| PROSPECTUS SUPPLEMENT NO. 2 | Filed Pursuant to Rule 424(b)(3) |

| (to prospectus dated March 19, 2021) | Registration No. 333-251034 |

PURECYCLE TECHNOLOGIES, INC.

25,000,000 Shares

Common Stock

This prospectus supplement is being filed to update and supplement the information contained in the prospectus dated March 19, 2021 (as supplemented or amended from time to time, the “Prospectus”), with the information contained in our Current Report on Form 8-K, which was filed with the Securities and Exchange Commission (“SEC”) on May 17, 2021 (the “Form 8-K”). Accordingly, we have attached the Form 8-K to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the resale from time to time of up to 25,000,000 shares of our common stock, par value $0.001 per share (“Common Stock”), issued pursuant to the terms of those certain subscription agreements entered into (the “PIPE Investment”) in connection with the Business Combination (as defined in the Prospectus). As described in the Prospectus, the selling securityholders named therein or their permitted transferees (collectively, the “Selling Stockholders”), may sell from time to time up to 25,000,000 shares of our Common Stock that were issued to the Selling Stockholders in connection with the closing of the PIPE Investment and the Business Combination.

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Our Common Stock, warrants and units are listed on The Nasdaq Capital Market under the symbols “PCT,” “PCTTW” and “PCTTU,” respectively. On May 18, 2021, the closing price of our Common Stock was $13.39 per share.

Investing in our securities involves risks that are described in the “Risk Factors” section beginning on page 23 of the Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is May 19, 2021.

United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 17, 2021

| PureCycle Technologies, Inc. | ||

| (Exact Name of Registrant as Specified in its Charter) |

| Delaware | 001-40234 | 86-2293091 | ||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| 5950 Hazeltine National Drive, Suite 650, Orlando, Florida | 32822 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code:(877) 648-3565

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) |

Name of each exchange on which registered | ||

| Common Stock, par value $0.001 per share | PCT | The Nasdaq Stock Market LLC | ||

| Warrants, each exercisable for one share of common stock, $0.001 par value per share, at an exercise price of $11.50 per share | PCTTW | The Nasdaq Stock Market LLC | ||

| Units, each consisting of one share of common stock, $0.001 par value per share, and three quarters of one warrant | PCTTU | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (Sec.230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Sec.240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial Condition.

On May 17, 2021, PureCycle Technologies, Inc. (the “Company”), issued a press release, attached hereto as Exhibit 99.1 and incorporated herein by reference, announcing the Company’s financial results for the three months ended March 31, 2021 and certain other information.

The information contained in Item 7.01 concerning the presentation to Company’s investors is hereby incorporated into this Item 2.02 by reference.

Item 7.01. Regulation FD Disclosure.

The slide presentation attached hereto as Exhibit 99.2, and incorporated herein by reference, will be presented to certain investors of the Company on May 17, 2021 and may be used by the Company in various other presentations to investors.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Exhibit Number | Description of Exhibit |

| 99.1 | Press release by PureCycle Technologies, Inc. on May 17, 2021 of first quarter 2021 financial results. |

| 99.2 | PureCycle Technologies, Inc. presentation to investors. |

| 101 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

| 104 | The cover page from this Current Report on Form 8-K, formatted as Inline XBRL. |

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| PURECYCLE TECHNOLOGIES, INC. | ||

| May 17, 2021 | By: | /s/ Brad Kalter |

| Name: Brad Kalter | ||

| Title: General Counsel and Corporate Secretary | ||

Exhibit 99.1

| NEWS RELEASE |

PureCycle Technologies, Inc. Provides First Quarter 2021 Corporate Update

- Began trading on NASDAQ under the ticker “PCT” on March 18, 2021

- Total cash balance of $570 million ($318 million of which is restricted) at quarter-end March 31, 2021

- Construction of first manufacturing plant in Ironton, OH (“Plant 1”) began in October 2020 and continues to progress as planned; continue to expect the facility to be commercially operational by the end of 2022 with an annual installed production capacity of 107 million pounds

- Expect approximately 1 billion pounds of installed capacity by the end of 2024; near term planning for the next series of manufacturing facilities is underway and is expected to be sited in the United States (“cluster” site model) followed by Europe

ORLANDO, Fla., May 17, 2021 – PureCycle Technologies, Inc. ("PureCycle” or “the Company") (NASDAQ: PCT), a company focused on polypropylene recycling, today announced a corporate update and financial results for the first quarter ending March 31, 2021.

Management Commentary

“Polypropylene is one of the largest contributors to the global plastics waste crisis, and PureCycle is unlocking a large and under-penetrated market with our patented purification recycling technology, licensed from The Procter & Gamble Company (P&G), for converting waste polypropylene into virgin-like resin. The market demand for polypropylene is enormous at over 160 billion pounds annually and expanding rapidly with global demand expected to exceed 200 billion pounds by 2025. This demand, coupled with increasing international focus from regulators and consumers on sustainable plastic solutions, creates significant global opportunities for PureCycle. We have continued to achieve our strategic goals and milestones over the course of the first quarter, further developed our financial profile with additional liquidity, enhanced our manufacturing capabilities, and strengthened our world-class team to position the Company for the future,” said Mike Otworth, PureCycle’s Chairman and Chief Executive Officer.

The Company is pleased with the progress during the first quarter, highlighted by PureCycle becoming a public company, remaining on-track with the construction schedule for the Company’s first manufacturing plant in Ironton, Ohio (“Plant 1”), and starting line engineering on the second commercial facility. PureCycle maintains a strong balance sheet with $570 million in cash and cash equivalents following the closings of multiple transactions with investors who have conducted significant due diligence on various aspects of the Company’s business. PureCycle has the capital needed to complete construction of Plant 1 and commence funding of subsequent commercial facilities.

PureCycle remains confident in the efficacy and scalability of its technology as well as its manufacturing capabilities. The Company’s technology has had over 350 lab scale tests over the last seven years and almost two years of successful operation of the Feedstock Evaluation Unit (FEU). This technology has been evaluated extensively by an independent engineering firm as well as PureCycle’s strategic partners. Furthermore, the technology was invented by P&G and is protected through an extensive patent portfolio.

The FEU has been operational since July 2019 to test and optimize the efficiency, commercial design, scale up, and throughput of the purification process. The FEU has also been instrumental in validating suitable feedstocks that enabled full contracting for Plant 1. Additionally, the FEU continues to provide product samples to current and future customers for their extensive application testing requirements.

The PureCycle team is committed to the goal of transforming waste polypropylene into sustainable, high-quality products. The Company has every confidence in the recently assembled world-class team, the strength of the technology, and patent estate. PureCycle’s capabilities afford the opportunity to transform an immense global problem into a sustainable solution that will drive shareholder value well into the future.

Liquidity and Capital Allocation

Cash and cash equivalents totaled $570.1 million, including $317.5 million in restricted cash, at quarter end March 31, 2021. In conjunction with closing the business combination, the Company received $326 million of gross proceeds related to the transaction closing and the release of the PIPE investment funds ($250.0 million aggregate purchase price based on 25 million issued shares of common stock at $10.00 per share). The gross proceeds were offset by $28.0 million of capitalized issuance costs.

PureCycle had debt of $310.0 million as of March 31, 2021. This included $250.0 million revenue bond issuance on October 7, 2020, by the Southern Ohio Port Authority and $60.0 million of convertible notes issued at 5.875% due October 15, 2022. PureCycle estimates approximately $266.0 million in remaining cost to complete Plant 1, in line with original estimates.

Conference Call

The Company will hold a conference call today at 11:00 a.m. ET to provide an update on recent corporate developments, including activity from the first quarter, recent corporate actions and updated future strategic plans.

Date: Monday, May 17, 2021

Time: 11:00 a.m. ET

Toll-free dial-in number: 1-855-940-5314

International dial-in number: 1-929-517-0418

Conference ID: 6150677

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Investor Relations at 1-949-574-3860.

The conference call will have a live Q&A session and be available for replay here and on the Company's website at www.purecycletech.com.

A replay of the conference call will be available after 2:00 p.m. Eastern time on the same day through May 24, 2021, via the information below:

Toll-free replay number: 1-855-859-2056

International replay number: 1-404-537-3406

Replay ID: 6150677

Timeline for Form 10-Q Submission

As a result of recent public comments from the SEC regarding the treatment of certain warrants similar to some of those issued in the initial public offering of Roth CH Acquisition I Co. prior to the Company’s business combination, the Company has made the decision to treat such warrants as a liability under its balance sheet, rather than equity. While the Company does not believe this change will have a material impact on the balance sheet or the remainder of the financial statements, the completion of the required documentation and reviews may prevent the Company from filing its quarterly report on Form 10-Q today. Consequently, the Company may utilize the relief offered by the SEC under Rule 12b-25 under the Securities Exchange Act of 1934 and may file its quarterly report on Form 10-Q within five days following the normal reporting deadline.

Forward-Looking Statements

This press release contains forward-looking statements, including statements about the anticipated benefits of the business combination, and the financial condition, results of operations, earnings outlook and prospects of PCT. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements are based on the current expectations of the management of PCT and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in “Risk Factors,” those discussed and identified in public filings made with the Securities and Exchange Commission (the “SEC”) by PCT and the following:

| · | PCT’s ability to meet, and to continue to meet, applicable regulatory requirements for the use of PCT’s UPRP in food grade applications (both in the United States and abroad); |

| · | PCT’s ability to comply on an ongoing basis with the numerous regulatory requirements applicable to the UPRP and PCT’s facilities (both in the United States and abroad); |

| · | expectations and changes regarding PCT’s strategies and future financial performance, including its future business plans, expansion plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and PCT’s ability to invest in growth initiatives; |

| · | PCT’s ability to scale and build Plant 1 in a timely and cost-effective manner; |

| · | PCT's ability to maintain exclusivity under the P&G license (as described below); |

| · | the implementation, market acceptance and success of PCT’s business model and growth strategy; |

| · | the success or profitability of PCT’s offtake arrangements; |

| · | the ability to source feedstock with a high polypropylene content; |

| · | PCT’s future capital requirements and sources and uses of cash; |

| · | PCT’s ability to obtain funding for its operations and future growth; |

| · | developments and projections relating to PCT’s competitors and industry; |

| · | the outcome of any legal proceedings to which PCT is, or may become a party, including recently filed securities class action cases; |

| · | the ability to recognize the anticipated benefits of the business combination; |

| · | unexpected costs related to the business combination; |

| · | geopolitical risk and changes in applicable laws or regulations; |

| · | the possibility that PCT may be adversely affected by other economic, business, and/or competitive factors; |

| · | operational risk; and |

| · | risk that the COVID-19 pandemic, and local, state, and federal responses to addressing the pandemic may have an adverse effect PCT’s business operations, as well as PCT’s financial condition and results of operations. |

Should one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of PCT prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

All subsequent written and oral forward-looking statements or other matters attributable to PCT or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this press release. Except to the extent required by applicable law or regulation, PCT undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date of this press release or to reflect the occurrence of unanticipated events.

About PureCycle Technologies

PureCycle Technologies LLC, a subsidiary of PureCycle Technologies, Inc., holds a global license to commercialize the only patented solvent-based purification recycling technology, developed by P&G for restoring waste polypropylene (PP) into virgin-like resin. The proprietary process removes color, odor and other contaminants from recycled feedstock resulting in virgin-like polypropylene suitable for any PP market. To learn more, visit purecycletech.com

Company Contact:

Amy Jo Clark

aclark@purecycletech.com

(317) 504-0133

Investor Relations Contacts:

Cody Slach, Georg Venturatos

Gateway Investor Relations

PCT@GatewayIR.com

(949) 574-3860

Exhibit 99.2

1 1 First Quarter 2021 Corporate Update May 17 th , 2021

2 2 Forward - Looking Statements Certain statements in this Presentation contain forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended (the “Securities Act”), and Section 21 E of the Securities Exchange Act of 1934 , as amended (the “Exchange Act”), including statements about the outcome of any legal proceedings to which PCT is, or may become a party, and the financial condition, results of operations, earnings outlook and prospects of PureCycle Technologies, Inc . (“PCT”) . Forward - looking statements generally relate to future events or our future financial or operating performance and may refer to projections and forecasts . Forward - looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions (or the negative versions of such words or expressions), but the absence of these words does not mean that a statement is not forward - looking . The forward - looking statements are based on the current expectations of the management of PCT and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of this Presentation . There can be no assurance that future developments will be those that have been anticipated . These forward - looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward - looking statements . These risks and uncertainties include, but are not limited to, those factors described in the Company’s Quarterly Report on Form 10 - Q entitled “Risk Factors,” those discussed and identified in public filings made with the SEC by PCT, and the following : PCT's ability to meet, and to continue to meet, applicable regulatory requirements for the use of PCT’s ultra - pure recycled polypropylene (“UPRP”) in food grade applications (both in the United States and abroad) ; PCT's ability to comply on an ongoing basis with the numerous regulatory requirements applicable to the UPRP and PCT’s facilities (both in the United States and abroad) ; Expectations and changes regarding PCT’s strategies and future financial performance, including its future business plans, expansion plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and PCT’s ability to invest in growth initiatives ; PCT’s ability to scale and build the Ironton plant in a timely and cost - effective manner ; PCT’s ability to maintain exclusivity under The Procter & Gamble Company license ; the implementation, market acceptance and success of PCT’s business model and growth strategy ; the success or profitability of PCT’s offtake arrangements ; the ability to source feedstock with a high polypropylene content ; PCT’s future capital requirements and sources and uses of cash ; PCT’s ability to obtain funding for its operations and future growth ; developments and projections relating to PCT’s competitors and industry ; the outcome of any legal proceedings to which PCT is, or may become a party, including recently filed securities clas s action cases ; the ability to recognize the anticipated benefits of the Business Combination ; unexpected costs related to the Business Combination ; geopolitical risk and changes in applicable laws or regulations ; the possibility that PCT may be adversely affected by other economic, business, and/or competitive factors ; operational risk ; and the risk that the COVID - 19 pandemic, and local, state, federal and international responses to addressing the pandemic may have an adverse effect on PCT’s business operations, as well as PCT’s financial condition and results of operations . PCT specifically disclaims any obligation to update this Presentation . These forward - looking statements should not be relied upon as representing PCT’s assessments as of any date subsequent to the date of this Presentation . Accordingly, undue reliance should not be placed upon the forward - looking statements .

3 3 PCT Is Committed to Our Mission: A Pure Planet Limited Use M echanically recycled polypropylene ( rPP ) is grey or black, odorous and non - food grade which results in limited consumer applications < 1% Recycling Rate Less than 1% of PP is collected and mechanically recycled today vs. nearly 20% of polyethylene terephthalate (PET) 1 Strong Market for PP Represents 28% of the world’s polymer demand with over 160 billion pounds produced annual ly 2 New Ideas, Technologies, and Partnerships are Needed to Solve This Global Problem

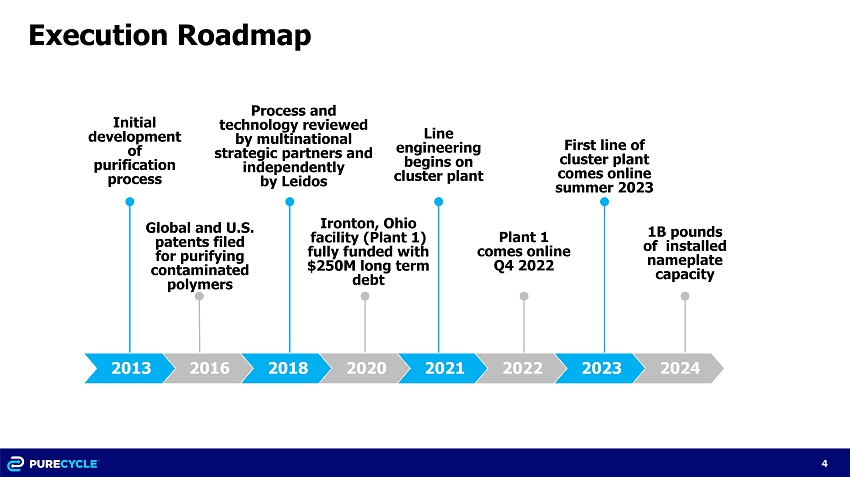

4 4 Execution Roadmap 2016 2018 2020 2021 2022 2023 Initial development of purification process Line engineering begins on cluster plant Plant 1 comes online Q4 2022 Ironton, Ohio facility (Plant 1) fully funded with $250M long term debt Global and U.S. patents filed for purifying contaminated polymers Process and technology reviewed by multinational strategic partners and independently by Leidos 2013 2024 First line of cluster plant comes online summer 2023 1B pounds of installed nameplate capacity

5 5 Build - out plan expected to drive EBITDA and margin growth Blue - Chip Customers, Partners and Strategic Investors Commercialization Significantly De - Risked Premium Pricing Locked - In Contracts Proprietary and Proven Technology Company Highlights »

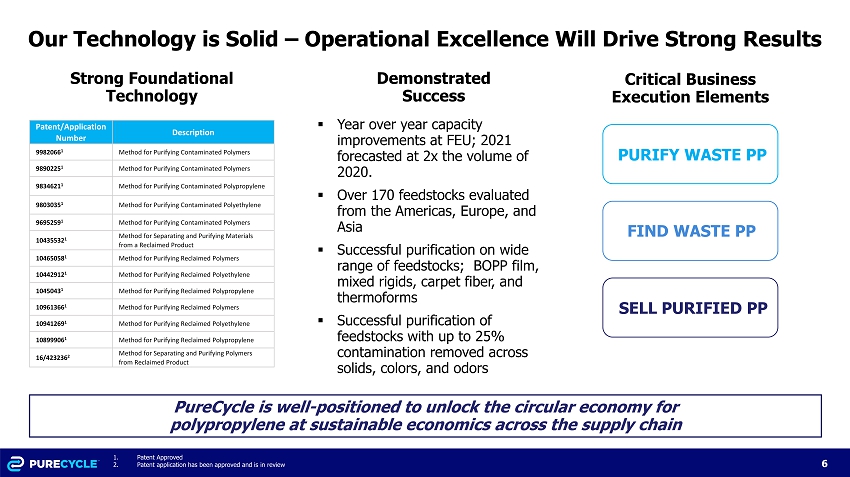

6 6 Our Technology is Solid – Operational Excellence Will Drive Strong Results FIND WASTE PP PURIFY WASTE PP SELL PURIFIED PP Patent/Application Number Description 9982066 1 Method for Purifying Contaminated Polymers 9890225 1 Method for Purifying Contaminated Polymers 9834621 1 Method for Purifying Contaminated Polypropylene 9803035 1 Method for Purifying Contaminated Polyethylene 9695259 1 Method for Purifying Contaminated Polymers 10435532 1 Method for Separating and Purifying Materials from a Reclaimed Product 10465058 1 Method for Purifying Reclaimed Polymers 10442912 1 Method for Purifying Reclaimed Polyethylene 1045043 1 Method for Purifying Reclaimed Polypropylene 10961366 1 Method for Purifying Reclaimed Polymers 10941269 1 Method for Purifying Reclaimed Polyethylene 10899906 1 Method for Purifying Reclaimed Polypropylene 16/423236 2 Method for Separating and Purifying Polymers from Reclaimed Product Strong Foundational Technology Critical Business Execution Elements PureCycle is well - positioned to unlock the circular economy for polypropylene at sustainable economics across the supply chain Demonstrated Success ▪ Year over year capacity improvements at FEU; 2021 forecasted at 2x the volume of 2020. ▪ Over 170 feedstocks evaluated from the Americas, Europe, and Asia ▪ Successful purification on wide range of feedstocks; BOPP film, mixed rigids, carpet fiber, and thermoforms ▪ Successful purification of feedstocks with up to 25% contamination removed across solids, colors, and odors 1. Patent Approved 2. Patent application has been approved and is in review

7 7 PURIFY WASTE PP Construction of Ironton Facility (Plant 1) is On Track Q1 2021 Operational Accomplishments ▪ Final engineering and procurement activities are on track, utilities purchased, and purification engineering at 90% review ▪ Plant 1 is on track for entering operations in Q4 2022; overall cost & schedule remain on track ▪ Accelerated U.S. cluster strategy while continuing to pursue European strategy ▪ Cluster plant is on schedule; line engineering and site selection is in progress (as planned) ▪ Developing digital framework to optimize plant operations and accelerate growth Warehouse Prep On Track Excavation Nearly Complete Procurement & Engineering KPIs On Track Digital Foundation Prep

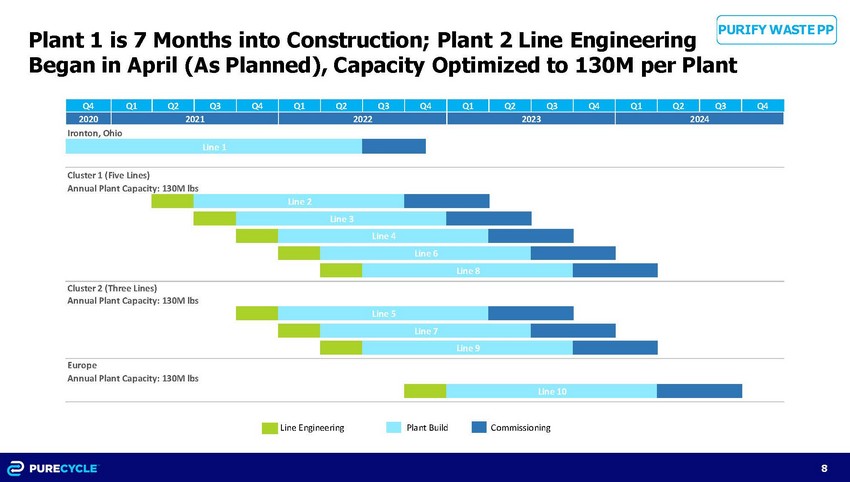

8 8 PURIFY WASTE PP Plant 1 is 7 Months into Construction; Plant 2 Line Engineering Began in April (As Planned), Capacity Optimized to 130M per Plant Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2020 Ironton, Ohio Cluster 1 (Five Lines) Annual Plant Capacity: 130M lbs Cluster 2 (Three Lines) Annual Plant Capacity: 130M lbs Europe Annual Plant Capacity: 130M lbs Line Engineering Plant Build Commissioning Line 7 Line 9 Line 10 Line 2 Line 3 Line 4 Line 6 Line 8 Line 5 2021 2022 2023 2024 Line 1

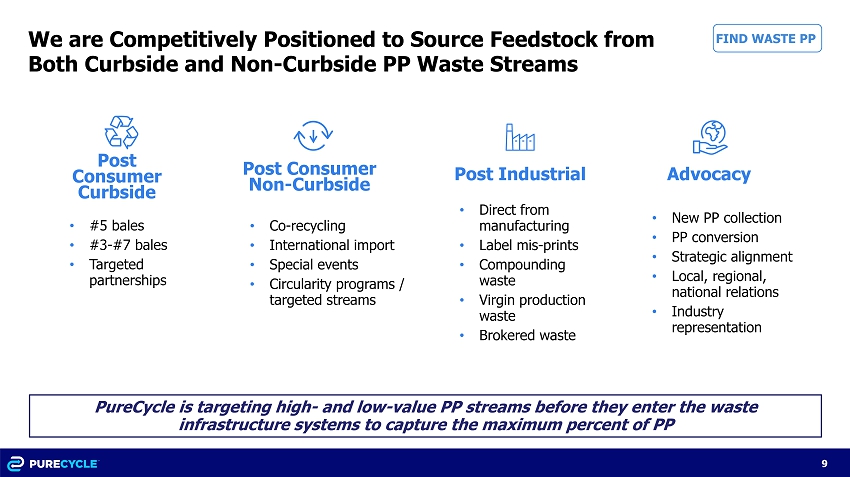

9 9 We are Competitively Positioned to Source Feedstock from Both Curbside and Non - Curbside PP Waste Streams Post Industrial Advocacy Post Consumer Non - Curbside Post Consumer Curbside FIND WASTE PP PureCycle is targeting high - and low - value PP streams before they enter the waste infrastructure systems to capture the maximum percent of PP • Direct from manufacturing • Label mis - prints • Compounding waste • Virgin production waste • Brokered waste • New PP collection • PP conversion • Strategic alignment • Local, regional, national relations • Industry representation • Co - recycling • International import • Special events • Circularity programs / targeted streams • # 5 bales • #3 - #7 bales • Targeted partnerships

10 10 B C A Feedstock Pricing Risk Commodity Pricing Risk Low Index + Premium based on virgin pricing plus a premium A High Low B Fixed Price Reflect a flat price, de - linked from the price of virgin ($1 - $2 per pound) C Feedstock + Fixed Price Passes on cost of feedstock to customers while maintaining margin ($1+ per pound) We Use a Variety of Pricing Mechanisms to Reduce Pricing Risk While Maintaining Average Pricing Above $1 per Pound SELL PURIFIED PP

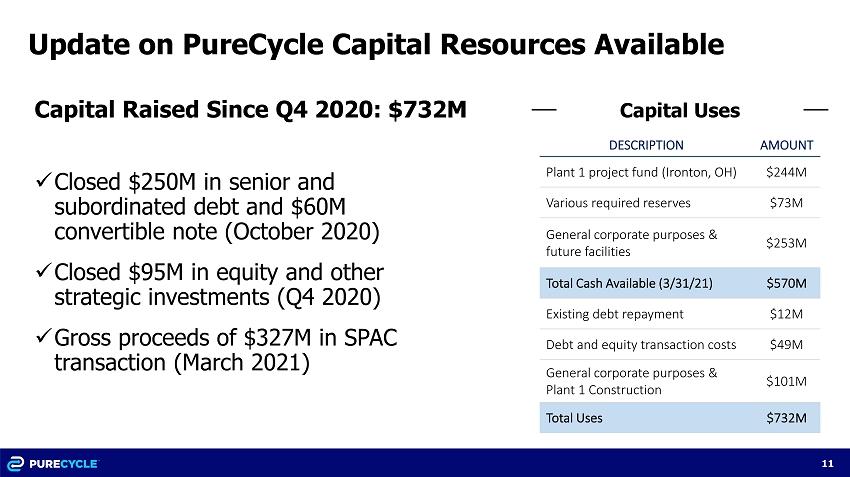

11 11 Update on PureCycle Capital Resources Available x Closed $250M in senior and subordinated debt and $60M convertible note (October 2020) x Closed $95M in equity and other strategic investments (Q4 2020) x Gross proceeds of $327M in SPAC transaction (March 2021) DESCRIPTION AMOUNT Plant 1 project fund (Ironton, OH) $244M Various required reserves $73M General corporate purposes & future facilities $253M Total Cash Available (3/31/21) $570M Existing debt repayment $12M Debt and equity transaction costs $49M General corporate purposes & Plant 1 Construction $101M Total Uses $732M Capital Uses Capital Raised Since Q4 2020: $732M

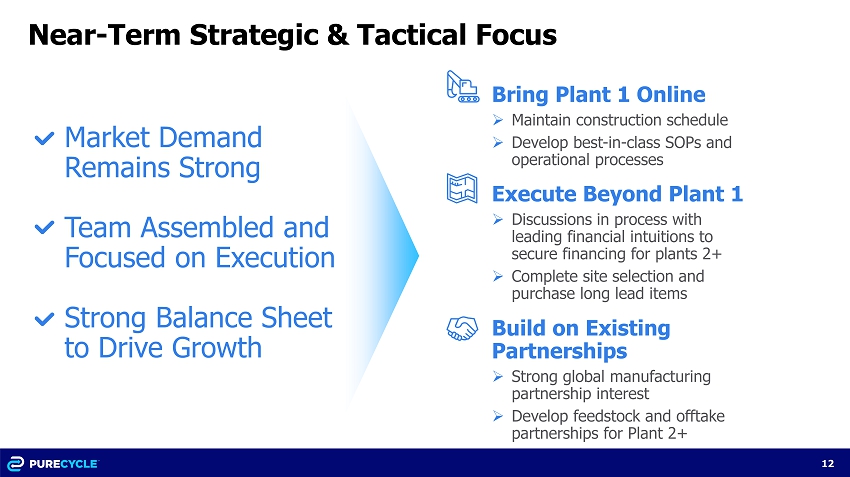

12 12 Near - Term Strategic & Tactical Focus Bring Plant 1 Online » Maintain construction schedule » Develop best - in - class SOPs and operational processes Execute Beyond Plant 1 » Discussions in process with leading financial intuitions to secure financing for plants 2+ » Complete site selection and purchase long lead items Build on Existing Partnerships » Strong global manufacturing partnership interest » Develop feedstock and offtake partnerships for Plant 2+ Market Demand Remains Strong Team Assembled and Focused on Execution Strong Balance Sheet to Drive Growth