| PROSPECTUS SUPPLEMENT NO. 7 | Filed Pursuant to Rule 424(b)(3) | |

| (to prospectus dated July 1, 2021) | Registration No. 333-257423 |

PURECYCLE TECHNOLOGIES, INC.

18,177,703 Shares

Common Stock

This prospectus supplement is being filed to update and supplement the information contained in the prospectus dated July 1, 2021 (as supplemented or amended from time to time, the “Prospectus”), with the information contained in our Current Report on Form 8-K, which was filed with the Securities and Exchange Commission (“SEC”) on November 10, 2021 (the “Form 8-K”). Accordingly, we have attached the Form 8-K to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the issuance by us of 5,936,625 shares of our common stock, par value $0.001 per share (“Common Stock”), that may be issued upon exercise of the Company Warrants (as defined in the Prospectus).

The Prospectus and prospectus supplement also relate to the offer and sale from time to time by the selling stockholders named in the Prospectus or their permitted transferees (collectively, the “Selling Stockholders”) of up to 12,241,078 shares of Common Stock, which includes (i) 8,903,842 shares of Common Stock that may be issued upon conversion of the Convertible Notes (as defined in the Prospectus) currently outstanding as of the most recent interest payment date, (ii) up to 951,360 additional shares of Common Stock issuable upon conversion of the Convertible Notes assuming all remaining interest payments are made to holders of the Convertible Notes entirely in kind and the maturity date of the Convertible Notes is extended through April 15, 2023 (from October 15, 2022) at our election with respect to 50% of the amount outstanding under the Convertible Notes at October 15, 2022 and (iii) up to 2,385,876 shares of Common Stock held by certain initial stockholders named therein (including the shares of our Common Stock that may be issued upon conversion of the Company Warrants held by such initial stockholders).

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Our Common Stock, warrants and units are listed on The Nasdaq Capital Market under the symbols “PCT,” “PCTTW” and “PCTTU,” respectively. On November 10, 2021, the closing price of our Common Stock was $11.50 per share.

Investing in our securities involves risks that are described in the “Risk Factors” section beginning on page 14 of the Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is November 10, 2021.

United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 10, 2021

| PureCycle Technologies, Inc. | ||

| (Exact Name of Registrant as Specified in its Charter) |

| Delaware | 001-40234 | 86-2293091 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| 5950 Hazeltine National Drive, Suite 650, | ||

| Orlando, Florida | 32822 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (877) 648-3565

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) |

Name of each exchange on which registered | ||

| Common Stock, par value $0.001 per share | PCT | The Nasdaq Stock Market LLC | ||

| Warrants, each exercisable for one share of common stock, $0.001 par value per share, at an exercise price of $11.50 per share | PCTTW | The Nasdaq Stock Market LLC | ||

| Units, each consisting of one share of common stock, $0.001 par value per share, and three quarters of one warrant | PCTTU | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (Sec.230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Sec.240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial Condition.

On November 10, 2021, PureCycle Technologies, Inc. (the “Company”) issued a press release, attached hereto as Exhibit 99.1 and incorporated herein by reference, announcing the Company’s financial results for the third quarter ended September 30, 2021 and certain other information.

The information contained in Item 7.01 concerning the presentation to the Company’s investors is hereby incorporated into this Item 2.02 by reference.

Item 7.01. Regulation FD Disclosure.

The slide presentation attached hereto as Exhibit 99.2, and incorporated herein by reference, will be presented to certain investors of the Company on November 11, 2021 and may be used by the Company in various other presentations to investors.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Exhibit Number | Description of Exhibit |

| 99.1 | Press release by PureCycle Technologies, Inc. on November 10, 2021 of third quarter 2021 financial results. |

| 99.2 | PureCycle Technologies, Inc. presentation to investors. |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| PURECYCLE TECHNOLOGIES, INC. | ||

| November 10, 2021 | By: | /s/ Brad Kalter |

| Name: Brad Kalter | ||

| Title: General Counsel and Corporate Secretary | ||

Exhibit 99.1

| NEWS RELEASE |

PureCycle Technologies Provides Third Quarter 2021 Update

- Plant 1, the first manufacturing plant in Ironton, Ohio, remains on schedule for expected completion in the fourth quarter of 2022

- Plant 2, first cluster facility in Augusta, Georgia, on track for site work expected to begin in the first quarter of 2022

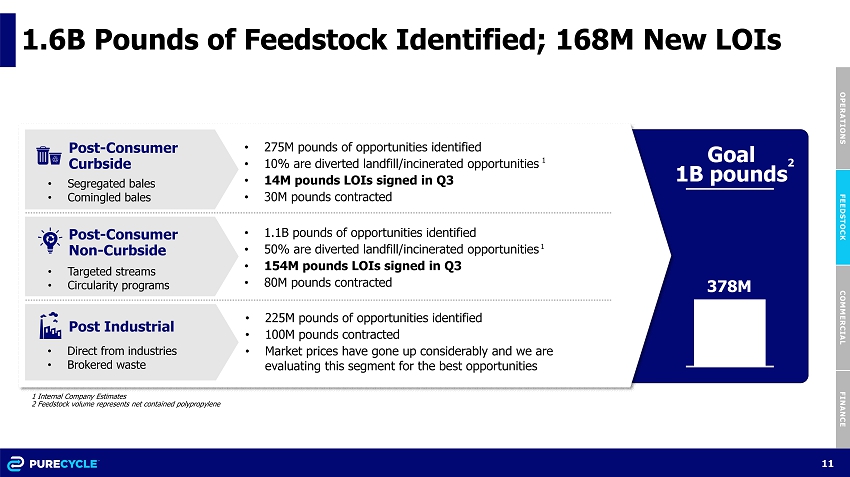

- Identified 1.6-billion-pound feedstock supply pipeline; Signed 6 new LOIs representing 168 million pounds of feedstock

- Submitted FDA Letter of No Objection on September 10, 2021

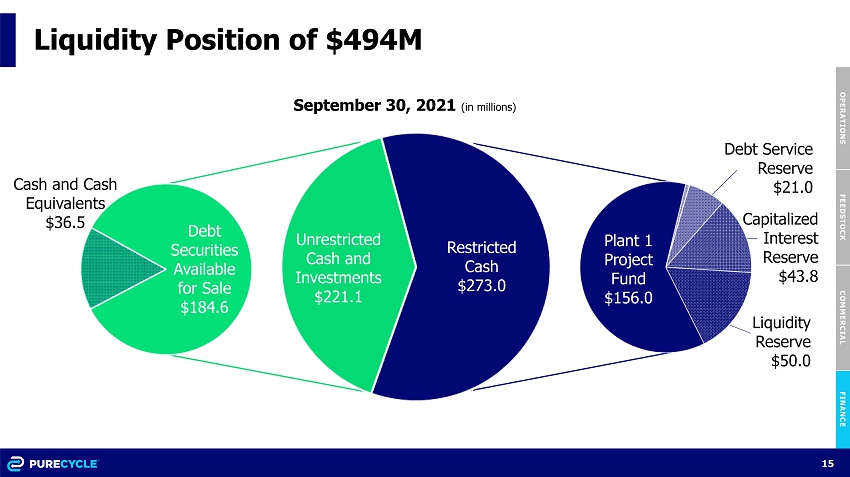

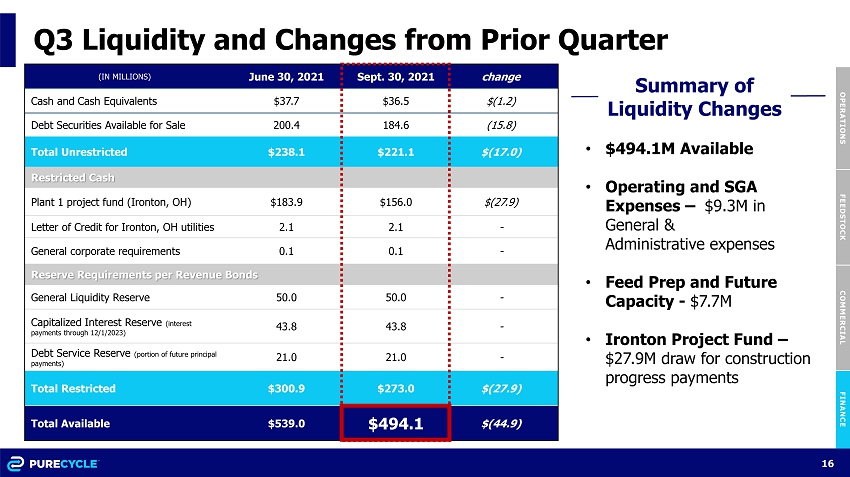

- Total liquidity of $494.1 million, including $221.1 million of unrestricted cash and investments and $273.0 million of restricted cash, at quarter-end September 30, 2021

(ORLANDO, Florida – November 10, 2021) – PureCycle Technologies, Inc. ("PureCycle” or “the Company") (NASDAQ: PCT), a company seeking to revolutionize polypropylene recycling, today announced a corporate update and financial results for the third quarter ending September 30, 2021.

Management Commentary

“Since our second quarter update, we have continued to execute and advance our strategic plan, highlighted by Plant 1 in Ironton, Ohio, which is progressing on schedule to be operational in the fourth quarter of 2022. In addition, our first cluster facility in Augusta, Georgia remains on track with site work expected to begin in the first quarter of 2022,” said Mike Otworth, PureCycle's Chairman and Chief Executive Officer.

“We

successfully expanded our feedstock supply network during the quarter signing multiple LOIs for feedstock, as well as identifying a 1.6-billion-pound

feedstock supply pipeline. On the commercial front, we continue to see demand and the market continues to accept our Feedstock+ pricing

model. Additionally, we completed the submission of the FDA Letter of No Objection in September and the first ever PureCycled plastic

product was brought to market. PureCycle remains on schedule to achieve our strategic milestones and we look forward to updating you on

our progress next quarter.

“What we are creating at PureCycle is more than a plastic that can be infinitely

sustainable, we are giving brands an opportunity to be deliberate and genuine when it comes to creating sustainable products that put

our environment at the forefront. The work we have done over the last quarter not only positions us well to achieve our strategic goals,

but also helps bring this tremendous opportunity to the commercial market.”

Operational

Update

In Ironton, Ohio, our flagship facility is well under way and

is expected to be operational in the fourth quarter of 2022. Our first facility is expected to produce 107 million pounds per year of

Ultra-Pure Recycled (UPR) resin. In the second quarter of next year, we expect to have both our module equipment delivered and our Ironton

feedstock preprocessing facility (PreP) operational. In Ironton’s September 2021 Leidos report, the noted schedule delays are non-critical

path activities that include the rail line and final building modifications. We expect that these activities should not impact the final

project completion.

During the third quarter, PureCycle approved additional investments in Ironton

with a focus on de-risking and processing expansion, contributing to an increase in the total project costs by $30-40 million relative

to the initial budget. Approximately two-thirds of the additional cost represents an investment to process a higher percentage of feed

contaminants and safety design improvements, while approximately one-third represents an escalation in base material pricing.

The Augusta cluster facility, which is designed to ultimately

produce up to 650 million pounds annually per year across five processing lines, remains on track for preliminary site work to begin in

the first quarter of 2022. PureCycle continues to address the critical path for Augusta by making long lead purchases which will occur

throughout the rest of this year.

During the third quarter, the Company has made considerable progress

on European site selection, identified potential European feedstocks, and with the Company’s submitted FDA Letter of No Objection,

PureCycle has begun preparations for communications with the European Food Safety Authority (EFSA).

PureCycle made significant announcements during the third quarter as it relates

to the Company’s expansion into the Asia-Pacific and continues to progress the memoranda of understanding with Mitsui in Japan and

SK Geo Centric in South Korea to definitive agreements, which will help the Company pave the way for building a PureCycle ecosystem globally.

Feedstock and Commercial Update

PureCycle made significant advancements in the Company’s feedstock procurement

process during the third quarter highlighted by the identification of approximately 1.6 billion pounds of potential feedstock that is,

at present, moving through the market and/or being landfilled. This feedstock supply pipeline comprises 3 diverse types of waste streams:

post-consumer non-curbside (approx. 1.1 billion pounds identified), post-consumer curbside (approx. 275 million pounds identified), and

post-industrial (approx. 225 million pounds identified). PureCycle is seeking to decentralize its feedstock intake and most recently announced

a PreP facility in Winter Garden, Florida. This new facility is PureCycle’s first satellite PreP facility and represents a strategy

that focuses on decentralizing feedstock intake, which allows the Company to accept and sort plastic waste closer to the source and further

encourages PureCycle’s feedstock supply line.

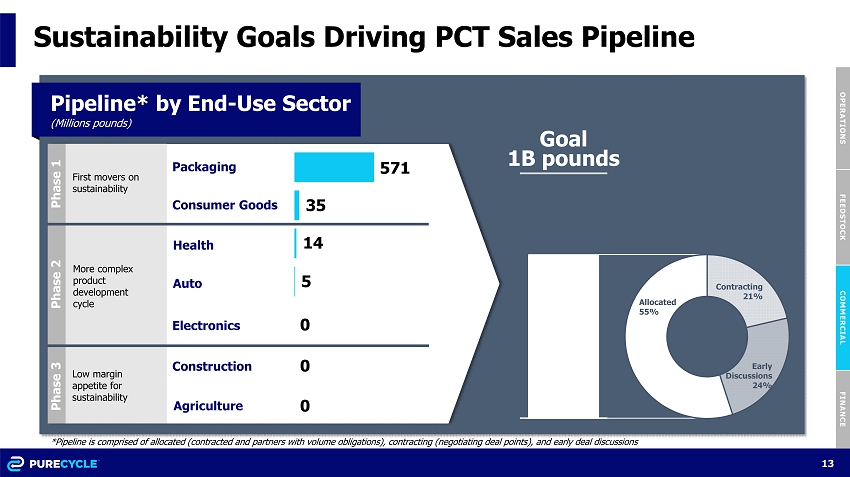

PureCycle continues to see a robust pipeline of demand for its UPR resin and

the Company is seeing market acceptance of its Feedstock+ pricing model. PureCycle remains in active discussions representing 277 million

pounds across existing and new market segments using the Feedstock+ pricing model. The Company also saw the first PureCycled plastic product

made with 95% of our UPR plastic come onto the market. The shampoo dispenser brought to market by EC30 was made commercially available

earlier this month and represents the Company’s UPR resin’s ability to deliver exceptional aesthetic and mechanical properties

that meet both sustainability goals and appeal to the consumer.

Liquidity and Capital Resources

Total liquidity of $494.1 million including $221.1 million of cash, cash equivalents

and debt securities available for sale and $273.0 million in restricted cash.

PureCycle had $319.0 million in debt and accrued interest, less $19.3 million of discount and issuance costs as of September 30, 2021. Plant 1’s original budget was $242.1 million, which was funded through bond financing. As of September 30, 2021, the remaining capital allocated from the bond funds was $155.9 million.

Conference Call

The Company will hold a conference call today at 11:00 a.m. ET to provide an update on recent corporate developments, including activity from the third quarter and updated future strategic plans.

Date: Thursday, November 11, 2021

Time: 11:00 a.m. ET

Toll-free dial-in number: 1-855-940-5314

International dial-in number: 1-929-517-0418

Conference ID: 1084324

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Investor Relations at 1-949-574-3860.

The conference call will have a live Q&A session and be available for replay here and on the Company's website at www.purecycle.com.

A replay of the conference call will be available after 2 p.m. Eastern time on the same day through November 18, 2021, via the information below:

Toll-free replay number: (855) 859-2056

International replay number: (404) 537-3406

Replay ID: 1084324

Forward-Looking

Statements

This press release contains forward-looking statements, including statements

about the financial condition, results of operations, earnings outlook and prospects of PCT. In addition, any statements that refer to

projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking

statements. Forward-looking statements are typically identified by words such as "plan," "believe," "expect,"

"anticipate," "intend," "outlook," "estimate," "forecast," "project," "continue,"

"could," "may," "might," "possible," "potential," "predict," "should,"

"would" and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements are based on the current expectations of the management of PCT and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section of PCT’s Quarterly Report on Form 10-Q entitled "Risk Factors," those discussed and identified in public filings made with the Securities and Exchange Commission (the "SEC") by PCT and the following:

| · | PCT's ability to meet, and to continue to meet, applicable regulatory requirements for the use of PCT's UPR in food grade applications (both in the United States and abroad); |

| · | PCT's ability to comply on an ongoing basis with the numerous regulatory requirements applicable to the UPR and PCT's facilities (both in the United States and abroad); |

| · | expectations and changes regarding PCT's strategies and future financial performance, including its future business plans, expansion plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and PCT's ability to invest in growth initiatives; |

| · | PCT's ability to scale and build the Ironton, Ohio plant in a timely and cost-effective manner; |

| · | PCT’s ability to build its first U.S. cluster facility, located in Augusta, Georgia (the “Augusta Facility”), in a timely and cost-effective manner; |

| · | PCT’s ability to sort and process polypropylene plastic at its plastic waste prep (“Feed PreP”) facilities; |

| · | PCT's ability to maintain exclusivity under The Procter & Gamble Company license; |

| · | the implementation, market acceptance and success of PCT's business model and growth strategy; |

| · | the success or profitability of PCT's offtake arrangements; |

| · | the ability to source feedstock with a high polypropylene content; |

| · | PCT's future capital requirements and sources and uses of cash; |

| · | PCT's ability to obtain funding for its operations and future growth; |

| · | developments and projections relating to PCT's competitors and industry; |

| · | the outcome of any legal or regulatory proceedings to which PCT is, or may become a party, including the recently filed securities class action case and the ongoing SEC investigation; |

| · | the ability to recognize the anticipated benefits of the business combination; |

| · | unexpected costs related to the business combination; |

| · | geopolitical risk and changes in applicable laws or regulations; |

| · | the possibility that PCT may be adversely affected by other economic, business, and/or competitive factors; |

| · | operational risk; and |

| · | the risk that the COVID-19 pandemic, including any variants and the efficacy and distribution of vaccines, and local, state, federal and international responses to addressing the pandemic may have an adverse effect on PCT’s business operations, as well as PCT’s financial condition and results of operations. |

Should one or more of these risks or uncertainties materialize or should any

of the assumptions made by the management of PCT prove incorrect, actual results may vary in material respects from those projected in

these forward-looking statements.

All subsequent written and oral forward-looking statements or other matters attributable

to PCT or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements contained or referred

to in this press release. Except to the extent required by applicable law or regulation, PCT undertakes no obligation to update these

forward-looking statements to reflect events or circumstances after the date of this press release or to reflect the occurrence of unanticipated

events.

About PureCycle Technologies

PureCycle Technologies LLC, a subsidiary of PureCycle Technologies, Inc., holds a global license to commercialize the only patented solvent-based purification recycling technology, developed by The Procter & Gamble Company for restoring waste polypropylene (PP) into ultra-pure recycled (UPR) resin. The proprietary process removes color, odor and other contaminants from recycled feedstock resulting in UPR plastic suitable for any PP market. To learn more, visit purecycle.com

Company Contact:

Anna Farrar

afarrar@purecycle.com

(954) 647-7059

Investor Relations Contact:

Georg Venturatos

Gateway Investor Relations

PCT@GatewayIR.com

(949) 574-3860

Exhibit 99.2

1 1 Third Quarter 2021 Corporate Update November 11, 2021

2 2 Forward - Looking Statements Certain statements in this Presentation contain forward - looking statements within the meaning of Section 27A of the Securities A ct of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including statements about the outco me of any legal or regulatory proceedings to which PureCycle Technologies, Inc. (“PCT”) is, or may become a party, and the financial condition, results of operations, ear nin gs outlook and prospects of PureCycle Technologies, Inc. (“PCT”). Forward - looking statements generally relate to future events or our future financial or operating pe rformance and may refer to projections and forecasts. Forward - looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “inte nd,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expres sio ns (or the negative versions of such words or expressions), but the absence of these words does not mean that a statement is not forward - looking. The forward - looking statements are based on the current expectations of the management of PCT and are inherently subject to unce rtainties and changes in circumstances and their potential effects and speak only as of this Presentation. There can be no assurance that future developments will b e t hose that have been anticipated. These forward - looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward - looking statements. These risks and uncertainties include, but are not limited to, those factors des cribed in the section of the Company’s Quarterly Report on Form 10 - Q (the “Form 10 - Q”) entitled “Risk Factors,” those discussed and identified in public filings made with the SE C by PCT, and the following: PCT's ability to meet, and to continue to meet, applicable regulatory requirements for the use of PCT’s ultra - pure recycled polypropylene (“UPRP” ) in food grade applications (both in the United States and abroad); PCT's ability to comply on an ongoing basis with the numerous regulatory requirements applicable t o t he UPRP and PCT’s facilities (both in the United States and abroad); Expectations and changes regarding PCT’s strategies and future financial performance, including it s f uture business plans, expansion plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating ex pen ses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and PCT’s ability to invest in growth initiatives; PCT’s ability to scale and build the I ron ton plant in a timely and cost - effective manner; PCT’s ability to build its first cluster facility, located in Augusta, Georgia in a timely and cost - effective manner; PCT’s ability to sort and process polypropylene plastic waste at its plastic waste prep (“Feed PreP ”) facilities; PCT’s ability to maintain exclusivity under The Procter & Gamble Company license; the implementation, market a cce ptance and success of PCT’s business model and growth strategy; the success or profitability of PCT’s offtake arrangements; the ability to source feedstock with a high polypropylene content; PCT’s future capital requirements and sources and uses of cash; PCT’s ability to obtain funding for its operations a nd future growth; developments and projections relating to PCT’s competitors and industry; the outcome of any legal or regulatory proceedings to which PCT is, or may become a party, including recently filed securities class action case; the ability to recognize the anticipated benefits of the Business Combination (as defined in the Form 10 - Q); unexpe cted costs related to the Business Combination; geopolitical risk and changes in applicable laws or regulations; the possibility that PCT may be adversely affected by other eco nomic, business, and/or competitive factors; operational risk; and the risk that the COVID - 19 pandemic, including any variants and the efficacy and distribution of vaccines, and local, state, federal and international responses to addressing the pandemic may have an adverse effect on PCT’s business operations, as well as PCT’s financial cond iti on and results of operations. PCT specifically disclaims any obligation to update this Presentation. These forward - looking statements should not be relied upon as representing PCT’s assessments as of any date subsequent to the date of this Presentation. Accordingly, undue reliance should not be placed upon the forward - looking statements.

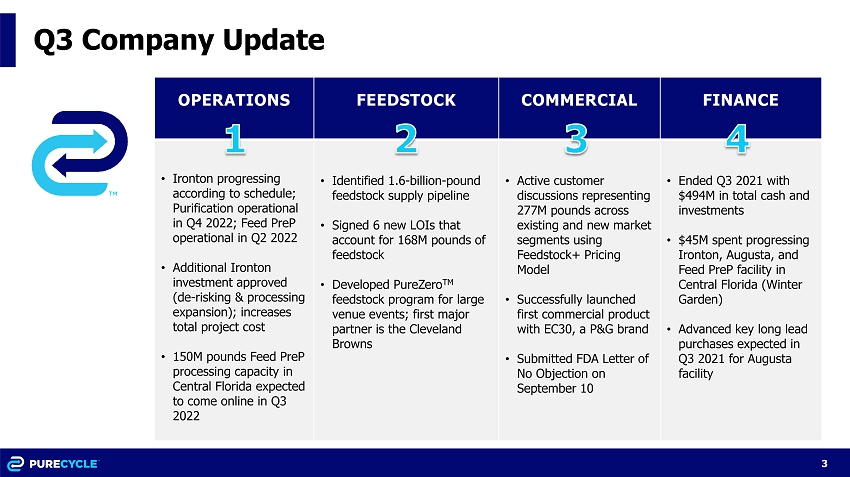

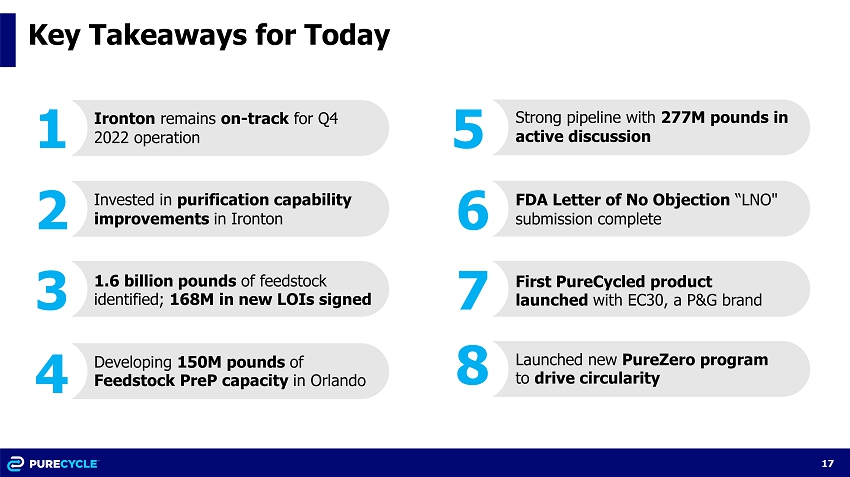

3 3 Q3 Company Update OPERATIONS FEEDSTOCK COMMERCIAL FINANCE • Ironton progressing according to schedule; Purification operational in Q4 2022; Feed PreP operational in Q2 2022 • Additional Ironton investment approved (de - risking & processing expansion); increases total project cost • 150M pounds Feed PreP processing capacity in Central Florida expected to come online in Q3 2022 • Identified 1.6 - billion - pound feedstock supply pipeline • Signed 6 new LOIs that account for 168M pounds of feedstock • Developed PureZero TM feedstock program for large venue events; first major partner is the Cleveland Browns • Active customer discussions representing 277M pounds across existing and new market segments using Feedstock+ Pricing Model • Successfully launched first commercial product with EC30, a P&G brand • Submitted FDA Letter of No Objection on September 10 • Ended Q3 2021 with $494M in total cash and investments • $45M spent progressing Ironton, Augusta, and Feed PreP facility in Central Florida (Winter Garden) • Advanced key long lead purchases expected in Q3 2021 for Augusta facility

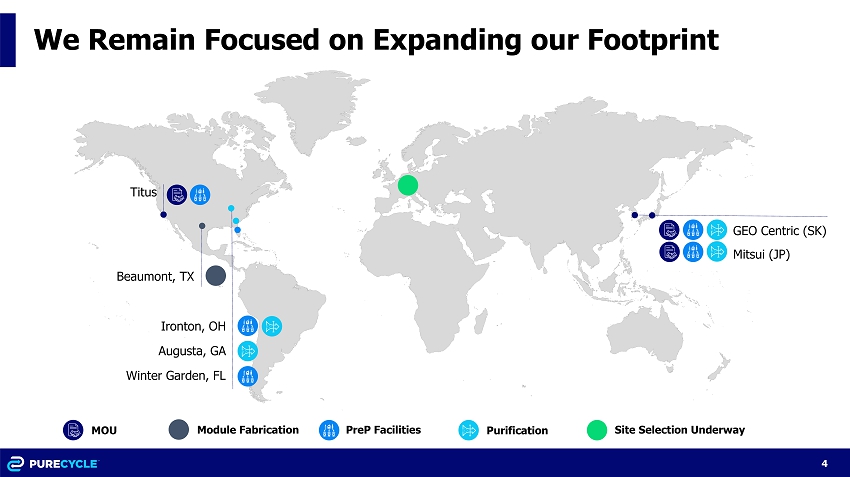

4 4 We Remain Focused on Expanding our Footprint Titus GEO Centric (SK) PreP Facilities Purification Site Selection Underway Winter Garden, FL Ironton, OH Augusta, GA MOU Mitsui (JP) Module Fabrication Beaumont, TX

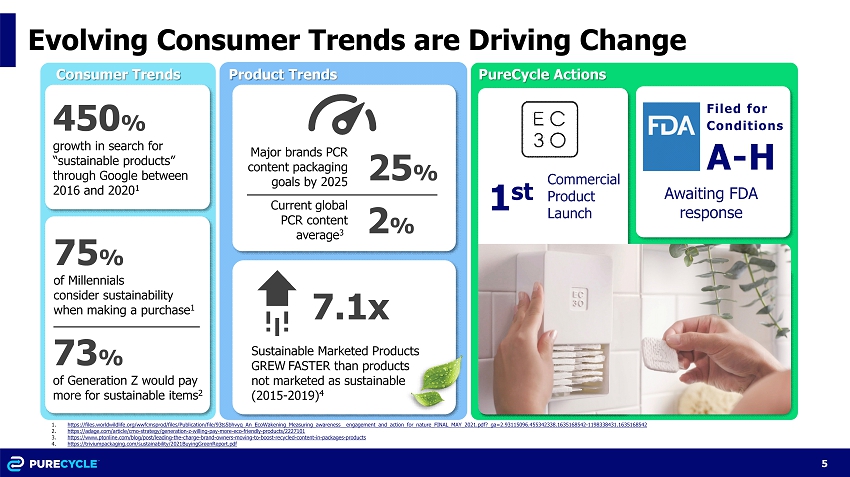

5 5 Evolving Consumer Trends are Driving Change 1. https://files.worldwildlife.org/wwfcmsprod/files/Publication/file/93ts5bhvyq_An_EcoWakening_Measuring_awareness__engagement_a nd_ action_for_nature_FINAL_MAY_2021.pdf?_ga=2.93115096.455342338.1635168542 - 1198338431.1635168542 2. https://adage.com/article/cmo - strategy/generation - z - willing - pay - more - eco - friendly - products/2227101 3. https://www.ptonline.com/blog/post/leading - the - charge - brand - owners - moving - to - boost - recycled - content - in - packages - products 4. https://triviumpackaging.com/sustainability/2021BuyingGreenReport.pdf Filed for Conditions A - H 450 % growth in search for “sustainable products” through Google between 2016 and 2020 1 75 % of Millennials consider sustainability when making a purchase 1 73 % of Generation Z would pay more for sustainable items 2 25 % Major brands PCR content packaging goals by 2025 7.1x Consumer Trends Product Trends Sustainable Marketed Products GREW FASTER than products not marketed as sustainable (2015 - 2019) 4 PureCycle Actions Current global PCR content average 3 2 % Awaiting FDA response Commercial Product Launch 1 st

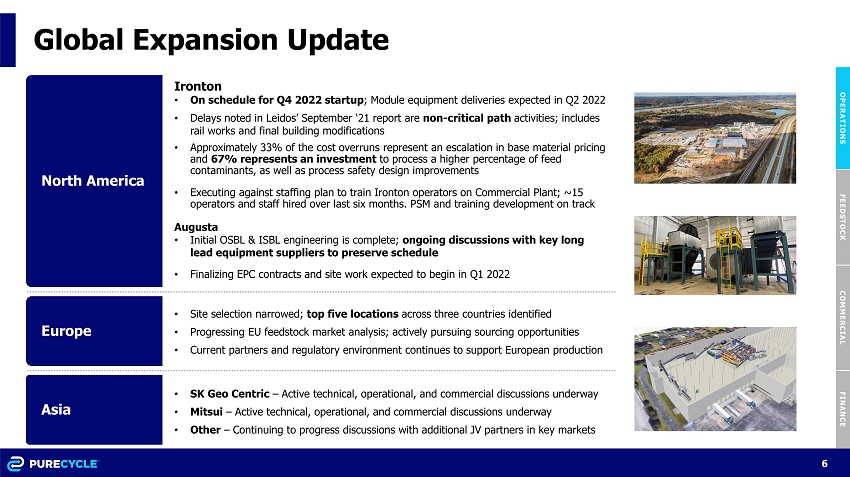

6 6 Global Expansion Update Ironton • On schedule for Q4 2022 startup ; Module equipment deliveries expected in Q2 2022 • Delays noted in Leidos’ September ‘21 report are non - critical path activities; includes rail works and final building modifications • Approximately 33% of the cost overruns represent an escalation in base material pricing and 67% represents an investment to process a higher percentage of feed contaminants, as well as process safety design improvements • Executing against staffing plan to train Ironton operators on Commercial Plant; ~15 operators and staff hired over last six months. PSM and training development on track Augusta • Initial OSBL & ISBL engineering is complete; ongoing discussions with key long lead equipment suppliers to preserve schedule • Finalizing EPC contracts and site work expected to begin in Q1 2022 North America Asia • SK Geo Centric – Active technical, operational, and commercial discussions underway • Mitsui – Active technical, operational, and commercial discussions underway • Other – Continuing to progress discussions with additional JV partners in key markets • Site selection narrowed; top five locations across three countries identified • Progressing EU feedstock market analysis; actively pursuing sourcing opportunities • Current partners and regulatory environment continues to support European production OPERATIONS FEEDSTOCK COMMERCIAL FINANCE Europe

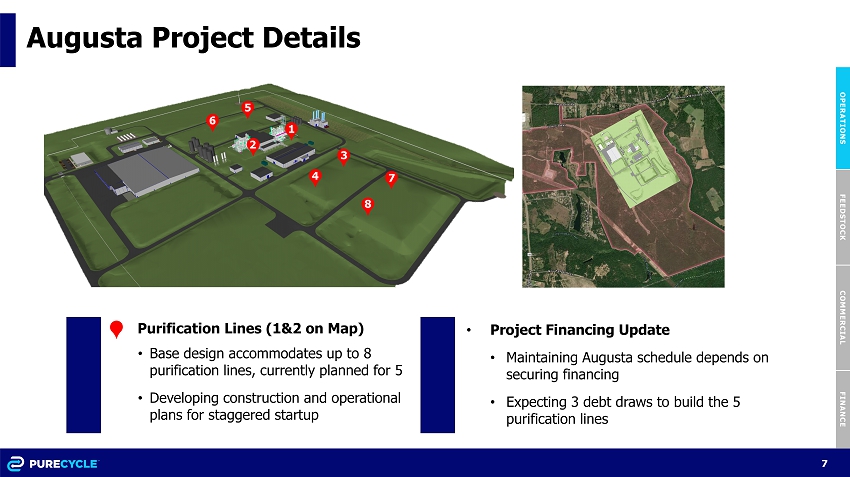

7 7 • Project Financing Update • Maintaining Augusta schedule depends on securing financing • Expecting 3 debt draws to build the 5 purification lines Augusta Project Details OPERATIONS FEEDSTOCK COMMERCIAL FINANCE 2 4 1 3 5 6 7 8 • Purification Lines (1&2 on Map) • Base design accommodates up to 8 purification lines, currently planned for 5 • Developing construction and operational plans for staggered startup

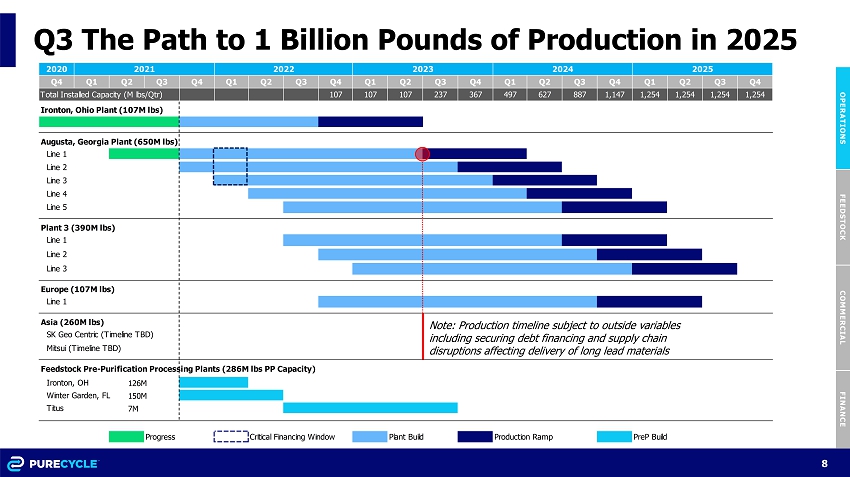

8 8 2020 Q4 Q1 Q3 Q2 Q3 Q1 Q2 Q4 Q3 Q4 Q1 Q2 Q3 Q4 107 107 367 887 1,147 1,254 1,254 1,254 1,254 Ironton, Ohio Plant (107M lbs) Annual Line Capacity: 107M lbs Augusta, Georgia Plant (650M lbs) Annual Line Capacity: 130MM lbs Line 1 Line 2 Line 3 Line 4 Line 5 Plant 3 (390M lbs) Line 1 Line 2 Line 8 Line 3 Europe (107M lbs) Line 1 Asia (260M lbs) SK Geo Centric (Timeline TBD) Mitsui (Timeline TBD) Feedstock Pre-Purification Processing Plants (286M lbs PP Capacity) Ironton, OH 126M Winter Garden, FL 150M Titus 7M Progress Critical Financing Window Plant Build Production Ramp PreP Build 2021 2022 2023 2024 2025 Q2 Total Installed Capacity (M lbs/Qtr) 107 237 497 627 Q2 Q1 Q4 Q3 Q1Q4 Q3 The Path to 1 Billion Pounds of Production in 2025 OPERATIONS FEEDSTOCK COMMERCIAL FINANCE Note: Production timeline subject to outside variables including securing debt financing and supply chain disruptions affecting delivery of long lead materials

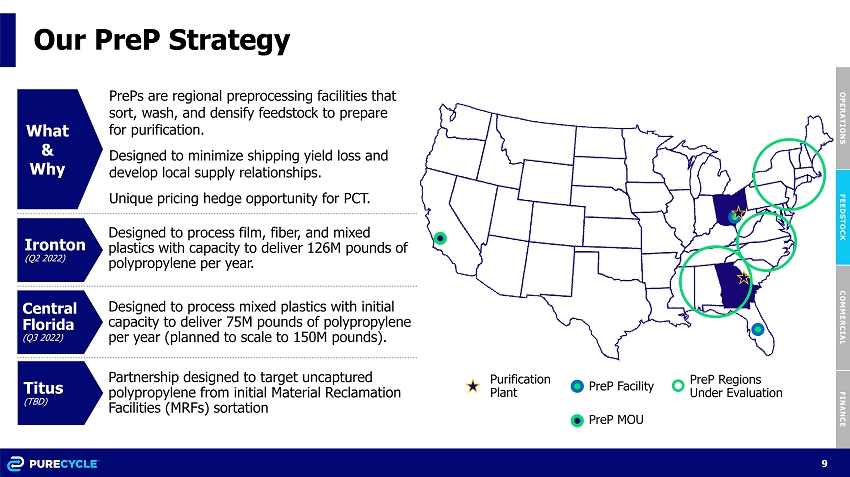

9 9 Our PreP Strategy PrePs are regional preprocessing facilities that sort, wash, and densify feedstock to prepare for purification. Designed to minimize shipping yield loss and develop local supply relationships. Unique pricing hedge opportunity for PCT. What & Why Designed to process film, fiber, and mixed plastics with capacity to deliver 126M pounds of polypropylene per year. PreP Facility Purification Plant OPERATIONS FEEDSTOCK COMMERCIAL FINANCE PreP Regions Under Evaluation Ironton (Q2 2022) Central Florida (Q3 2022) Titus (TBD) Partnership designed to target uncaptured polypropylene from initial Material Reclamation Facilities (MRFs) sortation Designed to process mixed plastics with initial capacity to deliver 75M pounds of polypropylene per year (planned to scale to 150M pounds). PreP MOU

10 10 OPERATIONS FEEDSTOCK COMMERCIAL FINANCE Build Feedstock Network Develop Targeted Regions Leverage Feed Prep to Harvest PP Secure 1 billion pounds of feedstock… To meet the demand for PCT, the company needs the ability to process a wide variety of waste streams because the resin produced is highly dependent on the waste that is purified . Building a Sustainable Feedstock Advantage It is critical to develop a sufficient feedstock supply network and the capacity to process it efficiently in order to scale our operations and meet customer needs . The concentration of polypropylene varies markedly depending on the feed source. PureCycle needs to build the PrePs to unlock a broader range of feedstock sources . The PreP facilities will be designed to reduce logistics and shipping costs and ensure that the company can reliably create feed streams with a sufficient concentration of Polypropylene to run the purification plants efficiently. Clustering the purification plants should allow PCT to gain economies of scale at the property and benefits from the strong logistics and other intrinsic qualities that Augusta provides . …To Support 2025 Sustainability Goals What We’re Doing Why We’re Doing It

11 11 1.6B Pounds of Feedstock Identified; 168M New LOIs Post Industrial Post - Consumer Non - Curbside Post - Consumer Curbside • Segregated bales • Comingled bales • Targeted streams • Circularity programs • Direct from industries • Brokered waste OPERATIONS FEEDSTOCK COMMERCIAL FINANCE Goal 1B pounds 1 Internal Company Estimates 2 Feedstock volume represents net contained polypropylene • 275M pounds of opportunities identified • 10% are diverted landfill/incinerated opportunities • 14M pounds LOIs signed in Q3 • 30M pounds contracted • 1.1B pounds of opportunities identified • 50% are diverted landfill/incinerated opportunities • 154M pounds LOIs signed in Q3 • 80M pounds contracted • 225M pounds of opportunities identified • 100M pounds contracted • Market prices have gone up considerably and we are evaluating this segment for the best opportunities 2 1 1 378M

12 12 that Drive Circularity PureCycle Awareness PureZero TM Program

13 13 Sustainability Goals Driving PCT Sales Pipeline OPERATIONS FEEDSTOCK COMMERCIAL FINANCE Packaging Construction Consumer Goods Health Auto Pipeline* by End - Use Sector (Millions pounds) Agriculture Electronics First movers on sustainability Low margin appetite for sustainability Phase 1 Phase 2 Phase 3 More complex product development cycle Goal 1B pounds *Pipeline is comprised of allocated (contracted and partners with volume obligations), contracting (negotiating deal points), an d early deal discussions Contracting 21% Early Discussions 24% Allocated 55% 571 35 14 5 0 0 0

14 14 PureCycled Polypropylene…from Post - Consumer Feedstock Ultra - Pure Recycled Polypropylene Blow Molded Bottle 50% PCT Resin Storage Container 100% PCT Resin Hinge Closure 100% PCT Resin Simple Closure 100% PCT Resin EC30 Case 95 % PCT Resin 1st Commercial Product

15 15 Liquidity Position of $494M Capitalized Interest Reserve $43.8 Debt Service Reserve $21.0 September 30, 2021 (in millions) Liquidity Reserve $50.0 Cash and Cash Equivalents $36.5 Unrestricted Cash and Investments $221.1 Debt Securities Available for Sale $184.6 Restricted Cash $273.0 Plant 1 Project Fund $156.0 OPERATIONS FEEDSTOCK COMMERCIAL FINANCE

16 16 Q3 Liquidity and Changes from Prior Quarter (IN MILLIONS) June 30, 2021 Sept. 3 0, 2021 change Cash and Cash Equivalents $37.7 $36.5 $(1.2) Debt Securities Available for Sale 200.4 184.6 (15.8) Total Unrestricted $238.1 $221.1 $(17.0) Restricted Cash Plant 1 project fund (Ironton, OH) $183.9 $156.0 $(27.9) Letter of Credit for Ironton, OH utilities 2.1 2.1 - General corporate requirements 0.1 0.1 - Reserve Requirements per Revenue Bonds General Liquidity Reserve 50.0 50.0 - Capitalized Interest Reserve (interest payments through 12/1/2023) 43.8 43.8 - Debt Service Reserve (portion of future principal payments) 21.0 21.0 - Total Restricted $300.9 $273.0 $(27.9) Total Available $539.0 $494.1 $(44.9) Summary of Liquidity Changes • $494.1M Available • Operating and SGA Expenses – $ 9.3 M in General & Administrative expenses • Feed Prep and Future Capacity - $7.7M • Ironton Project Fund – $27.9M draw for construction progress payments OPERATIONS FEEDSTOCK COMMERCIAL FINANCE

17 17 Key Takeaways for Today 1 2 3 6 7 Ironton remains on - track for Q4 2022 operation Developing 150M pounds of Feedstock PreP capacity in Orlando Strong pipeline with 277M pounds in active discussion 5 FDA Letter of No Objection “LNO" submission complete Invested in purification capability improvements in Ironton 1.6 billion pounds of feedstock identified; 168M in new LOIs signed 4 First PureCycled product launched with EC30, a P&G brand Launched new PureZero program to drive circularity 8

18 18 One Goal, A Pure Planet.