Exhibit 99.2

1 1 Second Quarter 2021 Corporate Update August 12, 2021

Forward - Looking Statements 2 Certain statements in this Presentation contain forward - looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including statements about the outcome of any legal proceedings to which PCT is, or may become a party, and the financial condition, results of operations, earnings outlook and prospects of PureCycle Technologies, Inc. (“PCT”). Forward - looking statements generally relate to future events or our future financial or operating performance and may refer to projections and forecasts. Forward - looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions (or the negative versions of such words or expressions), but the absence of these words does not mean that a statement is not forward - looking. The forward - looking statements are based on the current expectations of the management of PCT and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of this Presentation. There can be no assurance that future developments will be those that have been anticipated. These forward - looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward - looking statements. These risks and uncertainties include, but are not limited to, those factors described in the Company’s Quarterly Report on Form 10 - Q entitled “Risk Factors,” those discussed and identified in public filings made with the SEC by PCT, and the following: PCT's ability to meet, and to continue to meet, applicable regulatory requirements for the use of PCT’s ultra - pure recycled polypropylene (“UPRP”) in food grade applications (both in the United States and abroad); PCT's ability to comply on an ongoing basis with the numerous regulatory requirements applicable to the UPRP and PCT’s facilities (both in the United States and abroad); Expectations and changes regarding PCT’s strategies and future financial performance, including its future business plans, expansion plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and PCT’s ability to invest in growth initiatives; PCT’s ability to scale and build the Ironton plant in a timely and cost - effective manner; PCT’s ability to build its first cluster facility, located in Augusta, Georgia in a timely and cost - effective manner; PCT’s ability to maintain exclusivity under The Procter & Gamble Company license; the implementation, market acceptance and success of PCT’s business model and growth strategy; the success or profitability of PCT’s offtake arrangements; the ability to source feedstock with a high polypropylene content; PCT’s future capital requirements and sources and uses of cash; PCT’s ability to obtain funding for its operations and future growth; developments and projections relating to PCT’s competitors and industry; the outcome of any legal proceedings to which PCT is, or may become a party, including recently filed securities class action cases; the ability to recognize the anticipated benefits of the Business Combination; unexpected costs related to the Business Combination; geopolitical risk and changes in applicable laws or regulations; the possibility that PCT may be adversely affected by other economic, business, and/or competitive factors; operational risk; and the risk that the COVID - 19 pandemic, and local, state, federal and international responses to addressing the pandemic may have an adverse effect on PCT’s business operations, as well as PCT’s financial condition and results of operations. PCT specifically disclaims any obligation to update this Presentation. These forward - looking statements should not be relied upon as representing PCT’s assessments as of any date subsequent to the date of this Presentation. Accordingly, undue reliance should not be placed upon the forward - looking statements.

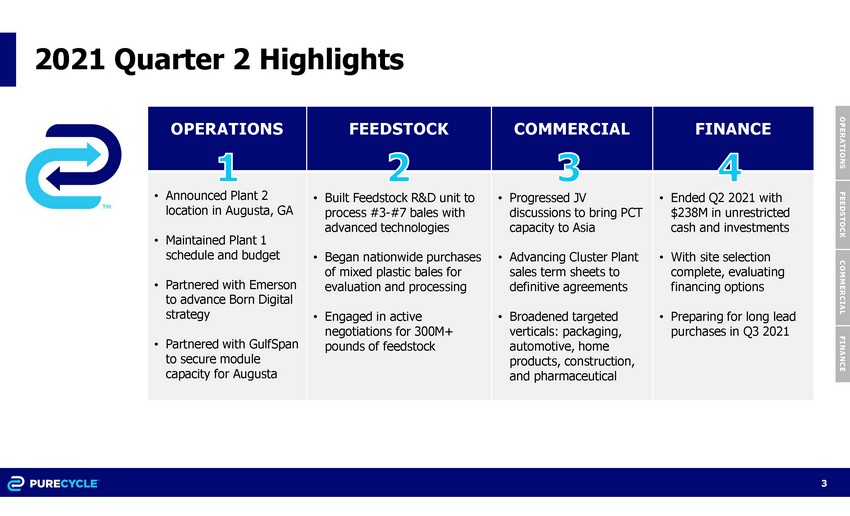

2021 Quarter 2 Highlights O P E R A T I O N S F EE D S T O C K COMMERCIAL F I N A N C E • Announced Plant 2 location in Augusta, GA • Maintained Plant 1 schedule and budget • Partnered with Emerson to advance Born Digital strategy • Partnered with GulfSpan to secure module capacity for Augusta • Built Feedstock R&D unit to process #3 - #7 bales with advanced technologies • Began nationwide purchases of mixed plastic bales for evaluation and processing • Engaged in active negotiations for 300M+ pounds of feedstock • Progressed JV discussions to bring PCT capacity to Asia • Advancing Cluster Plant sales term sheets to definitive agreements • Broadened targeted verticals: packaging, automotive, home products, construction, and pharmaceutical • Ended Q2 2021 with $238M in unrestricted cash and investments • With site selection complete, evaluating financing options • Preparing for long lead purchases in Q3 2021 OPERATIONS FEEDSTOCK COMMERCIAL FINANCE 3

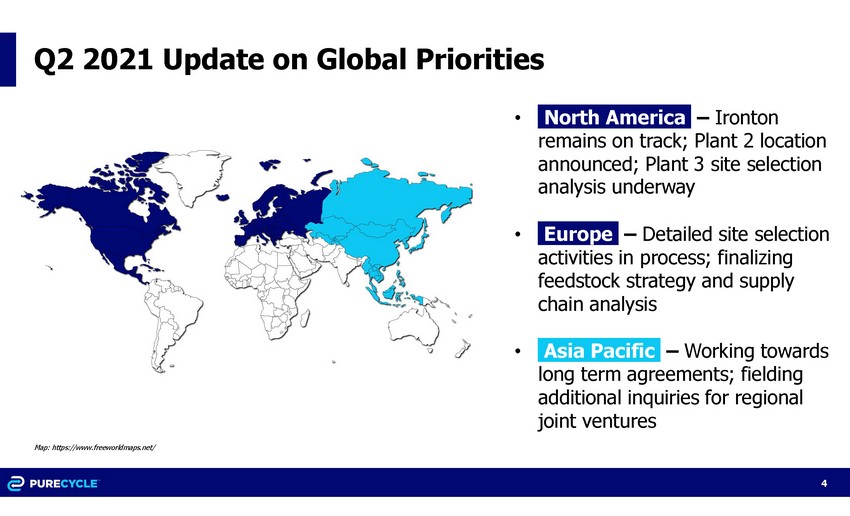

Q2 2021 Update on Global Priorities • North America – Ironton remains on track; Plant 2 location announced; Plant 3 site selection analysis underway • Europe – Detailed site selection activities in process ; finalizing feedstock strategy and supply chain analysis • Asia Pacific – Working towards long term agreements ; fielding additional inquiries for regional joint ventures Map:https:// www.freeworldmaps.net/ 4

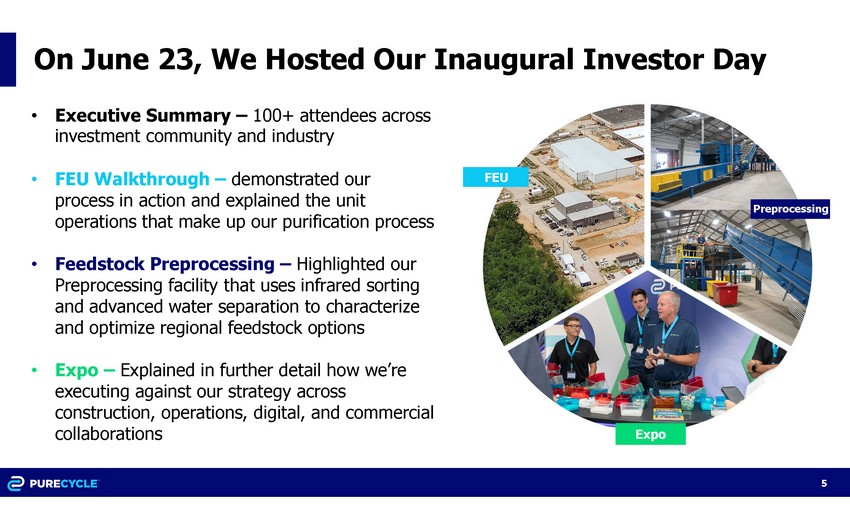

On June 23, We Hosted Our Inaugural Investor Day • Executive Summary – 100+ attendees across investment community and industry • FEU Walkthrough – demonstrated our process in action and explained the unit operations that make up our purification process • Feedstock Preprocessing – Highlighted our Preprocessing facility that uses infrared sorting and advanced water separation to characterize and optimize regional feedstock options • Expo – Explained in further detail how we’re executing against our strategy across construction, operations, digital, and commercial collaborations F F E E U U 5 FEU E E x x p p o o Expo PPrreepprroocceessssiinngg Preprocessing

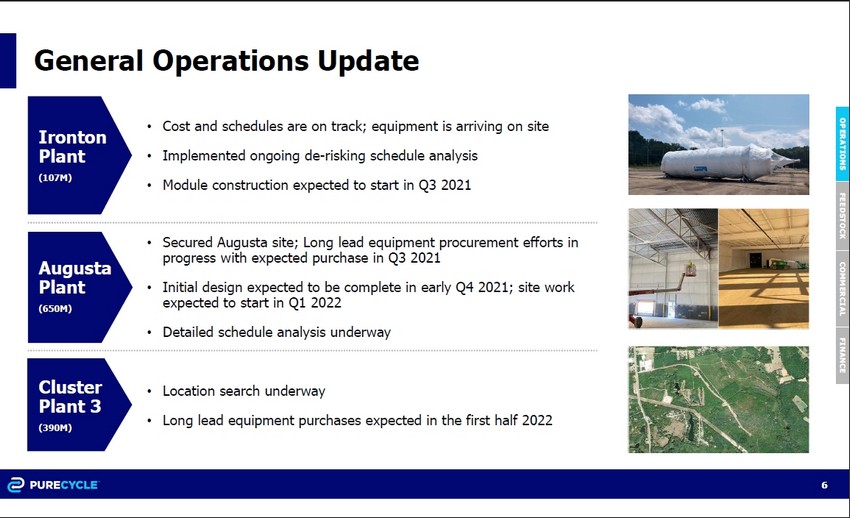

General Operations Update • Cost and schedules are on track; equipment is arriving on site • Implemented ongoing de - risking schedule analysis • Module construction expected to start in Q3 2021 O PER A T I ON S F E ED ST O C K COMMERCIAL FINANCE • Secured Augusta site; Long lead equipment procurement efforts in progress with expected purchase in Q3 2021 • Initial design expected to be complete in early Q4 2021; site work expected to start in Q1 2022 • Detailed schedule analysis underway • Location search underway • Long lead equipment purchases expected in the first half 2022 I r o n t o n Plant (107M) A u g u s t a Plant (650M) C lu s t e r Plant 3 (390M) 6

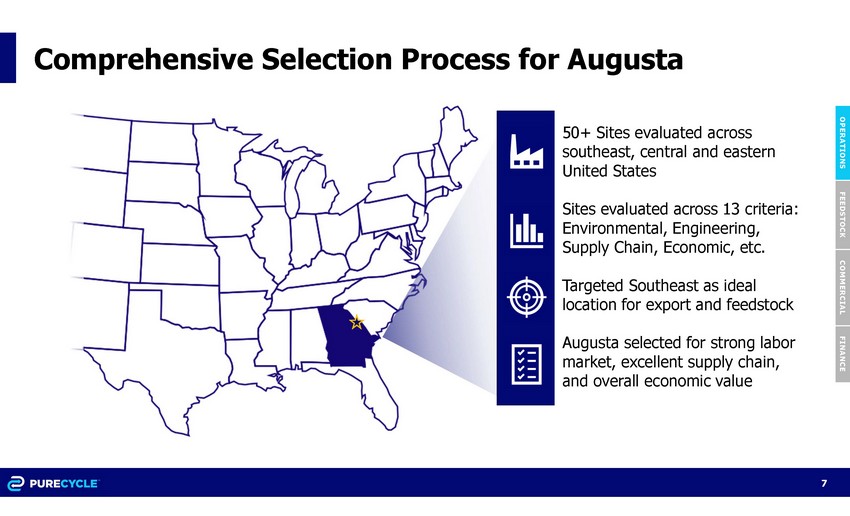

Comprehensive Selection Process for Augusta O PER A T I ON S 7 F E ED ST O C K COMMERCIAL FINANCE 50+ Sites evaluated across southeast, central and eastern United States Sites evaluated across 13 criteria: Environmental, Engineering, Supply Chain, Economic, etc. Targeted Southeast as ideal location for export and feedstock Augusta selected for strong labor market, excellent supply chain, and overall economic value

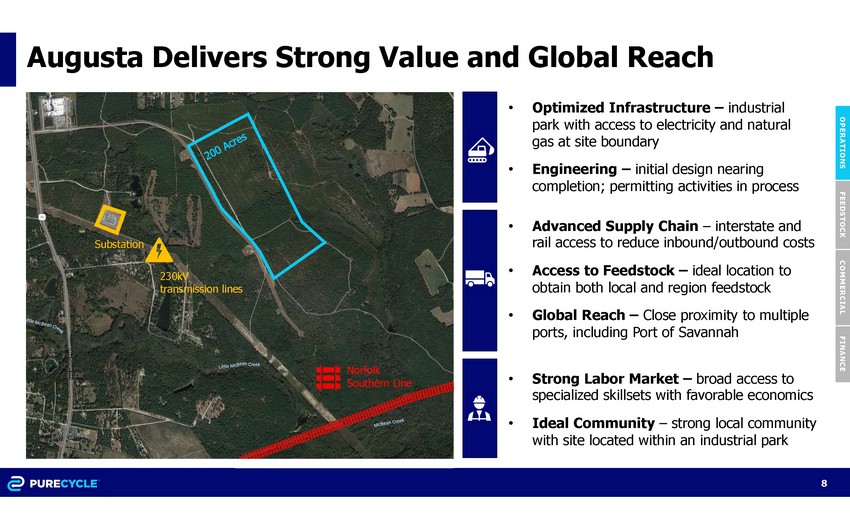

• Optimized Infrastructure – industrial park with access to electricity and natural gas at site boundary • Engineering – initial design nearing completion; permitting activities in process Augusta Delivers Strong Value and Global Reach Substation 230kV transmission lines Norfolk Southern Line O PER A T I ON S F E ED ST O C K COMMERCIAL FINANCE • Strong Labor Market – broad access to specialized skillsets with favorable economics • Ideal Community – strong local community with site located within an industrial park • Advanced Supply Chain – interstate and rail access to reduce inbound/outbound costs • Access to Feedstock – ideal location to obtain both local and region feedstock • Global Reach – Close proximity to multiple ports, including Port of Savannah 8

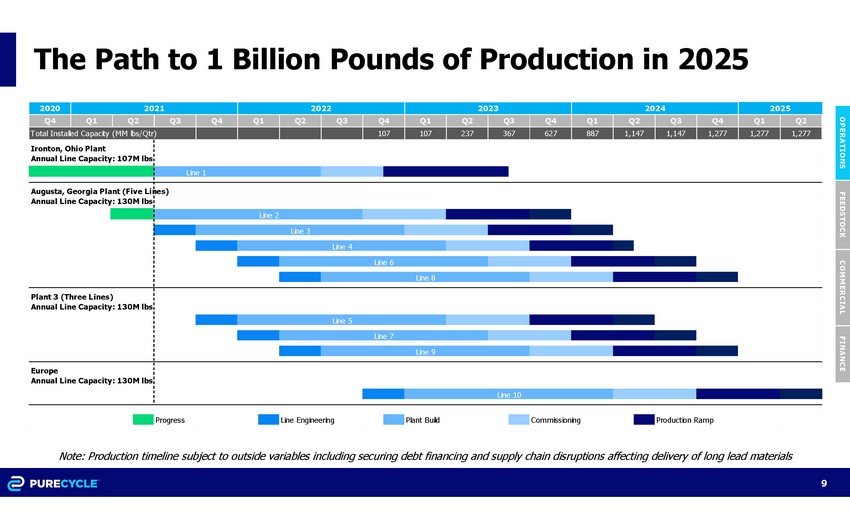

Q 3 Q 4 Q 2 Q 3 Q 1 Q 2 Q 4 Q 1 Q 3 Q 4 Q 1 Q 2 10 7 2 3 7 6 2 7 88 7 1 , 1 4 7 1 , 2 7 7 1 , 27 7 1 , 27 7 Plant 3 (Three Lines) Annual Line Capacity: 130M lbs Europe Annual Line Capacity: 130M lbs Progress Line Engineering Plant Build Commissioning Production Ramp 2 0 2 5 Total Installed Capacity (MM lbs/Qtr) Q 2 1 , 1 4 7 3 6 7 10 7 Q 4 20 2 1 2 0 2 2 2 0 2 3 Line 10 2 0 2 4 2020 Q 4 Q 1 Q 2 Ironton, Ohio Plant Annual Line Capacity: 107M lbs Line 1 Augusta, Georgia Plant (Five Lines) Annual Line Capacity: 130M lbs Line 2 Line 3 Line 4 Line 6 Line 8 Line 5 Line 7 Line 9 Q 1 Q 3 The Path to 1 Billion Pounds of Production in 2025 O PER A T I ON S Note:Productiontimelinesubjecttooutsidevariablesincludingsecuringdebtfinancingandsupplychaindisruptionsaffectingdeliveryoflon gle admaterials 9 F E ED ST O C K COMMERCIAL FINANCE

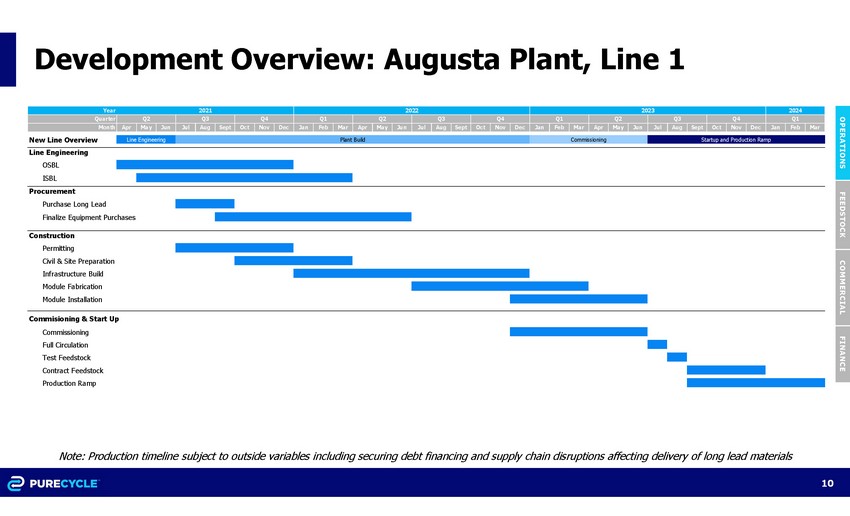

Year 2021 2022 2023 2024 Q u a r t e r Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 M o n t h Apr May Jun Jul Aug Sept Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sept Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sept Oct Nov Dec Jan Feb Mar New Line Overview Line Engineering O S B L ISBL Procurement Purchase Long Lead Finalize Equipment Purchases C o n st r u c t i o n P e r m i t t i n g Civil & Site Preparation Infrastructure Build Module Fabrication Module Installation Commisioning & Start Up Commissioning Full Circulation Test Feedstock Contract Feedstock Production Ramp Line Engineering Startup and Production Ramp Plant Build Commissioning Development Overview: Augusta Plant, Line 1 O PER A T I ON S Note:Productiontimelinesubjecttooutsidevariablesincludingsecuringdebtfinancingandsupplychaindisruptionsaffectingdeliveryoflon gle admaterials 10 F E ED ST O C K COMMERCIAL FINANCE

We are in Active Negotiations with Numerous Feedstock Suppliers for 300M+ Pounds Annually • Active Discussions: 80M+ Pounds • Conducting initial trials with multiple preprocessors and film producers; challenging feedstocks are priced well below market • Conducted National MRF survey of more than 150 MRFs to identify MRFs best suited to provide PCT either PP bales or mixed plastic bales that can be sorted at a PCT facility • Active Discussions & LOI Negotiations: 200M+ Pounds • Actively targeting feedstock across agricultural, automotive, and medical; joined various associations to develop circular partnerships • Suppliers prefer partners that can manage a range of impurities • Active LOI Negotiations: 50M+ Pounds • Purchased various plastic bales from across the country for Feedstock Preprocessing, analysis, and continued discussions with Material Recovery Facilities (MRFs) O PER A T I ON S F EE D S T O C K COMMERCIAL F I N A N C E P o s t - C o n s u m e r Curbside • Segregated bales • Comingled bales P o s t - C o n s u m e r Non - Curbside • Targeted streams • Circularity programs Post Industrial • Direct from industries • Brokered waste Advocacy • Industry representation • New PP collection programs Preprocessing Mixed Bales 11

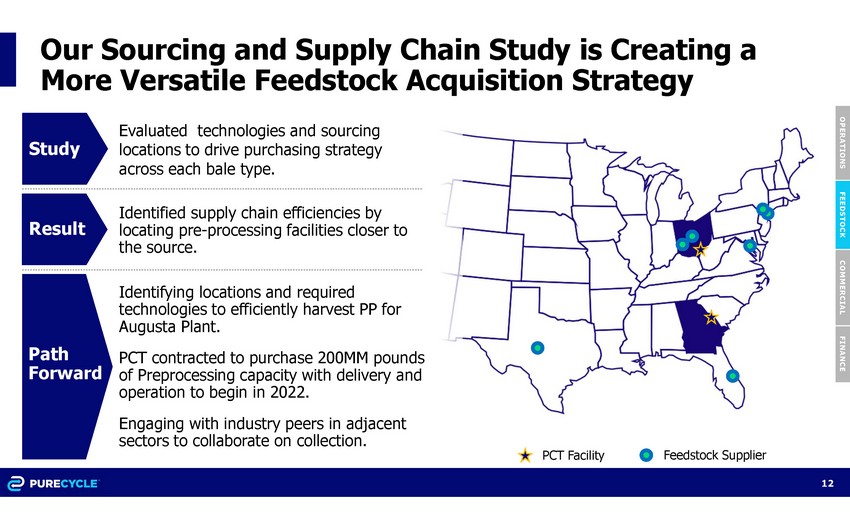

Our Sourcing and Supply Chain Study is Creating a More Versatile Feedstock Acquisition Strategy O PER A T I ON S F E ED ST O C K COMMERCIAL FINANCE Evaluated technologies and sourcing locations to drive purchasing strategy across each bale type. Identified supply chain efficiencies by locating pre - processing facilities closer to the source. Identifying locations and required technologies to efficiently harvest PP for Augusta Plant. PCT contracted to purchase 200 MM pounds of Preprocessing capacity with delivery and operation to begin in 2022 . Engaging with industry peers in adjacent sectors to collaborate on collection. Path F o r w a r d Result S t u dy Feedstock Supplier 12 PCT Facility

Our Resin Delivers: Exceptional Clarity O PER A T I ON S F E ED ST O C K COMMERCIAL FINANCE 13

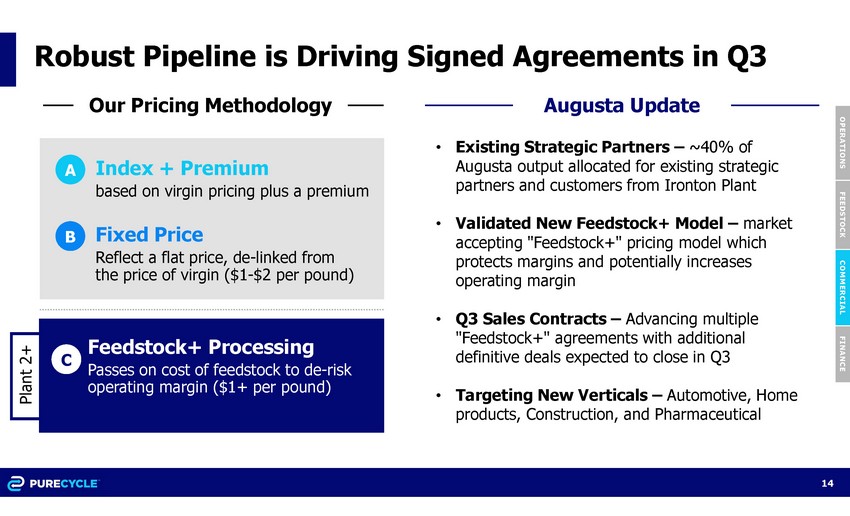

Robust Pipeline is Driving Signed Agreements in Q3 Index + Premium based on virgin pricing plus a premium A B Fixed Price Reflect a flat price, de - linked from the price of virgin ($1 - $2 per pound) O PER A T I ON S F E ED ST O C K COMMERCIAL FINANCE Our Pricing Methodology Augusta Update • Existing Strategic Partners – ~40% of Augusta output allocated for existing strategic partners and customers from Ironton Plant • Validated New Feedstock+ Model – market accepting "Feedstock+" pricing model which protects margins and potentially increases operating margin • Q3 Sales Contracts – Advancing multiple "Feedstock+" agreements with additional definitive deals expected to close in Q3 • Targeting New Verticals – Automotive, Home products, Construction, and Pharmaceutical Plant 2+ C Feedstock+ Processing Passes on cost of feedstock to de - risk operating margin ($1+ per pound) 14

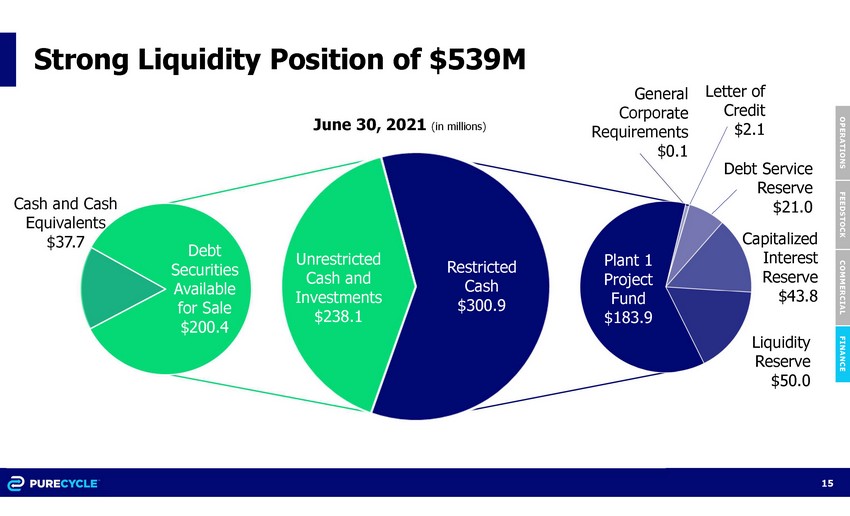

Strong Liquidity Position of $539M Debt Service R es e r ve $ 2 1 . 0 C a p i t a l i z e d I n t e r e s t R es e r ve $ 4 3 . 8 General a t e nts 0 . 1 O PER A T I ON S F E ED ST O C K COMMERCIAL FINANCE Li q u i d i t y R es e r ve $ 5 0 . 0 C o r po r Jun e 30 , 202 1 ( in m illions) R e q u i r e me $ Cash and Cash Equivalents $37.7 Letter of Cr e d it $ 2 . 1 Unrestricted Cash and I n v es t m e n t s $238.1 15 Debt S e c u r i t i e s Available for Sale $200.4 R es t r i c t e d Cash $300.9 Plant 1 Pr o j e c t Fund $183.9

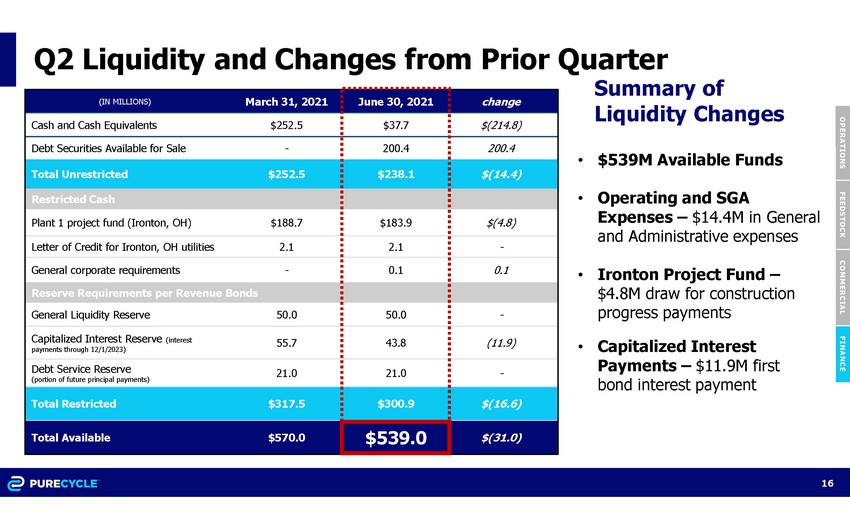

Q2 Liquidity and Changes from Prior Quarter O PER A T I ON S F E ED ST O C K COMMERCIAL FINANCE (IN MILLIONS) March 31, 2021 June 30, 2021 change Cash and Cash Equivalents $252.5 $37.7 $(214.8) Debt Securities Available for Sale - 200.4 200.4 Total Unrestricted $252.5 $238.1 $(14.4) Restricted Cash Plant 1 project fund (Ironton, OH) $188.7 $183.9 $(4.8) Letter of Credit for Ironton, OH utilities 2.1 2.1 - General corporate requirements - 0.1 0.1 Reserve Requirements per Revenue Bonds General Liquidity Reserve 50.0 50.0 - Capitalized Interest Reserve (interest payments through 12/1/2023) 55.7 43.8 (11.9) Debt Service Reserve (portion of future principal payments) 21.0 21.0 - Total Restricted $317.5 $300.9 $(16.6) Total Available $570.0 $539.0 $(31.0) Summary of Liquidity Changes • $539M Available Funds • Operating and SGA Expenses – $14.4M in General and Administrative expenses • Ironton Project Fund – $4.8M draw for construction progress payments • Capitalized Interest Payments – $11.9M first bond interest payment 16

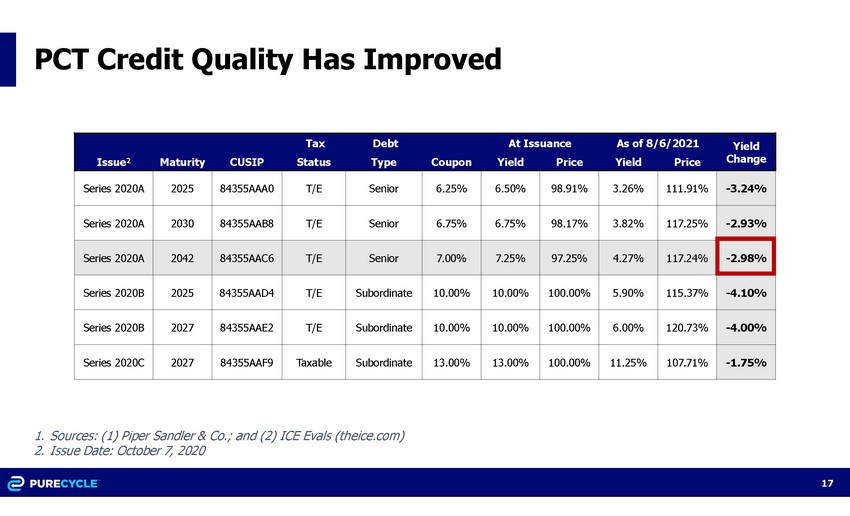

PCT Credit Quality Has Improved 17 1.Sources:(1)PiperSandler&Co.;and(2)ICEEvals(theice.com) 2.IssueDate:October7,2020 Tax Debt At Issuance As of 8/6/2021 Yield Issue 2 Maturity CUSIP Status Type Coupon Yield Price Yield Price Change Series 2020A 2025 84355AAA0 T/E Senior 6.25% 6.50% 98.91% 3.26% 111.91% - 3.24% Series 2020A 2030 84355AAB8 T/E Senior 6.75% 6.75% 98.17% 3.82% 117.25% - 2.93% Series 2020A 2042 84355AAC6 T/E Senior 7.00% 7.25% 97.25% 4.27% 117.24% - 2.98% Series 2020B 2025 84355AAD4 T/E Subordinate 10.00% 10.00% 100.00% 5.90% 115.37% - 4.10% Series 2020B 2027 84355AAE2 T/E Subordinate 10.00% 10.00% 100.00% 6.00% 120.73% - 4.00% Series 2020C 2027 84355AAF9 Taxable Subordinate 13.00% 13.00% 100.00% 11.25% 107.71% - 1.75%

PureCycle is Delivering on Our Commitments 18 1 2 3 4 5 6 7 8 9 1 0 Ironton is on - track and fully funded Augusta selected for five lines totaling up to 650M pounds capacity Market is accepting “ Feedstock+” pricing model ~40% of Augusta capacity is allocated to existing customers Signed Feedstock LOI for up to 80M annually ; more to come Feedstock Preprocessing identifying smarter supply chain strategies FDA No Objection Letter "NOL" to be filed this quarter Executing JV strategy across Asia Pacific Initiating the Augusta project finance strategy this quarter Management laser focused on Plant 1 commissioning in Ironton

1 1 9 9 One Goal, A Pure Planet.