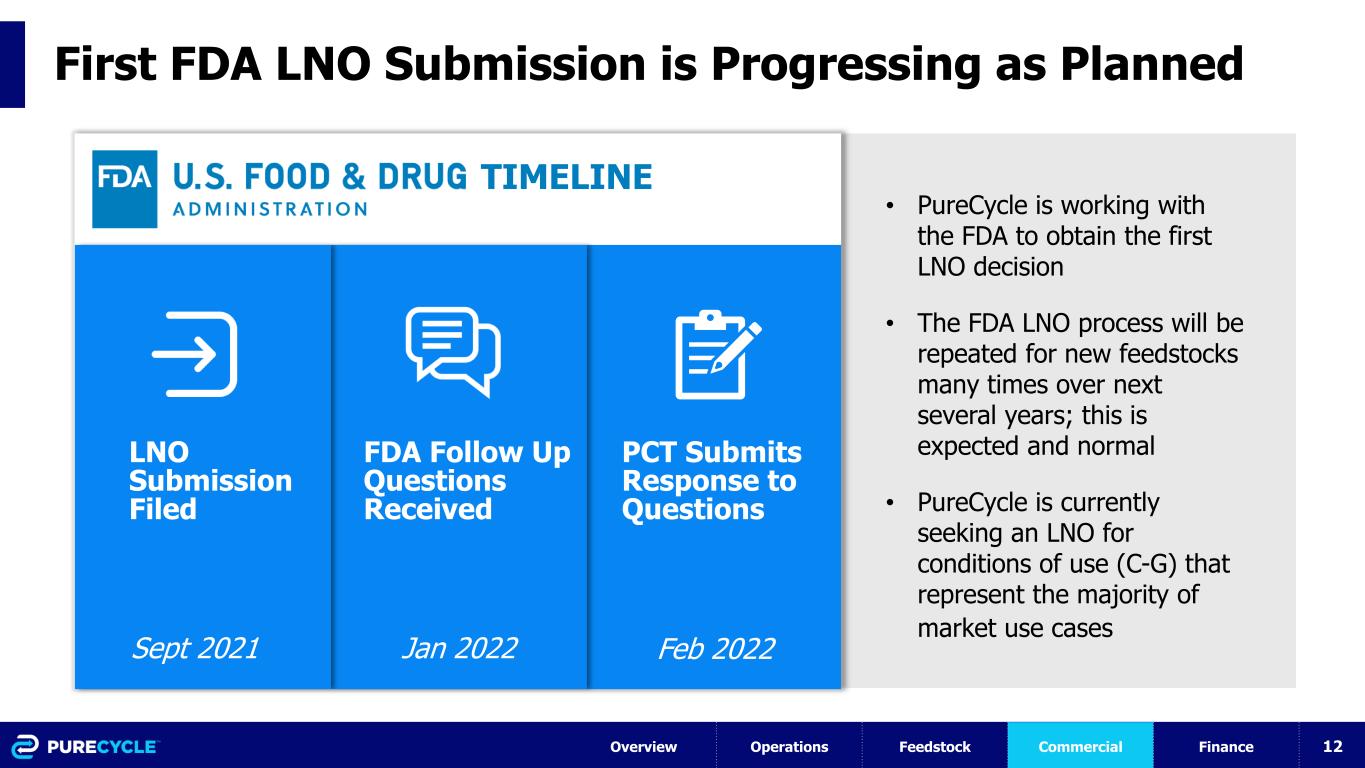

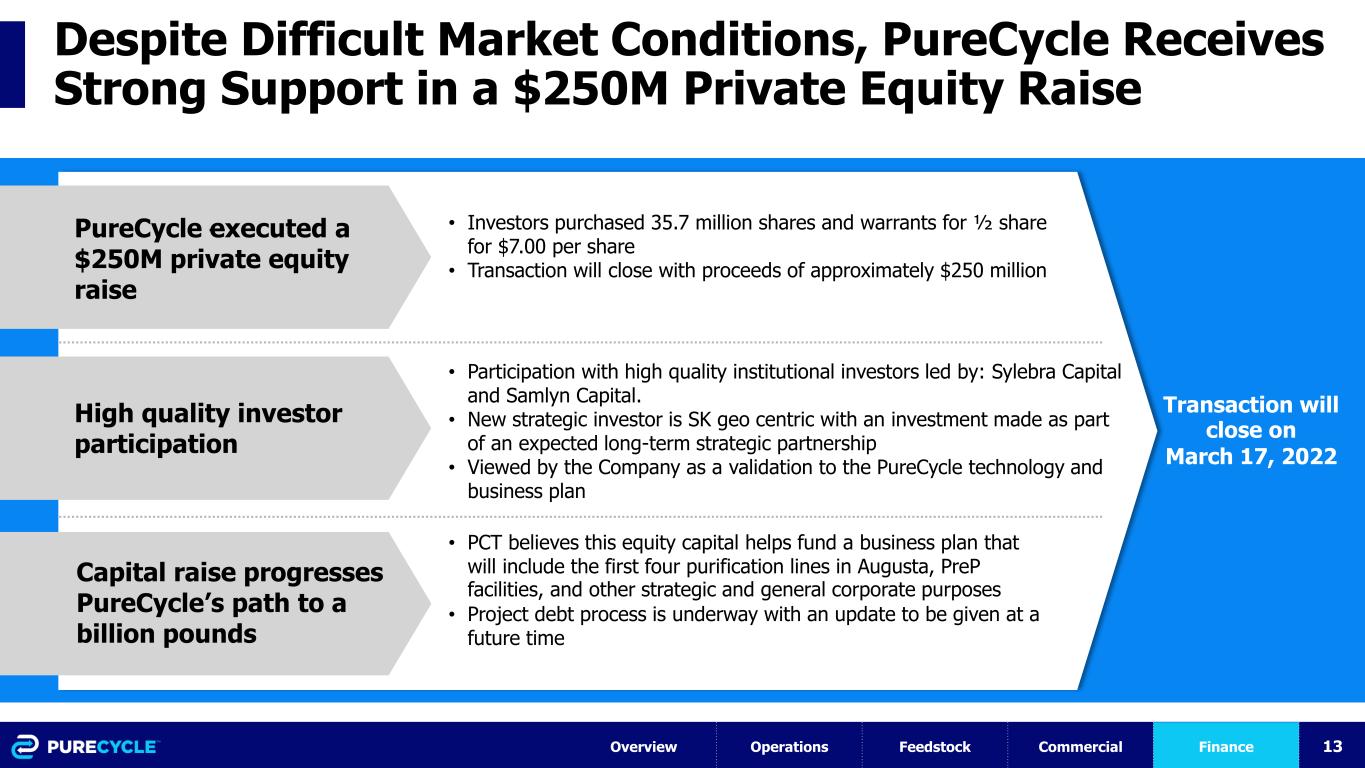

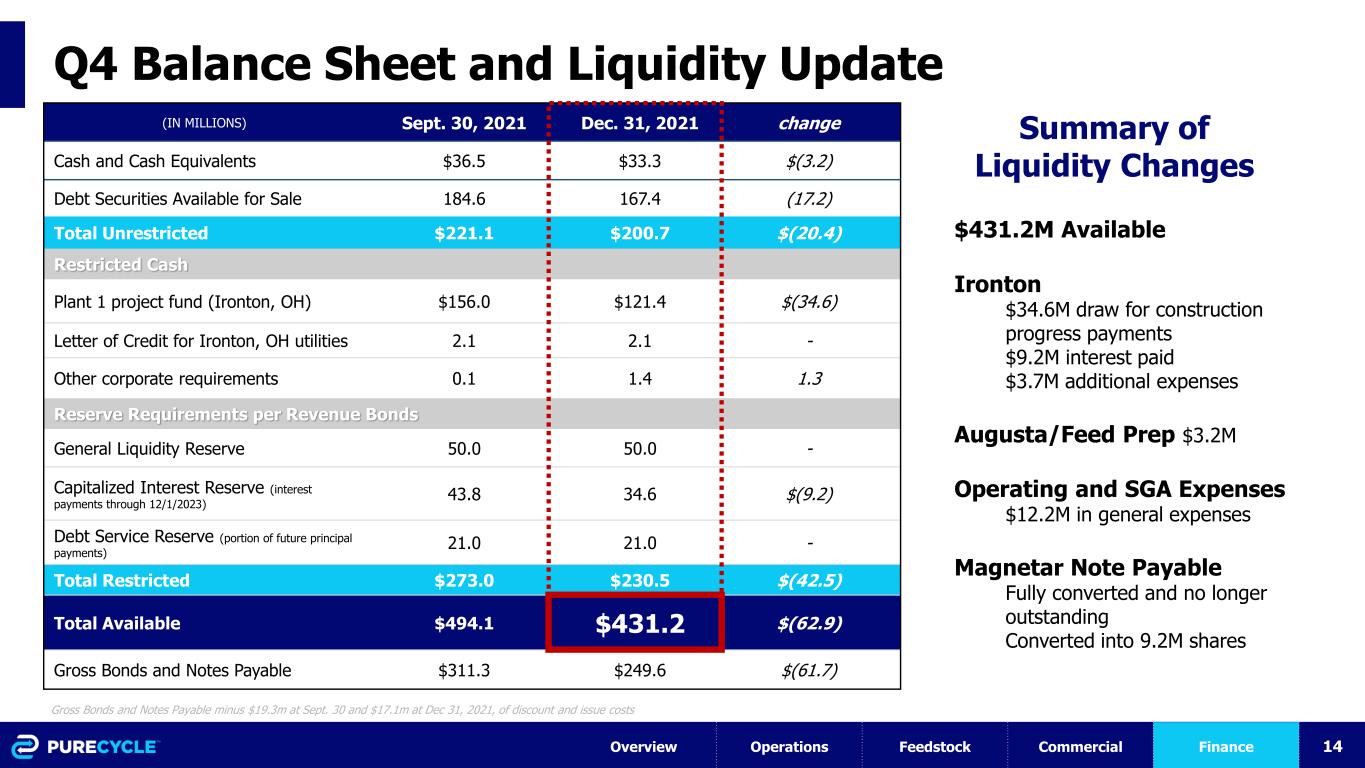

3 Q4 Update: Making Strong Operational Progress OPERATIONS FEEDSTOCK COMMERCIAL FINANCE • Ironton Purification planned to be operational in Q4 2022; PreP expected to be operational in Q2 2022 • Ironton progressing according to schedule despite supply chain disruptions • Augusta breaking ground on March 22, 2022 • Central Florida PreP start expected in Q3 2022 • Signed new LOIs that account for an increase of 60M pounds per year of feedstock • Total of 438M pounds of feedstock in aggregate • The Association for Plastics Recycling (APR) adopted the PureZeroTM program for this year’s Plastics Recycling Conference • Expanded commercial agreement footprint; converters now include: Aptar, Berry, and Winpak • Market acceptance of Feedstock+ pricing model with a sales pipeline of 822M pounds • Improved customer value proposition expected with independent LCA analysis; 35% reduction in carbon emission and 79% reduction in energy usage vs. “fossil” resin based on final Ironton design • Closed $250M private equity capital raise to support Augusta complex, strategic, and general corporate purposes • Ended Q4 2021 with $431M in total cash and investments • In discussions for long term project debt facility for Augusta complex and recycling PreP Overview Operations Feedstock Commercial Finance

4 Continuing Our Global Path to a Billion Pounds per year 887 130 130 North America* Ironton Augusta #1 Augusta #2 Augusta #3 Augusta #4 Augusta #5 Augusta #6 Q4 2022 Q4 2023 Q4 2023 Q2 2024 Q2 2024 Q1 2025 Q1 2025 Ulsan, SK Japan (Mitsui) Q4 2024** TBD Asia* Europe* NE Europe Q4 2024 Completion dates for all manufacturing based on current expectations and are subject to delays Timeline is contingent on completing agreement on schedule All references to capacity are in millions lbs / yr * ** ***

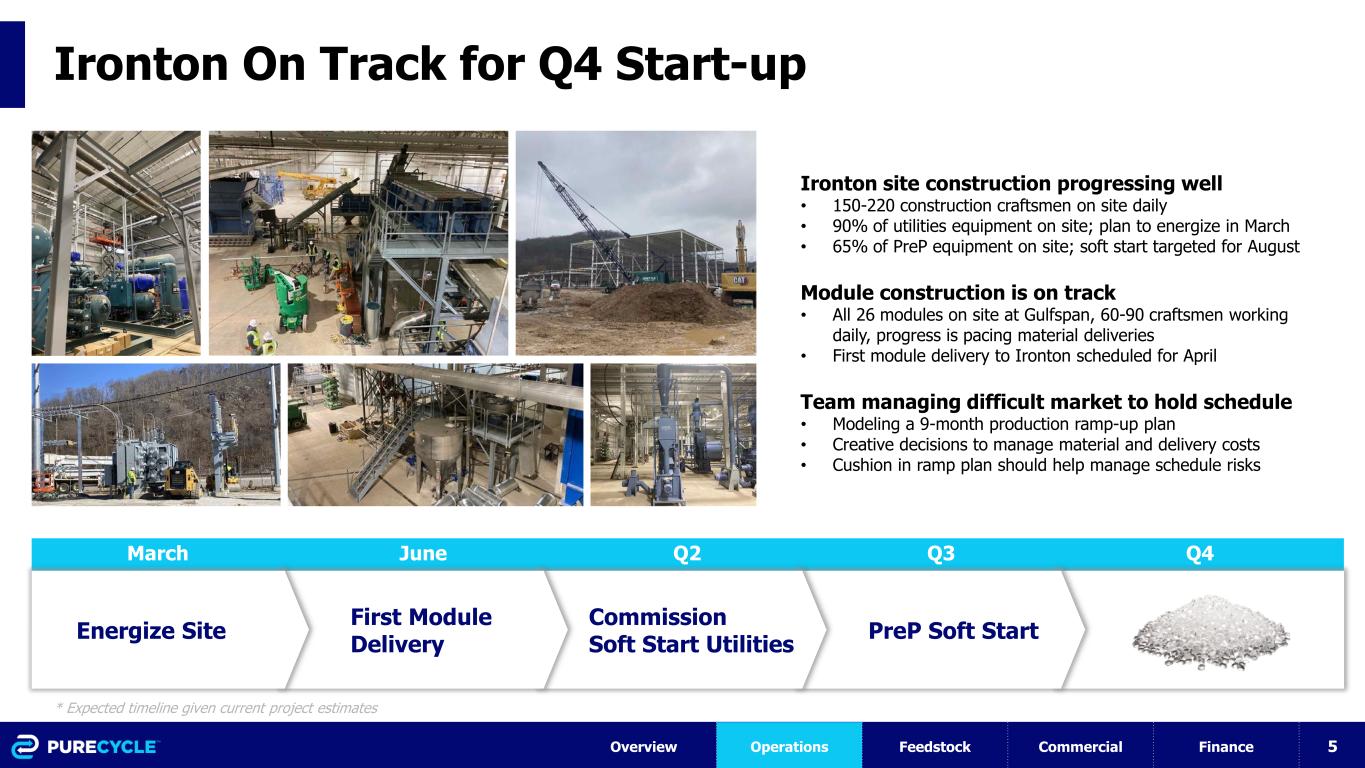

5 Ironton On Track for Q4 Start-up Energize Site First Module Delivery Commission Soft Start Utilities PreP Soft Start March June Q2 Q3 Q4 Ironton site construction progressing well • 150-220 construction craftsmen on site daily • 90% of utilities equipment on site; plan to energize in March • 65% of PreP equipment on site; soft start targeted for August Module construction is on track • All 26 modules on site at Gulfspan, 60-90 craftsmen working daily, progress is pacing material deliveries • First module delivery to Ironton scheduled for April Team managing difficult market to hold schedule • Modeling a 9-month production ramp-up plan • Creative decisions to manage material and delivery costs • Cushion in ramp plan should help manage schedule risks Overview Operations Feedstock Commercial Finance * Expected timeline given current project estimates

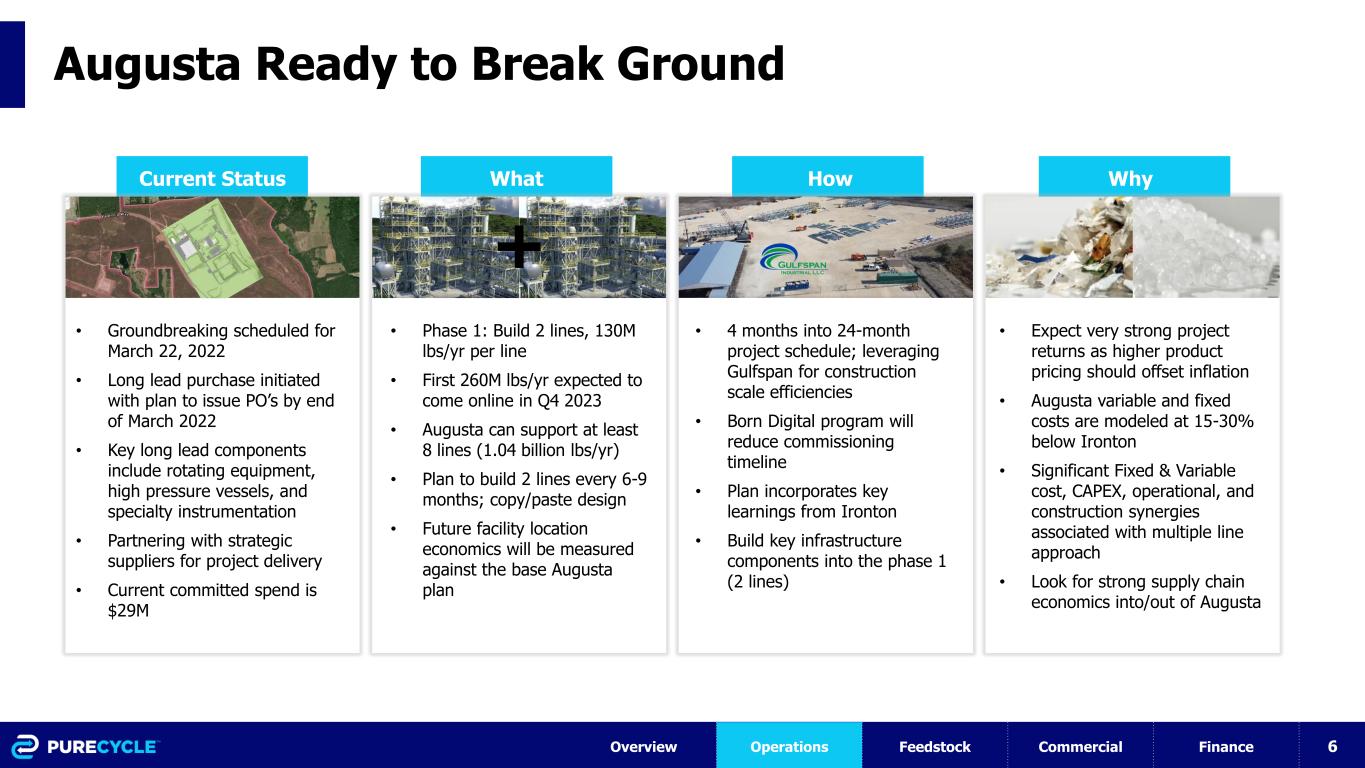

6 Augusta Ready to Break Ground • Phase 1: Build 2 lines, 130M lbs/yr per line • First 260M lbs/yr expected to come online in Q4 2023 • Augusta can support at least 8 lines (1.04 billion lbs/yr) • Plan to build 2 lines every 6-9 months; copy/paste design • Future facility location economics will be measured against the base Augusta plan • 4 months into 24-month project schedule; leveraging Gulfspan for construction scale efficiencies • Born Digital program will reduce commissioning timeline • Plan incorporates key learnings from Ironton • Build key infrastructure components into the phase 1 (2 lines) • Expect very strong project returns as higher product pricing should offset inflation • Augusta variable and fixed costs are modeled at 15-30% below Ironton • Significant Fixed & Variable cost, CAPEX, operational, and construction synergies associated with multiple line approach • Look for strong supply chain economics into/out of Augusta + Current Status What How Why • Groundbreaking scheduled for March 22, 2022 • Long lead purchase initiated with plan to issue PO’s by end of March 2022 • Key long lead components include rotating equipment, high pressure vessels, and specialty instrumentation • Partnering with strategic suppliers for project delivery • Current committed spend is $29M Overview Operations Feedstock Commercial Finance

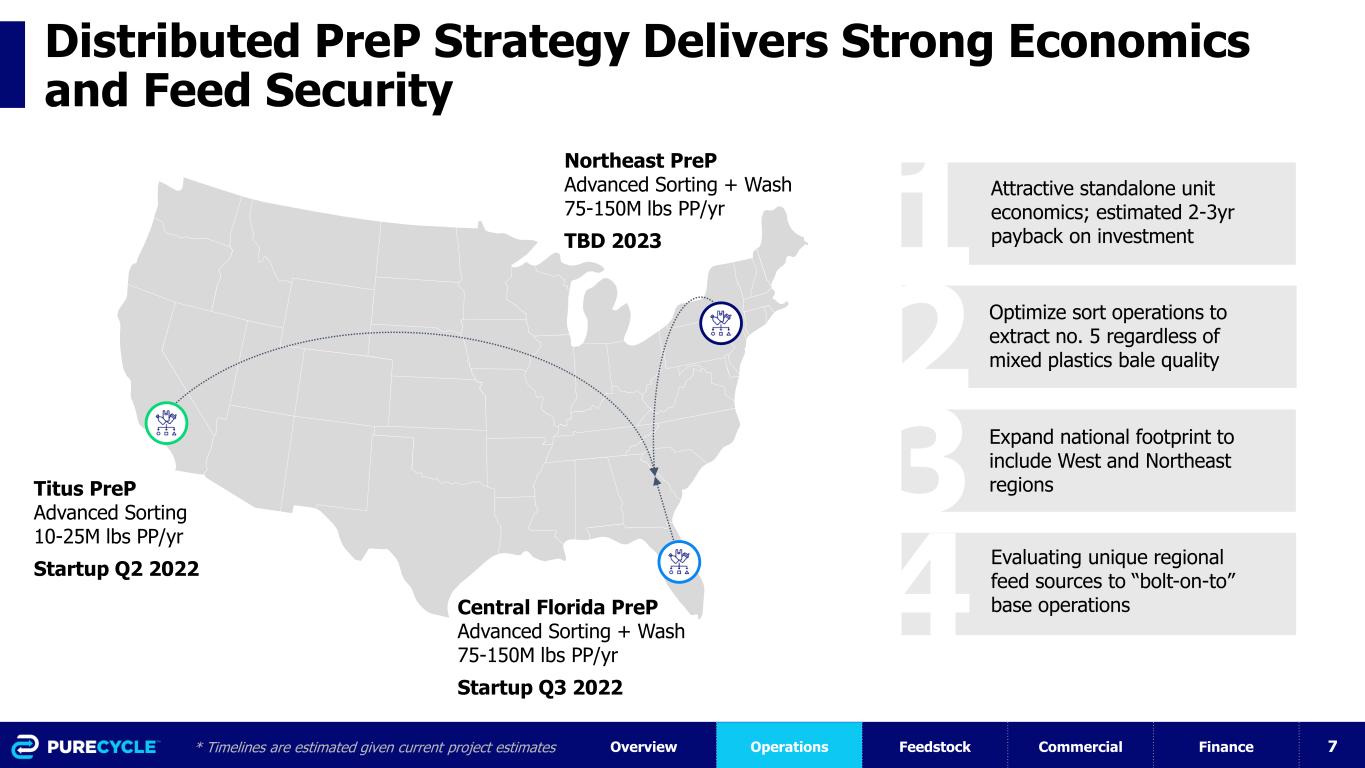

7 Distributed PreP Strategy Delivers Strong Economics and Feed Security Northeast PreP Advanced Sorting + Wash 75-150M lbs PP/yr TBD 2023 Central Florida PreP Advanced Sorting + Wash 75-150M lbs PP/yr Startup Q3 2022 Titus PreP Advanced Sorting 10-25M lbs PP/yr Startup Q2 2022 1 Expand national footprint to include West and Northeast regions 2 Optimize sort operations to extract no. 5 regardless of mixed plastics bale quality 3 4 Evaluating unique regional feed sources to “bolt-on-to” base operations Attractive standalone unit economics; estimated 2-3yr payback on investment Overview Operations Feedstock Commercial Finance* Timelines are estimated given current project estimates

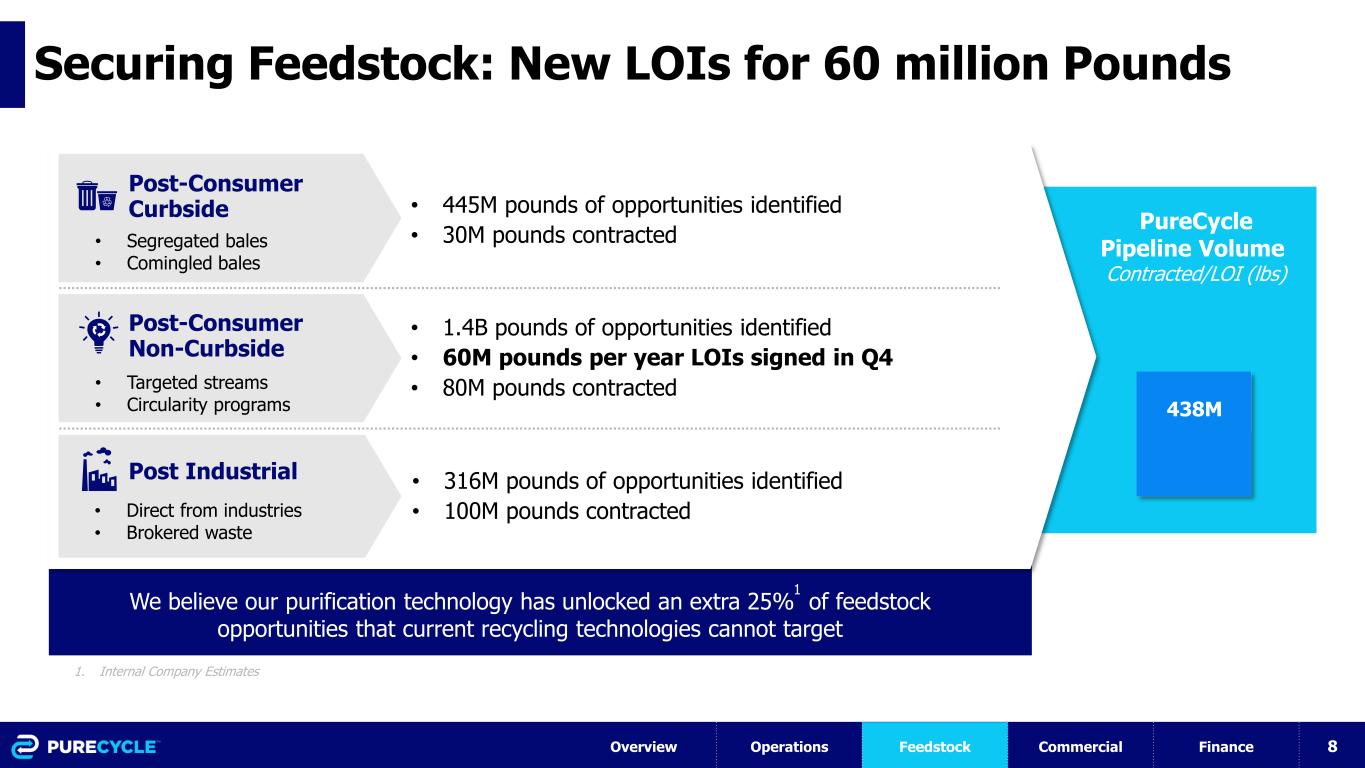

8 Securing Feedstock: New LOIs for 60 million Pounds Post Industrial Post-Consumer Non-Curbside Post-Consumer Curbside • Segregated bales • Comingled bales • Targeted streams • Circularity programs • Direct from industries • Brokered waste 1. Internal Company Estimates • 445M pounds of opportunities identified • 30M pounds contracted • 1.4B pounds of opportunities identified • 60M pounds per year LOIs signed in Q4 • 80M pounds contracted • 316M pounds of opportunities identified • 100M pounds contracted We believe our purification technology has unlocked an extra 25% of feedstock opportunities that current recycling technologies cannot target 1 PureCycle Pipeline Volume Contracted/LOI (lbs) 438M Overview Operations Feedstock Commercial Finance

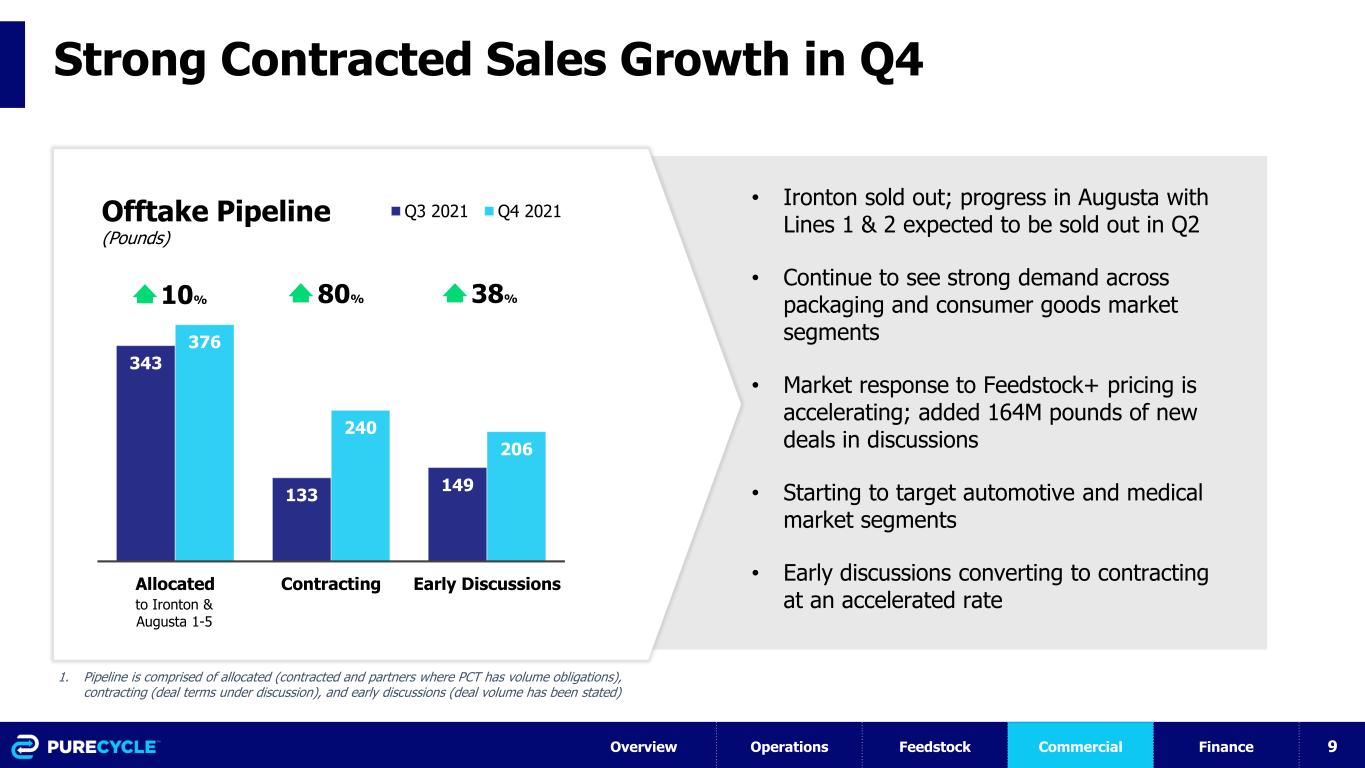

9 343 133 149 376 240 206 Allocated Contracting Early Discussions Q3 2021 Q4 2021 Strong Contracted Sales Growth in Q4 1. Pipeline is comprised of allocated (contracted and partners where PCT has volume obligations), contracting (deal terms under discussion), and early discussions (deal volume has been stated) Offtake Pipeline (Pounds) 10% 80% 38% to Ironton & Augusta 1-5 • Ironton sold out; progress in Augusta with Lines 1 & 2 expected to be sold out in Q2 • Continue to see strong demand across packaging and consumer goods market segments • Market response to Feedstock+ pricing is accelerating; added 164M pounds of new deals in discussions • Starting to target automotive and medical market segments • Early discussions converting to contracting at an accelerated rate Overview Operations Feedstock Commercial Finance

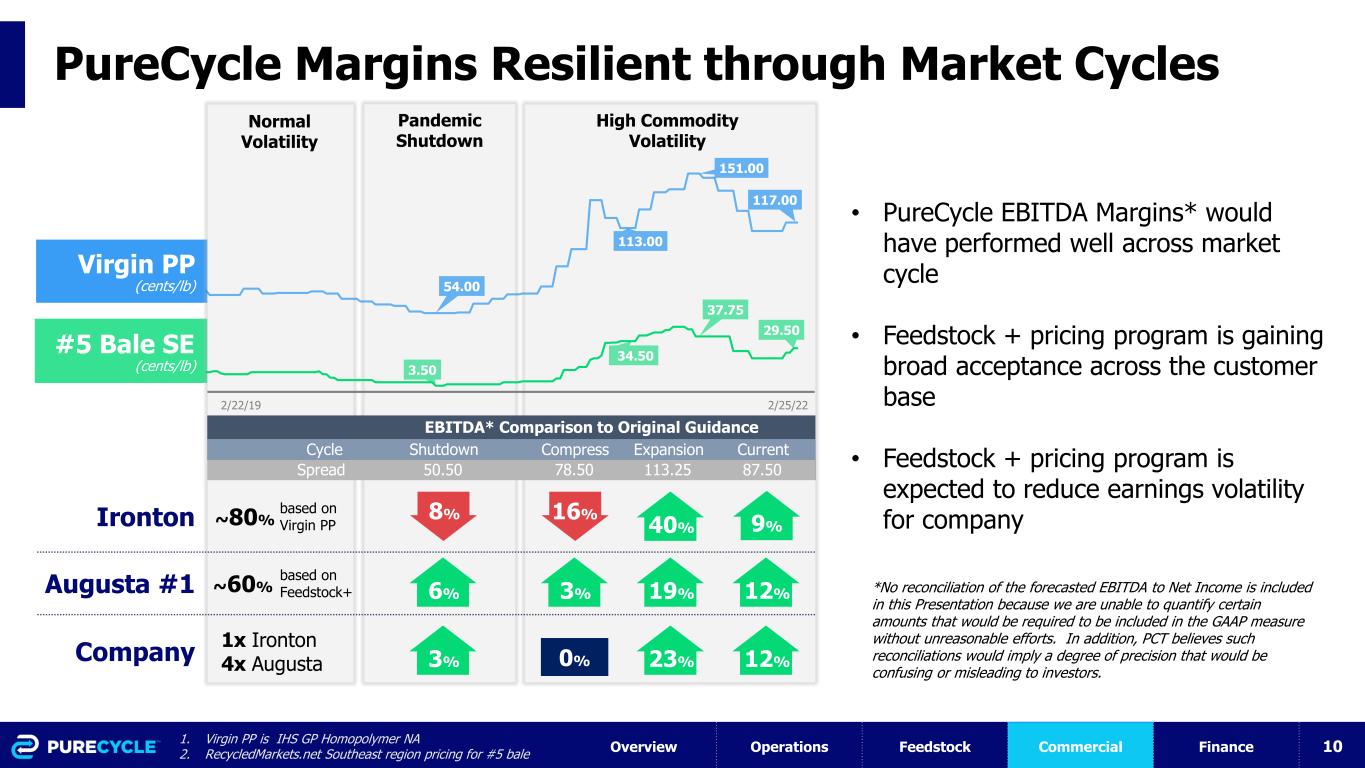

10 Virgin PP (cents/lb) #5 Bale SE (cents/lb) PureCycle Margins Resilient through Market Cycles 1. Virgin PP is IHS GP Homopolymer NA 2. RecycledMarkets.net Southeast region pricing for #5 bale Pandemic Shutdown 2/22/19 2/25/22 Ironton Augusta #1 ~80% ~60% Normal Volatility 54.00 113.00 151.00 117.00 3.50 34.50 37.75 29.50 EBITDA* Comparison to Original Guidance 9% 16% 40% 8%based on Virgin PP based on Feedstock+ High Commodity Volatility • PureCycle EBITDA Margins* would have performed well across market cycle • Feedstock + pricing program is gaining broad acceptance across the customer base • Feedstock + pricing program is expected to reduce earnings volatility for company 6% 3% 19% 12% Company 1x Ironton 4x Augusta 3% 0% 23% 12% Cycle Spread Shutdown Compress Expansion Current 50.50 78.50 113.25 87.50 Overview Operations Feedstock Commercial Finance *No reconciliation of the forecasted EBITDA to Net Income is included in this Presentation because we are unable to quantify certain amounts that would be required to be included in the GAAP measure without unreasonable efforts. In addition, PCT believes such reconciliations would imply a degree of precision that would be confusing or misleading to investors.

11 PureCycle LCA Indicates Advantage vs Fossil Plastics 35% 1% • PureCycle expects to improve customer value proposition with tangible alternative to expensive carbon credit purchase programs • Significant reductions expected relative to fossil-based PP on carbon footprint and energy usage • Independent review based on final design of Ironton, Ohio facility; will revalidate upon facility start-up • Further reductions available through introduction of renewable energy sources • Further details will be included in the PureCycle’s CSR Report (expected release in Q2 2022) LCA Energy above virgin PP below virgin PP 79% Carbon Water below virgin PP Overview Operations Feedstock Commercial Finance 1.54kg CO2 per kg of PP resin 16.5MJ per kg of PP resin 8.8Liters per kg of PP resin

12 LNO Submission Filed • PureCycle is working with the FDA to obtain the first LNO decision • The FDA LNO process will be repeated for new feedstocks many times over next several years; this is expected and normal • PureCycle is currently seeking an LNO for conditions of use (C-G) that represent the majority of market use cases First FDA LNO Submission is Progressing as Planned FDA Follow Up Questions Received PCT Submits Response to Questions TIMELINE Sept 2021 Jan 2022 Feb 2022 Overview Operations Feedstock Commercial Finance

13 Despite Difficult Market Conditions, PureCycle Receives Strong Support in a $250M Private Equity Raise • Investors purchased 35.7 million shares and warrants for ½ share for $7.00 per share • Transaction will close with proceeds of approximately $250 million • Participation with high quality institutional investors led by: Sylebra Capital and Samlyn Capital. • New strategic investor is SK geo centric with an investment made as part of an expected long-term strategic partnership • Viewed by the Company as a validation to the PureCycle technology and business plan • PCT believes this equity capital helps fund a business plan that will include the first four purification lines in Augusta, PreP facilities, and other strategic and general corporate purposes • Project debt process is underway with an update to be given at a future time PureCycle executed a $250M private equity raise High quality investor participation Capital raise progresses PureCycle’s path to a billion pounds Transaction will close on March 17, 2022 Overview Operations Feedstock Commercial Finance

14 Q4 Balance Sheet and Liquidity Update (IN MILLIONS) Sept. 30, 2021 Dec. 31, 2021 change Cash and Cash Equivalents $36.5 $33.3 $(3.2) Debt Securities Available for Sale 184.6 167.4 (17.2) Total Unrestricted $221.1 $200.7 $(20.4) Restricted Cash Plant 1 project fund (Ironton, OH) $156.0 $121.4 $(34.6) Letter of Credit for Ironton, OH utilities 2.1 2.1 - Other corporate requirements 0.1 1.4 1.3 Reserve Requirements per Revenue Bonds General Liquidity Reserve 50.0 50.0 - Capitalized Interest Reserve (interest payments through 12/1/2023) 43.8 34.6 $(9.2) Debt Service Reserve (portion of future principal payments) 21.0 21.0 - Total Restricted $273.0 $230.5 $(42.5) Total Available $494.1 $431.2 $(62.9) Gross Bonds and Notes Payable $311.3 $249.6 $(61.7) Summary of Liquidity Changes $431.2M Available Ironton $34.6M draw for construction progress payments $9.2M interest paid $3.7M additional expenses Augusta/Feed Prep $3.2M Operating and SGA Expenses $12.2M in general expenses Magnetar Note Payable Fully converted and no longer outstanding Converted into 9.2M shares Gross Bonds and Notes Payable minus $19.3m at Sept. 30 and $17.1m at Dec 31, 2021, of discount and issue costs Overview Operations Feedstock Commercial Finance

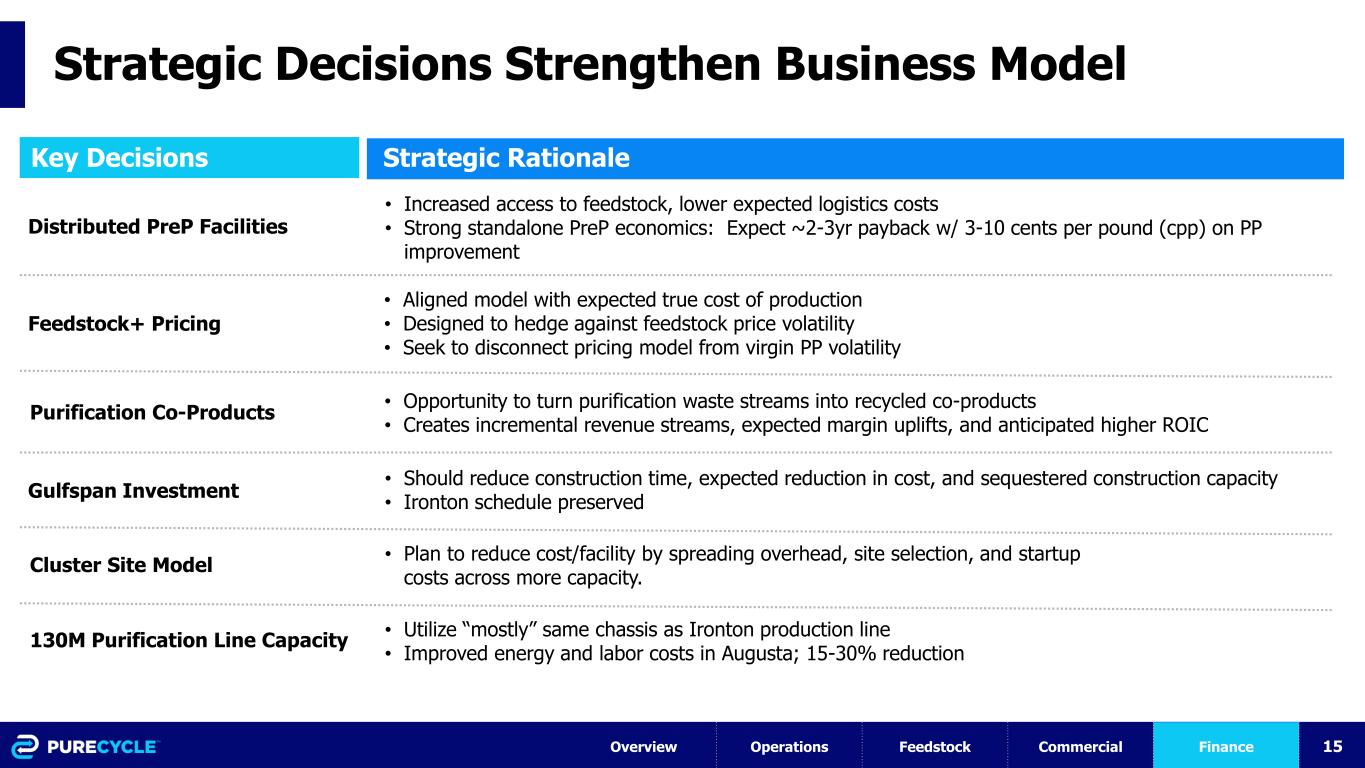

15 Strategic Decisions Strengthen Business Model Key Decisions Strategic Rationale • Increased access to feedstock, lower expected logistics costs • Strong standalone PreP economics: Expect ~2-3yr payback w/ 3-10 cents per pound (cpp) on PP improvement Distributed PreP Facilities Feedstock+ Pricing Gulfspan Investment Cluster Site Model • Aligned model with expected true cost of production • Designed to hedge against feedstock price volatility • Seek to disconnect pricing model from virgin PP volatility • Should reduce construction time, expected reduction in cost, and sequestered construction capacity • Ironton schedule preserved • Plan to reduce cost/facility by spreading overhead, site selection, and startup costs across more capacity. 130M Purification Line Capacity • Utilize “mostly” same chassis as Ironton production line • Improved energy and labor costs in Augusta; 15-30% reduction Purification Co-Products • Opportunity to turn purification waste streams into recycled co-products • Creates incremental revenue streams, expected margin uplifts, and anticipated higher ROIC Overview Operations Feedstock Commercial Finance

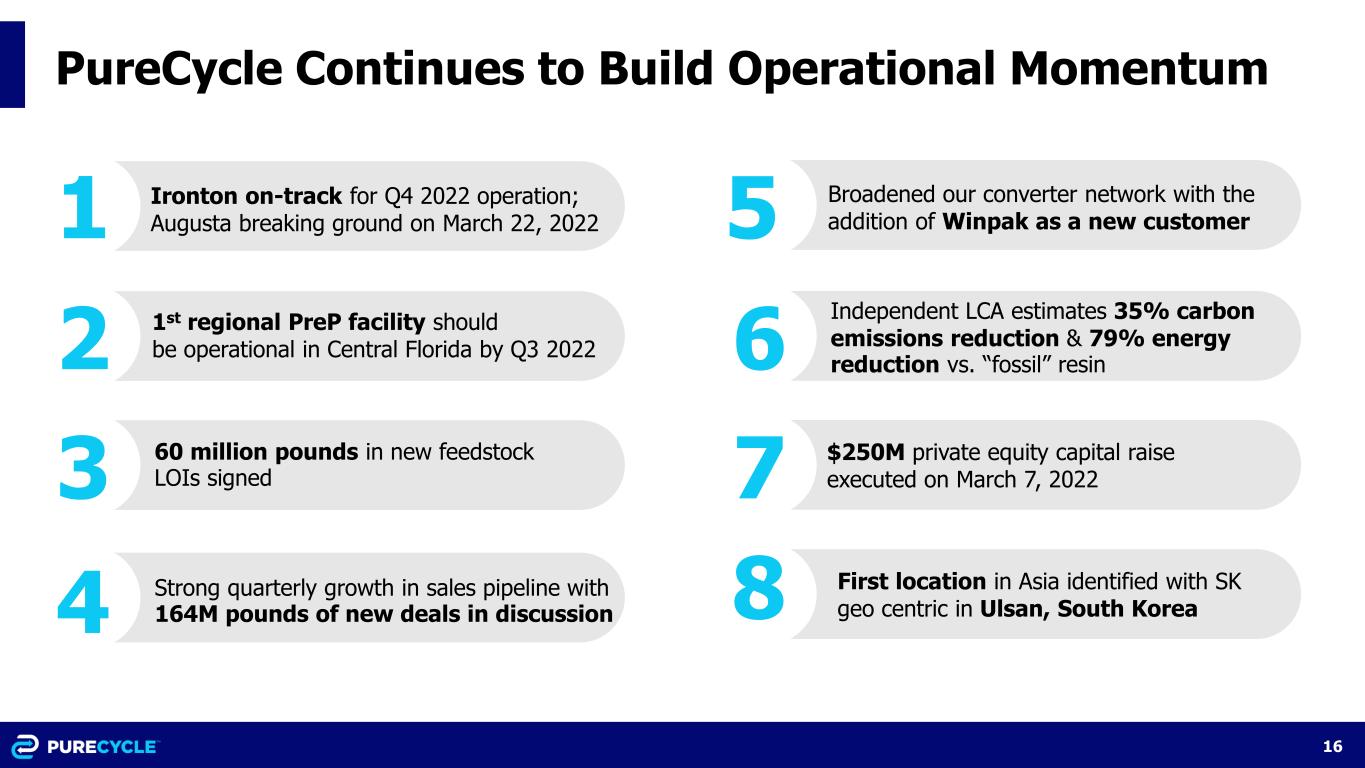

16 PureCycle Continues to Build Operational Momentum 1 2 3 6 7 $250M private equity capital raise executed on March 7, 2022 1st regional PreP facility should be operational in Central Florida by Q3 2022 Strong quarterly growth in sales pipeline with 164M pounds of new deals in discussion 5 First location in Asia identified with SK geo centric in Ulsan, South Korea Ironton on-track for Q4 2022 operation; Augusta breaking ground on March 22, 2022 Broadened our converter network with the addition of Winpak as a new customer 4 8 60 million pounds in new feedstock LOIs signed Independent LCA estimates 35% carbon emissions reduction & 79% energy reduction vs. “fossil” resin