| PROSPECTUS SUPPLEMENT NO. 11 | |

Filed Pursuant to Rule 424(b)(3) |

| (to prospectus dated July 1, 2021) | |

Registration No. 333-257423 |

PURECYCLE TECHNOLOGIES, INC.

18,177,703 Shares

Common Stock

This prospectus supplement is being filed to update

and supplement the information contained in the prospectus dated July 1, 2021 (as supplemented or amended from time to time, the “Prospectus”),

with the information contained in our Current Report on Form 8-K, which was filed with the Securities and Exchange Commission (“SEC”)

on March 9, 2022 (the “Form 8-K”). Accordingly, we have attached the Form 8-K to this prospectus supplement.

The Prospectus and this prospectus supplement relate

to the issuance by us of 5,936,625 shares of our common stock, par value $0.001 per share (“Common Stock”), that may be issued

upon exercise of the Company Warrants (as defined in the Prospectus).

The Prospectus and prospectus supplement also relate

to the offer and sale from time to time by the selling stockholders named in the Prospectus or their permitted transferees (collectively,

the “Selling Stockholders”) of up to 12,241,078 shares of Common Stock, which includes (i) 8,903,842 shares of Common Stock

that may be issued upon conversion of the Convertible Notes (as defined in the Prospectus) currently outstanding as of the most recent

interest payment date, (ii) up to 951,360 additional shares of Common Stock issuable upon conversion of the Convertible Notes assuming

all remaining interest payments are made to holders of the Convertible Notes entirely in kind and the maturity date of the Convertible

Notes is extended through April 15, 2023 (from October 15, 2022) at our election with respect to 50% of the amount outstanding under the

Convertible Notes at October 15, 2022 and (iii) up to 2,385,876 shares of Common Stock held by certain initial stockholders named therein

(including the shares of our Common Stock that may be issued upon conversion of the Company Warrants held by such initial stockholders).

This prospectus supplement updates and supplements

the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus,

including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there

is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this

prospectus supplement.

Our Common Stock, warrants and units are listed

on The Nasdaq Capital Market under the symbols “PCT,” “PCTTW” and “PCTTU,” respectively. On March

9, 2022, the closing price of our Common Stock was $8.47 per share.

Investing in our securities involves risks that

are described in the “Risk Factors” section beginning on page 14 of the Prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if the Prospectus or this prospectus

supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is March

11, 2022.

United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March

4, 2022

| |

PureCycle Technologies, Inc. |

|

| |

(Exact Name of Registrant as Specified in its Charter) |

|

| Delaware |

|

001-40234 |

|

86-2293091 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

| 5950 Hazeltine National Drive, |

Suite 650, |

Orlando |

|

32822 |

| Florida |

|

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (877) 648-3565

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on

which registered |

| |

|

|

|

|

| Common Stock, par value $0.001 per share |

|

PCT |

|

The Nasdaq Stock Market LLC |

| Warrants, each exercisable for one share of common stock, $0.001 par value per share, at an exercise price of $11.50 per share |

|

PCTTW |

|

The Nasdaq Stock Market LLC |

| Units, each consisting of one share of common stock, $0.001 par value per share, and three quarters of one warrant |

|

PCTTU |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (Sec.230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (Sec.240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

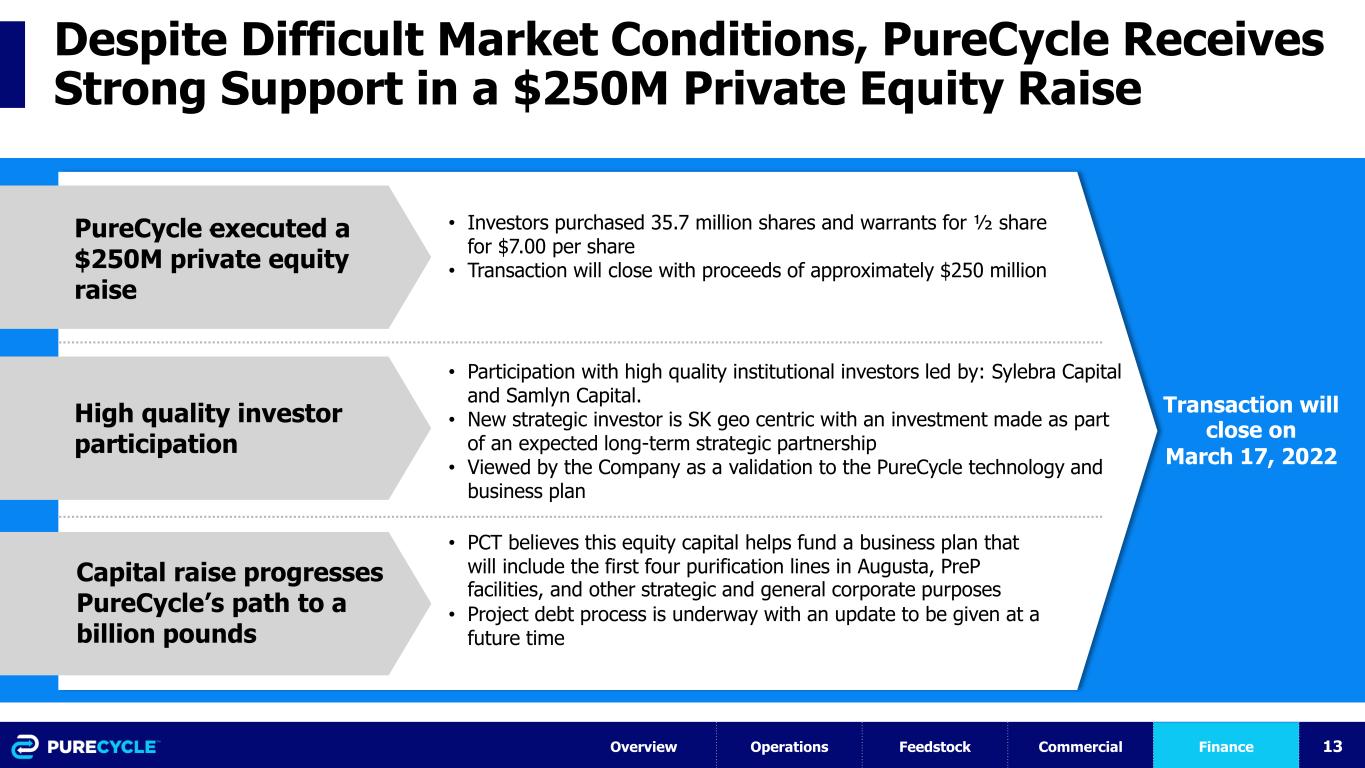

Item 1.01. Entry into a Material Definitive Agreement.

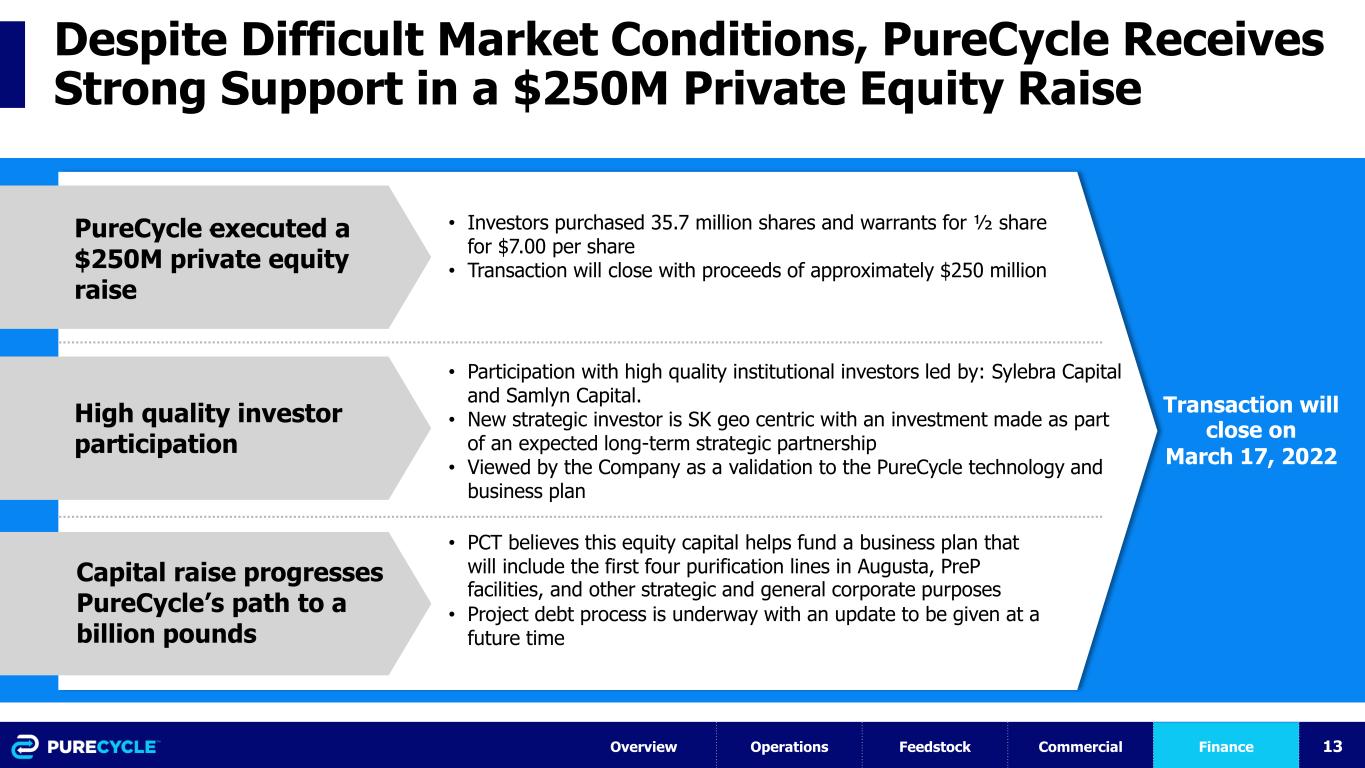

On or before March 7, 2022, PureCycle Technologies, Inc. (the “Company”)

entered into subscription agreements (the “Subscription Agreements”) with certain investors (the “Investors”),

pursuant to which the Company agreed to sell to the Investors, in a private placement, an aggregate of 35,714,278 shares of the Company’s

common stock, par value $0.001 per share (“Common Stock”), and Series A warrants to purchase an aggregate of

17,857,139 shares of Common Stock (the “Series A Warrants”, and the shares of Common Stock issuable upon exercise

of the Series A Warrants, the “Warrant Shares”) at a price of $7.00 per share of Common Stock and one-half (1/2)

of one Series A Warrant (the “Offering”). Messrs. Michael Otworth (Chief Executive Officer and Chairman of the

Company’s Board of Directors (the “Board”)), Jeffrey Fieler (Director) and Timothy Glockner (Director)

and Ms. Tanya Burnell (Director) participated in the Offering as Investors, either directly or, in the case of Mr. Timothy Glockner and

Ms. Tanya Burnell, indirectly by companies potentially related to or affiliated with them. The Series A Warrants have an exercise price

of $11.50 per share, will be exercisable beginning on the calendar day following the six month anniversary of the date of issuance, will

expire on March 17, 2026 and are redeemable at a price of $0.01 per Series A Warrant if the last sales price of the Common Stock has been

equal to or greater than $18.00 per share (subject to adjustment for splits, dividends, recapitalizations and other similar events) for

any twenty (20) trading days within a thirty (30) trading day period commencing after the Series A Warrants become exercisable. The closing

of the sales of the securities pursuant to the Subscription Agreements is expected to occur on March 17, 2022, subject to the closing

conditions therein, including, but not limited to, certain creditor approvals required by the Foreign Exchange Transactions Regulations

of Korea. The Company expects the gross proceeds to the Company from the Offering to be approximately $250 million before deducting fees

and other estimated offering expenses.

As part of the Subscription Agreements, the Company is required to

prepare and file a registration statement (the “Registration Statement”) with the Securities and Exchange Commission

(the “Commission”) under the Securities Act of 1933, as amended (the “Securities Act”),

covering the resale of the Shares and the Warrant Shares. The Company is required to have such Registration Statement declared effective

by the Commission within 60 calendar days (or 90 calendar days in the event of a “full review” by the Commission) following

the closing of the Offering.

As additional consideration for Sylebra Capital Management (“Sylebra”)

agreeing to participate in the Offering as an Investor, the Company entered into a board representation agreement with Sylebra (the “Board

Representation Agreement”). Pursuant to the Board Representation Agreement, Sylebra will be granted the right to designate

(i) one person to be nominated for election to the Board so long as Sylebra together with its affiliates beneficially owns at least 10.0%

of the Common Stock, and (ii) two persons to be nominated for election to the Board so long as Sylebra together with its affiliates beneficially

owns at least 15.0% of the Common Stock, subject to certain exceptions. The Board Representation Agreement will terminate upon the earlier

of when (i) Sylebra together with its affiliates beneficially owns less than 50.0% of the securities purchased in the Offering and (ii)

Sylebra together with its affiliates beneficially owns less than 10.0% of Common Stock. The Board Representation Agreement is effective

upon the closing of the Offering.

The foregoing descriptions of the material terms of the Subscription

Agreements, the Board Representation Agreement and the Series A Warrants do not purport to be complete and are qualified in their entirety

by reference to the full text of the form of Subscription Agreement, the Board Representation Agreement and the form of Series A Warrant,

copies of which are filed as Exhibits 10.1, 10.2 and 4.1, respectively, to this Current Report on Form 8-K and incorporated herein by

reference. A copy of the press release announcing the Offering, and certain other information, is filed as Exhibit 99.1 to this Current

Report on Form 8-K.

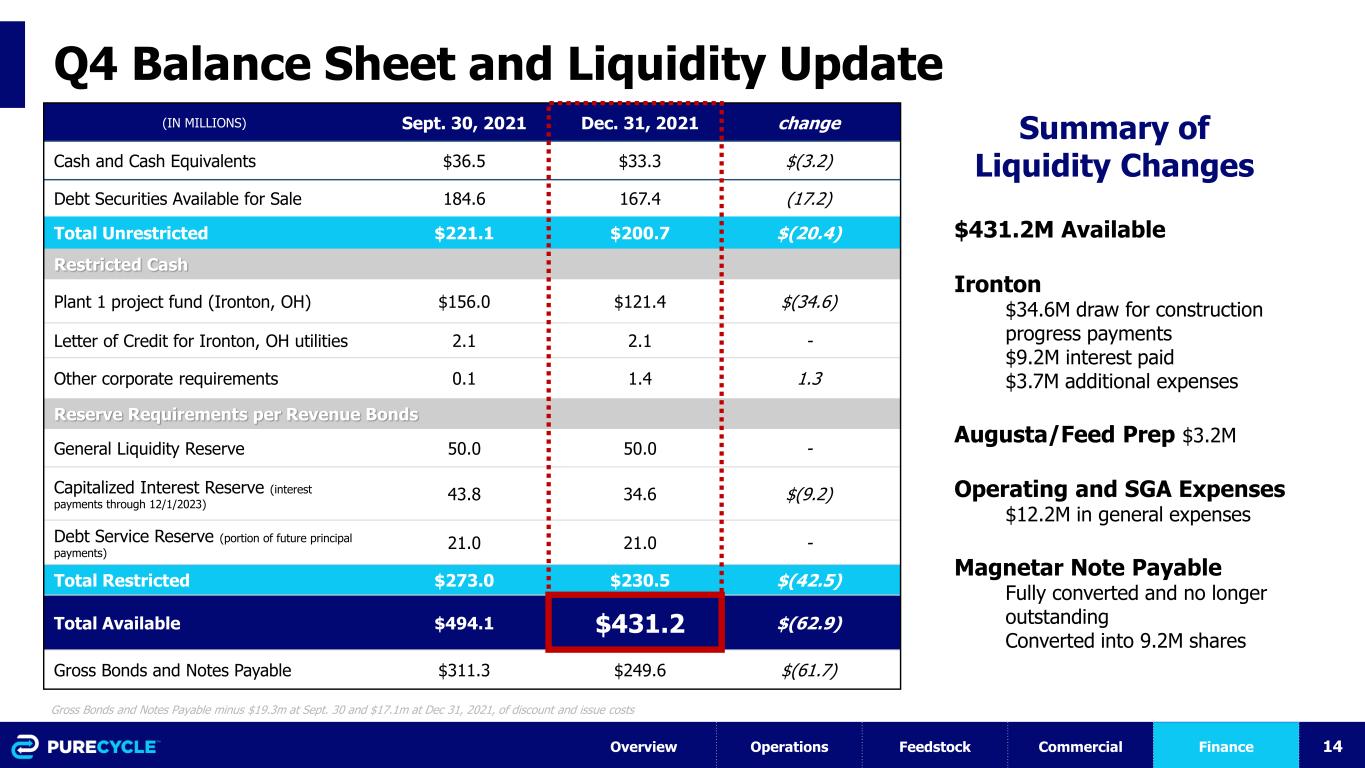

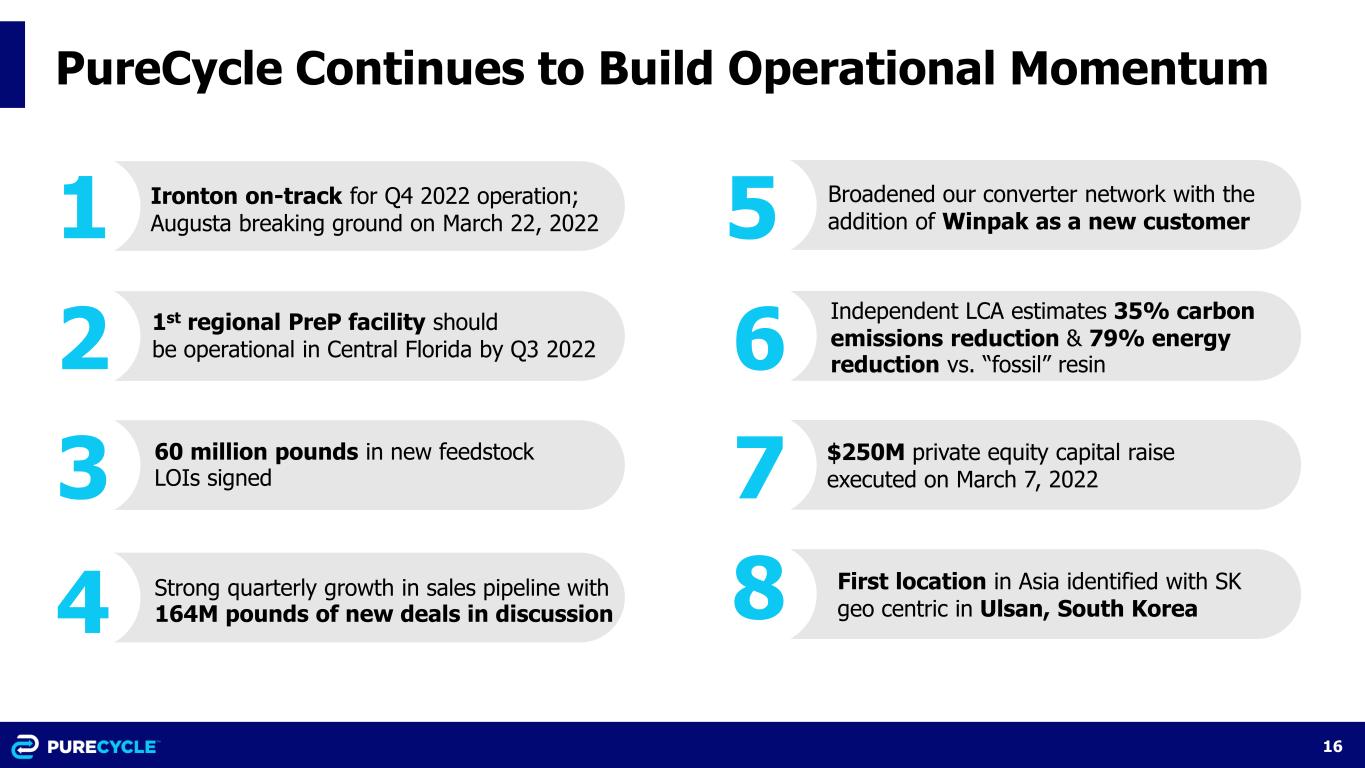

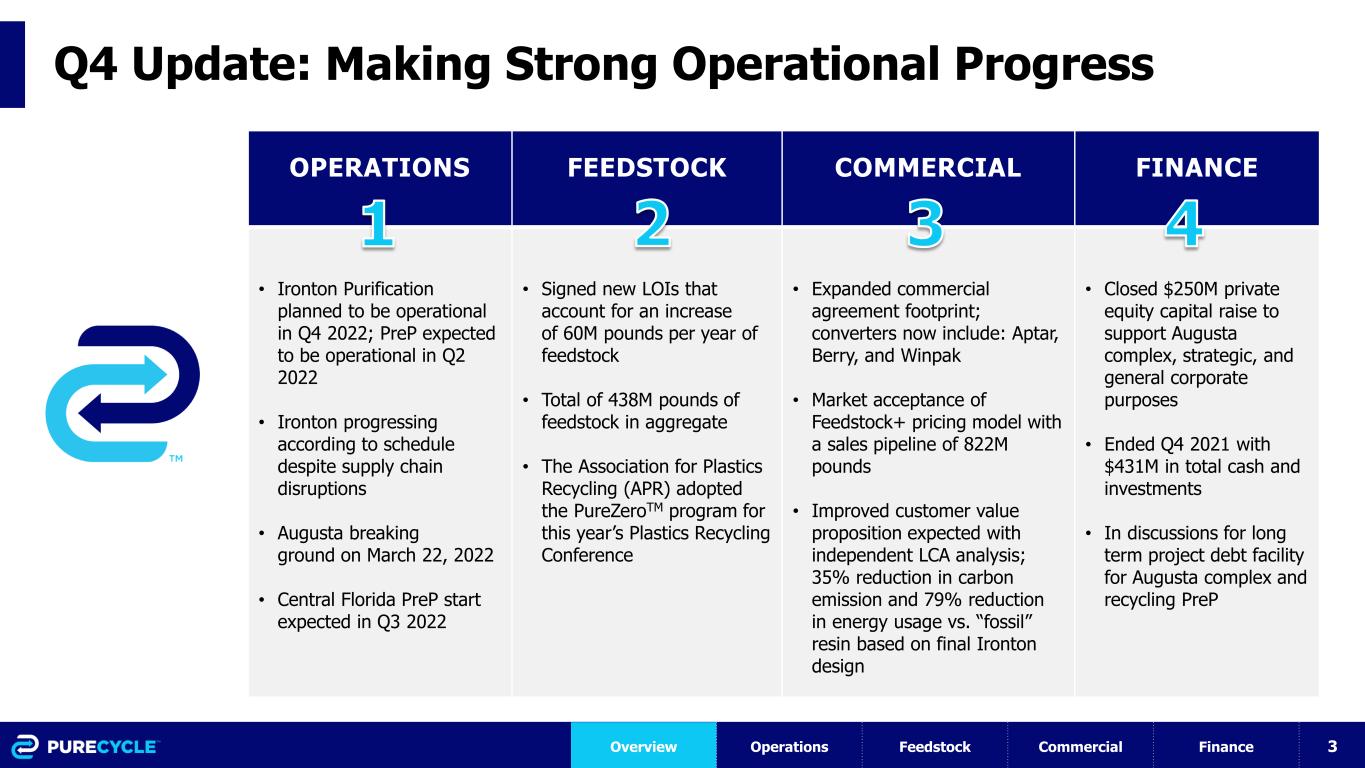

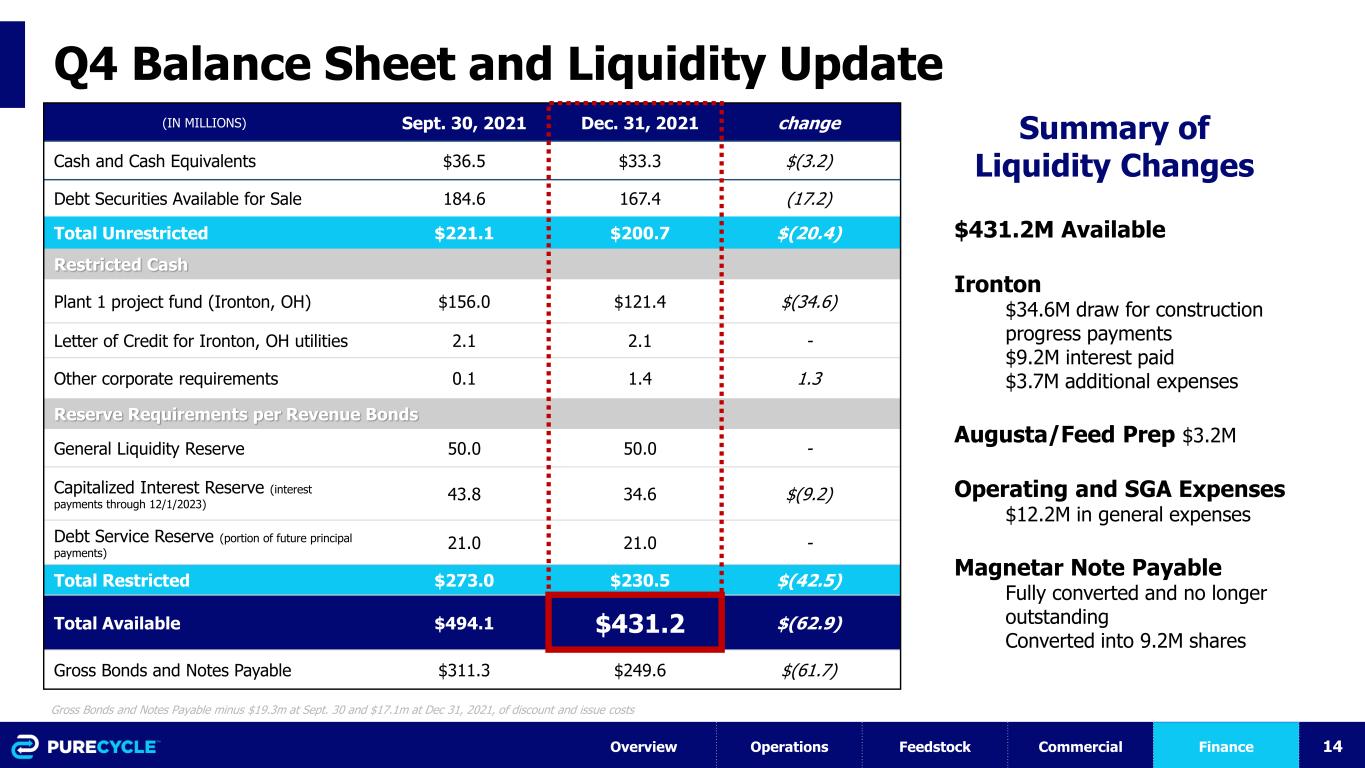

Item 2.02. Results of Operations and Financial Condition.

As noted above, on March 9, 2022, the Company issued a press release,

attached hereto as Exhibit 99.1 and incorporated herein by reference, announcing the Company’s financial results for the fourth

quarter and full year ended December 31, 2022, and certain other information.

The information contained in Item 7.01 concerning the presentation

to Company’s investors is hereby incorporated into this Item 2.02 by reference.

Item 3.02. Unregistered Sales of Equity Securities.

The information contained above in Item 1.01 related to the Offering

is hereby incorporated by reference into this Item 3.02. The securities being sold pursuant to the Subscription Agreements are being sold

and issued without registration under the Securities Act, in reliance on the exemptions provided by Section 4(a)(2) of the Securities

Act as a transaction not involving a public offering and/or Rule 506 promulgated thereunder, and in reliance on similar exemptions under

applicable state laws.

Item 5.05. Amendments to the Registrant’s Code of Ethics,

or Waiver of a Provision of the Code of Ethics.

The information set forth under Item 1.01 is incorporated by reference

into this Item 5.05. On March 4, 2022, after consideration of the terms and conditions of the Common Stock and Series A Warrant Subscription

Agreements and the Board Representation Agreement, as well as the particular facts and circumstances surrounding the Offering, the Board

approved a waiver to the conflicts of interest provision of the Company’s Code of Business Conduct and Ethics (the “Code”)

in connection with the participation of Messrs. Michael Otworth (Chief Executive Officer and Chairman of the Board), Jeffrey Fieler (Director)

and Timothy Glockner (Director) and Ms. Tanya Burnell (Director) in the Offering as Investors, either directly or, in the case of Mr.

Timothy Glockner and Ms. Tanya Burnell, indirectly by companies potentially related to or affiliated with them.

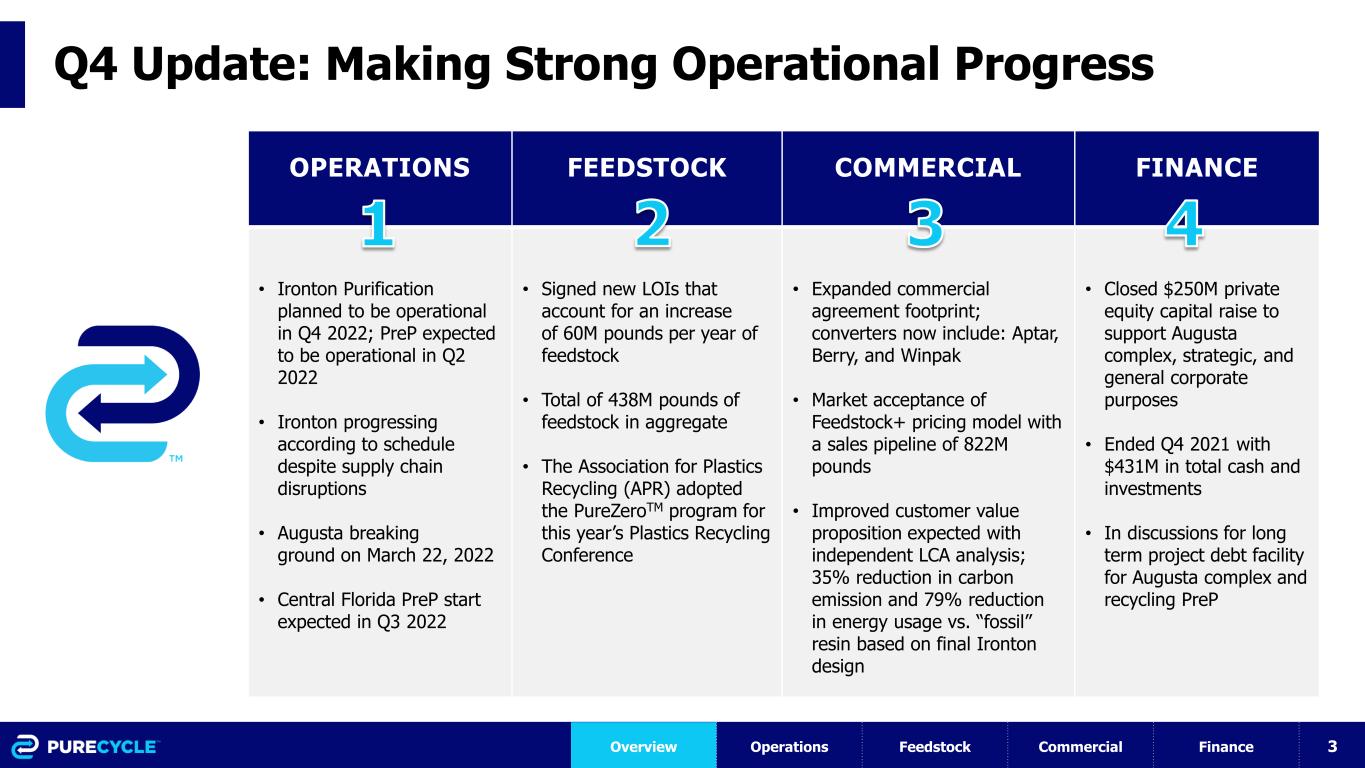

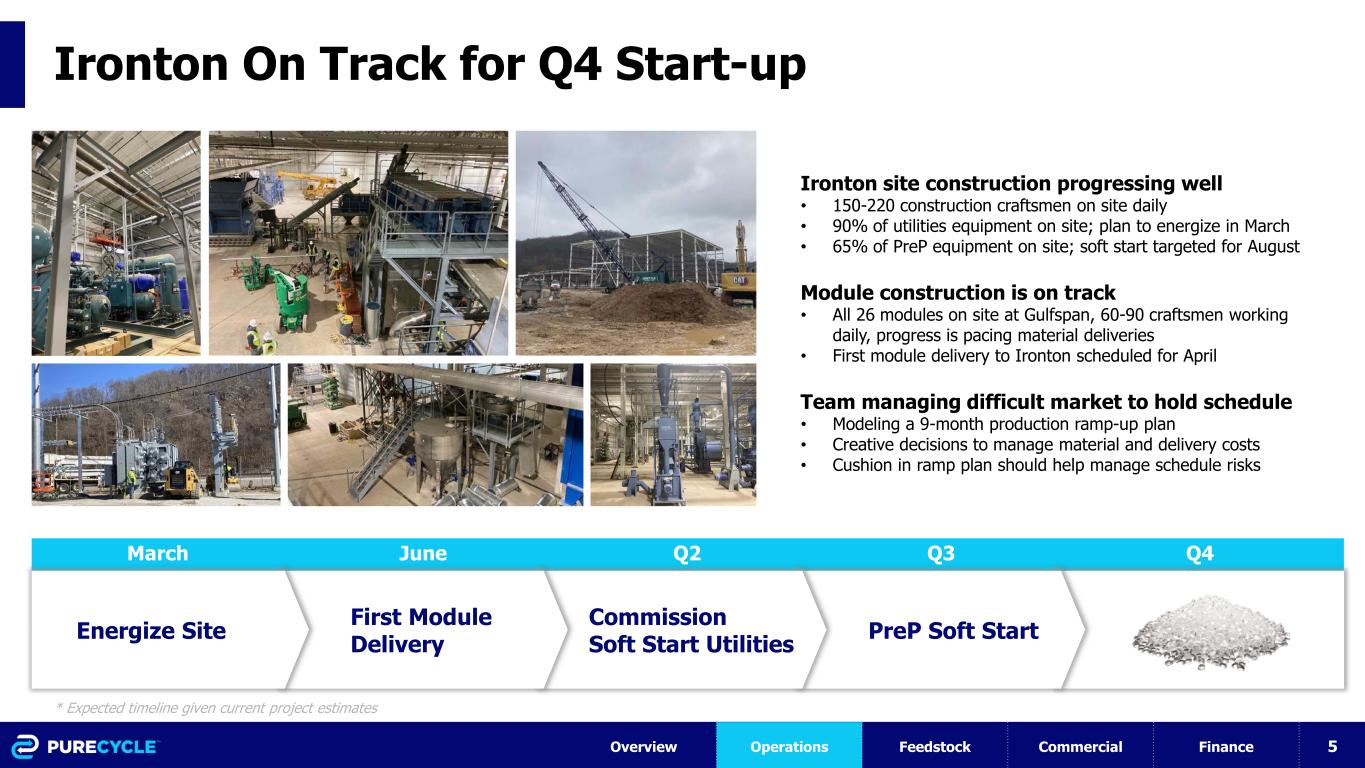

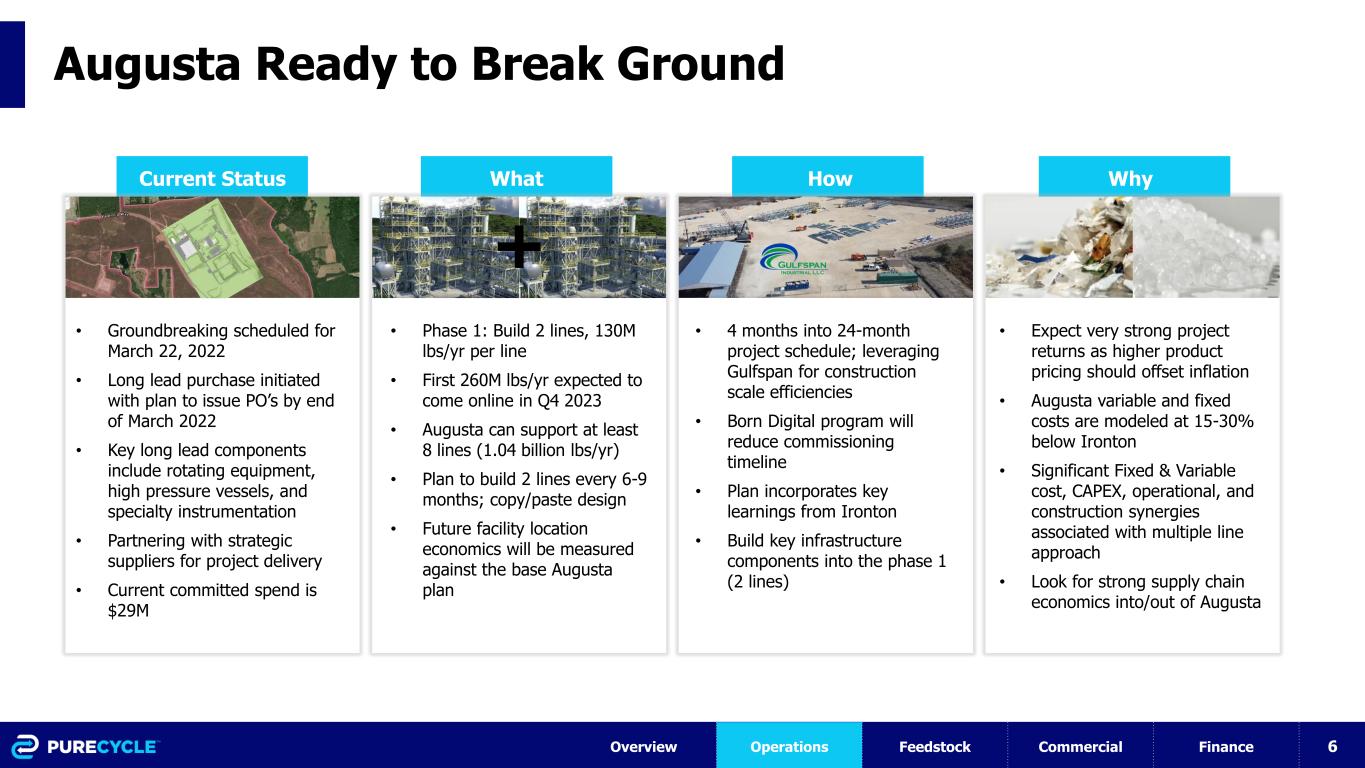

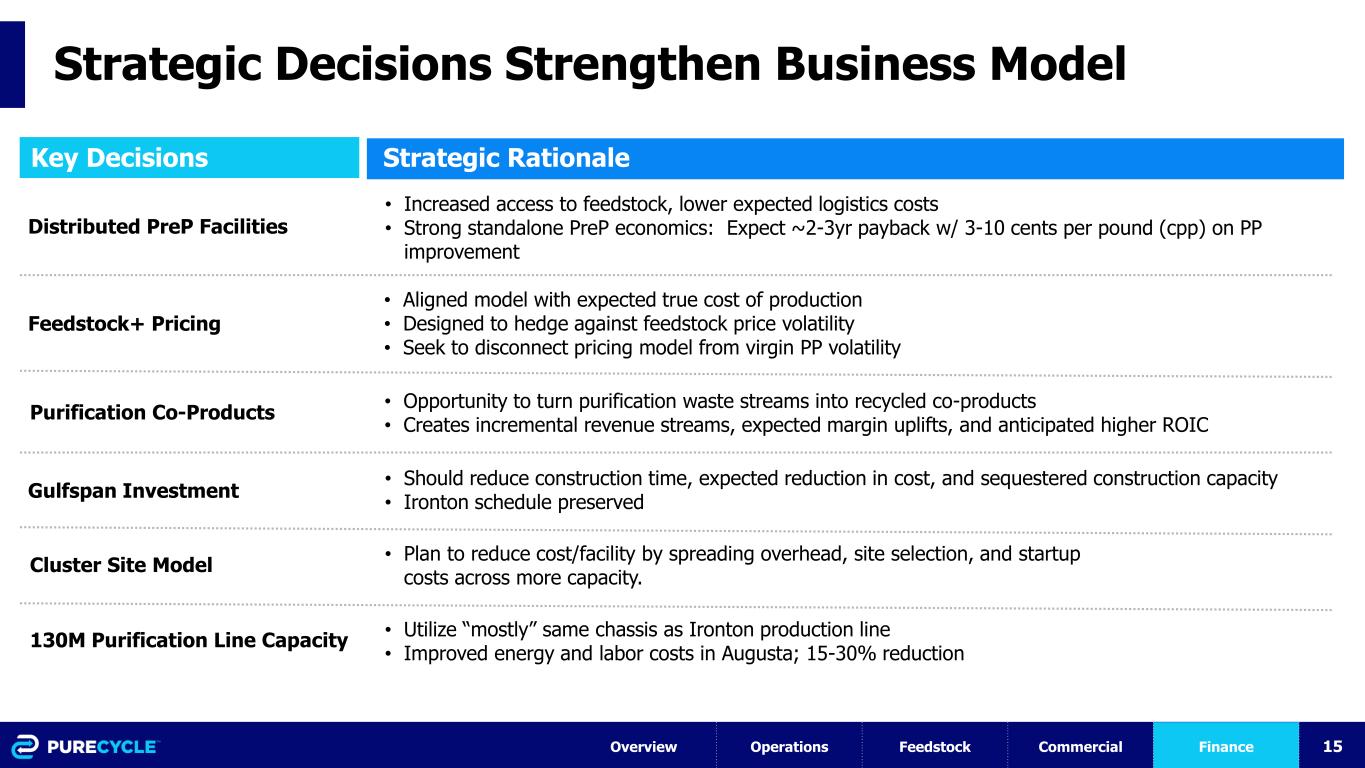

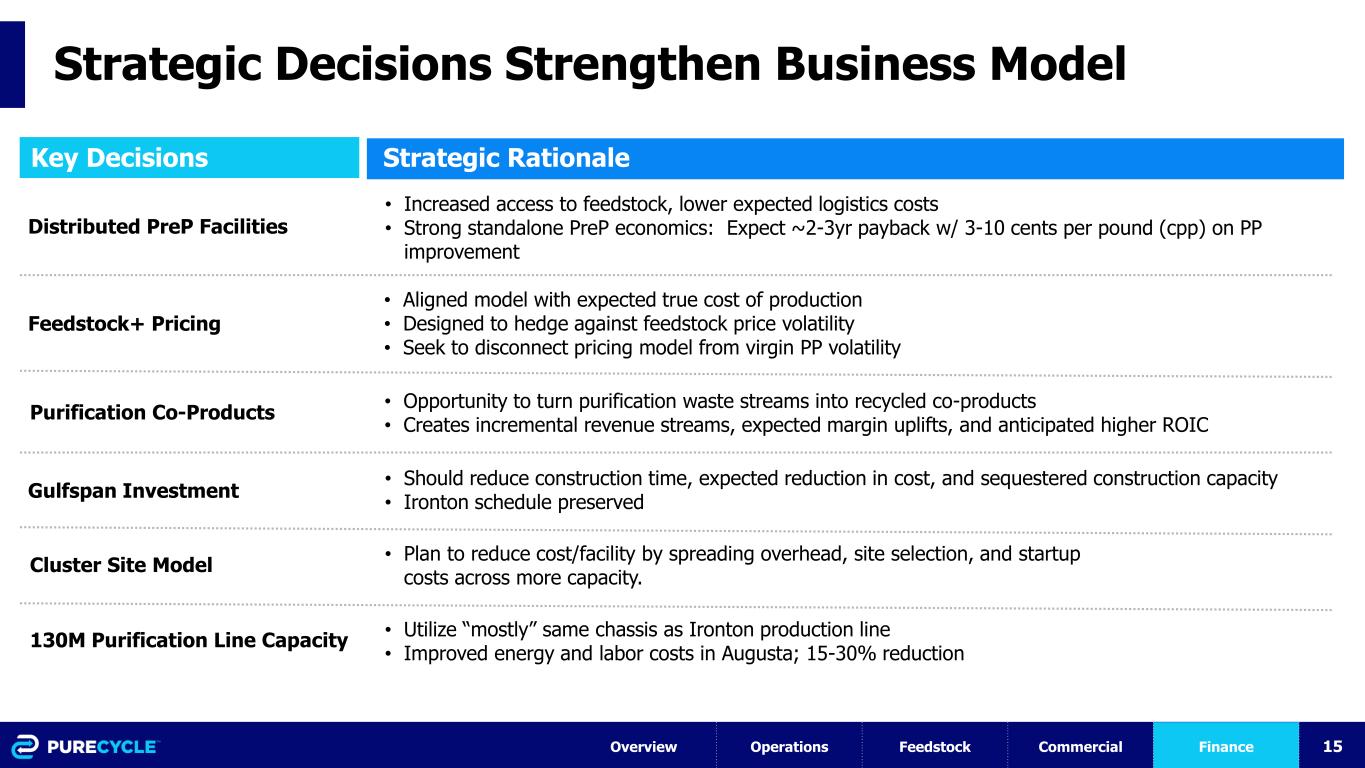

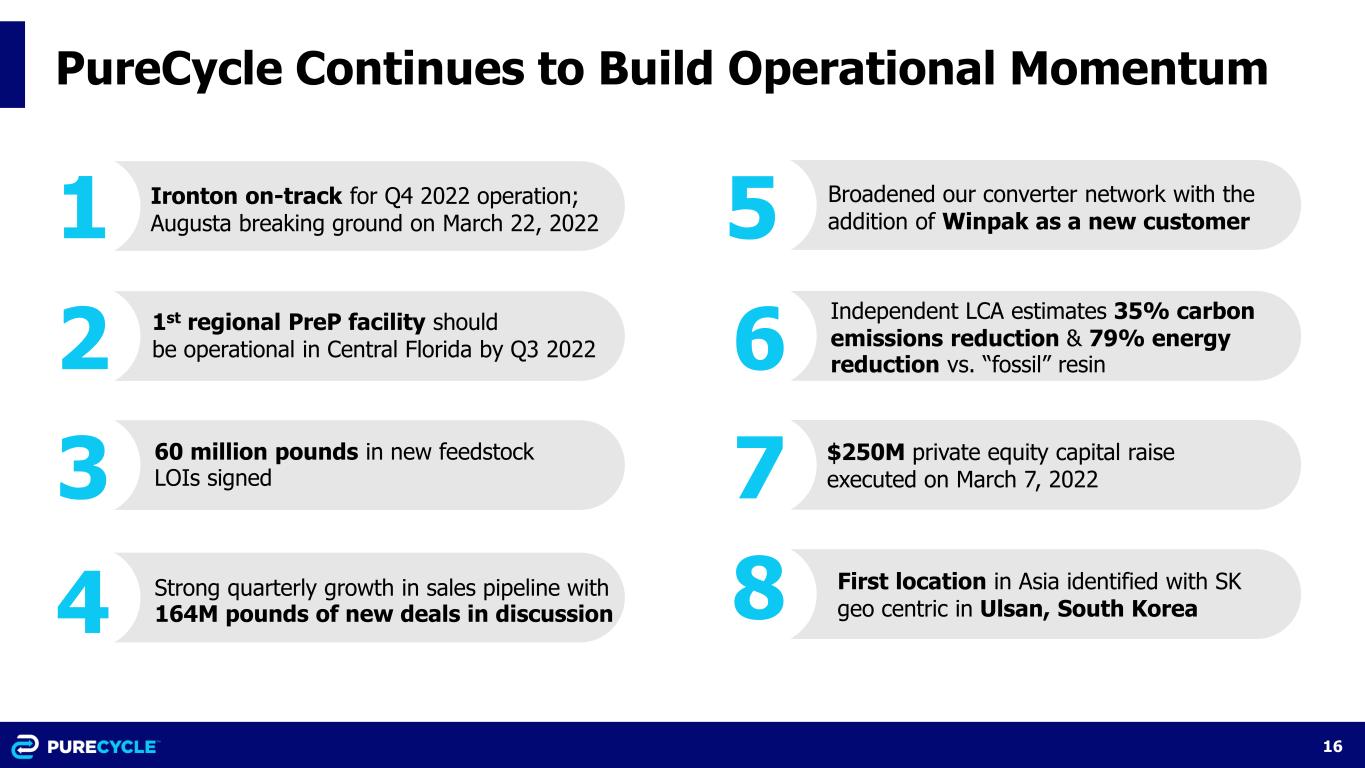

Item 7.01. Regulation FD Disclosure.

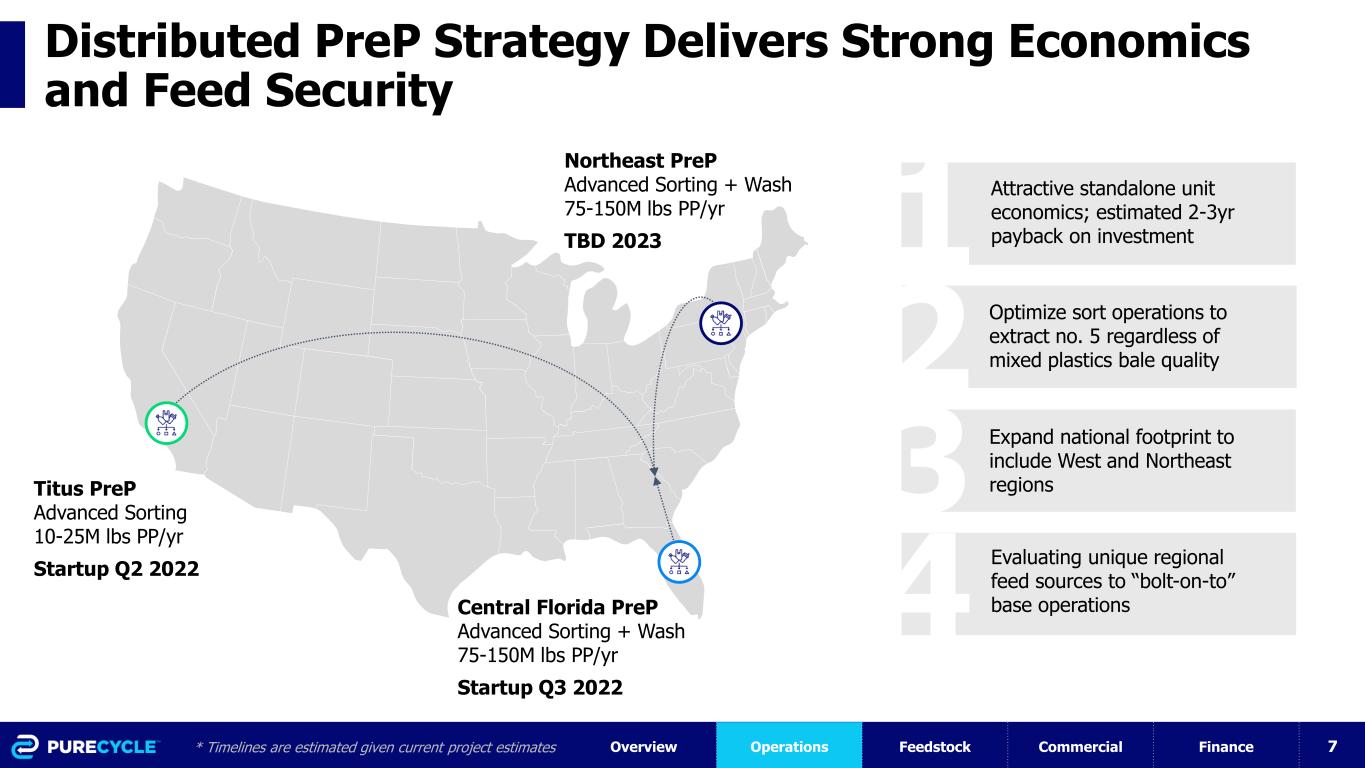

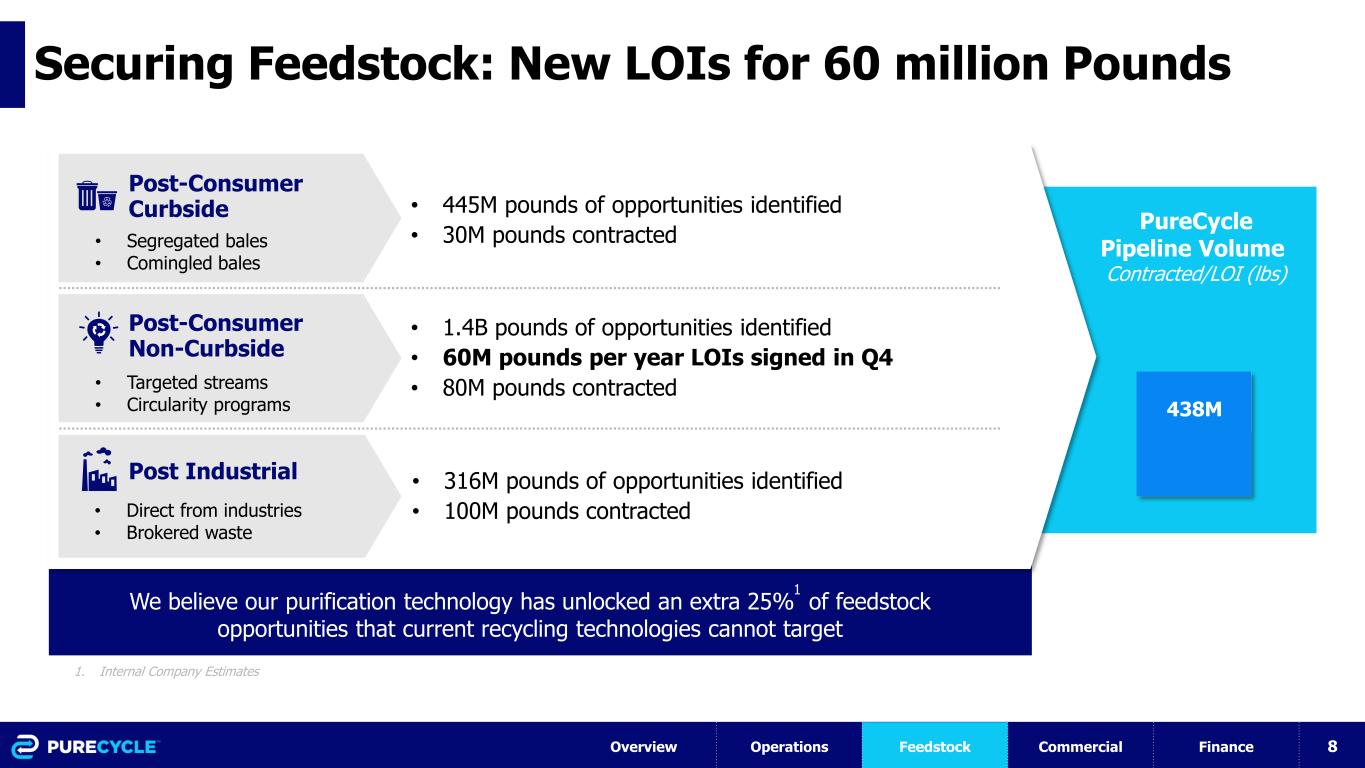

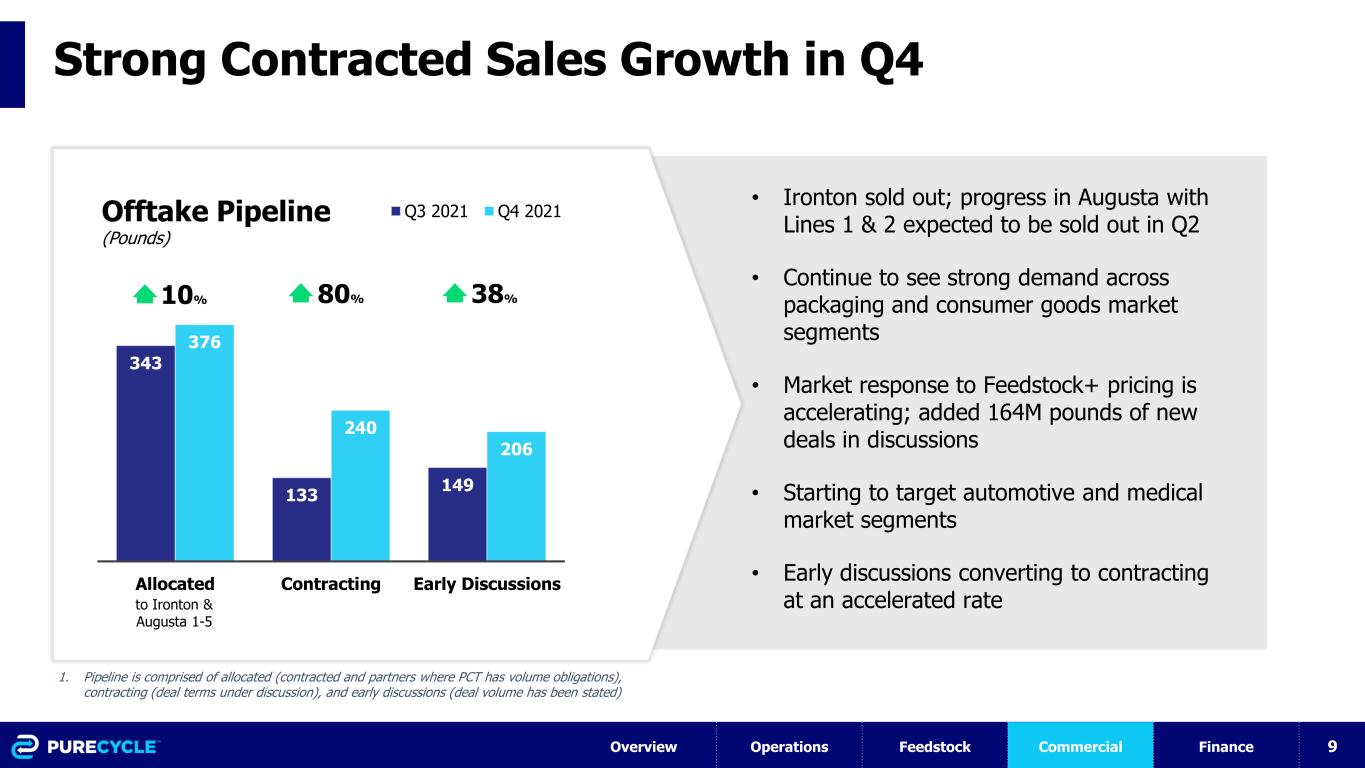

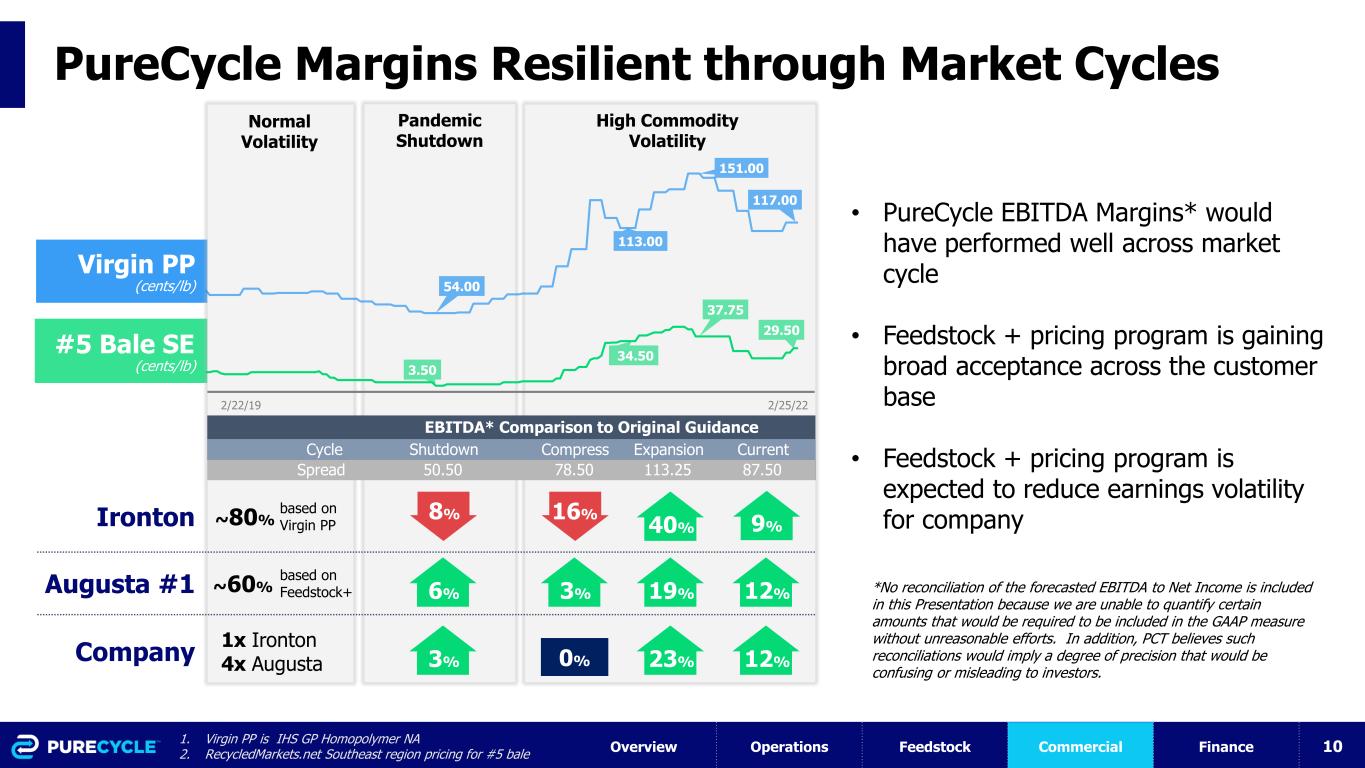

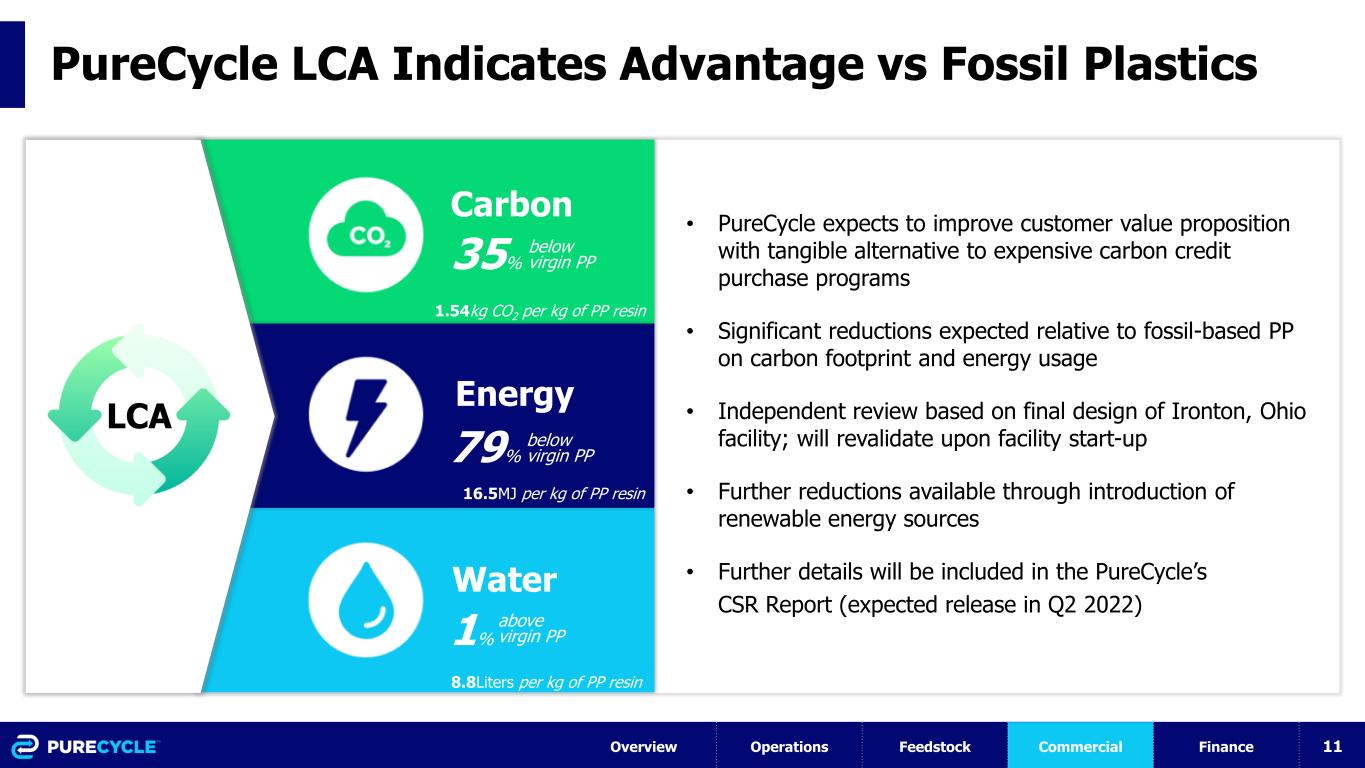

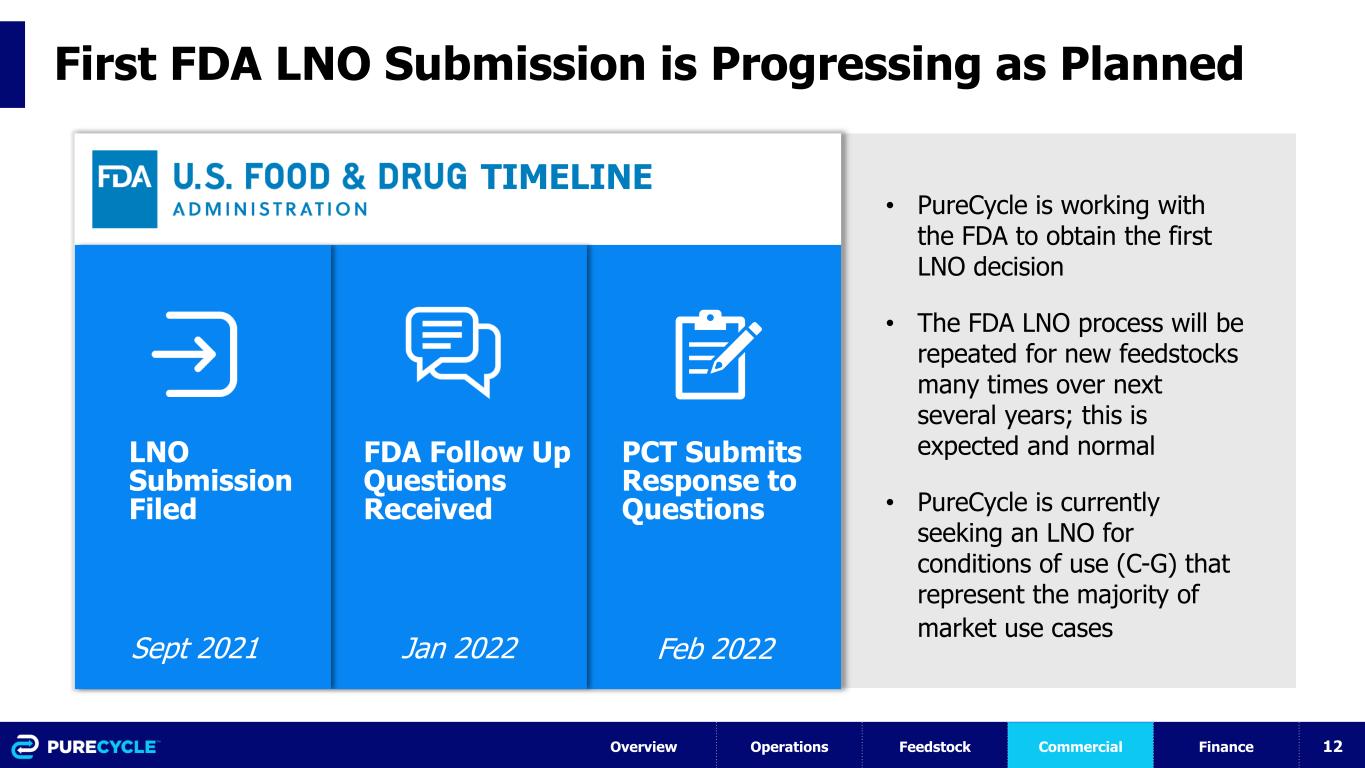

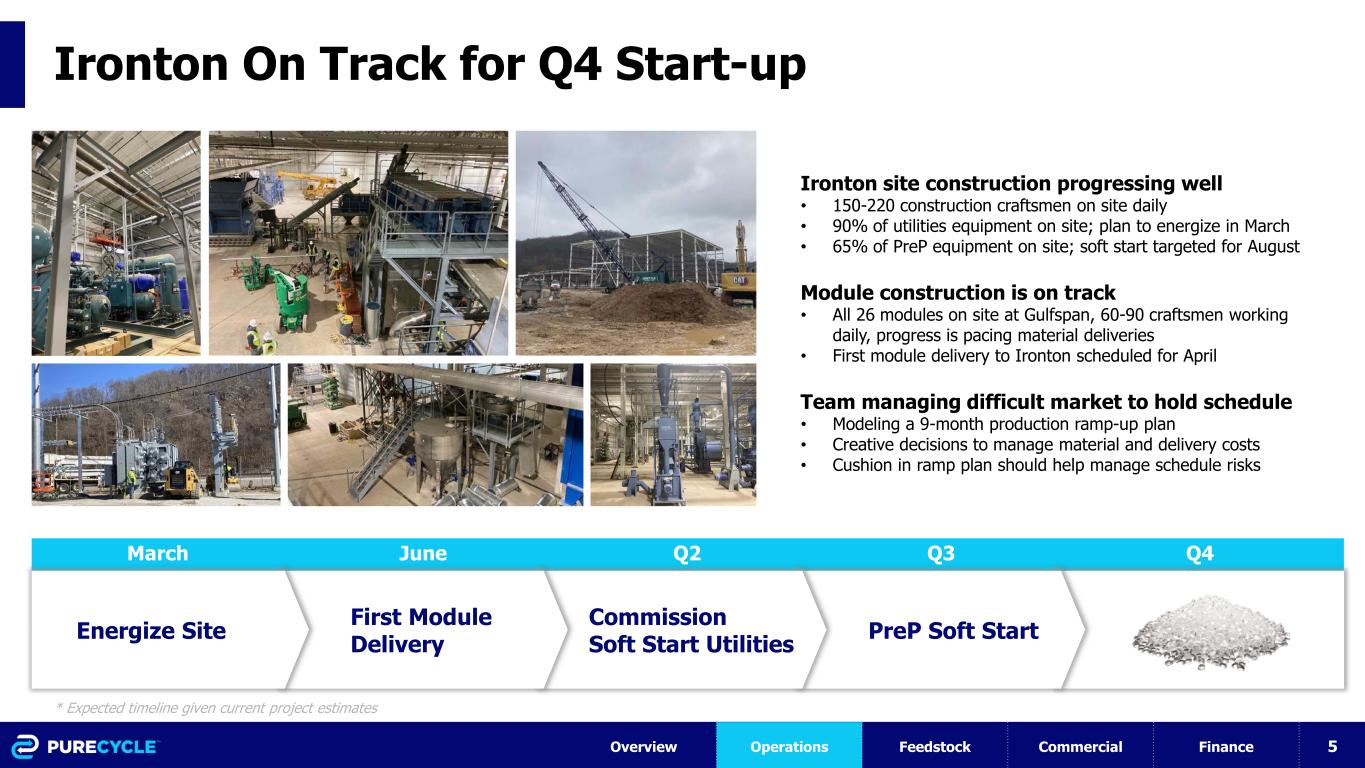

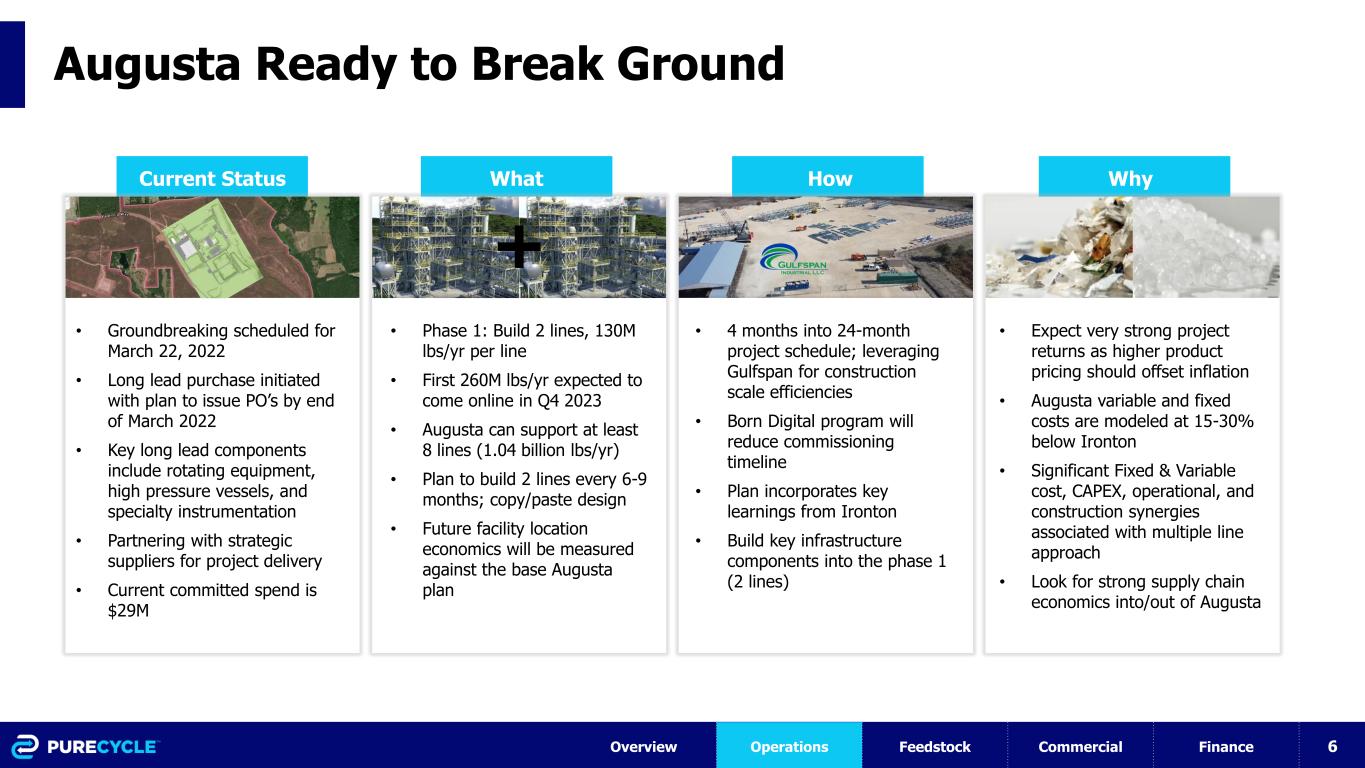

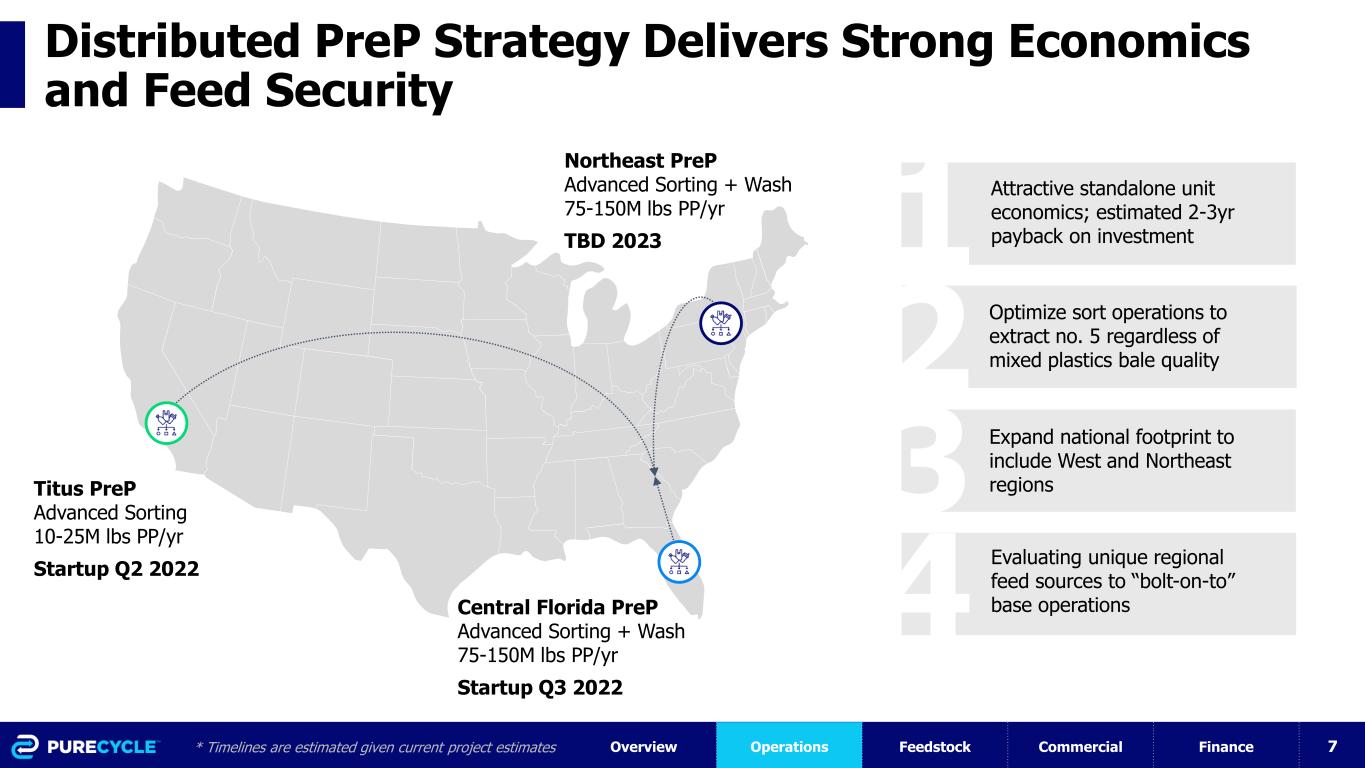

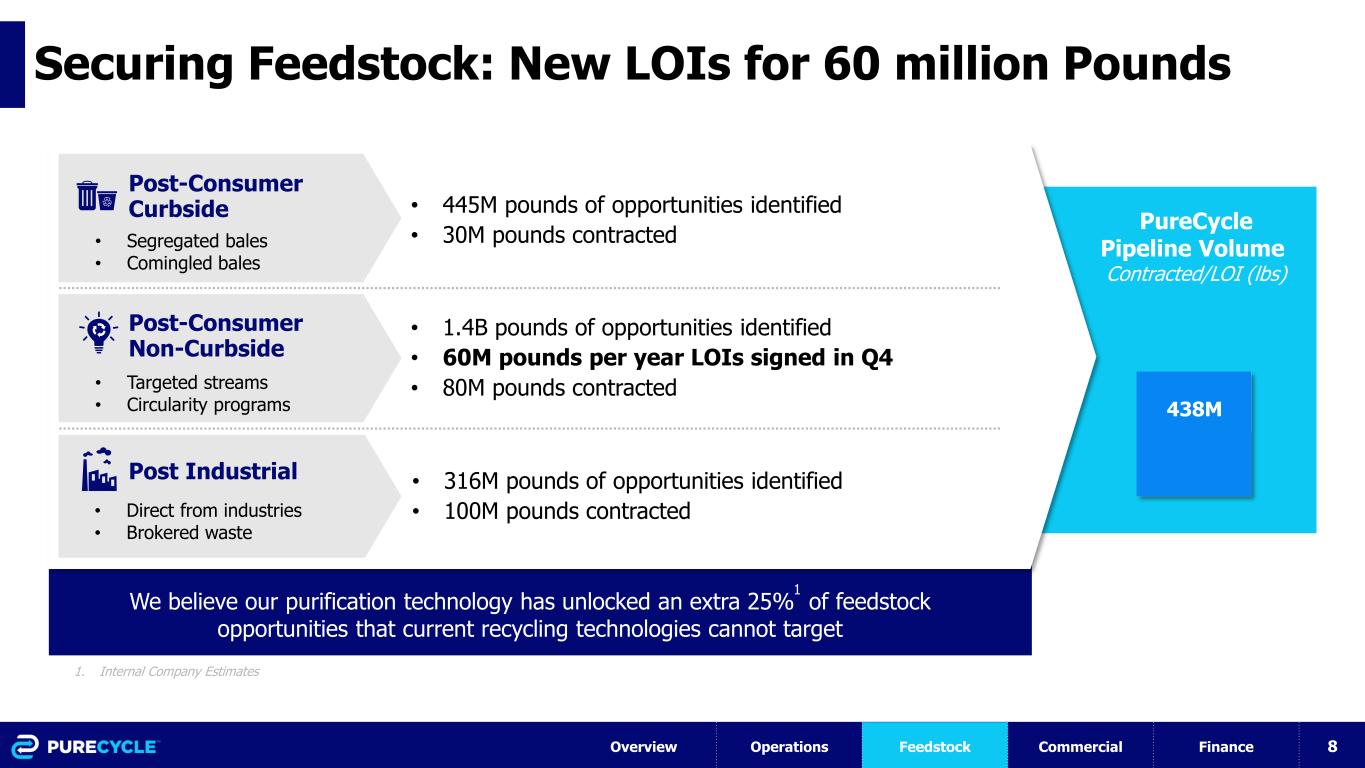

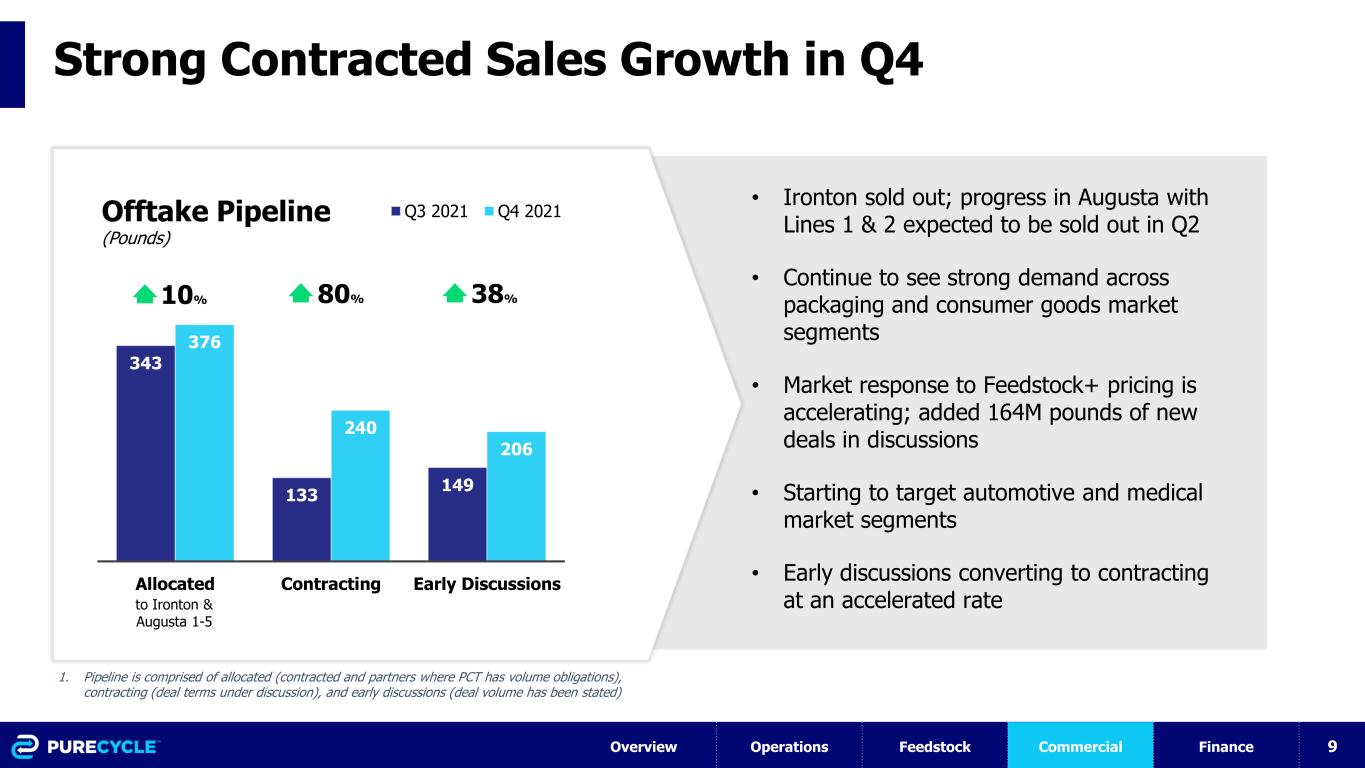

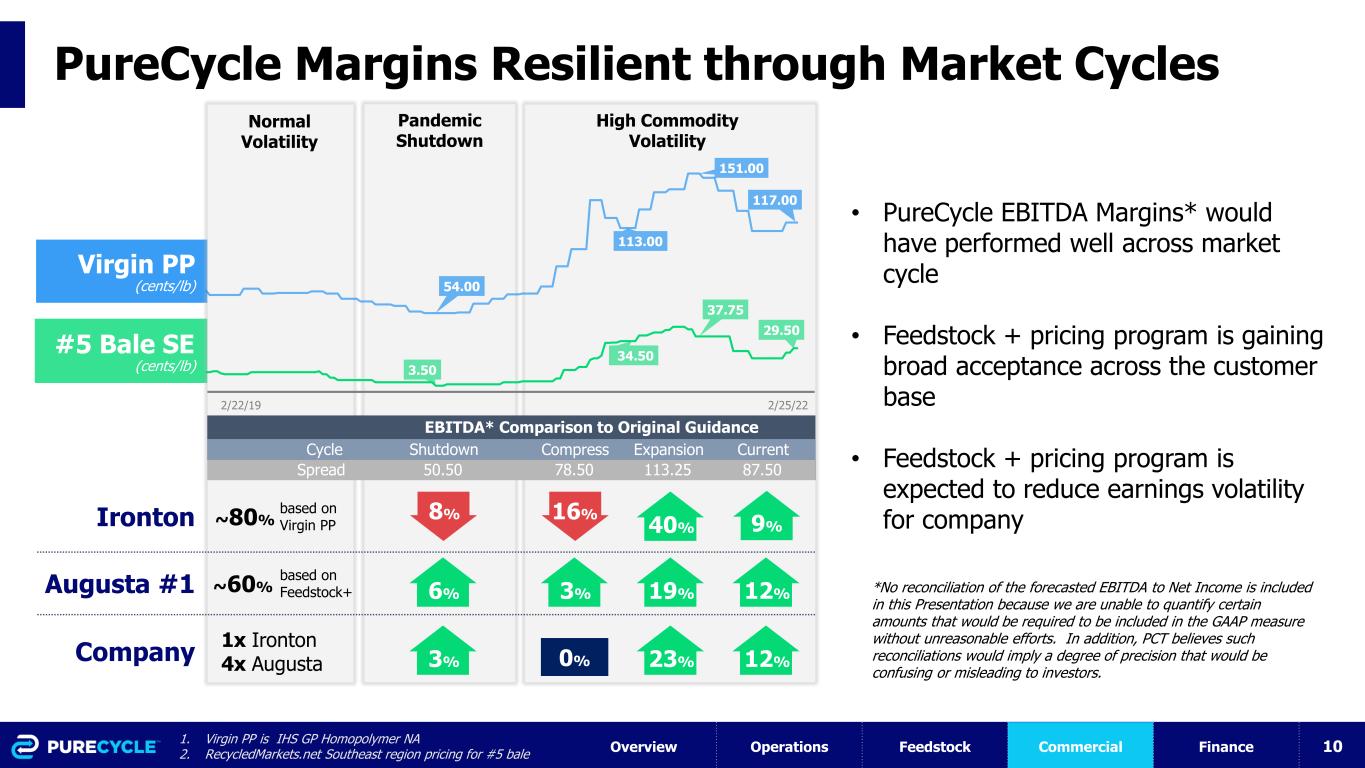

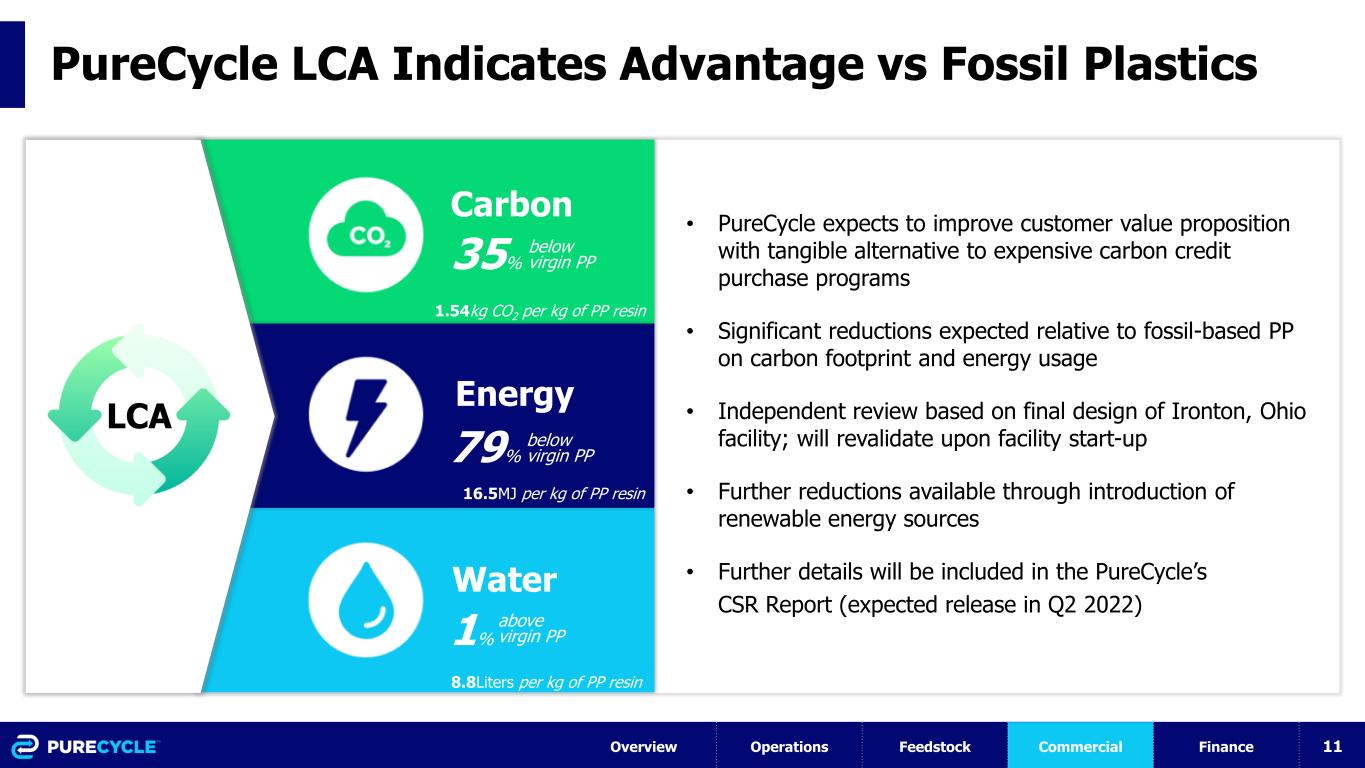

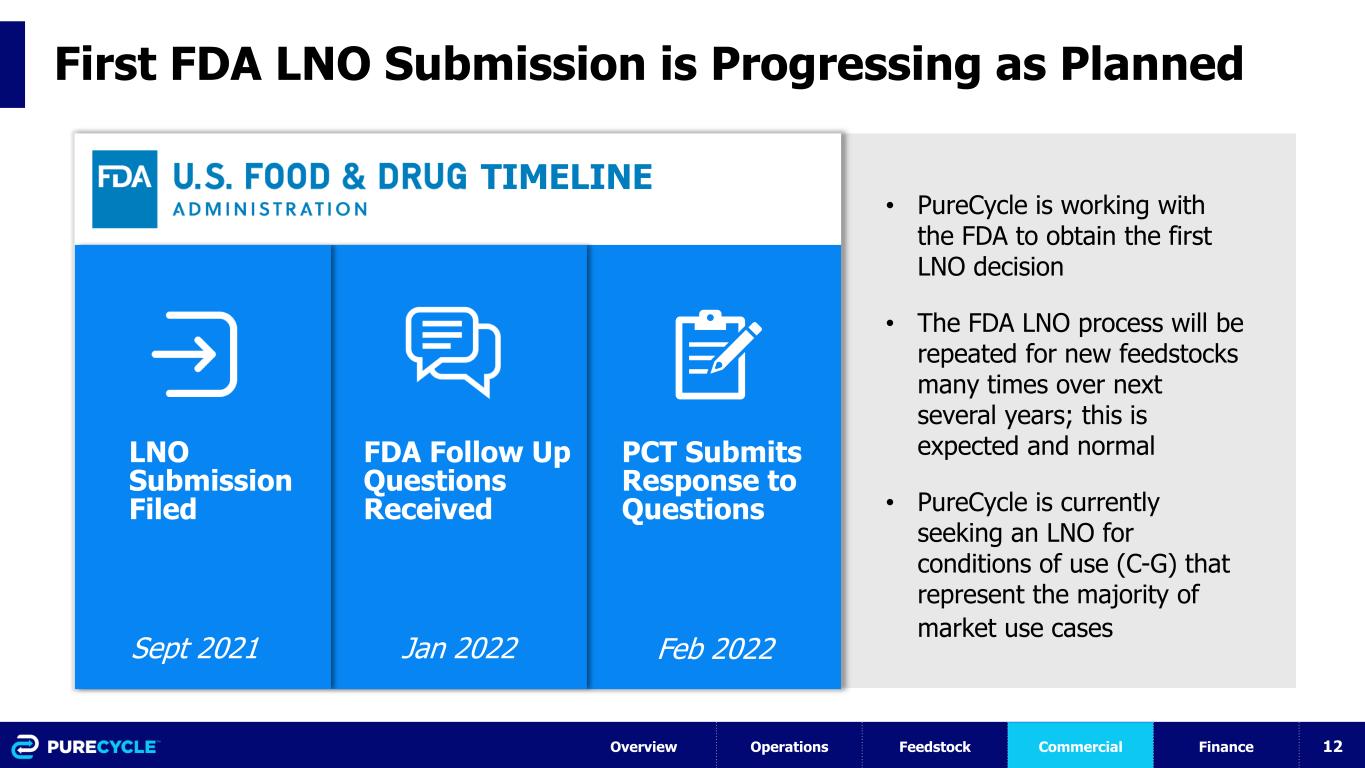

The slide presentation attached hereto as Exhibit 99.2, and incorporated

herein by reference, will be presented to certain investors of the Company on March 9, 2022 and may be used by the Company in various

other presentations to investors.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| Exhibit Number |

Description of Exhibit |

| 4.1 |

Form of Series A Warrant |

| 10.1 |

Form of Subscription Agreement |

| 10.2 |

Board Representation

Agreement |

| 99.1 |

Press release by PureCycle

Technologies, Inc. dated March 9, 2022 |

| 99.2 |

PureCycle Technologies,

Inc. presentation to investors |

| 104 |

Cover Page Interactive

Data File - the cover page XBRL tags are embedded within the Inline XBRL |

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of

1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

PURECYCLE TECHNOLOGIES, INC.

By: /s/ Lawrence Somma____________________

Name: Lawrence Somma

Title: Chief Financial Officer

Date: March 9, 2022

NEITHER THIS SECURITY NOR THE SECURITIES FOR WHICH THIS SECURITY IS EXERCISABLE HAVE BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES COMMISSION OF ANY STATE IN RELIANCE UPON AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND, ACCORDINGLY, MAY NOT BE OFFERED OR SOLD EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS.

SERIES A WARRANT

PURECYCLE TECHNOLOGIES, INC.

| | | | | | | | | | | |

| Warrant Shares: | | | Initial Exercise Date: September 17, 2022 |

THIS SERIES A WARRANT (this “Series A Warrant”) certifies that, for value received, _____________ or its assigns (the “Holder”) is entitled, upon the terms and subject to the limitations on exercise and the conditions hereinafter set forth, at any time on or after September 17, 2022 (the “Initial Exercise Date”) and on or prior to the earlier of (i) 5:00 p.m. (New York City time) on March 17, 2026 and (ii) the date fixed for redemption of the Subscription Warrants (defined below) as provided in Section 4 (the “Termination Date”) but not thereafter, to subscribe for and purchase from PureCycle Technologies, Inc., a Delaware corporation (the “Company”), up to ______ shares (as subject to adjustment hereunder, the “Warrant Shares”) of Common Stock. The purchase price of one share of Common Stock under this Series A Warrant shall be equal to the Exercise Price, as defined in Section 2(b).

This Series A Warrant is issued pursuant to that certain Subscription Agreement (the “Subscription Agreement”), effective on March 7, 2022, between the Company and the Holder. On or around the date of the Subscription Agreement, the Company entered into separate subscription agreements with the Company (“Other Subscription Agreements”) with certain other “qualified institutional buyers” (within the meaning of Rule 144A under the Securities Act and “accredited investors” (within the meaning of Rule 501(a) under the Securities Act), pursuant to which the Company issued and sold to such investors additional Series A warrants with terms substantially similar to this Series A Warrant (the “Other Series A Warrants”, and together with this Series A Warrant, the “Subscription Warrants”).

Section 1.Definitions. In addition to the terms defined elsewhere in this Series A Warrant, for all purposes of this Series A Warrant, the following terms have the meanings set forth in this Section 1.

“Bid Price” means, for any date, the price determined by the first of the following clauses that applies: (a) if the Common Stock is then listed or quoted on a Trading Market, the bid price of the Common Stock for the time in question (or the nearest preceding date) on the Trading Market on which the Common Stock is then listed or quoted as reported by Bloomberg (based on a Trading Day from 9:30 a.m. (New York City time) to 4:02 p.m. (New York City time)), (b) if OTCQB or OTCQX is not a Trading Market, the volume weighted average price of the Common Stock for such date (or the nearest preceding date) on OTCQB or OTCQX as applicable, (c) if the Common Stock is not then listed or quoted for trading on OTCQB or OTCQX and if prices for the Common Stock are then reported on The Pink Open Market (or a similar organization or agency succeeding to its functions of reporting prices), the most recent bid price per share of the

Common Stock so reported, or (d) in all other cases, the fair market value of a share of Common Stock as determined by an independent appraiser selected in good faith by the holders of a majority in interest of the Subscription Warrants then outstanding and reasonably acceptable to the Company, the fees and expenses of which shall be paid by the Company.

“Black Scholes Value” means the value of this Series A Warrant based on the Black-Scholes Option Pricing Model obtained from the “OV” function on Bloomberg determined as of the day of consummation of the applicable Fundamental Transaction for pricing purposes and reflecting (A) a risk-free interest rate corresponding to the U.S. Treasury rate for a period equal to the time between the date of the public announcement of the applicable Fundamental Transaction and the Termination Date, (B) an expected volatility equal to the greater of 100% and the 100 day volatility obtained from the HVT function on Bloomberg (determined utilizing a 365 day annualization factor) as of the Trading Day immediately following the public announcement of the applicable Fundamental Transaction, (C) the underlying price per share used in such calculation shall be the greater of (i) the sum of the price per share being offered in cash, if any, plus the value of any non-cash consideration, if any, being offered in such Fundamental Transaction and (ii) the highest VWAP during the period beginning on the Trading Day immediately preceding the announcement of the applicable Fundamental Transaction (or the consummation of the applicable Fundamental Transaction, if earlier) and ending on the Trading Day of the Holder’s request pursuant to this Section 3(d) and (D) a remaining option time equal to the time between the date of the public announcement of the applicable Fundamental Transaction and the Termination Date, and (E) a zero cost of borrow. The payment of the Black Scholes Value will be made by wire transfer of immediately available funds (or such other consideration) within the later of (i) five business days of the Holder’s election and (ii) the date of consummation of the Fundamental Transaction. The Company shall cause any successor entity in a Fundamental Transaction in which the Company is not the survivor (the “Successor Entity”) to assume in writing all of the obligations of the Company under this Series A Warrant in accordance with the provisions of this Section 3(d) pursuant to written agreements in form and substance reasonably satisfactory to the Holder and approved by the Holder (without unreasonable delay) prior to such Fundamental Transaction and shall, at the option of the Holder, deliver to the Holder in exchange for this Series A Warrant a security of the Successor Entity evidenced by a written instrument substantially similar in form and substance to this Series A Warrant which is exercisable for a corresponding number of shares of capital stock of such Successor Entity (or its parent entity) equivalent to the shares of Common Stock acquirable and receivable upon exercise of this Series A Warrant (without regard to any limitations on the exercise of this Series A Warrant) prior to such Fundamental Transaction, and with an exercise price which applies the exercise price hereunder to such shares of capital stock (but taking into account the relative value of the shares of Common Stock pursuant to such Fundamental Transaction and the value of such shares of capital stock, such number of shares of capital stock and such exercise price being for the purpose of protecting the economic value of this Series A Warrant immediately prior to the consummation of such Fundamental Transaction), and which is reasonably satisfactory in form and substance to the Holder. Upon the occurrence of any such Fundamental Transaction, the Successor Entity shall succeed to, and be substituted for (so that from and after the date of such Fundamental Transaction, the provisions of this Series A Warrant referring to the “Company” shall refer instead to the Successor Entity), and may exercise every right and power of the Company and shall assume all of the obligations of the Company under this Series A Warrant with the same effect as if such Successor Entity had been named as the Company herein.

“Business Day” and “business day” mean a day other than Saturday, Sunday or other day on which commercial banks in New York, New York are authorized or required by law to close.

“Common Stock” means the Company’s common stock, par value $0.001 per share.

“Common Stock Equivalents” means any securities of the Company that would entitle the holder thereof to acquire at any time Common Stock, including, without limitation, any debt, preferred stock, right, option, warrant or other instrument that is at any time convertible into or exercisable or exchangeable for, or otherwise entitles the holder thereof to receive, Common Stock.

“Trading Day” means a day on which the principal Trading Market is open for trading.

“Trading Market” means any of the following markets or exchanges on which the Common Stock is listed or quoted for trading on the date in question: the NYSE American, the Nasdaq Capital Market, the Nasdaq Global Market, the Nasdaq Global Select Market or the New York Stock Exchange (or any successors to any of the foregoing).

“VWAP” means, for any date, the price determined by the first of the following clauses that applies: (a) if the Common Stock is then listed or quoted on a Trading Market, the daily volume weighted average price of the Common Stock for such date (or the nearest preceding date) on the Trading Market on which the Common Stock is then listed or quoted as reported by Bloomberg (based on a Trading Day from 9:30 a.m. (New York City time) to 4:02 p.m. (New York City time)), (b) if OTCQB or OTCQX is not a Trading Market, the volume weighted average price of the Common Stock for such date (or the nearest preceding date) on OTCQB or OTCQX as applicable, (c) if the Common Stock is not then listed or quoted for trading on OTCQB or OTCQX and if prices for the Common Stock are then reported in The Pink Open Market (or a similar organization or agency succeeding to its functions of reporting prices), the most recent bid price per share of the Common Stock so reported, or (d) in all other cases, the fair market value of a share of Common Stock as determined by an independent appraiser selected in good faith by the holders of a majority in interest of the Subscription Warrants then outstanding and reasonably acceptable to the Company, the fees and expenses of which shall be paid by the Company.

“Warrant Agent” shall be any duly appointed agent selected by the Company. The Warrant Agent shall initially be the Company

Section 2.Exercise.

(a)Exercise of Series A Warrant.

(i)Exercise by Holder. Exercise of the purchase rights represented by this Series A Warrant may be made, in whole or in part, at any time or times on or after the Initial Exercise Date and on or before the Termination Date by delivery to the Company (with a copy to the Warrant Agent) of a duly executed facsimile copy or PDF copy submitted by e-mail (or e-mail attachment) of the Notice of Exercise in the form annexed hereto (the “Notice of Exercise”). Within the earlier of (i) two (2) Trading Days and (ii) the number of Trading Days comprising the Standard Settlement Period (as defined in Section 2(d)(i) herein) following the date of exercise as aforesaid, the Holder shall deliver the aggregate Exercise Price for the shares specified in the applicable Notice of Exercise by wire transfer or cashier’s check drawn on a United States bank unless the cashless exercise procedure specified in Section 2(c) below is specified in the applicable Notice of Exercise. No ink-original Notice of Exercise shall be required, nor shall any medallion guarantee (or other type of guarantee or notarization) of any Notice of Exercise be required.

(ii)Exercise Procedures. Notwithstanding anything herein to the contrary, subject to Section 2(d)(ii), the Holder shall not be required to physically

surrender this Series A Warrant to the Company until the Holder has purchased all of the Warrant Shares available hereunder and this Series A Warrant has been exercised in full, in which case, the Holder shall surrender this Series A Warrant to the Company for cancellation within three (3) Trading Days of the date on which the final Notice of Exercise is delivered to the Company (with a copy to the Warrant Agent). Partial exercises of this Series A Warrant resulting in purchases of a portion of the total number of Warrant Shares available hereunder shall have the effect of lowering the outstanding number of Warrant Shares purchasable hereunder in an amount equal to the applicable number of Warrant Shares purchased. The Holder and the Company shall maintain records showing the number of Warrant Shares purchased and the date of such purchases. The Company shall deliver any objection to any Notice of Exercise within one (1) business day of receipt of such notice. The Holder and any assignee, by acceptance of this Series A Warrant, acknowledge and agree that, by reason of the provisions of this paragraph, following the purchase of a portion of the Warrant Shares hereunder, the number of Warrant Shares available for purchase hereunder at any given time may be less than the amount stated on the face hereof.

(iii)Maximum Percentage. The Holder may notify the Company in writing in the event it elects to be subject to the provisions contained in this Section 2(a)(iii); provided however, no Holder shall be subject to this Section 2(a)(iii) unless he, she or it makes such election. If the election is made by the Holder, the Warrant Agent shall not effect the exercise of the Holder’s Series A Warrants, and such Holder shall not have the right to exercise such Series A Warrants, to the extent that after giving effect to such exercise, such person (together with such person’s affiliates), to the Warrant Agent’s actual knowledge, would beneficially own in excess of 9.9% (or such other amount as a Holder may specify)(the “Maximum Percentage”) of the shares of Common Stock outstanding immediately after giving effect to such exercise. For purposes of the foregoing sentence, the aggregate number shares of Common Stock beneficially owned by such person and its affiliates shall include the number of shares of Common Stock issuable upon exercise of the Series A Warrants with respect to which the determination of such sentence is being made, but shall exclude Common Stock that would be issuable upon (x) exercise of the remaining, unexercised portion of the Series A Warrants beneficially owned by such person and its affiliates and (y) exercise or conversion of the unexercised or unconverted portion of any other securities of the Company beneficially owned by such person and its affiliates (including, without limitation, any convertible notes or convertible preferred shares or warrants), subject to a limitation on conversion or exercise analogous to the limitation contained herein. Except as set forth in the preceding sentence, for purposes of this paragraph, beneficial ownership shall be calculated in accordance with Section 13(d) of the Securities Exchange Act of 1934, as amended. For purposes of the Series A Warrants, in determining the number of outstanding shares of Common Stock, the Holder may rely on the number of outstanding shares of Common Stock as reflected in (1) the Company’s most recent Annual Report on Form 10-K, Quarterly Report on Form 10-Q, Current Report on Form 8-K or other public filing with the U.S. Securities and Exchange Commission (the “Commission”) as the case may be, (2) a more recent public announcement by the Company or (3) any other notice by the Company setting forth the number of shares of Common Stock outstanding. For any reason at any time, upon the written request of the Holder of the Series A Warrants, the Company shall, within five (5) Business Days, confirm orally and in writing to such Holder the number of shares of Common Stock then outstanding. By written notice to the Company,

the Holder of the Series A Warrants may from time to time increase or decrease the Maximum Percentage applicable to such Holder to any other percentage specified in such notice; provided, however, that any such increase shall not be effective until the sixty-first (61st) day after such notice is delivered to the Company.

(b)Exercise Price. The exercise price per share of Common Stock under this Series A Warrant shall be $11.50, subject to adjustment hereunder (the “Exercise Price”).

(c)Cashless Exercise. If at any time after the Initial Exercise Date, there is no effective registration statement registering, or the prospectus contained therein is not available for the resale of the Warrant Shares by the holder, then this Series A Warrant may also be exercised, in whole or in part, at such time by means of a “cashless exercise” in which the Holder shall be entitled to receive a number of Warrant Shares equal to the quotient obtained by dividing [(A-B) (X)] by (A), where:

| | | | | | | | |

| (A) = | as applicable: (i) the VWAP on the Trading Day immediately preceding the date of the applicable Notice of Exercise if such Notice of Exercise is (1) both executed and delivered pursuant to Section 2(a) hereof on a day that is not a Trading Day or (2) both executed and delivered pursuant to Section 2(a) hereof on a Trading Day prior to the opening of “regular trading hours” (as defined in Rule 600(b)(68) of Regulation NMS promulgated under the federal securities laws) on such Trading Day, (ii) at the option of the Holder, either (y) the VWAP on the Trading Day immediately preceding the date of the applicable Notice of Exercise or (z) the Bid Price of the Common Stock on the principal Trading Market as reported by Bloomberg L.P. (“Bloomberg”) as of the time of the Holder’s execution of the applicable Notice of Exercise if such Notice of Exercise is executed during “regular trading hours” on a Trading Day and is delivered within two (2) hours thereafter (including until two (2) hours after the close of “regular trading hours” on a Trading Day) pursuant to Section 2(a) hereof or (iii) the VWAP on the date of the applicable Notice of Exercise if the date of such Notice of Exercise is a Trading Day and such Notice of Exercise is both executed and delivered pursuant to Section 2(a) hereof after the close of “regular trading hours” on such Trading Day; |

| (B) = | the Exercise Price of this Series A Warrant, as adjusted hereunder; and |

| (X) = | the number of Warrant Shares that would be issuable upon exercise of this Series A Warrant in accordance with the terms of this Series A Warrant if such exercise were by means of a cash exercise rather than a cashless exercise. |

If Warrant Shares are issued in such a cashless exercise, the parties acknowledge and agree that in accordance with Section 3(a)(9) of the Securities Act, the Warrant Shares shall take on the characteristics of this Series A Warrant being exercised, and the holding period of the Warrant Shares being issued may be tacked on to the holding period of this Series A Warrant. The Company agrees not to take any position contrary to this Section 2(c).

(d)Mechanics of Exercise.

(i)Delivery of Warrant Shares Upon Exercise. The Company shall cause the Warrant Shares purchased hereunder to be transmitted by the Company’s transfer agent (the “Transfer Agent”) to the Holder by crediting the account of the Holder’s or its designee’s balance account with The Depository Trust Company through its Deposit or Withdrawal at Custodian system (“DWAC”) if the Company is then a participant in such system and either (A) there is an effective registration statement permitting the issuance of the Warrant Shares to or resale of the Warrant Shares by the Holder or (B) the Warrant Shares are eligible for resale by the Holder without volume or manner-of-sale limitations pursuant to Rule 144 (assuming cashless exercise of this Series A Warrant), and otherwise by physical delivery of a certificate, registered in the Company’s share register in the name of the Holder or its designee, for the number of Warrant Shares to which the Holder is entitled pursuant to such exercise to the address specified by the Holder by the date that is the earliest of (i) two (2) Trading Days after the delivery to the Company of the Notice of Exercise, (ii) one (1) Trading Day after delivery of the aggregate Exercise Price to the Company and (iii) the number of Trading Days comprising the Standard Settlement Period after the delivery to the Company of the Notice of Exercise (such date, the “Warrant Share Delivery Date”). Upon delivery of the Notice of Exercise the Holder shall be deemed for all corporate purposes to have become the holder of record of the Warrant Shares with respect to which this Series A Warrant has been exercised, irrespective of the date of delivery of the Warrant Shares, provided that payment of the aggregate Exercise Price (other than in the case of a cashless exercise) is received within the earlier of (i) two (2) Trading Days and (ii) the number of Trading Days comprising the Standard Settlement Period following delivery of the Notice of Exercise. If the Company fails for any reason to deliver to the Holder the Warrant Shares subject to a Notice of Exercise by the Warrant Share Delivery Date, the Company shall pay to the Holder, in cash, as liquidated damages and not as a penalty, for each $1,000 of Warrant Shares subject to such exercise (based on the VWAP of the Common Stock on the date of the applicable Notice of Exercise), $5.00 per Trading Day (increasing to $10.00 per Trading Day on the fifth Trading Day after such liquidated damages begin to accrue) for each Trading Day after such Warrant Share Delivery Date until such Warrant Shares are delivered or Holder rescinds such exercise. The Company agrees to maintain a transfer agent that is a participant in the FAST program so long as this Series A Warrant remains outstanding and exercisable. As used herein, “Standard Settlement Period” means the standard settlement period, expressed in a number of Trading Days, on the Company’s primary Trading Market with respect to the Common Stock as in effect on the date of delivery of the Notice of Exercise.

(ii)Delivery of New Series A Warrants Upon Exercise. If this Series A Warrant shall have been exercised in part, the Company shall, at the request of the Holder and upon surrender of this Series A Warrant certificate, at the time of delivery of the Warrant Shares, deliver to the Holder a new Series A Warrant evidencing the rights of the Holder to purchase the unpurchased Warrant Shares called for by this Series A Warrant, which new Series A Warrant shall in all other respects be identical with this Series A Warrant.

(iii)Rescission Rights. If the Company fails to cause the Transfer Agent to transmit to the Holder the Warrant Shares pursuant to Section 2(d)(i) by the Warrant Share Delivery Date, then the Holder will have the right to rescind such exercise.

(iv)Compensation for Buy-In on Failure to Timely Deliver Warrant Shares Upon Exercise. In addition to any other rights available to the Holder, if the Company fails to cause the Transfer Agent to transmit to the Holder the Warrant Shares in accordance with the provisions of Section 2(d)(i) above pursuant to an exercise on or before the Warrant Share Delivery Date, and if after such date the Holder is required by its broker to purchase (in an open market transaction or otherwise) or the Holder’s brokerage firm otherwise purchases, shares of Common Stock to deliver in satisfaction of a sale by the Holder of the Warrant Shares which the Holder anticipated receiving upon such exercise (a “Buy-In”), then the Company shall (A) pay in cash to the Holder the amount, if any, by which (x) the Holder’s total purchase price (including brokerage commissions, if any) for the shares of Common Stock so purchased exceeds (y) the amount obtained by multiplying (1) the number of Warrant Shares that the Company was required to deliver to the Holder in connection with the exercise at issue times (2) the price at which the sell order giving rise to such purchase obligation was executed, and (B) at the option of the Holder, either reinstate the portion of this Series A Warrant and equivalent number of Warrant Shares for which such exercise was not honored (in which case such exercise shall be deemed rescinded) or deliver to the Holder the number of shares of Common Stock that would have been issued had the Company timely complied with its exercise and delivery obligations hereunder. For example, if the Holder purchases Common Stock having a total purchase price of $11,000 to cover a Buy-In with respect to an attempted exercise of shares of Common Stock with an aggregate sale price giving rise to such purchase obligation of $10,000, under clause (A) of the immediately preceding sentence the Company shall be required to pay the Holder $1,000. The Holder shall provide the Company written notice indicating the amounts payable to the Holder in respect of the Buy-In and, upon request of the Company, evidence of the amount of such loss. Nothing herein shall limit a Holder’s right to pursue any other remedies available to it hereunder, at law or in equity including, without limitation, a decree of specific performance and/or injunctive relief with respect to the Company’s failure to timely deliver shares of Common Stock upon exercise of this Series A Warrant as required pursuant to the terms hereof.

(v)No Fractional Series A Warrant, Shares or Scrip. No fractional Series A Warrants, shares or scrip representing fractional shares shall be issued upon the exercise of this Series A Warrant. To the extent the Holder would be entitled to a fractional Series A Warrant, the Company shall round down to the nearest whole number of Series A Warrants to be issued to the Holder. As to any fraction of a share which the Holder would otherwise be entitled to purchase upon such exercise, the Company shall, at its election, either pay a cash adjustment in respect of such final fraction in an amount equal to such fraction multiplied by the Exercise Price or round up to the next whole share.

(vi)Charges, Taxes and Expenses. Issuance of Warrant Shares shall be made without charge to the Holder for any issue or transfer tax or other incidental expense in respect of the issuance of such Warrant Shares, all of which taxes and expenses shall be paid by the Company, and such Warrant Shares shall be issued in the name of the Holder or in such name or names as may be directed by the Holder; provided, however, that, in the event that Warrant Shares are to be issued in a name other than the name of the Holder, this Series A Warrant when surrendered for exercise shall be accompanied by the Assignment Form attached hereto as Exhibit B duly executed by the Holder and the Company may require, as a condition thereto, the payment of a sum sufficient to reimburse it for any

transfer tax incidental thereto. The Company shall pay all Transfer Agent fees required for same-day processing of any Notice of Exercise and all fees to The Depository Trust Company (or another established clearing corporation performing similar functions) required for same-day electronic delivery of the Warrant Shares.

(vii)Closing of Books. The Company will not close its stockholder books or records in any manner which prevents the timely exercise of this Series A Warrant, pursuant to the terms hereof.

Section 3.Certain Adjustments.

(a)Stock Dividends and Splits. If the Company, at any time while this Series A Warrant is outstanding: (i) pays a stock dividend or otherwise makes a distribution or distributions on shares of its Common Stock or any other equity or equity equivalent securities payable in shares of Common Stock (which, for avoidance of doubt, shall not include any shares of Common Stock issued by the Company upon exercise of this Series A Warrant), (ii) subdivides outstanding shares of Common Stock into a larger number of shares, (iii) combines (including by way of reverse stock split) outstanding shares of Common Stock into a smaller number of shares, or (iv) issues by reclassification of shares of the Common Stock any shares of capital stock of the Company, then in each case the Exercise Price shall be multiplied by a fraction of which the numerator shall be the number of shares of Common Stock (excluding treasury shares, if any) outstanding immediately before such event and of which the denominator shall be the number of shares of Common Stock outstanding immediately after such event, and the number of shares issuable upon exercise of this Series A Warrant shall be proportionately adjusted such that the aggregate Exercise Price of this Series A Warrant shall remain unchanged. Any adjustment made pursuant to this Section 3(a) shall become effective immediately after the record date for the determination of stockholders entitled to receive such dividend or distribution and shall become effective immediately after the effective date in the case of a subdivision, combination or re-classification.

(b)Subsequent Rights Offerings. In addition to any adjustments pursuant to Section 3(a) above, if at any time the Company grants, issues or sells any Common Stock Equivalents or rights to purchase stock, warrants, securities or other property pro rata to the record holders of any class of shares of Common Stock (the “Purchase Rights”), then the Holder will be entitled to acquire, upon the terms applicable to such Purchase Rights, the aggregate Purchase Rights which the Holder could have acquired if the Holder had held the number of shares of Common Stock acquirable upon complete exercise of this Series A Warrant (without regard to any limitations on exercise hereof) immediately before the date on which a record is taken for the grant, issuance or sale of such Purchase Rights, or, if no such record is taken, the date as of which the record holders of shares of Common Stock are to be determined for the grant, issue or sale of such Purchase Rights.

(c)Pro Rata Distributions. During such time as this Series A Warrant is outstanding, if the Company shall declare or make any dividend or other distribution of its assets (or rights to acquire its assets) to holders of shares of Common Stock, by way of return of capital or otherwise (including, without limitation, any distribution of cash, stock or other securities, property or options by way of a dividend, spin off, reclassification, corporate rearrangement, scheme of arrangement or other similar transaction) (a “Distribution”), at any time after the issuance of this Series A Warrant, then, in each such case, the Holder shall be entitled to participate in such Distribution to the same extent that the Holder would have participated therein if the Holder had held the number of shares of Common Stock acquirable upon complete exercise of this Series A

Warrant (without regard to any limitations on exercise hereof) immediately before the date of which a record is taken for such Distribution, or, if no such record is taken, the date as of which the record holders of shares of Common Stock are to be determined for the participation in such Distribution.

(d)Fundamental Transaction. If, at any time while this Series A Warrant is outstanding, (i) the Company, directly or indirectly, in one or more related transactions effects any merger or consolidation of the Company with or into another Person, (ii) the Company, directly or indirectly, effects any sale, lease, license, assignment, transfer, conveyance or other disposition of all or substantially all of the consolidated assets of the Company in one or a series of related transactions, (iii) any, direct or indirect, purchase offer, tender offer or exchange offer (whether by the Company or another person) is completed pursuant to which holders of Common Stock are permitted to sell, tender or exchange their shares for other securities, cash or property and has been accepted by the holders of 50% or more of the outstanding Common Stock, (iv) the Company, directly or indirectly, in one or more related transactions effects any reclassification, reorganization or recapitalization of the Common Stock or any compulsory share exchange pursuant to which the Common Stock is effectively converted into or exchanged for other securities, cash or property, or (v) the Company, directly or indirectly, in one or more related transactions consummates a stock or share purchase agreement or other business combination (including, without limitation, a reorganization, recapitalization, spin-off, merger or scheme of arrangement) with another person or group of persons whereby such other person or group acquires more than 50% of the outstanding shares of Common Stock (not including any shares of Common Stock held by the other person or other persons making or party to, or associated or affiliated with the other persons making or party to, such stock or share purchase agreement or other business combination) (each a “Fundamental Transaction”), then, upon any subsequent exercise of this Series A Warrant, the Holder shall have the right to receive, for each Warrant Share that would have been issuable upon such exercise immediately prior to the occurrence of such Fundamental Transaction, at the option of the Holder (without regard to any limitation in Section 2(e) on the exercise of this Series A Warrant), the number of shares of Common Stock of the successor or acquiring corporation or of the Company, if it is the surviving corporation, and any additional consideration (the “Alternate Consideration”) receivable as a result of such Fundamental Transaction by a holder of the number of shares of Common Stock for which this Series A Warrant is exercisable immediately prior to such Fundamental Transaction (without regard to any limitation in Section 2(e) on the exercise of this Series A Warrant). For purposes of any such exercise, the determination of the Exercise Price shall be appropriately adjusted to apply to such Alternate Consideration based on the amount of Alternate Consideration issuable in respect of one share of Common Stock in such Fundamental Transaction, and the Company shall apportion the Exercise Price among the Alternate Consideration in a reasonable manner reflecting the relative value of any different components of the Alternate Consideration. If holders of Common Stock are given any choice as to the securities, cash or property to be received in a Fundamental Transaction, then the Holder shall be given the same choice as to the Alternate Consideration it receives upon any exercise of this Series A Warrant following such Fundamental Transaction. Notwithstanding anything to the contrary, in the event of a Fundamental Transaction, the Company or any Successor Entity (as defined below) shall, at the Holder’s option, exercisable at any time concurrently with, or within 30 days after, the consummation of the Fundamental Transaction (or, if later, the date of the public announcement of the applicable Fundamental Transaction), purchase this Series A Warrant from the Holder by paying to the Holder an amount of cash equal to the Black Scholes Value (as defined below) of the remaining unexercised portion of this Series A Warrant on the date of the consummation of such Fundamental Transaction; provided, however, that, if the Fundamental Transaction is not within the Company’s control,

including not approved by the Company’s Board of Directors, Holder shall only be entitled to receive from the Company or any Successor Entity the same type or form of consideration (and in the same proportion), at the Black Scholes Value of the unexercised portion of this Series A Warrant, that is being offered and paid to the holders of Common Stock of the Company in connection with the Fundamental Transaction, whether that consideration be in the form of cash, stock or any combination thereof, or whether the holders of Common Stock are given the choice to receive from among alternative forms of consideration in connection with the Fundamental Transaction; provided, further, that if holders of Common Stock of the Company are not offered or paid any consideration in such Fundamental Transaction, such holders of Common Stock will be deemed to have received common stock of the Successor Entity (which Successor Entity may be the Company following such Fundamental Transaction) in such Fundamental Transaction.

(e)Calculations. All calculations under this Section 3 shall be made to the nearest cent or the nearest 1/100th of a share, as the case may be. For purposes of this Section 3, the number of shares of Common Stock deemed to be issued and outstanding as of a given date shall be the sum of the number of shares of Common Stock (excluding treasury shares, if any) issued and outstanding.

(f)Notice to Holder.

(i)Adjustment to Exercise Price. Whenever the Exercise Price is adjusted pursuant to any provision of this Section 3, the Company shall promptly deliver to the Holder by facsimile or email a notice setting forth the Exercise Price after such adjustment and any resulting adjustment to the number of Warrant Shares and setting forth a brief statement of the facts requiring such adjustment.

(ii)Notice to Allow Exercise by Holder. If (A) the Company shall declare a dividend (or any other distribution in whatever form) on the Common Stock, (B) the Company shall declare a special nonrecurring cash dividend on or a redemption of the Common Stock, (C) the Company shall authorize the granting to all holders of the Common Stock rights or warrants to subscribe for or purchase any shares of capital stock of any class or of any rights, (D) the approval of any stockholders of the Company shall be required in connection with any reclassification of the Common Stock, any consolidation or merger to which the Company is a party, any sale or transfer of all or substantially all of its assets, or any compulsory share exchange whereby the Common Stock is converted into other securities, cash or property, or (E) the Company shall authorize the voluntary or involuntary dissolution, liquidation or winding up of the affairs of the Company, then, in each case, the Company shall cause to be delivered by facsimile or email to the Holder at its last facsimile number or email address as it shall appear upon the Warrant Register of the Company, at least 20 calendar days prior to the applicable record or effective date hereinafter specified, a notice stating (x) the date on which a record is to be taken for the purpose of such dividend, distribution, redemption, rights or warrants, or if a record is not to be taken, the date as of which the holders of the Common Stock of record to be entitled to such dividend, distributions, redemption, rights or warrants are to be determined or (y) the date on which such reclassification, consolidation, merger, sale, transfer or share exchange is expected to become effective or close, and the date as of which it is expected that holders of the Common Stock of record shall be entitled to exchange their shares of the Common Stock for securities, cash or other property deliverable upon such reclassification, consolidation, merger, sale, transfer or share exchange; provided that the failure to deliver such notice or any defect therein or in the delivery thereof shall not affect the validity of the

corporate action required to be specified in such notice. To the extent that any notice provided in this Series A Warrant constitutes, or contains, material, non-public information regarding the Company, the Company shall simultaneously file such notice with the Commission pursuant to a Current Report on Form 8-K. The Holder shall remain entitled to exercise this Series A Warrant during the period commencing on the date of such notice to the effective date of the event triggering such notice except as may otherwise be expressly set forth herein.

(g)Voluntary Adjustment By Company. Subject to the rules and regulations of the Trading Market, the Company may at any time during the term of this Series A Warrant, subject to the prior written consent of the Holder, reduce the then current Exercise Price to any amount and for any period of time deemed appropriate by the board of directors of the Company.

Section 4.Redemption.

(a)Redemption. Subject to Section 4(d), all (and not less than all) of the outstanding Subscription Warrants may be redeemed, in whole and not in part, at the option of the Company, at any time after the Subscription Warrants become exercisable, and prior to their expiration, at the office of the Warrant Agent, upon the notice referred to in Section 6(b), at the price of $0.01 per Subscription Warrant (“Redemption Price”); provided that the last sales price of the shares of Common Stock has been equal to or greater than $18.00 per share (subject to adjustment for splits, dividends, recapitalizations and other similar events) for any twenty (20) Trading Days within a thirty (30) Trading Day period commencing after the Subscription Warrants become exercisable and ending on the third business day prior to the date on which notice of redemption is given and provided further that there is a current registration statement in effect with respect to the shares of Common Stock underlying the Subscription Warrants for each day in the 30-Trading Day period and continuing each day thereafter until the Redemption Date (defined below).

(b)Date Fixed for, and Notice of, Redemption. In the event the Company shall elect to redeem all of the Subscription Warrants, the Company shall fix a date for the redemption (the “Redemption Date”). Notice of redemption shall be mailed by first class mail, postage prepaid, by the Company not less than 30 days prior to the date fixed for redemption to the holders of the Subscription Warrants to be redeemed at their last addresses as they shall appear on the Warrant Register (defined below). Any notice mailed in the manner herein provided shall be conclusively presumed to have been duly given, whether or not the holder received such notice.

(c)Exercise After Notice of Redemption. This Series A Warrant may be exercised in accordance with Section 2 at any time after notice of redemption shall have been given by the Company pursuant to Section 6(b) hereof and prior to the Redemption Date; provided that the Company may require the Holder to exercise this Series A Warrant to elect “cashless exercise” in accordance with the procedures of Section 2(c), and the Holder must exercise this Series A Warrant on a cashless basis if the Company so requires. On and after the Redemption Date, the Holder of this Series A Warrant shall have no further rights except to receive, upon surrender of this Series A Warrant, the Redemption Price.

(d)No Other Rights to Cash Payment. Except for a redemption in accordance with this Section 4, the Holder shall not be entitled to any cash payment whatsoever from the Company in connection with the ownership, exercise or surrender of this Series A Warrant.

(e)Exclusion of Certain Series A Warrants. The Company understands that the redemption rights provided for by this Section 4 apply only to outstanding Subscription Warrants. To the extent a person holds rights to purchase Subscription Warrants, such purchase rights shall not be extinguished by redemption. However, once such purchase rights are exercised, the Company may redeem the Subscription Warrants issued upon such exercise provided that the criteria for redemption is met.

Section 5.Transfer of Series A Warrant.

(a)Transferability. Subject to compliance with any applicable securities laws, this Series A Warrant and all rights hereunder are transferable, in whole or in part, upon surrender of this Series A Warrant at the principal office of the Company or its designated Warrant Agent, which shall initially be the Company, together with a written assignment of this Series A Warrant substantially in the form attached hereto duly executed by the Holder or its agent or attorney and funds sufficient to pay any transfer taxes payable upon the making of such transfer. Upon such surrender and, if required, such payment, the Company shall execute and deliver a new Series A Warrant or Series A Warrants in the name of the assignee or assignees, as applicable, and in the denomination or denominations specified in such instrument of assignment, and shall issue to the assignor a new Series A Warrant evidencing the portion of this Series A Warrant not so assigned, and this Series A Warrant shall promptly be cancelled. Notwithstanding anything herein to the contrary, the Holder shall not be required to physically surrender this Series A Warrant to the Company unless the Holder has assigned this Series A Warrant in full, in which case, the Holder shall surrender this Series A Warrant to the Company within three (3) Trading Days of the date on which the Holder delivers an assignment form to the Company assigning this Series A Warrant in full. The Series A Warrant, if properly assigned in accordance herewith, may be exercised by a new holder for the purchase of Warrant Shares without having a new Series A Warrant issued.

(b)New Series A Warrants. This Series A Warrant may be divided or combined with other Series A Warrants upon presentation hereof at the aforesaid office of the Company, together with a written notice specifying the names and denominations in which new Series A Warrants are to be issued, signed by the Holder or its agent or attorney. Subject to compliance with Section 5(a), as to any transfer which may be involved in such division or combination, the Company shall execute and deliver a new Series A Warrant or Series A Warrants in exchange for the Series A Warrant or Series A Warrants to be divided or combined in accordance with such notice. All Series A Warrants issued on transfers or exchanges shall be dated the original issuance date and shall be identical with this Series A Warrant except as to the number of Warrant Shares issuable pursuant thereto.

(c)Series A Warrant Register. The Company shall register this Series A Warrant, upon records to be maintained by the Company for that purpose (the “Series A Warrant Register”), in the name of the record Holder hereof from time to time. The Company and the Warrant Agent may deem and treat the registered Holder of this Series A Warrant as the absolute owner hereof for the purpose of any exercise hereof or any distribution to the Holder, and for all other purposes, absent actual notice to the contrary. The Company has appointed the Warrant Agent to maintain the Series A Warrant Register, as the Company’s agent. The Company shall remain responsible for the contents of the Series A Warrant Register, notwithstanding the appointment of a Warrant Agent. The Company shall provide thirty (30) days’ prior written notice to the Holder of any appointment of or change in Warrant Agent and the new Warrant Agent’s contact

information, including if the Company shall itself directly maintain the Series A Warrant Register after a third-party Warrant Agent has been appointed.

Section 6.Miscellaneous.

(a)No Rights as Stockholder Until Exercise; No Settlement in Cash. This Series A Warrant does not entitle the Holder to any voting rights, dividends or other rights as a stockholder of the Company prior to the exercise hereof, except as expressly set forth in Section 3. Without limiting any rights of a Holder to receive Warrant Shares on a “cashless exercise” pursuant to Section 2(c) or to receive cash payments pursuant to Section 2(d)(i) and Section 2(d)(iv) herein, in no event shall the Company be required to net cash settle an exercise of this Series A Warrant.

(b)Loss, Theft, Destruction or Mutilation of Series A Warrant. The Company covenants that upon receipt by the Company of evidence reasonably satisfactory to it of the loss, theft, destruction or mutilation of this Series A Warrant or any stock certificate relating to the Warrant Shares, and in case of loss, theft or destruction, of indemnity or security reasonably satisfactory to it (which, in the case of this Series A Warrant, shall not include the posting of any bond), and upon surrender and cancellation of this Warrant or stock certificate, if mutilated, the Company will make and deliver a new Series A Warrant or stock certificate of like tenor and dated as of such cancellation, in lieu of such Series A Warrant or stock certificate.

(c)Saturdays, Sundays, Holidays, etc. If the last or appointed day for the taking of any action or the expiration of any right required or granted herein shall not be a business day, then such action may be taken or such right may be exercised on the next succeeding business day.

(d)Authorized Shares. The Company covenants that, during the period this Series A Warrant is outstanding, it will reserve from its authorized and unissued Common Stock a sufficient number of shares to provide for the issuance of the Warrant Shares upon the exercise of any purchase rights under this Series A Warrant. The Company further covenants that its issuance of this Series A Warrant shall constitute full authority to its officers who are charged with the duty of issuing the necessary Warrant Shares upon the exercise of the purchase rights under this Series A Warrant. The Company will take all such reasonable action as may be necessary to assure that such Warrant Shares may be issued as provided herein without violation of any applicable law or regulation, or of any requirements of the Trading Market upon which the Common Stock may be listed. The Company covenants that all Warrant Shares which may be issued upon the exercise of the purchase rights represented by this Series A Warrant will, upon exercise of the purchase rights represented by this Series A Warrant and payment for such Warrant Shares in accordance herewith, be duly authorized, validly issued, fully paid and nonassessable and free from all taxes, liens and charges created by the Company in respect of the issue thereof (other than taxes in respect of any transfer occurring contemporaneously with such issue).

Except and to the extent as waived or consented to by the Holder, the Company shall not by any action, including, without limitation, amending its certificate of incorporation or through any reorganization, transfer of assets, consolidation, merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms of this Series A Warrant, but will at all times in good faith assist in the carrying out of all such terms and in the taking of all such actions as may be necessary or appropriate to protect the rights of Holder as set forth in this Series A Warrant against impairment. Without limiting the generality of

the foregoing, the Company will (i) not increase the par value of any Warrant Shares above the amount payable therefor upon such exercise immediately prior to such increase in par value, (ii) take all such action as may be necessary or appropriate in order that the Company may validly and legally issue fully paid and nonassessable Warrant Shares upon the exercise of this Series A Warrant and (iii) use commercially reasonable efforts to obtain all such authorizations, exemptions or consents from any public regulatory body having jurisdiction thereof, as may be, necessary to enable the Company to perform its obligations under this Series A Warrant.

Before taking any action which would result in an adjustment in the number of Warrant Shares for which this Series A Warrant is exercisable or in the Exercise Price, the Company shall obtain all such authorizations or exemptions thereof, or consents thereto, as may be necessary from any public regulatory body or bodies having jurisdiction thereof.

(e)Governing Law. All questions concerning the construction, validity, enforcement and interpretation of this Series A Warrant shall be governed by and construed and enforced in accordance with the internal laws of the State of New York, without regard to the principles of conflicts of law thereof. Each party agrees that all legal proceedings concerning the interpretations, enforcement and defense of the transactions contemplated by this Series A Warrant (whether brought against a party hereto or its respective affiliates, directors, officers, shareholders, partners, members, employees or agents) shall be commenced exclusively in the state and federal courts sitting in the City of New York. Each party hereby irrevocably submits to the exclusive jurisdiction of the state and federal courts sitting in the City of New York, Borough of Manhattan for the adjudication of any dispute hereunder or in connection herewith or with any transaction contemplated hereby or discussed herein (including with respect to the enforcement of this Series A Warrant), and hereby irrevocably waives, and agrees not to assert in any action or proceeding, any claim that it is not personally subject to the jurisdiction of any such court, that such action or proceeding is improper or is an inconvenient venue for such proceeding. Each party hereby irrevocably waives personal service of process and consents to process being served in any such action or proceeding by mailing a copy thereof via registered or certified mail or overnight delivery (with evidence of delivery) to such party at the address in effect for notices to it under this Series A Warrant and agrees that such service shall constitute good and sufficient service of process and notice thereof. Nothing contained herein shall be deemed to limit in any way any right to serve process in any other manner permitted by law. If either party shall commence an action or proceeding to enforce any provisions of this Series A Warrant, the prevailing party in such action or proceeding shall be reimbursed by the non-prevailing party for its reasonable attorneys’ fees and other costs and expenses incurred with the investigation, preparation and prosecution of such action or proceeding.

(f)Restrictions. The Holder acknowledges that the Warrant Shares acquired upon the exercise of this Series A Warrant, if not registered, and the Holder does not utilize cashless exercise, will have restrictions upon resale imposed by state and federal securities laws.

(g)Nonwaiver and Expenses. No course of dealing or any delay or failure to exercise any right hereunder on the part of the Holder shall operate as a waiver of such right or otherwise prejudice the Holder’s rights, powers or remedies. Without limiting any other provision of this Series A Warrant, if the Company willfully and knowingly fails to comply with any provision of this Series A Warrant, which results in any material damages to the Holder, the Company shall pay to the Holder such amounts as shall be sufficient to cover any costs and expenses including, but not limited to, reasonable

attorneys’ fees, including those of appellate proceedings, incurred by the Holder in collecting any amounts due pursuant hereto or in otherwise enforcing any of its rights, powers or remedies hereunder.

(h)Notices. Any notice or communication required or permitted hereunder shall be in writing and either delivered personally, emailed or sent by overnight mail via a reputable overnight carrier, or sent by certified or registered mail, postage prepaid, and shall be deemed to be given and received (i) when so delivered personally, (ii) when sent, with no mail undeliverable or other rejection notice, if sent by email, or (iii) three (3) business days after the date of mailing to the address below or to such other address or addresses as such person may hereafter designate by notice given hereunder:

(i)if to a Holder, to its address, email address and/or facsimile number set forth on the register of Holders on file with the Company, with copies to such Holder’s representatives as set forth on such register, or to such other address, email address and/or to the attention of such other person as the recipient party has specified by written notice given to each other party five (5) days prior to the effectiveness of such change;

(ii)if to the Company, to:

PureCycle Technologies Inc.

5950 Hazeltine National Drive, Suite 650

Orlando, Florida 32822

Attention: Brad Kalter

E-mail: bkalter@purecycle.com

with a required copy to (which copy shall not constitute notice):

Jones Day

1221 Peachtree Street, NE, Suite 400

Atlanta, Georgia 30361

Attention: Joel T. May and Thomas L. Short

E-mail: jtmay@jonesday.com; tshort@jonesday.com

(i)Limitation of Liability. No provision hereof, in the absence of any affirmative action by the Holder to exercise this Series A Warrant to purchase Warrant Shares, and no enumeration herein of the rights or privileges of the Holder, shall give rise to any liability of the Holder for the purchase price of any Common Stock or as a stockholder of the Company, whether such liability is asserted by the Company or by creditors of the Company.

(j)Remedies. The Holder, in addition to being entitled to exercise all rights granted by law, including recovery of damages, will be entitled to specific performance of its rights under this Series A Warrant. The Company agrees that monetary damages would not be adequate compensation for any loss incurred by reason of a breach by it of the provisions of this Series A Warrant and hereby agrees to waive and not to assert the defense in any action for specific performance that a remedy at law would be adequate.

(k)Successors and Assigns. Subject to applicable securities laws, this Series A Warrant and the rights and obligations evidenced hereby shall inure to the benefit of and be binding upon the successors and permitted assigns of the Company and the successors and permitted assigns of Holder. The provisions of this Series A Warrant are

intended to be for the benefit of any Holder from time to time of this Series A Warrant and shall be enforceable by the Holder or holder of Warrant Shares.

(l)Amendment. This Series A Warrant may be amended by the Company without the consent of any of the holders of the Subscription Warrants for the purpose of (i) curing any ambiguity, or curing, correcting or supplementing any defective provision contained herein, or making any other provisions with respect to matters or questions arising under this Series A Warrant that is not inconsistent with the provisions of this Series A Warrant, (ii) evidencing the succession of another corporation to the Company and the assumption by any such successor of the covenants of the Company contained in this Series A Warrant, (iii) evidencing and providing for the acceptance of appointment by a successor Warrant Agent with respect to the Subscription Warrants, and any provisions required in connection therewith, (iv) adding to the covenants of the Company for the benefit of the Holder or surrendering any right or power conferred upon the Company under this Series A Warrant, (v) to comply with the rules of the Depositary Trust Company (“DTC”), including to permit the deposit of Subscription Warrants with the DTC and settlement through the facilities thereof, if applicable; or (vi) amending this Series A Warrant in any manner that the Company may deem to be necessary or desirable and that will not adversely affect the interests of the Holder in any material respect. All other modifications or amendments to this Series A Warrant and the other Subscription Warrants, including any amendment to increase the Exercise Price or move the Termination Date, shall require the written consent of the holders of a majority of the then outstanding Subscription Warrants; provided that any material and adverse modification, waiver or termination of the economic terms of the transactions contemplated under this Series A Warrant shall require the prior written consent of the Holder of this Series A Warrant.

(m)Severability. Wherever possible, each provision of this Series A Warrant shall be interpreted in such manner as to be effective and valid under applicable law, but if any provision of this Series A Warrant shall be prohibited by or invalid under applicable law, such provision shall be ineffective to the extent of such prohibition or invalidity, without invalidating the remainder of such provisions or the remaining provisions of this Series A Warrant.

(n)Headings. The headings used in this Series A Warrant are for the convenience of reference only and shall not, for any purpose, be deemed a part of this Series A Warrant.

********************

(Signature Page Follows)

IN WITNESS WHEREOF, the Company has caused this Series A Warrant to be executed by its officer thereunto duly authorized as of the date first above indicated.

PURECYCLE TECHNOLOGIES, INC.

By:

Name:

Title:

NOTICE OF EXERCISE

To: PURECYCLE TECHNOLOGIES, INC.

CC: WARRANT AGENT

(1) The undersigned hereby elects to purchase ________ Warrant Shares of the Company pursuant to the terms of the attached Series A Warrant (only if exercised in full), and tenders herewith payment of the exercise price in full, together with all applicable transfer taxes, if any.

(2) Payment shall take the form of (check applicable box):

in lawful money of the United States; or

if otherwise permitted, the cancellation of such number of Warrant Shares as is necessary, in accordance with the formula set forth in subsection 2(c), to exercise this Warrant with respect to the maximum number of Warrant Shares purchasable pursuant to the cashless exercise procedure set forth in subsection 2(c).

(3) Please issue said Warrant Shares in the name of the undersigned or in such other name as is specified below:

_______________________________

The Warrant Shares shall be delivered to the following DWAC Account Number:

_______________________________

_______________________________

_______________________________

(4) Accredited Investor. The undersigned is an “accredited investor” as defined in Regulation D promulgated under the Securities Act of 1933, as amended.

| | | | | |

| Name of Investing Entity: | |

Signature of Authorized Signatory of Investing Entity: | |

| Name of Authorized Signatory: | |

| Title of Authorized Signatory: | |

| Date: | |

ASSIGNMENT FORM

(To assign the foregoing Series A Warrant, execute this form and supply required information. Do not use this form to purchase shares.)

FOR VALUE RECEIVED, the foregoing Series A Warrant and all rights evidenced thereby are hereby assigned to:

| | | | | | | | | | | |

| Name: | | |

| | |

| | (Please Print) |

| | |

| Address: | | |

| | (Please Print) |

| Phone Number: | | |

| | |

| Email Address: | | |

| | |

| Dated: _______________ __, ______ | | |

| | |

| Holder’s Signature: | | | |

| | |

| Holder’s Address: | | | |

SUBSCRIPTION AGREEMENT

This SUBSCRIPTION AGREEMENT (this “Subscription Agreement”) is entered into this __ day of March, 2022, by and between PureCycle Technologies, Inc., a Delaware corporation (the “Company”), and the undersigned (the “Subscriber” or “you”).

WHEREAS, the Company’s common stock, par value $0.001 per share (the “Common Stock”) is listed on the Nasdaq Capital Market (“Nasdaq”) under the ticker symbol “PCT”;

WHEREAS, Subscriber desires to subscribe for and purchase from the Company (i) that number of shares of Common Stock set forth on the signature page hereto (the “Shares”) and (ii) that number of Series A warrants set forth on the signature page hereto, in the form attached hereto as Exhibit A (the “Series A Warrants”), with each whole Series A Warrant entitling the holder to purchase one share of Common Stock (the “Warrant Shares”, and together with the Shares and the Series A Warrants, the “Securities”) for the aggregate purchase price set forth on the signature page hereto (the “Purchase Price”), which payment (other than the aggregate par value of the Shares) will be directed to the Company, and the Company desires to issue and sell to Subscriber the Shares and the Series A Warrants in consideration of the payment of the Purchase Price by or on behalf of Subscriber to the Company; and

WHEREAS, to the extent the Subscriber would be entitled to a fractional Series A Warrant, the Company shall round down to the nearest whole number of Series A Warrants to be issued to the Subscriber.