salary rate of $500,000, a 2022 target STIP opportunity equal to 70% of his base salary, an expected long-term incentive award target of $700,000, and certain customary employee benefits. The offer letter also provides that Mr. Somma will participate in the Severance Plan, which is further described below. The offer letter also provides that Mr. Somma will enter into a restrictive covenant agreement.

In connection with his commencement of employment in January 2021, we provided an offer letter to Mr. Kalter, which offer letter provides for the basic terms of his employment, including an initial annual base salary rate of $375,000, participation in annual and long-term incentive plans, a sign-on payment of $150,000 (paid in 2021), and certain customary employee benefits. The offer letter also provides that Mr. Kalter will participate in the Severance Plan. The offer letter also provides that Mr. Kalter will enter into a restrictive covenant agreement.

Independent Contractor Agreement

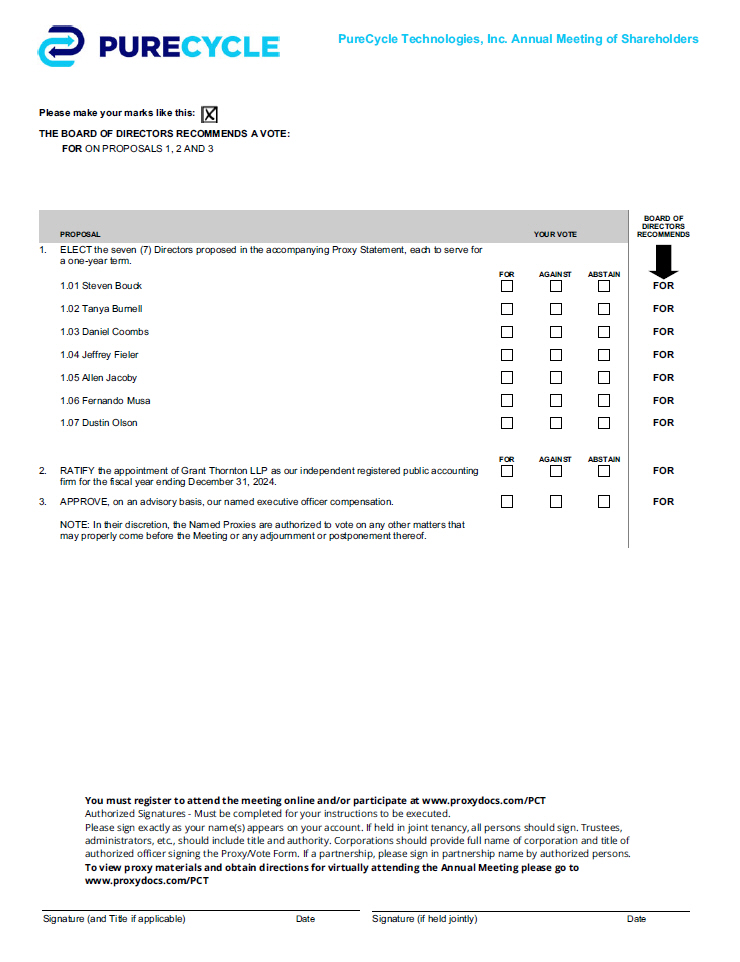

In connection with Mr. Fieler’s appointment as I-CFO, which was effective as of December 1, 2023, the Company and Mr. Fieler executed an independent contractor agreement (“ICA”). Pursuant to the terms of the ICA, Mr. Fieler’s appointment was on a month-to-month basis, with the ability for either party to terminate the appointment on not less than 30 days’ notice without cause. Mr. Fieler did not receive any cash compensation for his service as I-CFO. For the duration of Mr. Fieler’s service as interim CFO, Mr. Fieler received monthly compensation in the form of shares of the Company’s common stock valued at $42,500, with the number of shares to be based on the weighted average closing price of the Company’s common stock for the twenty (20) trading days prior to and including the last trading day of each month.

Additionally, Mr. Fieler was eligible for a minimum bonus at the conclusion of his service as interim CFO of $360,000, pro-rated based on the number of months (relative to a full year) in which Mr. Fieler served as I-CFO. The bonus award could be increased up to a value of $720,000 (subject to pro-ration as described above) based on Mr. Fieler’s performance as I-CFO in the discretion of the Compensation Committee. Payment of the bonus, when earned, was to be made in shares, with the number of shares based on the weighted average closing price of the Company’s common stock for the twenty (20) trading days prior to and including the last trading day of the month in which Mr. Fieler’s service as I-CFO ended. Mr. Fieler was not eligible for an annual long-term-incentive grant as his tenure as I-CFO was not expected to exceed twelve months. Mr. Fieler continued to receive his cash and equity compensation as a member of the Board.

Mr. Fieler’s appointment as I-CFO lasted through February 18, 2024, when the Company named its new CFO, Jaime Vasquez. For the duration of his I-CFO service, Mr. Fieler received monthly compensation equal to $42,500 in shares of the Company’s common stock. Additionally, following his I-CFO service, the Compensation Committee approved and Mr. Fieler received a bonus equal to $90,000, paid in 18,181 shares of the Company’s common stock. Mr. Fieler received no further compensation in connection with his appointment as I-CFO.

Separation Agreements

During Mr. Somma’s employment with the Company, he had an offer letter that provided for the basic terms of his employment, including an initial annual base salary rate of $500,000, a 2022 target STI opportunity equal to 70% of his base salary, an expected long-term incentive award target of $700,000, and certain customary employee benefits. The offer letter also provided that Mr. Somma would participate in the Severance Plan. The offer letter also provided that Mr. Somma would enter into a restrictive covenant agreement.

On December 1, 2023, we entered into a Separation Agreement with Lawrence Somma to memorialize the terms of his departure from the Company. The Separation Agreement provided for customary releases of claims in favor of the Company in exchange for the following: a lump sum payment of $300,000; full vesting of all remaining RSUs granted on November 23, 2021, prorated vesting through December 1, 2023, of RSUs granted on March 2, 2022, and March 22, 2023; prorated vesting through December 1, 2023, for non-qualified stock

39