Exhibit 3.1

Execution Version

CERTIFICATE OF DESIGNATIONS OF

SERIES B CONVERTIBLE PERPETUAL PREFERRED STOCK OF

PURECYCLE TECHNOLOGIES, INC.

Pursuant to Section 151 of the Delaware General Corporation Law (as amended, supplemented or restated from time to time, the “DGCL”), PURECYCLE TECHNOLOGIES, INC., a corporation organized and existing under the laws of the State of Delaware (the “Corporation”), in accordance with the provisions of Section 103 of the DGCL, DOES HEREBY CERTIFY:

That the Amended and Restated Certificate of Incorporation of the Corporation (as amended from time to time and including the Certificate of Designations with respect to the Series A Preferred Stock and this Certificate of Designations, the “Certificate of Incorporation”), authorizes the issuance of 475,000,000 shares of capital stock, consisting of 450,000,000 shares of common stock, par value $0.001 per share (“Common Stock”), and 25,000,000 shares of preferred stock, par value $0.001 per share (“Preferred Stock”);

That, pursuant to the provisions of the Certificate of Incorporation, the board of directors of the Corporation (the “Board”) is authorized to fix by resolution or resolutions the designations and the powers, including voting powers, if any, preferences and relative, participating, optional or other special rights, if any, and the qualifications, limitations or restrictions thereof, of any series of Preferred Stock, and to fix the number of shares constituting any such series; and

That, pursuant to the authority conferred upon the Board by the Certificate of Incorporation, the Board adopted the following resolution designating a new series of Preferred Stock as “Series B Convertible Perpetual Preferred Stock.”

WHEREAS, the Series B Convertible Perpetual Preferred Stock is being issued and sold to certain “qualified institutional buyers” (within the meaning of Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”)) and/or “accredited investors” (within the meaning of Rule 501(a) under the Securities Act) in reliance on Section 4(a)(2) of the Securities Act.

RESOLVED, that, pursuant to the authority vested in the Board in accordance with the provisions of Article IV of the Certificate of Incorporation and the provisions of Section 151 of the DGCL, a series of Preferred Stock of the Corporation titled the “Series B Convertible Perpetual Preferred Stock,” and having a par value of $0.001 per share and an initial number of authorized shares equal to 300,000, is hereby designated and created out of the authorized and unissued shares of Preferred Stock, which series has the powers (including voting powers), designations, preferences and relative, participating, optional or other special rights, and the qualifications, limitations and restrictions as follows:

SECTION 1. Designation; Number of Shares. The distinctive serial designation of such series of Preferred Stock is “Series B Convertible Perpetual Preferred Stock” (the “Series B Preferred Stock”). The authorized number of shares of Series B Preferred Stock shall be 300,000. The Corporation shall not have the authority to issue fractional shares of Series B Preferred Stock. Shares of Series B Preferred Stock that are purchased, redeemed or otherwise acquired by the Corporation shall be cancelled and retired and shall revert to authorized but unissued shares of Preferred Stock.

SECTION 2. Definitions; Interpretation.

| (a) | As used herein with respect to Series B Preferred Stock: |

“Accrued Dividends” means, as of any date, with respect to any share of Series B Preferred Stock, all dividends, whether in cash or In Kind, that have accrued on such share, whether or not declared, but that have not, as of such date, been paid.

“Accrued Value” means, with respect to any share of Series B Preferred Stock, as of any date of determination, (i) the Liquidation Preference thereof plus, (ii) all Accrued Dividends on such share as of such date.

“Additional Shares” has the meaning set forth in Section 12(a).

“Board” has the meaning set forth in the Preamble.

“Business Day” means a day that is a Monday, Tuesday, Wednesday, Thursday or Friday and is not a day on which banking institutions in New York City generally are authorized or obligated by law or executive order to close.

“Capital Stock” means, with respect to any Person, any and all shares of, interests in, rights to purchase, warrants to purchase, options for, participations in or other equivalents of or interests in (however designated) stock issued by such Person.

“Cash Dividend” has the meaning set forth in Section 4(b).

“Certificate of Designations” means this Certificate of Designations relating to the Series B Preferred Stock, as it may be amended from time to time.

“Certificate of Incorporation” has the meaning set forth in the Preamble.

“Change in Control” means the occurrence, directly or indirectly, of one of the following, whether in a single transaction or a series of transactions:

(a) any “person” or “group” (as such terms are used in Sections 13(d) and 14(d) of the Exchange Act), is or becomes the “beneficial owner” (as defined in Rules 13d-3 and 13d-5 under the Exchange Act) directly or indirectly, of (i) Common Stock representing more than 50% of the outstanding Common Stock or (ii) Voting Stock representing a majority of the Stockholder Voting Power of the Corporation; provided that, in the case of clause (ii), a transaction in which (x) the beneficial owners of securities that represented 100% of the Stockholder Voting Power of the Corporation immediately prior to such transaction are substantially the same as the holders of securities that represent a majority of the total voting power of all classes of the Voting Stock of the surviving Person or any Parent entity that wholly owns such surviving Person immediately after such transaction and (y) the beneficial owners of securities that represented 100% of the Stockholder Voting Power of the Corporation immediately prior to such transaction own, directly or indirectly, Voting Stock of the surviving Person or any Parent entity that wholly owns such surviving Person in substantially the same proportion to each other as immediately prior to such transaction, will be deemed not to be a Change in Control pursuant to this clause (a)(ii);

2

(b) the merger or consolidation of the Corporation with or into another Person or the merger of another Person with or into the Corporation, or the sale, lease or transfer of all or substantially all of the assets of the Corporation (determined on a consolidated basis) to another Person (other than a sale, lease or transfer to a Subsidiary of the Corporation or a Person that becomes a Subsidiary of the Corporation), or any recapitalization, reclassification or other transaction in which all or substantially all of the Common Stock is exchanged for or converted into cash, securities or other property; provided that a transaction following which beneficial owners of securities that represented 100% of the Stockholder Voting Power of the Corporation immediately prior to such transaction own, directly or indirectly (in substantially the same proportion to each other as immediately prior to such transaction, other than changes in proportionality as a result of any cash/stock election provided under the terms of the definitive agreement regarding such transaction), at least a majority of the voting power of the Voting Stock of the surviving Person in such merger or consolidation transaction or any Parent entity that wholly owns such surviving Person immediately after such transaction will be deemed not to be a Change in Control pursuant to this clause (b); or

(c) the Common Stock (or other common stock underlying the Series B Preferred Stock) ceases to be listed or quoted on any of the Nasdaq Global Select Market, the Nasdaq Global Market, the Nasdaq Capital Market, the NYSE American or The New York Stock Exchange (or any of their respective successors);

provided that a transaction or event described in clause (a) or (b) will not constitute a Change in Control if at least ninety percent (90%) of the consideration received or to be received by the holders of Common Stock (excluding cash payments for fractional shares or pursuant to dissenters rights), in connection with such transaction or event, consists of shares of common stock listed (or depositary receipts representing shares of common stock, which depositary receipts are listed) on any of the Nasdaq Global Select Market, the Nasdaq Global Market, the Nasdaq Capital Market, the NYSE American or The New York Stock Exchange (or any of their respective successors), or that will be so listed when issued or exchanged in connection with such transaction or event, and such transaction or event constitutes a Reorganization Event whose Reference Property consists of such consideration.

“Change in Control Effective Date” means, in respect of any Change in Control, the effective date of such Change in Control.

“Change in Control Notice” has the meaning specified in Section 11(b).

“Change in Control Redemption” has the meaning specified in Section 11(a).

“Change in Control Redemption Time” has the meaning specified in Section 11(a).

3

“Closing Price” of the Common Stock on any date of determination means the closing sale price or, if no closing sale price is reported, the last reported sale price of the shares of the Common Stock on the NASDAQ on such date. If the Common Stock is not traded on the NASDAQ on any date of determination, the Closing Price of the Common Stock on such date of determination means the closing sale price as reported in the composite transactions for the principal United States securities exchange or automated quotation system on which the Common Stock is so listed or quoted, or, if no closing sale price is reported, the last reported sale price on the principal United States securities exchange or automated quotation system on which the Common Stock is so listed or quoted, or if the Common Stock is not so listed or quoted on a United States securities exchange or automated quotation system, the last quoted bid price for the Common Stock in the over-the-counter market as reported by OTC Markets Group Inc. or any similar organization, or, if that bid price is not available, the market price of the Common Stock on that date as determined by an Independent Financial Advisor retained by the Corporation for such purpose.

“Code” means the U.S. Internal Revenue Code of 1986, as amended.

“Common Stock” has the meaning set forth in the Preamble.

“Conversion Notice” has the meaning set forth in Section 7(c).

“Conversion Price” has the meaning set forth in Section 7(a).

“Conversion Rate” means, in respect of any conversion of Series B Preferred Stock, the number of shares of Common Stock deliverable upon such conversion for the Liquidation Preference of Series B Preferred Stock.

“Conversion Time” has the meaning set forth in Section 7(a).

“Corporation” has the meaning set forth in the Preamble.

“Corporation Redemption” has the meaning specified in Section 11(a).

“Daily VWAP” means, for any Trading Day, the per share volume-weighted average price as displayed under the heading “Bloomberg VWAP” on Bloomberg page “PCT <equity> AQR” (or its equivalent successor if such page is not available) in respect of the period from the scheduled open of trading until the scheduled close of trading of the primary trading session on such Trading Day (or if such volume-weighted average price is unavailable, the market value of one share of the Common Stock on such Trading Day determined, using a volume-weighted average method, by a nationally recognized independent “bulge-bracket” investment banking firm retained for this purpose by the Corporation). The “Daily VWAP” shall be determined without regard to after-hours trading or any other trading outside of the regular trading session trading hours.

“DGCL” has the meaning set forth in in the Preamble.

4

“Distributed Property” has the meaning set forth in Section 10(c).

“Dividend Payment Date” means March 31, June 30, September 30 and December 31 of each year (each, a “Quarterly Date”), commencing on the first Quarterly Date immediately following the Initial Issue Date (the “Initial Dividend Payment Date”); provided, however, that if any such Quarterly Date is not a Business Day, then the applicable Dividend shall be payable on the next Business Day immediately following such Quarterly Date, without any interest.

“Dividend Payment Period” means (a) in respect of any share of Series B Preferred Stock issued on the Initial Issue Date, the period from and including the Initial Issue Date to but excluding the Initial Dividend Payment Date and, subsequent to the Initial Dividend Payment Date, the period from and including any Dividend Payment Date to but excluding the next Dividend Payment Date, and (b) for any share of Series B Preferred Stock issued subsequent to the Initial Issue Date, the period from and including the Issue Date of such share to but excluding the next Dividend Payment Date and, subsequently, in each case the period from and including any Dividend Payment Date to but excluding the next Dividend Payment Date.

“Dividend Rate” means 7% per annum.

“Dividend Record Date” has the meaning set forth in Section 4(b).

“Dividends” has the meaning set forth in Section 4(a).

“DTC” means The Depository Trust Company or any successor thereto.

“Exchange Act” means the Securities Exchange Act of 1934, as from time to time amended.

“GAAP” means United States generally accepted accounting principles in effect from time to time applied consistently.

“Holder” means the record holder of one or more shares of Series B Preferred Stock, as shown on the books and records of the Corporation.

“Holder Redemption” has the meaning specified in Section 11(a).

“Implied Quarterly Dividend Amount” means, with respect to any share of Series B Preferred Stock, as of any date, the product of (a) the Accrued Value of such share on the first day of the applicable Dividend Payment Period (or in the case of the first Dividend Payment Period for such share, as of the Issue Date of such share) multiplied by (b) one-fourth of the Dividend Rate applicable on such date.

“In Kind” means, effective immediately before the close of business on the related Dividend Payment Date, the addition of a dollar amount to the Liquidation Preference of each share of Series B Preferred Stock equal to the Dividend on the Series B Preferred Stock (whether or not declared) that has accumulated on the Series B Preferred Stock in respect of the Dividend Payment Period ending on, but excluding, such Dividend Payment Date.

5

“Independent Financial Advisor” means an accounting, appraisal, investment banking firm or consultant of nationally recognized standing; provided, however, that such firm or consultant shall not be an Affiliate of the Corporation and shall be reasonably acceptable to the Holders of at least a majority of the shares of Series B Preferred Stock outstanding at such time.

“Initial Change in Control Notice” has the meaning specified in Section 11(b).

“Initial Issue Date” means June 20, 2025.

“Issue Date” means, with respect to any share of Series B Preferred Stock, the date of issuance of such share.

“Issue Price Per Share” means $1,000.00.

“Junior Securities” has the meaning set forth in Section 3.

“Liquidation Event” means any voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Corporation; provided, however, that the sale, conveyance, exchange or transfer (for cash, shares of stock, securities or other consideration) of all or substantially all of the property and assets or business of the Corporation shall not be deemed a voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Corporation, nor shall the merger, consolidation, statutory exchange or any other business combination transaction of the Corporation into or with any other Person or the merger, consolidation, statutory exchange or any other business combination transaction of any other Person into or with the Corporation be deemed to be a voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Corporation.

“Liquidation Preference” means, with respect to any share of Series B Preferred Stock, an amount equal to the Issue Price Per Share as adjusted for Dividends paid In Kind and accreted pursuant to the terms of this Certificate of Designations.

“Make-Whole Change in Control” means (A) a Change in Control (determined after giving effect to the proviso immediately after clause (c) of the definition thereof and after giving effect to any exceptions or exclusions from the definition of Change in Control, but without regard to the proviso in clause (a)(ii) of such definition or the proviso in clause (b) of such definition) with a Make-Whole Change in Control Effective Date prior to June 20, 2035 or (B) the sending of a Mandatory Conversion Notice pursuant to Section 8(b) with a Mandatory Conversion Time prior to June 20, 2035.

“Make-Whole Change in Control Conversion Period” means, in respect of any Make-Whole Change in Control, the period from, and including, the Make-Whole Change in Control Effective Date of such Make-Whole Change in Control to, and including, the thirty-fifth (35th) Trading Day after such Make-Whole Change in Control Effective Date (or, if such Make-Whole Change in Control also constitutes a Change in Control, to, but excluding, the related Change in Control Redemption Time).

6

“Make-Whole Change in Control Effective Date” means (A) in respect of any Make-Whole Change in Control pursuant to clause (A) of the definition thereof, the date on which such Make-Whole Change in Control occurs or becomes effective, and (B) in respect of any Make-Whole Change in Control pursuant to clause (B) of the definition thereof, the applicable Mandatory Conversion Notice Date.

“Mandatory Conversion” has the meaning set forth in Section 8(a).

“Mandatory Conversion Notice” has the meaning set forth in Section 8(b).

“Mandatory Conversion Right” has the meaning set forth in Section 8(a).

“Mandatory Conversion Time” has the meaning set forth in Section 8(a).

“Market Disruption Event” means, for the purposes of determining Daily VWAPs (a) a failure by the primary U.S. national or regional securities exchange or market on which the Common Stock is listed or admitted for trading to open for trading during its regular trading session or (b) the occurrence or existence prior to 1:00 p.m., New York City time, on any Scheduled Trading Day for the Common Stock for more than one half-hour period in the aggregate during regular trading hours of any suspension or limitation imposed on trading (by reason of movements in price exceeding limits permitted by the relevant stock exchange or otherwise) in the Common Stock or in any options contracts or futures contracts relating to the Common Stock.

“NASDAQ” means the Nasdaq Capital Market (or its successor).

“Optional Conversion” has the meaning set forth in Section 7(a).

“Ownership Limitation” has the meaning set forth in Section 13(a).

“Parent” means, with respect to any Person, a Person that owns, directly or indirectly, more than 50% of the voting power of the outstanding equity interests of such Person.

“Parity Securities” has the meaning set forth in Section 3.

“Participating Dividend” has the meaning set forth in Section 10(h).

“Person” means an individual, a partnership, a joint venture, a corporation, an association, a joint stock company, a limited liability company, a trust, an unincorporated organization or a government or any department or agency or political subdivision thereof, or any group (within the meaning of Section 13(d)(3) of the Exchange Act or any successor provision) consisting of one or more of the foregoing. For purposes of this Certificate of Designations, when used in reference to a Holder of shares of Series B Preferred Stock, the term “group” shall have the meaning set forth in Section 13(d)(3) of the Exchange Act or any successor provision; provided, however, that no inference, presumption or conclusion that two or more Holders constitute a “group” within the meaning of Section 13(d)(3) of the Exchange Act or Rule 13d-5 thereunder shall be raised from the fact that such Holders collectively may exercise or refrain from exercising the rights under this Certificate of Designations in the same manner, that such Holders may be represented by a single law firm or advisor or that such rights were negotiated with the Corporation at the same time or amended or modified with the Corporation and such Holders in the same or a similar manner.

7

“Preferred Stock” has the meaning set forth in the Preamble.

“Redemption Price” has the meaning specified in Section 11(a).

“Reference Property” has the meaning set forth in Section 10(f).

“Register” means the securities register maintained in respect of the Series B Preferred Stock by the Corporation or the Transfer Agent, as applicable.

“Reorganization Event” has the meaning set forth in Section 10(f).

“Requisite Stockholder Approval” means the stockholder approval contemplated by Rule 5635(b) of the NASDAQ listing rules with respect to the issuance of shares of Common Stock upon conversion of the Series B Preferred Stock; provided, however, that the Requisite Stockholder Approval will be deemed to be obtained if, due to any amendment or binding change in the interpretation of the applicable NASDAQ listing rules, such stockholder approval is no longer required for the Company to settle all conversions of the Series B Preferred Stock in shares of Common Stock.

“Scheduled Trading Day” means a day that is scheduled to be a Trading Day on the principal U.S. national or regional securities exchange or market on which the Common Stock is listed or admitted for trading. If the Common Stock is not so listed or admitted for trading, “Scheduled Trading Day” means a Business Day.

“Senior Securities” has the meaning set forth in Section 3.

“Series A Preferred Stock” means the Corporation’s Series A Preferred Stock, par value $0.001 per share.

“Series B Preferred Stock” has the meaning set forth in Section 1.

“Stock Price” has the following meaning for any Make-Whole Change in Control: (A) if the holders of Common Stock receive only cash in consideration for their shares of Common Stock in a Make-Whole Change in Control and such Make-Whole Change in Control is pursuant to clause (b) of the definition of “Change in Control,” then the Stock Price is the amount of cash paid per share of Common Stock in such Make-Whole Change in Control; and (B) in all other cases, the Stock Price is the average of the Closing Prices per share of Common Stock for the five (5) consecutive Trading Days ending on, and including, the Trading Day immediately before the Make-Whole Change in Control Effective Date of such Make-Whole Change in Control.

8

“Stockholder Voting Power” means the aggregate number of votes which may be cast by holders of the Corporation’s Voting Stock, with the calculation of such aggregate number of votes being conclusively made for all purposes under this Certificate of Designations and the Certificate of Incorporation, absent manifest error, by the Corporation based on the Corporation’s review of the Register, the Corporation’s other books and records, each Holder’s public filings pursuant to Section 13 or Section 16 of the Exchange Act and any other written evidence satisfactory to the Corporation regarding any Holder’s beneficial ownership of any securities of the Corporation.

“Subsidiary” means, with respect to any Person, any corporation, limited liability company, partnership or other entity of which (i) if a corporation, a majority of the total voting power of shares of stock entitled (without regard to the occurrence of any contingency) to vote in the election of directors, managers or trustees thereof is, at the time of determination, owned or controlled, directly or indirectly, by that Person or one or more of the other Subsidiaries of that Person or a combination thereof, (ii) if a partnership, limited liability company, association or other business entity, a majority of the partnership, limited liability company, or other similar ownership interests thereof is at the time owned or controlled, directly or indirectly, by any Person or one or more Subsidiaries of that Person or a combination thereof, or (iii) if a non-profit corporation or similar entity, the power to vote or direct the voting of sufficient securities or membership or other interests to elect directors (or comparable authorized persons of such entity) having a majority of the voting power of the board of directors (or comparable governing body) of such corporation or similar entity is, at the time of determination, owned or controlled, directly or indirectly, by that Person or one or more of the other Subsidiaries of that Person or a combination thereof. For purposes hereof, a Person or Persons will be deemed to have a majority ownership interest in a partnership, limited liability company, association or other business entity if such Person or Persons is allocated a majority of partnership, association or other business entity gains or losses or otherwise control the managing director, managing member, general partner or other managing Person of such partnership, limited liability company, association or other business entity. When used in the context of or based on the Corporation’s consolidated financial statements, the term “Subsidiaries” shall mean those entities that the Corporation has determined to be consolidated subsidiaries under GAAP.

“Trading Day” means a day on which (i) trading in the Common Stock (or other security for which a closing sale price must be determined) generally occurs on NASDAQ or, if the Common Stock (or such other security) is not then listed on NASDAQ, on the principal other U.S. national or regional securities exchange on which the Common Stock (or such other security) is then listed or, if the Common Stock (or such other security) is not then listed on a U.S. national or regional securities exchange, on the principal other market on which the Common Stock (or such other security) is then traded and (ii) a Closing Price for the Common Stock (or closing sale price for such other security) is available on such securities exchange or market; provided that if the Common Stock (or such other security) is not so listed or traded, “Trading Day” means a Business Day; and provided further, that for purposes of determining Daily VWAPs only, “Trading Day” means a day on which (x) there is no Market Disruption Event and (y) trading in the Common Stock generally occurs on NASDAQ or, if the Common Stock is not then listed on NASDAQ, on the principal other U.S. national or regional securities exchange on which the Common Stock is then listed or, if the Common Stock is not then listed on a U.S. national or regional securities exchange, on the principal other market on which the Common Stock is then listed or admitted for trading, except that if the Common Stock is not so listed or admitted for trading, “Trading Day” means a Business Day.

9

“Transfer Agent” means Continental Stock Transfer and Trust Company, or such other transfer agent as engaged by the Corporation with respect to the Series B Preferred Stock.

“Valuation Period” has the meaning set forth in Section 10(c).

“Voting Stock” means (a) with respect to the Corporation, the Common Stock and any other Capital Stock of the Corporation having the right to vote generally in any election of directors of the Board and (b) with respect to any other Person, all Capital Stock of such Person having the right to vote generally in any election of directors of the board of directors of such Person or other similar governing body.

(b) Interpretation. Except where otherwise expressly provided or unless the context otherwise necessarily requires, in this Certificate of Designations: (i) reference to a given Article, Section, Subsection, clause, Exhibit or Schedule is a reference to an Article, Section, Subsection, clause, Exhibit or Schedule of this Certificate of Designations, unless otherwise specified; (ii) the terms “hereof,” “herein,” “hereto,” “hereunder” and “herewith” refer to this Certificate of Designations as a whole; (iii) reference to a given agreement, instrument, document or law is a reference to that agreement, instrument, document, law or regulation as modified, amended, supplemented and restated through the date as to which such reference was made, and, as to any law or regulation, any successor law or regulation; (iv) accounting terms have the meanings given to them under GAAP, and in any cases in which there exist elective options or choices in GAAP determinations relating to the Corporation or any of its Subsidiaries, or where management discretion is permitted in classification, standards or other aspects of GAAP related determinations relating to the Corporation or any of its Subsidiaries, the historical accounting principles and practices of the Corporation or such Subsidiaries, as applicable, shall continue to be applied, unless otherwise required under GAAP; (v) reference to a Person includes its predecessors, successors and permitted assigns and transferees; (vi) the singular includes the plural and the masculine includes the feminine, and vice versa; (vii) the words “include,” “includes” or “including” means “including, for example and without limitation”; and (viii) references to “days” means calendar days.

SECTION 3. Ranking. The Series B Preferred Stock will rank, with respect to dividend rights and rights upon Liquidation Events:

(a) senior to the Common Stock and any other class or series of the Capital Stock of the Corporation now existing or hereafter authorized, classified or reclassified, the terms of which do not expressly provide that such class or series ranks senior to or on a parity with the Series B Preferred Stock (other than the Series A Preferred Stock) as to divided rights and rights upon Liquidation Events (such Capital Stock, the “Junior Securities”);

10

(b) on a parity with any other class or series of Capital Stock of the Corporation now existing or hereafter authorized, classified or reclassified, the terms of which expressly provide that such class or series ranks on a parity with the Series B Preferred Stock as to dividend rights and rights upon Liquidation Events (the “Parity Securities”);

(c) junior to the Series A Preferred Stock and any other class or series of Capital Stock of the Corporation now existing or hereafter authorized, classified or reclassified, the terms of which expressly provide that such class or series ranks senior to the Series B Preferred Stock as to dividend rights and rights upon Liquidation Events (the “Senior Securities”); and

(d) junior to all existing and future indebtedness of the Corporation.

SECTION 4. Dividends.

(a) Accrual of Dividends. From and after the Initial Issue Date of the Series B Preferred Stock, dividends (“Dividends”) on each share of the Series B Preferred Stock shall accrue and accumulate on a daily basis, as cumulative dividends, whether or not declared by the Board and whether or not there are funds legally available for the payment of dividends, at a rate equal to the Dividend Rate. All accrued but unpaid dividends on any share of the Series B Preferred Stock shall, unless declared and paid in cash or In Kind, as permitted, compound quarterly on each Dividend Payment Date. The amount of Dividends accruing with respect to any share of Series B Preferred Stock for any day shall be determined by dividing (x) the Implied Quarterly Dividend Amount as of such day by (y) the actual number of days in the Dividend Payment Period in which such day falls; provided, however, that if during any Dividend Payment Period any Accrued Dividends in respect of one (1) or more prior Dividend Payment Periods are paid in cash or In Kind (it being understood that no In Kind payment may be used to cure an unpaid cash dividend), then after the date of such payment the amount of Dividends accruing with respect to any share of Series B Preferred Stock for any day shall be determined by dividing (x) the Implied Quarterly Dividend Amount (recalculated to take into account such payment of Accrued Dividends) by (y) the actual number of days in such Dividend Payment Period. The amount of Dividends accrued with respect to any share of Series B Preferred Stock for any Dividend Payment Period shall equal the sum of the daily Dividend amounts accrued in accordance with the prior sentence of this Section 4(a) with respect to such share during such Dividend Payment Period. For the avoidance of doubt, for any share of Series B Preferred Stock with an Issue Date that is not a Dividend Payment Date, the amount of Dividends accrued with respect to the initial Dividend Payment Period for such share shall equal the product of (A) the daily accrual determined as specified in the prior sentence, assuming a full Dividend Payment Period in accordance with the definition of such term, and (B) the number of days from and including such Issue Date to but excluding the next Dividend Payment Date.

11

(b) Payment of Dividends. Dividends shall be payable on each share of Series B Preferred Stock quarterly in arrears, commencing on the initial Dividend Payment Date following the Issue Date of such shares, at the election of the Corporation, which election shall be made by written notice to the Holders on or prior to the Dividend Record Date corresponding to the relevant Dividend Payment Date, either (i) in cash (a “Cash Dividend”), to the extent such payment is not prohibited by law, and only out of funds legally available therefor, (ii) In Kind or (iii) any combination of (i) and (ii). To the extent that the Corporation does not communicate its election for method of Dividend in writing at least three (3) Business Days prior to the relevant Dividend Payment Date, such election shall be deemed to be an election for an In Kind method of payment. To the extent all or a portion of a Dividend is made In Kind, the addition of all or a portion of the Dividend, as applicable, to the Liquidation Preference will occur automatically, without the need for any action on the part of the Corporation or any other Person. Any Dividends added to the Liquidation Preference of any share of Series B Preferred Stock as an In Kind dividend will be deemed to be declared and paid on such share of Series B Preferred Stock for all purposes of this Certificate of Designations. Cash Dividend payments shall be aggregated per Holder and shall be made to the nearest cent (with $.005 being rounded upward). Each Dividend will be paid to Holders of Preferred Stock as they appear on the Register at the close of business on the fifteenth (15th) day of the calendar month of the applicable Dividend Payment Date, whether or not such date is a Business Day (each, a “Dividend Record Date”).

(c) Dividend Calculations. Dividends on the Series B Preferred Stock shall accrue daily commencing on the Initial Issue Date, and shall be deemed to accrue from such date whether or not earned or declared and whether or not there are profits, surplus or other funds of the Corporation legally available for the payment of dividends.

(d) Conversion Following a Record Date. If the Conversion Time for any share of Series B Preferred Stock is prior to the close of business on a Dividend Record Date, the Holder of such shares will not be entitled to any Dividend in respect of such Dividend Record Date, other than through the inclusion of Accrued Dividends as of the Conversion Time in the calculation of Accrued Value. If the Conversion Time for any shares of Series B Preferred Stock is after the close of business on a Dividend Record Date but prior to the corresponding Dividend Payment Date for such Dividend, the Holder of such shares as of such Dividend Record Date shall be entitled to receive such dividend, notwithstanding the conversion of such shares prior to the applicable scheduled dividend payment date; provided, however, that (i) in the case of an In Kind Dividend, the amount of such Dividend shall be included in the Accrued Dividends as of the Conversion Time in the calculation of Accrued Value as if such Conversion Time was the Dividend Payment Date and (ii) in the case of a Cash Dividend, the amount of such Dividend shall not be included for the purpose of determining the amount of Accrued Dividends with respect to such Conversion Time.

(e) Partial Dividend Payment. Except as otherwise provided herein, if at any time the Corporation pays less than the total amount of Accrued Dividends with respect to the Series B Preferred Stock, such payment shall be distributed pro rata among the Holders of Series B Preferred Stock based upon the aggregate Accrued Dividends on the shares held by each such Holder.

12

SECTION 5. Liquidation Rights.

(a) Voluntary or Involuntary Liquidation. In the event of any Liquidation Event, then, on a pari passu basis with holders of any Parity Securities and subject to the rights of holders of Senior Securities, Holders of Series B Preferred Stock shall be entitled to receive in full, out of the assets of the Corporation or proceeds thereof (whether capital or surplus) available for distribution to stockholders of the Corporation, and after satisfaction of all liabilities and obligations to creditors of the Corporation, before any distribution of such assets and/or proceeds is made to or set aside for the holders of any other Junior Securities, an amount per share of Series B Preferred Stock equal to the greater of (i) the Accrued Value as of the date of such Liquidation Event and (ii) the amount such Holders would have received had such Holders, immediately prior to such Liquidation Event, converted such shares of Series B Preferred Stock and Accrued Dividends with respect to such shares of Series B Preferred Stock to Common Stock. Holders of Series B Preferred Stock shall not be entitled to any further payments in the event of any such Liquidation Event other than what is expressly provided for in this Section 5 and will have no right or claim to any of the Corporation’s remaining assets.

(b) Partial Payment. If in any distribution described in Section 5(a), the assets of the Corporation and/or proceeds thereof are not sufficient to pay the amount set forth therein in full to all Holders of shares of Series B Preferred Stock and the applicable liquidation distributions to holders of any Parity Securities, the Holders of shares of Series B Preferred Stock and the holders of any Parity Securities shall be entitled to receive their pro rata portion of such assets and/or proceeds in proportion to the respective full preferential amounts that would otherwise be payable in respect of the Series B Preferred Stock and any Parity Securities in the aggregate upon such liquidation if all amounts payable on or with respect to such shares of Series B Preferred Stock and any Parity Securities were paid in full.

SECTION 6. Voting Rights.

(a) The Holders of Series B Preferred Stock shall not have any voting rights except as from time to time required by law or expressly contemplated in this Certificate of Designations.

(b) Except as required or requested by applicable judgment, decree, or order of any court, arbitrator or other governmental authority or any statute, rule, ordinance or regulation of any governmental authority, including without limitation all foreign, federal, state and local laws, including all foreign, federal, state and local laws relating to taxes, environmental protection, occupational health and safety, product quality and safety and employment and labor matters, at any time that there remains Series B Preferred Stock outstanding, unless otherwise approved by the Holders of a majority of the then-outstanding Series B Preferred Stock, the Corporation agrees not to take the following actions:

i. The Corporation shall not amend or waive any provision contained in the Certificate of Incorporation in any way that materially, adversely and disproportionately affects the rights, preferences, and privileges or power of the Series B Preferred Stock.

ii. The Corporation shall not increase the authorized number of shares of Series A Preferred Stock unless such increase is required pursuant to the Certificate of Designations of Series A Preferred Stock, dated September 13, 2024, and as modified by the waivers entered into by all of the holders of the Series A Preferred Stock on September 17, 2024.

iii. Other than in connection with the Series A Preferred Stock, the Corporation shall not issue any equity securities of the Corporation containing rights, preferences or privileges with respect to distributions or liquidation superior to or on parity with the Series B Preferred Stock.

13

iv. The Corporation shall not repurchase or redeem any issued and outstanding Common Stock other than any such repurchases or redemptions (i) undertaken in connection with any equity incentive agreements approved by the Board, (ii) undertaken to satisfy obligations of the Corporation existing on the date of this Certificate of Designations or (iii) that do not result in payments by the Corporation in an aggregate amount, together with all prior payments made pursuant to this clause (iii), in excess of $50.0 million.

SECTION 7. Optional Conversion.

(a) Right to Convert. Subject to the terms of Section 13, each Holder shall have the right, at such Holder’s option, subject to the conversion procedures set forth in Section 7(c), to convert each share of such Holder’s Series B Preferred Stock at such time into the number of shares of Common Stock equal to (i) the Accrued Value divided by (ii) the applicable Conversion Price (an “Optional Conversion”). The “Conversion Price” applicable to the Series B Preferred Stock shall initially be equal to $14.02. Such initial Conversion Price, and the Conversion Rate, shall be subject to adjustment as provided below. The right of conversion may be exercised as to all or any portion of such Holder’s Series B Preferred Stock from time to time in accordance with this Section 7; provided that, in each case, no right of conversion may be exercised by a Holder in respect of fewer than 10 shares of Series B Preferred Stock (unless such conversion relates to all shares of Series B Preferred Stock held by such Holder).

(b) Reserved Shares. The Corporation shall at all times reserve and keep available out of its authorized and unissued Common Stock, solely for issuance upon the conversion of the Series B Preferred Stock, such number of shares of Common Stock as shall from time to time be issuable upon the conversion of all the shares of Series B Preferred Stock then outstanding. Any shares of Common Stock issued upon conversion of Series B Preferred Stock shall be duly authorized, validly issued, fully paid and non-assessable.

(c) Mechanics of Optional Conversion. In order for a Holder to effect an Optional Conversion, such Holder shall (i) provide written notice (the form of which is attached hereto as Exhibit A) to the Transfer Agent (“Conversion Notice”) that such Holder elects to convert all or any number of such Holder’s shares of Series B Preferred Stock and, if applicable, any event on which such conversion is contingent, including, but not limited to a Change in Control or other corporate transaction as such Holder may specify, and (ii) if such Holder’s shares are certificated, surrender the certificate or certificates for such shares of Series B Preferred Stock at the office of the Transfer Agent. The Conversion Notice shall state such Holder’s name or the names of the nominees in which such Holder wishes the shares of Common Stock to be issued. If required by the Corporation or the Transfer Agent, any certificates surrendered for conversion shall be endorsed or accompanied by a written instrument or instruments of transfer, in a form reasonably satisfactory to the Corporation, duly executed by the registered Holder or his, her or its attorney duly authorized in writing. The Holder shall pay any stock transfer, documentary, stamp or similar taxes required to be paid by the Holder pursuant to this Certificate of Designations. The close of business on the date of receipt by the Transfer Agent of the Conversion Notice and, if applicable, certificates (or lost certificate affidavit and agreement) shall be the time of conversion (the “Conversion Time”), and the shares of Common Stock issuable upon conversion of the specified shares shall be deemed to be outstanding of record as of such date. The Corporation shall, as soon as practicable after the Conversion Time, and,using commercially reasonable efforts to do so no later than the next Trading Day, issue and deliver to such Holder, or to his, her or its nominees, a notice of issuance for the number of shares of Common Stock in accordance with the provisions hereof and a notice of issuance for the number (if any) of the shares of Series B Preferred Stock represented by the surrendered certificate that were not converted into Common Stock. Such delivery of shares of Common Stock shall be made by book-entry, through the facilities of DTC. Notwithstanding anything to the contrary herein, the number of shares of Common Stock deliverable per share of Series B Preferred Stock upon conversion shall not be in contravention of the Ownership Limitation.

14

(d) Effect of Conversion. All shares of Series B Preferred Stock which shall have been surrendered for conversion as herein provided shall no longer be deemed to be outstanding, all rights with respect to such shares shall immediately cease and terminate, and Dividends shall no longer accrue or be declared on any such shares of Series B Preferred Stock at the Conversion Time, except only the right of the Holders thereof to receive shares of Common Stock in exchange therefor. Any shares of Series B Preferred Stock so converted shall be retired and cancelled and may not be reissued as shares of such series, and the Corporation may thereafter take such appropriate action (without the need for stockholder action) as may be necessary to reduce the authorized number of shares of Preferred Stock accordingly.

(e) No Further Adjustment. Until the Conversion Time with respect to any share of Series B Preferred Stock has occurred, such share of Series B Preferred Stock will remain outstanding and will be entitled to all of the powers, designations, preferences and other rights provided herein.

SECTION 8. Mandatory Conversion.

(a) Mandatory Conversion Event. Subject to the terms of Section 13, on or after July 5, 2029, the Corporation may elect (the “Mandatory Conversion Right”), at any time the Closing Price per share of Common Stock has been at least 175% of the Conversion Price for at least twenty (20) Trading Days (whether or not consecutive) during any thirty (30) consecutive Trading Days (including the last day of such period), the last day of which shall be the Trading Day immediately preceding the date of the Mandatory Conversion Notice (defined below), to cause all (but not less than all) of the outstanding shares of Series B Preferred Stock to convert (such conversion, a “Mandatory Conversion”) into a number of shares of Common Stock per share of Series B Preferred Stock equal to (i) the Accrued Value divided by (ii) the applicable Conversion Price, on the 7th Business Day following the delivery of the Mandatory Conversion Notice (the “Mandatory Conversion Time”). For the avoidance of doubt, the Mandatory Conversion of the Series B Preferred Stock with a Mandatory Conversion Time prior to June 20, 2035 will constitute a Make-Whole Change in Control pursuant to clause (B) of the definition thereof.

15

(b) Procedural Requirements. If the Corporation elects to exercise the Mandatory Conversion Right, all Holders of the Series B Preferred Stock shall be sent written notice of the Corporation’s exercise of the Mandatory Conversion Right, the Mandatory Conversion Time, and the place designated for Mandatory Conversion of such shares of Series B Preferred Stock pursuant to this Section 8(b) (such notice, the “Mandatory Conversion Notice”) (including to or through DTC and the Transfer Agent, if applicable). Prior to the Mandatory Conversion Time specified in the Mandatory Conversion Notice, each Holder shall, if such Holder’s shares are certificated, surrender the certificate or certificates for such shares of Series B Preferred Stock at the office of the Transfer Agent and state such Holder’s name or the names of the nominees in which such Holder wishes the shares of Common Stock to be issued. If required by the Corporation or the Transfer Agent, any certificates surrendered for conversion shall be endorsed or accompanied by a written instrument or instruments of transfer, in a form reasonably satisfactory to the Corporation, duly executed by the registered holder or his, her or its attorney duly authorized in writing. The Holder shall pay any stock transfer, documentary, stamp or similar taxes required to be paid by the Holder pursuant to this Certificate of Designations. The date of the Mandatory Conversion Notice shall be the time of conversion, and the shares of Common Stock issuable upon conversion of the specified shares shall be deemed to be outstanding of record as of such date. The Corporation shall, on the date of the Mandatory Conversion Time, issue and deliver to such Holder the number of shares of Common Stock in accordance with the provisions hereof. Such delivery of shares of Common Stock shall be made by book-entry, through the facilities of DTC. Notwithstanding anything to the contrary herein, the number of shares of Common Stock deliverable per share of Series B Preferred Stock upon conversion shall not be in contravention of the Ownership Limitation.

(c) Reserved.

(d) Effect of Conversion. All shares of Series B Preferred Stock which shall have been surrendered for conversion as herein provided shall no longer be deemed to be outstanding, all rights with respect to such shares shall immediately cease and terminate, and Dividends shall no longer accrue or be declared on any such shares of Series B Preferred Stock at the Mandatory Conversion Time, except only the right of the Holders thereof to receive shares of Common Stock in exchange therefor. Any shares of Series B Preferred Stock so converted shall be retired and cancelled and may not be reissued as shares of such series, and the Corporation may thereafter take such appropriate action (without the need for stockholder action) as may be necessary to reduce the authorized number of shares of Preferred Stock accordingly.

(e) No Further Adjustment. Until the Mandatory Conversion Time with respect to any share of Series B Preferred Stock has occurred, such share of Series B Preferred Stock will remain outstanding and will be entitled to all of the powers, designations, preferences and other rights provided herein.

SECTION 9. Fractional Shares. The Corporation shall not issue any fractional shares of Common Stock upon conversion of Series B Preferred Stock and in the event that any conversion of the shares of Series B Preferred Stock would result in the issuance of a fractional share, the number of shares of Common Stock issued or issuable to such Holder shall be rounded up to the nearest whole share of Common Stock. Whether or not fractional shares would be issuable upon such conversion shall be determined on the basis of the total number of shares of a Holder’s Series B Preferred Stock being converted into Common Stock and the aggregate number of shares of Common Stock issuable to such Holder upon such conversion.

16

SECTION 10. Anti-Dilution Adjustments. The Conversion Price shall be adjusted from time to time by the Corporation if any of the following events occurs, except that the Corporation shall not make any adjustments to the Conversion Price if Holders of the Series B Preferred Stock participate (other than in the case of (x) a share split or share combination or (y) a tender or exchange offer), at the same time and upon the same terms as holders of the Common Stock and solely as a result of holding shares of Series B Preferred Stock, in any of the transactions described in Sections 10(a), 10(b), 10(c), 10(d) or 10(e), without having to convert their Series B Preferred Stock, as if they held a number of shares of Common Stock equal to the number of shares of Common Stock into which the number of shares of Series B Preferred Stock held by such Holder are then convertible pursuant to Section 7 (without regard to any limitations on conversion).

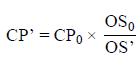

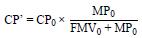

(a) Subdivisions, Combinations and Stock Dividends. If the Corporation exclusively issues shares of Common Stock as a dividend or distribution on all or substantially all shares of the Common Stock, or if the Corporation effects a share split or share combination, or a reclassification of Common Stock into a greater or lesser number of shares of Common Stock (in each case excluding an issuance solely pursuant to a Reorganization Event, as to which the provisions of Section 10(f) shall apply), the Conversion Price shall be adjusted based on the following formula:

where,

| CP0 | = | the Conversion Price in effect immediately prior to the close of business on the record date of such dividend or distribution, or immediately prior to the open of business on the effective date of such share split, share combination or reclassification, as applicable; |

| CP’ | = | the Conversion Price in effect immediately after the close of business on such record date or immediately after the open of business on such effective date, as applicable; |

| OS0 | = | the number of shares of Common Stock outstanding immediately prior to the close of business on such record date or immediately prior to the open of business on such effective date, as applicable (before giving effect to any such dividend, distribution, split or combination); and |

| OS’ | = | the number of shares of Common Stock outstanding immediately after giving |

effect to such dividend, distribution, share split, share combination or reclassification.

Any adjustment made under this Section 10(a) shall become effective immediately after the close of business on the record date for such dividend or distribution, or immediately after the open of business on the effective date for such share split, share combination or reclassification, as applicable. If any dividend or distribution of the type described in this Section 10(a) is declared but not so paid or made, the Conversion Price shall be immediately readjusted, effective as of the date the Board determines not to pay such dividend or distribution, to the Conversion Price that would then be in effect if such dividend or distribution had not been declared.

17

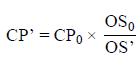

(b) Rights Offerings. If the Corporation distributes to all or substantially all holders of the Common Stock any rights, options or warrants (other than rights issued or otherwise distributed pursuant to a stockholder rights plan, as to which Section 10(c) shall apply) entitling them, for a period of not more than sixty (60) calendar days after the announcement date of such distribution, to subscribe for or purchase shares of the Common Stock at a price per share that is less than the arithmetic average of the Daily VWAPs of the Common Stock for the 10 consecutive Trading Day period ending on, and including, the Trading Day immediately preceding the date of announcement of such distribution, the Conversion Price shall be decreased based on the following formula:

where,

| CP0 | = | the Conversion Price in effect immediately prior to the close of business on the record date for such distribution; |

| CP’ | = | the Conversion Price in effect immediately after the close of business on such record date; |

| OS0 | = | the number of shares of Common Stock outstanding immediately prior to the close of business on such record date; |

| X | = | the total number of shares of Common Stock issuable pursuant to such rights, options or warrants; and |

| Y | = | the number of shares of Common Stock equal to the aggregate price payable to exercise such rights, options or warrants, divided by the arithmetic average of the Daily VWAPs of the Common Stock over the 10 consecutive Trading Day period ending on, and including, the Trading Day immediately preceding the date of announcement of the distribution of such rights, options or warrants. |

Any decrease made under this Section 10(b) shall be made successively whenever any such rights, options or warrants are distributed and shall become effective immediately after the close of business on the record date for such distribution. To the extent that shares of the Common Stock are not delivered after the expiration of such rights, options or warrants (including as a result of such rights, options or warrants not being exercised), the Conversion Price shall be increased to the Conversion Price that would then be in effect had the decrease with respect to the distribution of such rights, options or warrants been made on the basis of delivery of only the number of shares of Common Stock actually delivered. If such rights, options or warrants are not so distributed, the Conversion Price shall be increased to the Conversion Price that would then be in effect if such record date for such distribution had not occurred.

18

For purposes of this Section 10(b), in determining whether any rights, options or warrants entitle the holders to subscribe for or purchase shares of the Common Stock at less than such arithmetic average of the Daily VWAPs of the Common Stock for the 10 consecutive Trading Day period ending on, and including, the Trading Day immediately preceding the date of announcement for such distribution, and in determining the aggregate offering price of such shares of Common Stock, there shall be taken into account any consideration received by the Corporation for such rights, options or warrants and any amount payable on exercise or conversion thereof, the value of such consideration, if other than cash, to be determined by the Corporation in good faith.

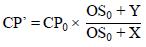

(c) Distributed Property; Spin-Offs. If the Corporation distributes shares of its Capital Stock, evidences of its indebtedness, other assets or property of the Corporation or rights, options or warrants to acquire its Capital Stock or other securities, to all or substantially all holders of the Common Stock, excluding (i) dividends, distributions, rights, options or warrants as to which an adjustment was effected (or would be required without regard to Section 10(j)) pursuant to Section 10(a) or Section 10(b), (ii) dividends or distributions paid exclusively in cash as to which the provisions set forth in Section 10(d) shall apply, (iii) Spin-Offs as to which the provisions set forth below in this Section 10(c) shall apply, (iv) except as otherwise described in Section 10(g), rights issued or otherwise distributed pursuant to a stockholder rights plan and (v) a distribution solely pursuant to a Reorganization Event, as to which the provisions of Section 10(f) shall apply (any of such shares of Capital Stock, evidences of indebtedness, other assets or property or rights, options or warrants to acquire Capital Stock or other securities, the “Distributed Property”), then the Conversion Price shall be decreased based on the following formula:

where,

| CP0 | = | the Conversion Price in effect immediately prior to the close of business on the record date for such distribution; |

| CP’ | = | the Conversion Price in effect immediately after the close of business on such record date; |

| SP0 | = | the arithmetic average of the Daily VWAPs of the Common Stock over the 10 consecutive Trading Day period ending on, and including, the Trading Day immediately preceding the ex-dividend date for such distribution; and |

| FMV | = | the fair market value (as determined by the Corporation in good faith) of the Distributed Property with respect to each outstanding share of the Common Stock on the ex-dividend date for such distribution. |

Any decrease made under the portion of this Section 10(c) above shall become effective immediately after the close of business on the record date for such distribution. To the extent such distribution is not so paid or made, the Conversion Price shall be increased to the Conversion Price that would then be in effect had the adjustment been made on the basis of only the distribution, if any, actually made or paid. Notwithstanding the foregoing, if “FMV” (as defined above) is equal to or greater than “SP0” (as defined above), in lieu of the foregoing decrease, each Holder of a share of Series B Preferred Stock shall receive, in respect of each such share, at the same time and upon the same terms as holders of the Common Stock receive the Distributed Property, the amount and kind of Distributed Property such Holder would have received if such Holder owned a number of shares of Common Stock that such share of Series B Preferred Stock would have been convertible into at the Conversion Price in effect on the record date for the distribution. If the Corporation in good faith determines the “FMV” (as defined above) of any distribution for purposes of this Section 10(c) by reference to the actual or when-issued trading market for any securities, it shall in doing so consider the prices in such market over the same period used in computing the Daily VWAPs of the Common Stock over the 10 consecutive Trading Day period ending on, and including, the Trading Day immediately preceding the ex-dividend date for such distribution.

19

If the Corporation distributes or dividends shares of Capital Stock of any class or series, or similar equity interests, of or relating to a Subsidiary or other business unit of the Corporation to all or substantially all holders of the Common Stock (other than solely pursuant to (x) a Reorganization Event, as to which the provisions of Section 10(f) shall apply; or (y) a tender offer or exchange offer for shares of the Common Stock, as to which the provisions of Section 10(e) shall apply), and such Capital Stock or equity interests are listed or quoted (or will be listed or quoted upon the consummation of the transaction) on a U.S. national securities exchange (a “Spin-Off”), then the Conversion Price shall be decreased based on the following formula:

where,

| CP0 | = | the Conversion Price in effect immediately prior to the end of the Valuation Period; |

| CP’ | = | the Conversion Price in effect immediately after the end of the Valuation Period; |

| FMV0 | = | the product of (x) the arithmetic average of the Daily VWAPs per share or unit of the Capital Stock or equity interests distributed to holders of the Common Stock (determined by reference to the definitions of Daily VWAP, Trading Day and Market Disruption Event as if references therein to Common Stock (or its securities exchange ticker) were instead references to such Capital Stock or similar equity interests (or its securities exchange ticker)) over the first 10 consecutive Trading Day period after, and including, the ex-dividend date of the Spin-Off (the “Valuation Period”); and (y) the number of shares or units of such Capital Stock or equity interests distributed per share of Common Stock in such Spin-Off; and |

| MP0 | = | the arithmetic average of the Daily VWAPs of the Common Stock for each Trading Day in the Valuation Period. |

20

The decrease to the Conversion Price under the preceding paragraph shall occur at the close of business on the last Trading Day of the Valuation Period; provided that in respect of any conversion of Series B Preferred Stock, if the relevant Conversion Time occurs during the Valuation Period, references to “10” in the preceding paragraph shall be deemed to be replaced with such lesser number of Trading Days as have elapsed from, and including, the ex-dividend date of such Spin-Off to, and including, the Conversion Time or Mandatory Conversion Time, as applicable, in determining the Conversion Price for such conversion. To the extent any dividend or distribution of the type described above in this Section 10(c) is declared but not made or paid, the Conversion Price will be readjusted to the Conversion Price that would then be in effect had the adjustment been made on the basis of only the dividend or distribution, if any, actually made or paid.

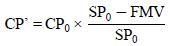

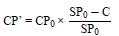

(d) Cash Dividends. If any cash dividend or distribution is made to all or substantially all holders of the Common Stock, the Conversion Price shall be adjusted based on the following formula:

where,

| CP0 | = | the Conversion Price in effect immediately prior to the close of business on the record date for such dividend or distribution; |

| CP’ | = | the Conversion Price in effect immediately after the close of business on the record date for such dividend or distribution; |

| SP0 | = | the Closing Price of the Common Stock on the Trading Day immediately preceding the ex-dividend date for such dividend or distribution; and |

| C | = | the amount in cash per share the Corporation distributes to all or substantially all holders of the Common Stock. |

Any decrease pursuant to this Section 10(d) shall become effective immediately after the close of business on the record date for such dividend or distribution. To the extent such dividend or distribution is not so paid, the Conversion Price shall be increased, effective as of the date the Board determines not to make or pay such dividend or distribution, to be the Conversion Price that would then be in effect had the adjustment been made on the basis of only the dividend or distribution, if any, actually made or paid. Notwithstanding the foregoing, if “C” (as defined above) is equal to or greater than “SP0” (as defined above), in lieu of the foregoing decrease, each Holder of a share of Series B Preferred Stock shall receive, in respect of each such share, at the same time and upon the same terms as holders of shares of the Common Stock, the amount of cash that such Holder would have received if such Holder owned a number of shares of Common Stock that such share of Series B Preferred Stock would have been convertible into at the Conversion Price in effect on the record date for the distribution.

21

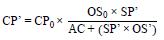

(e) Tender and Exchange Offers. If the Corporation or any of its Subsidiaries make a payment in respect of a tender or exchange offer for the Common Stock (other than solely pursuant to an odd-lot tender offer pursuant to Rule 13e-4(h)(5) under the Exchange Act (or any successor rule)), to the extent that the cash and value of any other consideration included in the payment per share of the Common Stock (determined as of the expiration time of such offer by the Corporation in good faith) exceeds the Closing Price per share of the Common Stock on the Trading Day next succeeding the last date on which tenders or exchanges may be made pursuant to such tender or exchange offer (as it may be amended), then the Conversion Price shall be decreased based on the following formula:

where,

| CP0 | = | the Conversion Price in effect immediately prior to the close of business on the 10th Trading Day immediately following, and including, the Trading Day next succeeding the date such tender or exchange offer expires; |

| CP’ | = | the Conversion Price in effect immediately after the close of business on the 10th Trading Day immediately following, and including, the Trading Day next succeeding the date such tender or exchange offer expires; |

| AC | = | the aggregate value, as of the time such tender or exchange offer expires, of all cash and other consideration paid for shares of Common Stock purchased or exchanged in such tender or exchange offer (such aggregate value to be determined, other than with respect to cash, by the Corporation in good faith); |

| OS0 | = | the number of shares of Common Stock outstanding immediately prior to the time such tender or exchange offer expires (including all shares of Common Stock accepted for purchase or exchange in such tender or exchange offer); |

| OS’ | = | the number of shares of Common Stock outstanding immediately after the time such tender or exchange offer expires (excluding all shares of Common Stock accepted for purchase or exchange in such tender or exchange offer); and |

| SP’ | = | the arithmetic average of the Daily VWAPs of the Common Stock over the 10 consecutive Trading Day period commencing on, and including, the Trading Day next succeeding the date such tender or exchange offer expires. |

The decrease to the Conversion Price under this Section 10(e) shall occur at the close of business on the 10th Trading Day immediately following, and including, the Trading Day next succeeding the date such tender or exchange offer expires; provided that in respect of any conversion of Series B Preferred Stock, if the relevant Conversion Time or Mandatory Conversion Time, as applicable, occurs during the 10 Trading Days immediately following, and including, the Trading Day next succeeding the expiration date of any tender or exchange offer, references to “10” or “10th” in the preceding paragraph shall be deemed replaced with such lesser number of Trading Days as have elapsed from, and including, the Trading Day next succeeding the date that such tender or exchange offer expires to, and including, the Conversion Time or Mandatory Conversion Time, as applicable, in determining the Conversion Price for such conversion.

22

To the extent such tender or exchange offer is announced but not consummated (including as a result of being precluded from consummating such tender or exchange offer under applicable law), or any purchases or exchanges of shares of Common Stock in such tender or exchange offer are rescinded, the Conversion Price will be readjusted to the Conversion Price that would then be in effect had the adjustment been made on the basis of only the purchases or exchanges of shares of Common Stock, if any, actually made, and not rescinded, in such tender or exchange offer.

(f) Adjustment for Reorganization Events. If there shall occur any:

(i) recapitalization, reclassification or change of the Common Stock (other than (x) changes solely resulting from a subdivision or combination of the Common Stock, (y) a change only in par value or from par value to no par value or no par value to par value or (z) stock splits and stock combinations that do not involve the issuance of any other series or class of securities);

(ii) consolidation, merger, combination or binding or statutory share exchange involving the Corporation;

(iii) sale, lease or other transfer of all or substantially all of the assets of the Corporation and its Subsidiaries, taken as a whole, to any Person; or

(iv) other similar event,

in each case, as a result of which, the Common Stock is converted into, or is exchanged for, or represents solely the right to receive, other securities, cash or other property, or any combination of the foregoing (a “Reorganization Event”), then following any such Reorganization Event, each share of Series B Preferred Stock shall remain outstanding and be convertible into the number, kind and amount of securities, cash or other property which a Holder would have received in such Reorganization Event had such Holder converted its shares of Series B Preferred Stock into the applicable number of shares of Common Stock immediately prior to the effective date of the Reorganization Event using the Conversion Price applicable immediately prior to the effective date of such Reorganization Event (the “Reference Property”); and, in such case, appropriate adjustment shall be made in the application of the provisions set forth in this Section 10 with respect to the rights and interests thereafter of the Holders, to the end that the provisions set forth in this Section 10 (including provisions with respect to changes in and other adjustments of the Conversion Price, to the extent the Reference Property consists of property other than cash and the Holders do not participate, on an as-converted basis, in applicable events with respect thereto) and Section 11 shall thereafter be applicable in relation to any shares of stock or other property thereafter deliverable upon the conversion of the Series B Preferred Stock. The Corporation (or any successor thereto) shall, no later than the Business Day after the effective date of such Reorganization Event, provide written notice to the Holders of such occurrence of such event and of the kind and amount of the cash, securities or other property that each share of Series B Preferred Stock will be convertible into under this Section 10(f). Failure to deliver such notice shall not affect the operation of this Section 10(f). The Corporation shall not enter into any agreement for a transaction constituting a Reorganization Event unless (i) such agreement provides for, or does not interfere with or prevent (as applicable), conversion of the Series B Preferred Stock in a manner that is consistent with and gives effect to this Section 10(f) and (ii) to the extent that the Corporation is not the surviving corporation in such Reorganization Event or will be dissolved in connection with such Reorganization Event, proper provision shall be made (as determined by the Corporation in good faith) in the agreements governing such Reorganization Event for the conversion of the Series B Preferred Stock into the Reference Property and the assumption by such Person of the obligations of the Corporation under this Certificate of Designations.

23

If the Reorganization Event causes the Common Stock to be converted into, or exchanged for, the right to receive more than a single type of consideration (determined based in part upon any form of stockholder election), then for the purposes of this Section 10(f), the Reference Property into which the Series B Preferred Stock shall be convertible shall be deemed to be the weighted average of the types and amounts of consideration per share actually received by holders of Common Stock. The Corporation shall notify holders and the Transfer Agent of the weighted average as soon as practicable after such determination is made.

(g) Stockholder Rights Plan. If the Corporation has a stockholder rights plan in effect upon conversion of the Series B Preferred Stock, each share of Common Stock issued upon such conversion shall be entitled to receive the appropriate number of rights, if any, and the certificates representing the Common Stock issued upon such conversion shall bear such legends, if any, in each case as may be provided by the terms of any such stockholder rights plan, as the same may be amended from time to time. However, if, prior to any conversion of Series B Preferred Stock, the rights have separated from the shares of Common Stock in accordance with the provisions of the applicable stockholder rights plan, the Conversion Price shall be adjusted at the time of separation as if the Corporation distributed to all or substantially all holders of the Common Stock Distributed Property as provided in Section 10(c), subject to readjustment in the event of the expiration, termination or redemption of such rights.

(h) Participating Dividends. In the event the Corporation shall make or issue, or, if earlier, fix a record date for the determination of holders of Common Stock entitled to receive, a dividend or distribution of cash or property (other than Common Stock) the Corporation shall simultaneously declare and pay a dividend in cash or such other property on the Series B Preferred Stock (each, a “Participating Dividend”) on a pro rata basis with the Common Stock determined on an as-converted basis assuming all Series B Preferred Stock then outstanding had been converted pursuant to Section 7 as of immediately prior to the record date of the applicable dividend (or if no record date is fixed, the date as of which the record holders of Common Stock entitled to such dividends are to be determined).

(i) Rounding; Par Value. All calculations under Section 10 shall be made to the nearest 1/10,000th of a cent or to the nearest 1/10,000th of a share, as the case may be (with 5/100,000ths rounded upward). No adjustment in the Conversion Price shall reduce the Conversion Price below the then par value of the Common Stock.

(j) Adjustment Deferral. If an adjustment to the Conversion Price otherwise required by this Certificate of Designations would result in a change of less than one percent (1%) to the Conversion Price, then the Corporation may, at its election, defer such adjustment, except that all such deferred adjustments must be given effect immediately upon the earliest of the following: (1) when all such deferred adjustments would result in a change of at least one percent (1%) to the Conversion Price; (2) the Conversion Time or Mandatory Conversion Time, as applicable, of any share of Series B Preferred Stock; (3) the date of any Mandatory Conversion Notice; (4) the date of any Initial Change in Control Notice; (5) any Change in Control Effective Date and/or any Make-Whole Change in Control Effective Date; and (6) the occurrence of any vote of the stockholders of the Corporation.

24

(k) Certificate as to Adjustment.

(i) Promptly following any adjustment of the Conversion Price, the Corporation shall furnish to each Holder at the address specified for such Holder in the books and records of the Corporation (or at such other address as may be provided to the Corporation in writing by such Holder, which may be an electronic mail address) a certificate of an officer of the Corporation setting forth in reasonable detail such adjustment and the facts upon which it is based and certifying the calculation thereof.

(ii) As promptly as reasonably practicable following the receipt by the Corporation of a written request by any Holder, but in any event not later than thirty (30) days thereafter, the Corporation shall furnish to such Holder a certificate of an officer of the Corporation certifying the Conversion Price then in effect and the number of Conversion Shares or the amount, if any, of other shares of stock, securities or assets then issuable to such Holder upon conversion of the shares of Series B Preferred Stock held by such Holder.