| PROSPECTUS SUPPLEMENT NO. 3 |

Filed Pursuant to Rule 424(b)(3) |

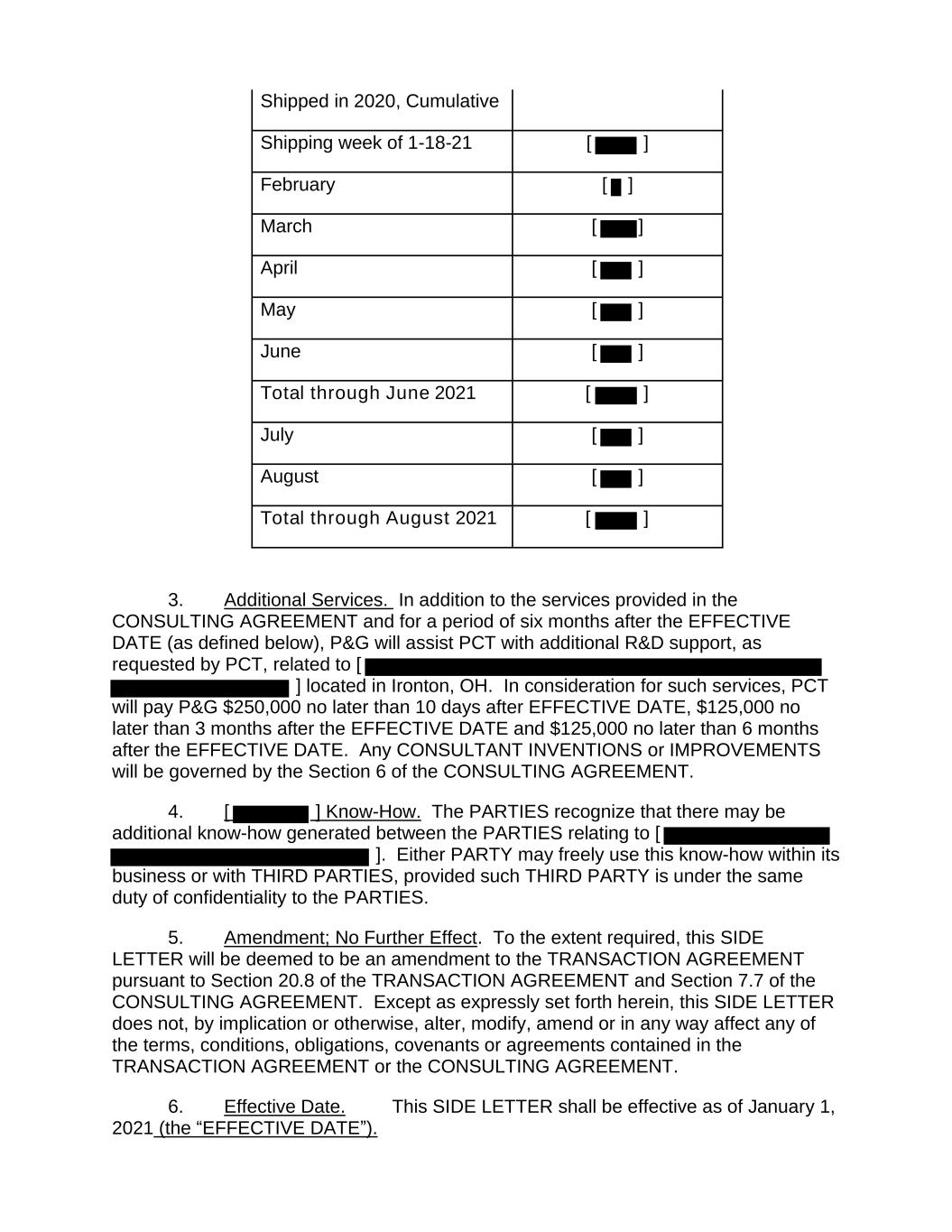

| (to prospectus dated March 19, 2021) |

Registration No. 333-251034 |

PURECYCLE TECHNOLOGIES, INC.

25,000,000 Shares

Common Stock

This prospectus supplement is being filed to update

and supplement the information contained in the prospectus dated March 19, 2021 (as supplemented or amended from time to time, the “Prospectus”),

with the information contained in our Quarterly Report on Form 10-Q, which was filed with the Securities and Exchange Commission (“SEC”)

on May 19, 2021 (the “Quarterly Report”). Accordingly, we have attached the Quarterly Report to this prospectus supplement.

The Prospectus and this prospectus supplement relate

to the resale from time to time of up to 25,000,000 shares of our common stock, par value $0.001 per share (“Common Stock”),

issued pursuant to the terms of those certain subscription agreements entered into (the “PIPE Investment”) in connection with

the Business Combination (as defined in the Prospectus). As described in the Prospectus, the selling securityholders named therein or

their permitted transferees (collectively, the “Selling Stockholders”), may sell from time to time up to 25,000,000 shares

of our Common Stock that were issued to the Selling Stockholders in connection with the closing of the PIPE Investment and the Business

Combination.

This prospectus supplement updates and supplements

the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus,

including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there

is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this

prospectus supplement.

Our Common Stock, warrants and units are listed

on The Nasdaq Capital Market under the symbols “PCT,” “PCTTW” and “PCTTU,” respectively. On May 18,

2021, the closing price of our Common Stock was $13.39 per share.

Investing in our securities involves risks that

are described in the “Risk Factors” section beginning on page 23 of the Prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if the Prospectus or this prospectus

supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is May

19, 2021.

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

(Mark One)

|

|

|

|

|

|

| ☒ |

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the quarterly period ended March

31, 2021

OR

|

|

|

|

|

|

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

transition period from to

Commission

File Number 001-40234

PureCycle

Technologies, Inc.

(Exact

name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

| State |

|

86-2293091 |

|

Delaware |

|

(I.R.S.

Employer

Identification

Number) |

5950

Hazeltine National Drive, Suite

650

Orlando,

Florida

32822

(877)

648-3565

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Securities

registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title

of each class |

|

Trading

Symbols |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

PCT |

|

The

Nasdaq Stock Market LLC |

| Warrants,

each exercisable for one share of common stock, $0.001 par value, at an exercise price of $11.50 per share |

|

PCTTW |

|

The

Nasdaq Stock Market LLC |

| Units,

each consisting of one share of common stock, $0.001 par value, and three quarters of one warrant |

|

PCTTU |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☐ No

☒

Indicate

by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was

required to submit such files). Yes

☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

|

|

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes ☐

No ☒

As

of May 19, 2021, there were approximately 117,349,281

shares of the registrant's common stock outstanding, par value $0.001 per share, outstanding.

PureCycle

Technologies, Inc.

QUARTERLY

REPORT on FORM 10-Q

TABLE

OF CONTENTS

|

|

|

|

|

|

|

Page |

|

PART I - Financial Information |

|

|

|

| Item

1. Financial Statements |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PureCycle

Technologies, Inc.

PART

I - FINANCIAL INFORMATION (CONTINUED)

CAUTIONARY

STATEMENT ON FORWARD-LOOKING STATEMENTS

This Quarterly Report

on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities

Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including statements

about the outcome of any legal proceedings to which PCT is, or may become a party; the anticipated benefits of the Business Combination,

and the financial condition, results of operations, earnings outlook and prospects of PCT. Forward-looking statements generally relate

to future events or our future financial or operating performance and may refer to projections and forecasts. Forward-looking statements

are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,”

“outlook,” “estimate,” “forecast,” “project,” “continue,” “could,”

“may,” “might,” “possible,” “potential,” “predict,” “should,”

“would” and other similar words and expressions (or the negative versions of such words or expressions), but the absence of

these words does not mean that a statement is not forward-looking.

The forward-looking statements

are based on the current expectations of the management of PCT and are inherently subject to uncertainties and changes in circumstances

and their potential effects and speak only as of the date of this Quarterly Report on Form 10-Q. There can be no assurance that future

developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other

assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking

statements. These risks and uncertainties include, but are not limited to, those factors described in the section of this Quarterly Report

on Form 10-Q entitled “Risk Factors,” those discussed and identified in public filings made with the SEC by PCT and the following:

• PCT's

ability to meet, and to continue to meet, applicable regulatory requirements for the use of PCT’s UPRP (as defined below) in food

grade applications (both in the United States and abroad);

• PCT's

ability to comply on an ongoing basis with the numerous regulatory requirements applicable to the UPRP and PCT’s facilities (both

in the United States and abroad);

• Expectations

and changes regarding PCT’s strategies and future financial performance, including its future business plans, expansion plans or

objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market

trends, liquidity, cash flows and uses of cash, capital expenditures, and PCT’s ability to invest in growth initiatives;

• PCT’s

ability to scale and build the Ironton plant in a timely and cost-effective manner;

• PCT’s

ability to maintain exclusivity under the P&G license (as described below);

• the

implementation, market acceptance and success of PCT’s business model and growth strategy;

• the

success or profitability of PCT’s offtake arrangements;

• the

ability to source feedstock with a high polypropylene content;

• PCT’s

future capital requirements and sources and uses of cash;

• PCT’s

ability to obtain funding for its operations and future growth;

• developments

and projections relating to PCT’s competitors and industry;

• the

outcome of any legal proceedings to which PCT is, or may become, a party including recently filed

securities class action

cases;

• the

ability to recognize the anticipated benefits of the Business Combination;

PureCycle

Technologies, Inc.

PART

I - FINANCIAL INFORMATION (CONTINUED)

• unexpected

costs related to the Business Combination;

• geopolitical

risk and changes in applicable laws or regulations;

• the

possibility that PCT may be adversely affected by other economic, business, and/or competitive factors;

• operational

risk; and

• the

risk that the COVID-19 pandemic, and local, state, federal and international responses to addressing the pandemic may have an adverse

effect on PCT’s business operations, as well as PCT’s financial condition and results of operations.

We undertake no obligation

to update any forward-looking statements made in this Quarterly Report on Form 10-Q to reflect events or circumstances after the date

of this Quarterly Report on Form 10-Q or to reflect new information or the occurrence of unanticipated events, except as required by law.

Should one or more of

these risks or uncertainties materialize or should any of the assumptions made prove incorrect, actual results may vary in material respects

from those projected in these forward-looking statements. You should not rely upon forward-looking statements as predictions of future

events.

PureCycle

Technologies, Inc.

CONDENSED

CONSOLIDATED BALANCE SHEETS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

| ASSETS |

| (in

thousands except per share data) |

March

31, 2021 |

|

December

31, 2020 |

| CURRENT

ASSETS |

|

|

|

| Cash |

$ |

252,549 |

|

|

$ |

64,492 |

|

| Prepaid

royalties and licenses |

4,575 |

|

|

2,890 |

|

| Prepaid

expenses and other current assets |

2,216 |

|

|

446 |

|

| Total

current assets |

259,340 |

|

|

67,828 |

|

| Restricted

cash |

317,535 |

|

|

266,082 |

|

| Property,

plant and equipment, net |

108,388 |

|

|

70,218 |

|

| TOTAL

ASSETS |

$ |

685,263 |

|

|

$ |

404,128 |

|

|

|

|

|

| LIABILITIES

AND STOCKHOLDERS’ EQUITY |

|

|

|

|

| CURRENT

LIABILITIES |

|

|

|

| Accounts

payable |

$ |

1,481 |

|

|

$ |

1,058 |

|

| Accrued

expenses |

18,452 |

|

|

26,944 |

|

| Accrued

interest |

10,428 |

|

|

4,951 |

|

| Notes

payable – current |

265 |

|

|

122 |

|

| Total

current liabilities |

30,626 |

|

|

33,075 |

|

| NON-CURRENT

LIABILITIES |

|

|

|

| Deferred

research and development obligation |

1,000 |

|

|

1,000 |

|

| Deferred

revenue |

5,000 |

|

|

— |

|

| Notes

payable |

57,224 |

|

|

26,477 |

|

| Bonds

payable |

231,809 |

|

|

235,676 |

|

| Warrant

liability |

18,258 |

|

|

— |

|

| TOTAL

LIABILITIES |

$ |

343,917 |

|

|

$ |

296,228 |

|

|

|

|

|

| COMMITMENT

AND CONTINGENCIES |

— |

|

|

— |

|

|

|

|

|

| STOCKHOLDERS'

EQUITY |

|

|

|

|

Common

shares - $0.001

par value, 250,000

shares authorized; 117,349

and 0

shares issued and outstanding as of March 31, 2021 and 2020, respectively |

117 |

|

|

— |

|

|

Class

A Units - no

par value; 0

and 3,981

units authorized; 0

and 3,612

units issued and outstanding as of March 31, 2021 and December 31, 2020 |

— |

|

|

38 |

|

|

Class

B Preferred Units - no

par value; 0

and 1,938

units authorized; 0

and 1,938

units issued and outstanding as of March 31, 2021 and December 31, 2020 |

— |

|

|

21 |

|

|

Class

B-1 Preferred Units - no

par value; 0

and 1,146

units authorized, 0

and 1,105

units issued and outstanding as of March 31, 2021 and December 31, 2020 |

— |

|

|

16 |

|

|

Class

C Units – no

par value; 0

and 1,069

units authorized, 0

and 865

units issued and 0

and 775

units outstanding as of March 31, 2021 and December 31, 2020 |

— |

|

|

7 |

|

| Additional

paid-in capital |

455,475 |

|

|

192,381 |

|

| Accumulated

deficit |

(114,246) |

|

|

(84,563) |

|

PureCycle

Technologies, Inc.

CONDENSED

CONSOLIDATED BALANCE SHEETS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL

STOCKHOLDERS' EQUITY |

341,346 |

|

|

107,900 |

|

| TOTAL

LIABILITIES AND STOCKHOLDERS’ EQUITY |

$ |

685,263 |

|

|

$ |

404,128 |

|

The

accompanying notes are an integral part of these financial statements.

PureCycle

Technologies, Inc.

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Three

months ended March 31, |

|

2021 |

|

2020 |

| (in

thousands except per share data) |

|

|

|

| Costs

and expenses |

|

|

|

| Operating

costs |

$ |

2,130 |

|

|

$ |

1,683 |

|

| Research

and development |

547 |

|

|

348 |

|

| Selling,

general and administrative |

7,624 |

|

|

1,238 |

|

| Total

operating costs and expenses |

10,301 |

|

|

3,269 |

|

| Interest

expense |

6,089 |

|

|

588 |

|

| Change

in fair value of warrants |

13,621 |

|

|

655 |

|

| Other

expense |

109 |

|

|

52 |

|

| Total

other expense |

19,819 |

|

|

1,295 |

|

| Net

loss |

$ |

(30,120) |

|

|

$ |

(4,564) |

|

| Loss

per share |

|

|

|

| Basic

and diluted |

$ |

(0.59) |

|

|

$ |

(0.19) |

|

| Weighted

average common shares |

|

|

|

| Basic

and diluted |

51,223 |

|

|

27,156 |

|

The

accompanying notes are an integral part of these financial statements.

PureCycle

Technologies, Inc.

CONDENSED

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

the Three Months Ended March 31, 2021 |

|

Common

stock |

|

Class

A |

|

Class

B Preferred |

|

Class

B-1 Preferred |

|

Class

C |

|

|

|

|

|

|

| (in

thousands) |

Shares |

|

Amount |

|

Units |

|

Amount |

|

Units |

|

Amount |

|

Units |

|

Amount |

|

Units |

|

Amount |

|

Additional

paid-in capital |

|

Accumulated

deficit |

|

Total

stockholders' equity |

| Balance,

December 31, 2020 |

— |

|

|

$ |

— |

|

|

3,612 |

|

|

$ |

88,081 |

|

|

1,938 |

|

|

$ |

20,071 |

|

|

1,105 |

|

|

$ |

41,162 |

|

|

775 |

|

|

$ |

11,967 |

|

|

$ |

31,182 |

|

|

$ |

(84,563) |

|

|

$ |

107,900 |

|

| Conversion

of stock |

— |

|

|

— |

|

|

34,386 |

|

|

(88,043) |

|

|

18,690 |

|

|

(20,050) |

|

|

15,217 |

|

|

(41,146) |

|

|

5,936 |

|

|

(11,960) |

|

|

161,199 |

|

|

— |

|

|

$ |

— |

|

| Balance

at December 31, 2020, effect of reverse recapitalization conversion |

— |

|

|

$ |

— |

|

|

37,998 |

|

|

$ |

38 |

|

|

20,628 |

|

|

$ |

21 |

|

|

16,322 |

|

|

$ |

16 |

|

|

6,711 |

|

|

$ |

7 |

|

|

$ |

192,381 |

|

|

$ |

(84,563) |

|

|

$ |

107,900 |

|

| Issuance

of units upon vesting of Legacy PCT profits interests |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

116 |

|

|

— |

|

|

239 |

|

|

— |

|

|

239 |

|

| Redemption

of vested profit units |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(5) |

|

|

— |

|

|

(36) |

|

|

— |

|

|

(36) |

|

|

Removal of beneficial conversion

feature upon adoption of ASU 2020-06 |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(31,075) |

|

|

437 |

|

|

(30,638) |

|

| Merger

Recapitalization |

81,754 |

|

|

82 |

|

|

(37,998) |

|

|

(38) |

|

|

(20,628) |

|

|

(21) |

|

|

(16,322) |

|

|

(16) |

|

|

(6,822) |

|

|

(7) |

|

|

— |

|

|

— |

|

|

— |

|

|

ROCH Shares Recapitalized,

Net of Redemptions, Warrant Liability and Issuance Costs of $27.9

million |

34,823 |

|

|

35 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

293,931 |

|

|

— |

|

|

293,966 |

|

| Issuance

of restricted stock awards |

775 |

|

|

1 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(1) |

|

|

— |

|

|

— |

|

| Forfeiture

of restricted stock |

(3) |

|

|

(1) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1 |

|

|

— |

|

|

— |

|

| Reclassification

of redeemable warrant to liability |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(33) |

|

|

— |

|

|

(33) |

|

| Equity

based compensation |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

68 |

|

|

— |

|

|

68 |

|

| Net

loss |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(30,120) |

|

|

(30,120) |

|

| Balance,

March 31, 2021 |

117,349 |

|

|

$ |

117 |

|

|

— |

|

|

$ |

— |

|

|

— |

|

|

$ |

— |

|

|

— |

|

|

$ |

— |

|

|

— |

|

|

$ |

— |

|

|

$ |

455,475 |

|

|

$ |

(114,246) |

|

|

$ |

341,346 |

|

PureCycle

Technologies, Inc.

CONDENSED

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

the Three Months Ended March 31, 2020 |

|

Common

stock |

|

Class

A |

|

Class

B Preferred |

|

Class

B-1 Preferred |

|

Class

C |

|

|

|

|

|

|

| (in

thousands) |

Shares |

|

Amount |

|

Units |

|

Amount |

|

Units |

|

Amount |

|

Units |

|

Amount |

|

Units |

|

Amount |

|

Additional

paid-in capital |

|

Accumulated

deficit |

|

Total

stockholders' equity |

| Balance,

December 31, 2019 |

— |

|

|

$ |

— |

|

|

2,581 |

|

|

$ |

387 |

|

|

1,728 |

|

|

$ |

1,898 |

|

|

630 |

|

|

$ |

23,656 |

|

|

436 |

|

|

$ |

4,054 |

|

|

$ |

107 |

|

|

$ |

(27,722) |

|

|

$ |

2,380 |

|

| Conversion

of stock |

— |

|

|

— |

|

|

24,575 |

|

|

(360) |

|

|

16,660 |

|

|

(1,880) |

|

|

8,670 |

|

|

(23,647) |

|

|

3,625 |

|

|

(4,050) |

|

|

29,937 |

|

|

— |

|

|

— |

|

| Balance

at December 31, 2019, effect of reverse recapitalization conversion |

— |

|

|

— |

|

|

27,156 |

|

|

$ |

27 |

|

|

18,388 |

|

|

$ |

18 |

|

|

9,300 |

|

|

$ |

9 |

|

|

4,061 |

|

|

$ |

4 |

|

|

$ |

30,044 |

|

|

$ |

(27,722) |

|

|

$ |

2,380 |

|

| Issuance

of units |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

4,578 |

|

|

5 |

|

|

— |

|

|

— |

|

|

11,569 |

|

|

— |

|

|

11,574 |

|

| Issuance

of units upon vesting of profits interests |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

362 |

|

|

— |

|

|

417 |

|

|

— |

|

|

417 |

|

| Net

loss |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(4,564) |

|

|

(4,564) |

|

| Balance,

March 31, 2020 |

— |

|

|

$ |

— |

|

|

27,156 |

|

|

$ |

27 |

|

|

18,388 |

|

|

$ |

18 |

|

|

13,878 |

|

|

$ |

14 |

|

|

4,423 |

|

|

$ |

4 |

|

|

$ |

42,030 |

|

|

$ |

(32,286) |

|

|

$ |

9,807 |

|

The

accompanying notes are an integral part of these financial statements.

PureCycle

Technologies, Inc.

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Three

months ended March 31, |

| (in

thousands) |

2021 |

|

2020 |

| Cash

flows from operating activities |

|

|

|

| Net

loss |

$ |

(30,120) |

|

|

$ |

(4,564) |

|

| Adjustments

to reconcile net loss to net cash used in operating activities |

|

|

|

| Equity-based

compensation |

307 |

|

|

417 |

|

| Fair

value change of warrants |

13,621 |

|

|

655 |

|

| Depreciation

expense |

490 |

|

|

465 |

|

| Accretion

of debt instrument discounts |

57 |

|

|

— |

|

| Amortization

of debt issuance costs |

784 |

|

|

— |

|

| Issuance

costs attributable to warrants |

109 |

|

|

— |

|

| Changes

in operating assets and liabilities |

|

|

|

| Prepaid

expenses and other current assets |

(1,770) |

|

|

(69) |

|

| Prepaid

royalties and licenses |

(1,685) |

|

|

— |

|

| Accounts

payable |

423 |

|

|

(987) |

|

| Accrued

expenses |

(13,037) |

|

|

(78) |

|

| Accrued

interest |

5,253 |

|

|

(758) |

|

| Deferred

revenue |

5,000 |

|

|

— |

|

| Net

cash used in operating activities |

$ |

(20,568) |

|

|

$ |

(4,919) |

|

| Cash

flows from investing activities |

|

|

|

| Construction

of plant |

(33,891) |

|

|

(763) |

|

| Net

cash used in investing activities |

$ |

(33,891) |

|

|

$ |

(763) |

|

| Cash

flows from financing activities |

|

|

|

| Proceeds

from secured term loan |

— |

|

|

— |

|

| Proceeds

from promissory note |

91 |

|

|

— |

|

| Payments

on promissory note from related parties |

— |

|

|

(600) |

|

| Payments

on advances from related parties |

— |

|

|

(2,333) |

|

| Proceeds

from ROCH and PIPE financing, net of issuance costs |

298,461 |

|

|

— |

|

| Convertible

notes issuance costs |

(480) |

|

|

— |

|

| Bond

issuance costs |

(4,067) |

|

|

— |

|

| Proceeds

from issuance of units |

— |

|

|

11,574 |

|

| Payments

on redemption of vested Legacy PCT profit interests |

(36) |

|

|

— |

|

| Net

cash provided by financing activities |

$ |

293,969 |

|

|

$ |

8,641 |

|

| Net

increase in cash |

239,510 |

|

|

2,959 |

|

| Cash,

beginning of period |

330,574 |

|

|

150 |

|

| Cash,

end of period |

$ |

570,084 |

|

|

$ |

3,109 |

|

| Supplemental

disclosure of cash flow information |

|

|

|

| Non-cash

operating activities |

|

|

|

| Interest

paid during the period, net of capitalized interest |

$ |

— |

|

|

$ |

456 |

|

| Non-cash

investing activities |

|

|

|

| Additions

to property, plant, and equipment in accrued expenses |

$ |

16,437 |

|

|

$ |

280 |

|

| Additions

to property, plant, and equipment in accrued interest |

$ |

224 |

|

|

$ |

12 |

|

| Non-cash

financing activities |

|

|

|

| Conversion

of accounts payable to promissory notes |

$ |

— |

|

|

$ |

661 |

|

| Initial

fair value of acquired warrant liability |

$ |

4,604 |

|

|

$ |

— |

|

The

accompanying notes are an integral part of these financial statements.

PureCycle

Technologies, Inc.

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

@

NOTE

1 - ORGANIZATION

Formation

and Organization

PureCycle

Technologies, Inc. (“PureCycle,” “PCT” or the “Company”) is headquartered in Orlando, Florida, and

its planned principal operation is to conduct business as a plastics recycler using PureCycle’s patented recycling process. Developed

and licensed by Procter & Gamble (“P&G”), the patented recycling process separates color, odor and other contaminants

from plastic waste feedstock to transform it into virgin-like resin. The Company is currently constructing its first planned facility

and conducting research and development activities to operationalize the licensed technology.

Business

Combination

On

March 17, 2021, PureCycle consummated the previously announced business combination (“Business Combination”) by and among

Roth CH Acquisition I Co., a Delaware corporation (“ROCH”), Roth CH Acquisition I Co. Parent Corp., a Delaware corporation

and wholly owned direct subsidiary of ROCH (“ParentCo”), Roth CH Merger Sub LLC, a Delaware limited liability company and

wholly owned direct subsidiary of Parent Co (“Merger Sub LLC”), Roth CH Merger Sub Corp., a Delaware corporation and wholly

owned direct subsidiary of Parent Co (“Merger Sub Corp”) and PureCycle Technologies LLC (“PCT LLC”) pursuant to

the Agreement and Plan of Merger dated as of November 16, 2020, as amended from time to time (the “Merger Agreement”).

Immediately

upon the completion of the Business Combination and the other transactions contemplated by the Merger Agreement (the “Transactions”,

and such completion, the “Closing”), ROCH changed its name to PureCycle Technologies Holdings Corp. and became a wholly owned

direct subsidiary of ParentCo, PCT LLC became a wholly owned direct subsidiary of PureCycle Technologies Holdings Corp. and a wholly owned

indirect subsidiary of ParentCo, and ParentCo changed its name to PureCycle Technologies, Inc. The Company’s common stock, units

and warrants are now listed on the Nasdaq Capital Market (“NASDAQ”) under the symbols “PCT,” “PCTTU”

and “PCTTW,” respectively.

In

connection with the Business Combination, ROCH entered into subscription agreements with certain investors (the “PIPE Investors”),

whereby it issued 25.0 million

shares of common stock at $10.00

per share (the “PIPE Shares”) for an aggregate purchase price of $250.0 million

(the “PIPE Financing”), which closed simultaneously with the consummation of the Business Combination. Upon the Closing of

the Business Combination, the PIPE Investors were issued shares of the Company’s common stock.

Legacy

PCT unitholders will be issued up to 4.0 million

additional shares of the Company’s common stock if certain conditions are met (“the Earnout”). The Legacy PCT unitholders

will be entitled to 2.0 million

shares if after six

months after the Closing and prior to or as of the third anniversary of the Closing, the closing price of the common stock

is greater than or equal to $18.00

over any 20

trading days within any 30-trading

day period. The Legacy PCT unitholders will be entitled to 2.0 million

shares upon the Phase II Facility becoming operational, as certified by Leidos Engineering, LLC (“Leidos”), an independent

engineering firm, in accordance with criteria established in agreements in connection with construction of the plant.

In

connection with the Business Combination, the Company incurred direct and incremental costs of approximately $27.9 million

related to the equity issuance, consisting primarily of investment banking and other professional fees, which were recorded to additional

paid-in capital as a reduction of proceeds.

The

Company incurred approximately $5.2 million

of expenses primarily related to advisory, legal, and accounting fees in conjunction with the Business Combination. Of this, $3.2 million

was recorded in general and administrative expenses on the consolidated statement of operations for the three months ended March 31, 2021.

Unless

the context otherwise requires, “Registrant,” “PureCycle,” “Company,” “PCT,” “we,”

“us,” and “our” refer to PureCycle Technologies, Inc., and its subsidiaries at and after the Closing and give

effect to the Closing. “Legacy PCT”, “ROCH” and “ParentCo” refer to PureCycle Technologies LLC, ROCH

and ParentCo, respectively, prior to the Closing.

PureCycle

Technologies, Inc.

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(Unaudited)

PureCycle

Technologies LLC was formed as a Delaware limited liability company on September 15, 2015 as Advanced Resin Technologies, LLC. In November

2016, Advanced Resin Technologies, LLC changed its name to PureCycle Technologies LLC.

The

aggregate consideration for the Business Combination was $1,156.9 million,

payable in the form of shares of the ParentCo Common Stock and assumed indebtedness.

The

following summarizes the merger consideration (in thousands except per share information):

|

|

|

|

|

|

| Total

shares transferred |

83,500 |

|

| Value

per share |

$ |

10.00 |

|

| Total

Share Consideration |

$ |

835,000 |

|

| Assumed

indebtedness |

|

| Revenue

Bonds |

249,600 |

|

| The

Convertible Notes |

60,000 |

|

| Term

Loan |

314 |

|

| Related

Party Promissory Note |

12,000 |

|

| Total

merger consideration |

$ |

1,156,914 |

|

The

following table reconciles the elements of the Business Combination to the condensed consolidated statement of cash flows for the three

months ended March 31, 2021 (in thousands):

|

|

|

|

|

|

| Cash

- ROCH Trust and cash (net of redemptions) |

$ |

76,510 |

|

| Cash

- PIPE |

250,000 |

|

| Less

transaction costs |

(28,049) |

|

| Net

Business Combination and PIPE financing |

$ |

298,461 |

|

In

addition to cash received by the Company at the Close of the Business Combination, the Company assumed a warrant liability from ROCH measured

at $4.6 million

at March 18, 2021.

Refer

to Note 6 – Warrants for further information.

Basis

of Presentation

The

accompanying condensed consolidated interim financial statements include the accounts of the Company. The condensed consolidated interim

financial statements are presented in U.S. Dollars. Certain information in footnote disclosures normally included in annual financial

statements was condensed or omitted for the interim periods presented in accordance with the rules and regulations of the Securities and

Exchange Commission (the “SEC”) and accounting principles generally accepted in the United States of America (“U.S.

GAAP”). Intercompany balances and transactions were eliminated upon consolidation. These condensed consolidated interim financial

statements should be read in conjunction with the consolidated financial statements and accompanying notes of Legacy PCT for the fiscal

year ended December 31, 2020 as filed on March 22, 2021 in our prospectus filed pursuant to Rule 424(b)(3) of the Securities Act.

The results of operations for the three months ended March 31, 2021 are not necessarily indicative of the results to be expected for the

entire year ending December 31, 2021. The accompanying condensed consolidated interim financial statements reflect all adjustments,

consisting of normal recurring adjustments, that are, in the opinion of management, necessary to present a fair statement of the results

for the interim periods presented.

Reclassifications

PureCycle

Technologies, Inc.

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(Unaudited)

Certain

amounts in prior periods have been reclassified to conform with the report classifications of the three months ended March 31, 2021, noting

the Company has reflected the reverse recapitalization pursuant to the Business Combination for all periods presented within the unaudited

condensed consolidated balance sheets and statements of stockholders’ equity.

Reverse

Recapitalization

The

Business Combination was accounted for as a reverse recapitalization and ROCH was treated as the “acquired” company for accounting

purposes. The Business Combination was accounted as the equivalent of Legacy PCT issuing stock for the net assets of ROCH, accompanied

by a recapitalization. Accordingly, all historical financial information presented in these condensed consolidated interim financial statements

represents the accounts of Legacy PCT “as if” Legacy PCT is the predecessor to the Company. The units and net loss per unit,

prior to the Business Combination, have been adjusted to share amounts reflecting the exchange ratio established in the Business Combination.

Potential

Impact of COVID-19 on the Company’s Business

With

the global spread of the COVID-19 pandemic and resulting shelter-in-place orders covering the Company’s corporate headquarters,

its Ohio plant operations, and employees, the Company has implemented policies and procedures to continue its operations under minimum

business operations guidelines. The extent to which the COVID-19 pandemic impacts the Company’s business, financial condition or

results of operations will depend on future developments, which are highly uncertain and cannot be accurately predicted.

Liquidity

The

Company has sustained recurring losses and negative cash flows from operations since its inception. As reflected in the accompanying condensed

consolidated interim financial statements, the Company has not yet begun commercial operations and does not have any sources of revenue.

In prior periods, substantial doubt was raised about the ability of Legacy PCT to continue as a going concern. The Company believes that

the total capital raised through the Business Combination is sufficient to adequately fund its future obligations for at least one year

from the date the condensed consolidated interim financial statements are available to be issued. As of March 31, 2021, and December 31,

2020, the Company had an unrestricted cash balance of $252.5

million and $64.5

million, respectively, working capital of $228.7

million and $34.8

million, respectively, and an accumulated deficit of $114.2

million and $84.6

million, respectively. For the three months ended March 31, 2021 and 2020, the Company incurred a net loss of $30.1

million and $4.6

million.

Emerging

Growth Company

At

March 31, 2021, we qualified as an “emerging growth company,” as defined in Section 2(a) of the Securities Act, as modified

by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), and we have taken and may take advantage of certain exemptions

from various reporting requirements that are applicable to other public companies that are not emerging growth companies including, but

not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002,

reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the

requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments

not previously approved.

Section

102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards

until private companies are required to comply with the new or revised standards. The JOBS Act provides that an emerging growth company

can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but

any such election to opt out is irrevocable. We have opted to take advantage of such extended transition period available to emerging

growth companies which means that when a standard is issued or revised and it has different application dates for public or private companies,

we can adopt the new or revised standard at the time private companies adopt the new or revised standard.

NOTE

2 - SUMMARY

OF SIGNIFICANT ACCOUNTING POLICIES

PureCycle

Technologies, Inc.

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(Unaudited)

Income

Taxes

To

calculate the interim tax provision, at the end of each interim period the Company estimates the annual effective tax rate and applies

that to its ordinary quarterly earnings. The effect of changes in the enacted tax laws or rates is recognized in the interim period in

which the change occurs. The computation of the annual estimated effective tax rate at each interim period requires certain estimates

and judgments including, but not limited to, the expected operating income for the year, projections of the proportion of income earned

and taxed in other jurisdictions, permanent differences between book and tax amounts, and the likelihood of recovering deferred tax assets

generated in the current year. The accounting estimates used to compute the provision for income taxes may change as new events occur,

additional information is obtained, or the tax environment changes.

Furthermore,

in December 2019, the FASB issued ASU No. 2019-12, Income

Taxes: Simplifying the Accounting for Income Taxes

(“ASU 2019-12”). The new guidance affects general principles within Topic 740, Income

Taxes. The amendments

of ASU 2019-12 are meant to simplify and reduce the cost of accounting for income taxes. The Company adopted the ASU during the first

quarter of 2021 using a prospective approach. The adoption of the ASU did not have a material impact on the Company’s condensed

consolidated financial statements.

Warrants

The Company evaluates

all of its financial instruments, including issued warrants, to determine if such instruments are liability classified, pursuant to ASC

480 - Distinguishing

Liabilities from Equity

(“ASC 480”) or derivatives or contain features that qualify as embedded derivatives pursuant to ASC 815 – Derivatives

and Hedging (“ASC

815”). The classification of instruments, including whether such instruments should be recorded as liabilities or as equity, is

re-assessed at the end of each reporting period. Issuance costs incurred with the Business Combination that are attributable to liability

classified warrants are expensed as incurred.

Recently

Issued Accounting Pronouncements

In

February 2016, the FASB issued ASU 2016-02, Leases

(Topic 842), to increase transparency and comparability among organizations by recognizing lease assets and lease liabilities on the balance

sheet and disclosing key information about leasing arrangements. In July 2018, ASU 2018-10, Codification

Improvements to Topic 842,

Leases,

was issued to provide more detailed guidance and additional clarification for implementing ASU 2016-02. Furthermore, in July 2018, the

FASB issued ASU 2018-11, Leases

(Topic 842): Targeted Improvements,

which provides an optional transition method in addition to the existing modified retrospective transition method by allowing a cumulative

effect adjustment to the opening balance of retained earnings in the period of adoption. Furthermore, on June 3, 2020, the FASB deferred

by one year the effective date of the new leases standard for private companies, private not-for-profits (“NFPs”) and public

NFPs that have not yet issued (or made available for issuance) financial statements reflecting the new standard. These new leasing standards

are effective for the Company beginning after December 15, 2021 and interim periods within fiscal years beginning after December 15, 2022,

with early adoption permitted. The Company is currently evaluating the effect of the adoption of this guidance on the consolidated financial

statements.

In

June 2016, the FASB issued ASU 2016-13, Financial

Instruments—Credit Losses (Topic 326): Measurement of Credit Losses of Financial Instruments (“ASU

2016-13”), which, together with subsequent amendments, amends the requirement on the measurement and recognition of expected credit

losses for financial assets held. ASU 2016-13 is effective for the Company beginning December 15, 2022, including interim periods within

those fiscal years, with early adoption permitted. The Company is currently in the process of evaluating the effects of this pronouncement

on the Company's financial statements and does not expect it to have a material impact on the consolidated financial statements.

In

August 2020, the FASB issued ASU No. 2020-06, Debt

- Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging - Contracts in Entity’s Own Equity (Subtopic

815-40) (“ASU

2020-06”). ASU 2020-06 simplifies the accounting for convertible debt instruments and convertible preferred stock by removing the

existing guidance in ASC 470-20 that requires entities to account for beneficial conversion features and cash conversion features in equity,

separately from the host convertible debt or preferred stock. Two methods of transition were permitted upon adoption: full retrospective

and modified retrospective. The Company elected to apply the

PureCycle

Technologies, Inc.

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(Unaudited)

modified

retrospective adoption approach to all contracts. Under this approach, prior periods were not restated. Rather, convertible notes and

other disclosures for prior periods were provided in the notes to the financial statements as previously reported under ASC 470-20, and

the cumulative effect of initially applying the guidance was recognized as an adjustment to Notes payable, Additional paid-in-capital

(“APIC”), and Accumulated deficit.

As

a result of applying the modified retrospective method to adopt ASU 2020-06, adjustments were made to the consolidated balance sheets

as of December 31, 2020 and the below illustrates how the notes payable, APIC, and accumulated deficit balances would be effected as of

January 1, 2021 (in thousands, as adjusted to show the effect of the reverse recapitalization as described in Note 1):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December

31, 2020 |

|

January

1, 2021 |

|

|

As

reported |

Adjustments |

As

adjusted |

| Notes

payable |

|

$ |

26,599 |

|

$ |

30,638 |

|

$ |

57,237 |

|

| APIC |

|

192,381 |

|

(31,075) |

|

161,306 |

|

| Accumulated

deficit |

|

$ |

84,563 |

|

$ |

437 |

|

$ |

85,000 |

|

NOTE

3 – NOTES

PAYABLE AND DEBT INSTRUMENTS

Secured

Term Loan

Enhanced

Capital Ohio Rural Fund, LLC

On

February 28, 2019, Legacy PCT entered into a subordinated debt agreement with Enhanced Capital Ohio Rural Fund, LLC. The agreement provides

for principal of $1.0 million

with an interest rate of the U.S. Federal prime rate per annum.

As

of March 31, 2021, and December 31, 2020, the outstanding balance of the loan is $0.

On October 7, 2020, upon the closing of the bond offering, the full outstanding balance was paid off. Legacy PCT incurred $12 thousand

of interest cost during the three months ended March 31, 2020.

Promissory

Notes

Koch

Modular Process Systems Secured Promissory Note

On

December 20, 2019, Legacy PCT entered into an agreement with Koch Modular Process Systems LLC (“KMPS”) to convert the current

balance of Account Payable due to KMPS into a promissory note. Legacy PCT issued a Secured Promissory Note for a principal amount of $1.7 million

with a maximum advance of funds up to $3.0 million.

During the three months ended March 31, 2020, Legacy PCT converted $661

of Accounts Payable into the note. The rate of interest on the loan balance is 21%

per annum through the month of November 2019 and 24%

per annum for December 2019 and thereafter.

As

of March 31, 2021, and December 31, 2020, the outstanding balance on the promissory note is $0.

On October 7, 2020, upon the closing of the bond offering, the full outstanding balance was paid off. Legacy PCT incurred $102 thousand

of interest cost during the three months ended March 31, 2020.

Denham-Blythe

Company, Inc. Secured Promissory Note

On

December 20, 2019, Legacy PCT and Denham-Blythe Company, Inc. (“DB”) entered into an agreement to convert the current balance

of Account Payable due to DB into a promissory note. Legacy PCT issued a Secured Promissory Note for a principal amount of $2.0 million.

The rate of interest on the loan balance is 24%

per annum for December 2019 and thereafter with interest on the loan payable monthly.

As

of March 31, 2021 and December 31, 2020, the outstanding balance on the promissory note is $0.

On October 7, 2020, upon the closing of the bond offering, the full outstanding balance was paid off. Legacy PCT incurred $121 thousand

of interest cost during the three months ended March 31, 2020. As the promissory note was used to

PureCycle

Technologies, Inc.

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(Unaudited)

construct

the Company’s property, plant and equipment, a portion of the interest cost incurred was capitalized within Property, Plant and

Equipment.

Promissory

Note to Related Party

Innventus

Fund I, LP

On

July 19, 2019, Legacy PCT entered into a Note and Warrant Financing agreement with Innventus Fund I, LP to obtain a $600 thousand

loan and warrant financing. The Negotiable Promissory Note has a maturity date of October 21, 2019, and an interest rate of 1-month LIBOR

plus 8.0%.

The aggregate unpaid principal amount of the loan and all accrued and unpaid interest is due on the maturity date. Legacy PCT repaid the

principal and all accrued and unpaid interest on February 5, 2020. Legacy PCT incurred $5 thousand

of interest cost during the three months ended March 31, 2020.

Auto

Now Acceptance Company, LLC

On

May 5, 2017, Legacy PCT entered into a revolving line of credit facility (the “Credit Agreement”) with Auto Now Acceptance

Company, LLC, a related party.

On

May 3, 2018, the Credit Agreement was amended and restated in its entirety and secured by a Security Agreement dated May 3, 2018. The

credit facility was increased to $14.0 million,

bearing interest at a rate of LIBOR plus 6.12%

per annum, payable monthly. The maturity date was extended to August 15, 2018.

On

July 31, 2018, the Credit Agreement was amended to extend the maturity date to February 15, 2019. Under the agreement, the Auto Now’s

advances of funds to Legacy PCT ceased on July 31, 2018.

On

May 29, 2020, Legacy PCT executed a Second Amended and Restated the Security Agreement and entered into a Third Amended and Restated Promissory

Note agreement to extend the financing on the loan from Auto Now Acceptance Company, LLC. The agreement extended the maturity date of

the loan to June 31, 2021 and adjusted the interest rate on the third amended loan agreement. The security interests include inventory,

equipment, accounts receivables and all the Company’s assets. The interest rate within the amendment increased as follows:

•The

annual rate of the 1-month LIBOR in U.S. dollars plus 6.12%

adjusted daily, from May 3, 2018 through May 18, 2020

•12%

per annum from May 19, 2020 through August 31, 2020

•16%

per annum from September 1, 2020 through December 31, 2020

•24%

per annum from January 1, 2021 through June 30, 2021

As

of March 31, 2021, and December 31, 2020 the outstanding balance on the credit facility is $0.

On December 21, 2020, Legacy PCT repaid the outstanding balance on the note. Legacy PCT incurred $355 thousand

of interest cost during the three months ended March 31, 2020. As the promissory note was used to construct the Company’s property,

plant and equipment, a portion of the interest cost incurred was capitalized within Property, Plant and Equipment.

Advances

from Related Parties

During

2019 and 2020, Legacy PCT received funding and support services from Innventure1 LLC (formerly Innventure LLC) and Wasson Enterprises.

On March 26, 2020, $375 thousand

of the balance was repaid. The remaining balance of $371 thousand

was assigned from Wasson Enterprise to Innventure LLC (Formerly WE-Innventure LLC).

Convertible

Notes

On

October 6, 2020, Legacy PCT entered into a Senior Notes Purchase Agreement (the “Agreement”) with certain investors. The Agreement

provides for the issuance of Senior Convertible Notes (the “Notes”), which have an

PureCycle

Technologies, Inc.

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(Unaudited)

interest

rate of 5.875%

and mature on October 15, 2022 (the “Maturity Date”) and are subject to a six-month

maturity extension at the Company’s option with respect to 50%

of the then outstanding Notes on a pro rata basis, unless repurchased or converted prior to such date (“Maturity Date Extension”).

The initial closing took place on the date of Indenture on October 7, 2020 (the “First Closing”), upon which $48.0

million in aggregate principal of Notes were issued to the Investors (“the Magnetar Investors”). The Agreement also includes

an obligation for the Company to issue and sell, and for each of the Magnetar Investors to purchase, Notes in the principal amount of

$12.0

million within 45

days after the Company enters into the Merger Agreement as defined in Note 1 (“Second Closing Obligation”). On December 29,

2020, the remaining Notes were purchased in accordance with the Agreement. The Notes are convertible through the Maturity Date at the

option of the holder. As of March 31, 2021 and December 31, 2020, none of the Notes were converted into shares of common stock.

The Notes are recorded within notes payable in the condensed consolidated balance sheet. As the Notes were used to construct the Company’s

property, plant and equipment, a portion of the interest costs incurred were capitalized within property, plant and equipment.

The

following provides a summary of the interest expense of PCT’s convertible debt instruments (in thousands):

|

|

|

|

|

|

|

|

|

|

Three

months ended March 31, |

|

2021 |

2020 |

| Contractual

interest expense |

$ |

881 |

|

$ |

— |

|

| Amortization

of deferred financing costs |

641 |

|

— |

|

| Effective

interest rate |

9.1 |

% |

— |

% |

The

following provides a summary of the convertible notes (in thousands):

|

|

|

|

|

|

|

|

|

|

As

of |

|

March

31, 2021 |

December

31, 2020 |

| Unamortized

deferred issuance costs |

$ |

2,916 |

|

$ |

3,288 |

|

| Net

carrying amount |

57,084 |

|

56,712 |

|

| Fair

value |

$ |

231,916 |

|

$ |

123,532 |

|

| Fair

value level |

Level

3 |

Level

3 |

As

of March 31, 2021, as a result of the Business Combination, the conversion price of the notes changed to the quotient of (A) $1,000

and (B) the SPAC transaction PIPE valuation; provided that if the Equity Value of the Company in connection with the SPAC Transaction

is greater than $775.0 million,

the conversion rate shall equal the product of (1) the amount that would otherwise be calculated pursuant to this clause set forth above

and (2) a fraction equal to the Equity Value of the Company divided by $775.0 million

(as such terms are defined in the indenture governing the Convertible Notes). The conversion price is $6.93

for potential conversion into approximately 8.66

million shares of common stock.

As

of December 31, 2020 the conversion price of the notes was the quotient of $1,000

and the quotient of (A) 80%

of the Adjusted Equity Value of the Company as determined based upon the sale of approximately 684 thousand

Legacy PCT Class A Units at $87.69

per unit (the “November Investment”) and (B) the number of outstanding shares of Capital Stock of the Company on a Fully-Diluted

Basis immediately prior to the November Investment (as such terms are defined in the indenture governing the Convertible Notes).

Revenue

Bonds

On

October 7, 2020, the Southern Ohio Port Authority (“SOPA”) issued certain revenue bonds (“Bonds”) and loaned the

proceeds from their sale to PureCycle: Ohio LLC, an Ohio limited liability company (“PCO”), pursuant to a loan agreement dated

as of October 1, 2020 between SOPA and PCO (“Loan Agreement”), to be used to (i) acquire,

PureCycle

Technologies, Inc.

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(Unaudited)

construct

and equip the Ohio Plant; (ii) fund a debt service reserve fund for the Series 2020A Bonds; (iii) finance capitalized interest; and (iv)

pay the costs of issuing the Bonds. The Bonds were offered in three series, including (i) Exempt Facility Revenue Bonds (PureCycle Project),

Tax-Exempt Series 2020A (“Series 2020A Bonds”); (ii) Subordinate Exempt Facility Revenue Bonds (PureCycle Project), Tax-Exempt

Series 2020B (“Series 2020B Bonds”); and (iii) Subordinated Exempt Facility Revenue Bonds (PureCycle Project), Taxable Series

2020C (“Series 2020C Bonds”), each series in the aggregate principal amount, bearing interest and maturing as shown in the

table below. The Series 2020A Bonds were issued at a total discount of $5.5 million.

The discount is amortized over the term of the Bonds using the effective interest method. The purchase price of the Bonds was paid and

immediately available to SOPA on October 7, 2020, the date of delivery of the Bonds to their original purchaser. PureCycle is not a direct

obligor on the Bonds and is not a party to the Loan Agreement or the indenture of trust dated as of October 1, 2020 (“Indenture”),

between SOPA and UMB Bank, N.A as trustee (“Trustee”), pursuant to which the Bonds have been issued. PureCycle has executed

a guaranty of completion dated as of October 7, 2020, with respect to the full and complete performance by PCO of PCO’s obligations

with respect to construction and completion of the Project, including construction by the completion date, free and clear of any liens

(other than permitted liens), and the payment of all project costs incurred prior to completion of the project, and all claims, liabilities,

losses and damages owed by PCO to each counterparty under the project documents (as such terms are defined in the Loan Agreement). In

addition, pursuant to the guaranty, PureCycle is obligated to fund and maintain a liquidity reserve for the project during the term of

the guaranty in the amount of $50.0 million

to be held in an escrow account with U.S. Bank, N.A., as escrow agent (“Liquidity Reserve”). Pursuant to the terms of the

Loan Agreement PCO executed promissory notes, one in the aggregate principal amount of each series of Bonds, in favor of SOPA, which were

assigned to the Trustee on October 7, 2020.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in

thousands) |

|

|

|

|

|

| Bond

Series |

Term |

Principal

Amount |

|

Interest

Rate |

Maturity

Date |

| 2020A |

A1 |

$ |

12,370 |

|

|

6.25 |

% |

December

1, 2025 |

| 2020A |

A2 |

$ |

38,700 |

|

|

6.50 |

% |

December

1, 2030 |

| 2020A |

A3 |

$ |

168,480 |

|

|

7.00 |

% |

December

1, 2042 |

| 2020B |

B1 |

$ |

10,000 |

|

|

10.00 |

% |

December

1, 2025 |

| 2020B |

B2 |

$ |

10,000 |

|

|

10.00 |

% |

December

1, 2027 |

| 2020C |

C1 |

$ |

10,000 |

|

|

13.00 |

% |

December

1, 2027 |

The

proceeds of the Bonds and certain equity contributions have been placed in various trust funds and non-interest-bearing accounts established

and administered by the Trustee under the Indenture. Before each disbursement of amounts in the Project Fund held by the Trustee under

the Indenture, PCO is required to submit to the Trustee a requisition for funds to be disbursed outlining the specified purpose of the

disbursement and substantiating the expenditure. In addition, 100%

of revenue attributable to the production of commercial-scale plant in Ironton, Ohio (the “Phase II Facility”) must be deposited

into an operating revenue escrow fund held by U.S. Bank National Association, as escrow agent. Funds in the trust accounts and operating

revenue escrow account will be disbursed by the Trustee when certain conditions are met, and will be used to pay costs and expenditures

related to the development of the Phase II Facility, make required interest and principal payments (including sinking fund redemption

amounts) and any premium, in certain circumstances required under the Indenture, to redeem the Bonds.

As

conditions for closing the Bonds, PureCycle and certain affiliates contributed $60.0 million

in equity at closing and contributed an additional $40.0 million

in equity upon the Closing of the Business Combination. PureCycle provided the Liquidity Reserve for the Ohio Plant construction of $50.0 million

and deposited the amount upon the Closing of the Business Combination. In addition, PureCycle must maintain at least $75.0 million

of cash on its balance sheet as of July 31, 2021 and $100.0 million

of cash on its balance sheet as of January 31, 2022, in each case, including the Liquidity Reserve.

PureCycle

Technologies, Inc.

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(Unaudited)

The

Bonds are recorded within Bonds payable in the condensed consolidated balance sheet. The Company incurred $4.8

million and $0,

respectively, of interest cost during the three months ended March 31, 2021 and 2020. As the Bond proceeds will be used to construct the

Company’s property, plant and equipment, a portion of the interest costs incurred was capitalized within Property, Plant and Equipment.

Paycheck

Protection Program

On

May 4, 2020, Legacy PCT entered into a Paycheck Protection Program (the “Program”, or “PPP loan”) Term Note with

PNC Bank to obtain principal of approximately $314

thousand. This Note is issued pursuant to the Coronavirus Aid, Relief, and Economic Security Act’s (the “CARES Act”)

(P.L. 116-136) Paycheck Protection Program. During a period from May 4, 2020 until the forgiveness amount is known, (“Deferral Period”),

interest on the outstanding principal balance will accrue at the Fixed Rate of 1%

per annum, but neither principal nor interest shall be due during the Deferral Period. Legacy PCT has applied for loan forgiveness as

of December 31, 2020 but as of March 31, 2021 has not yet received the forgiveness amount. All or a portion of this PPP loan may be forgiven

in accordance with the program requirements. The amount of forgiveness shall be calculated in accordance with the requirements of the

Program, including provisions of Section 1106 of the CARES Act. The unforgiven portion of the PPP loan is payable over two

years at an interest rate of 1%,

with a deferral of payments for the first ten

months.

As

of March 31, 2021 and December 31, 2020, the outstanding balance on the loan is approximately $314 thousand.

$174

thousand and $122

thousand are recorded as notes payable – current and $140

thousand and $192

thousand are recorded as notes payable in the condensed consolidated balance sheets.

NOTE

4 - STOCKHOLDERS’

EQUITY

The

condensed consolidated statements of stockholders’ equity reflect the reverse recapitalization as discussed in Note 1 as of March

17, 2021. As Legacy PCT was deemed the accounting acquirer in the reverse recapitalization with ROCH, all periods prior to the consummation

date reflect the balances and activity of Legacy PCT. The consolidated balances and the audited consolidated financial statements of Legacy

PCT, as of December 31, 2020, and the share activity and per share amounts in these condensed consolidated statements of equity were retroactively

adjusted, where applicable, using the recapitalization exchange ratio of 10.52

for Legacy PCT Class A Units. Legacy PCT Class B Preferred Units were converted into shares of PCT common stock at a share conversion

factor of 10.642

whereas Legacy PCT Class B-1 Preferred Units were converted into shares of PCT common stock at a share conversion factor of 14.768

as a result of the reverse recapitalization. Legacy PCT Class C Units were converted into shares of PCT common stock at a share conversion

factor of 9.32,

7.40,

or 2.747,

based on the distribution threshold of the Class C Unit.

Common

Stock

Holders

of PCT common stock are entitled to one vote for each share held of record on all matters submitted to a vote of stockholders. The holders

do not have cumulative voting rights in the election of directors. Upon the Company’s liquidation, dissolution or winding up and

after payment in full of all amounts required to be paid to creditors and to the holders of preferred stock having liquidation preferences,

if any, the holders of the Company’s common stock will be entitled to receive pro rata the Company’s remaining assets available

for distribution. Holders of the Company’s common stock do not have preemptive, subscription, redemption or conversion rights. All

shares of the Company’s common stock are fully paid and non-assessable. The Company is authorized to issue 250.0 million

shares of common stock with a par value of $0.001.

As of March 31, 2021 and December 31, 2020, 117.35

million and 0

shares are issued and outstanding, respectively.

Preferred

Stock

As

of March 31, 2021, the Company is authorized to issue 25.0 million

shares of preferred stock with a par value of $0.001,

of which no

shares are issued and outstanding.

NOTE

5 - EQUITY-BASED

COMPENSATION

2021

Equity Incentive Plan

PureCycle

Technologies, Inc.

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(Unaudited)

In