Exhibit 99.2

1 1 First Quarter 2021 Corporate Update May 17 th , 2021

2 2 Forward - Looking Statements Certain statements in this Presentation contain forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended (the “Securities Act”), and Section 21 E of the Securities Exchange Act of 1934 , as amended (the “Exchange Act”), including statements about the outcome of any legal proceedings to which PCT is, or may become a party, and the financial condition, results of operations, earnings outlook and prospects of PureCycle Technologies, Inc . (“PCT”) . Forward - looking statements generally relate to future events or our future financial or operating performance and may refer to projections and forecasts . Forward - looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions (or the negative versions of such words or expressions), but the absence of these words does not mean that a statement is not forward - looking . The forward - looking statements are based on the current expectations of the management of PCT and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of this Presentation . There can be no assurance that future developments will be those that have been anticipated . These forward - looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward - looking statements . These risks and uncertainties include, but are not limited to, those factors described in the Company’s Quarterly Report on Form 10 - Q entitled “Risk Factors,” those discussed and identified in public filings made with the SEC by PCT, and the following : PCT's ability to meet, and to continue to meet, applicable regulatory requirements for the use of PCT’s ultra - pure recycled polypropylene (“UPRP”) in food grade applications (both in the United States and abroad) ; PCT's ability to comply on an ongoing basis with the numerous regulatory requirements applicable to the UPRP and PCT’s facilities (both in the United States and abroad) ; Expectations and changes regarding PCT’s strategies and future financial performance, including its future business plans, expansion plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and PCT’s ability to invest in growth initiatives ; PCT’s ability to scale and build the Ironton plant in a timely and cost - effective manner ; PCT’s ability to maintain exclusivity under The Procter & Gamble Company license ; the implementation, market acceptance and success of PCT’s business model and growth strategy ; the success or profitability of PCT’s offtake arrangements ; the ability to source feedstock with a high polypropylene content ; PCT’s future capital requirements and sources and uses of cash ; PCT’s ability to obtain funding for its operations and future growth ; developments and projections relating to PCT’s competitors and industry ; the outcome of any legal proceedings to which PCT is, or may become a party, including recently filed securities clas s action cases ; the ability to recognize the anticipated benefits of the Business Combination ; unexpected costs related to the Business Combination ; geopolitical risk and changes in applicable laws or regulations ; the possibility that PCT may be adversely affected by other economic, business, and/or competitive factors ; operational risk ; and the risk that the COVID - 19 pandemic, and local, state, federal and international responses to addressing the pandemic may have an adverse effect on PCT’s business operations, as well as PCT’s financial condition and results of operations . PCT specifically disclaims any obligation to update this Presentation . These forward - looking statements should not be relied upon as representing PCT’s assessments as of any date subsequent to the date of this Presentation . Accordingly, undue reliance should not be placed upon the forward - looking statements .

3 3 PCT Is Committed to Our Mission: A Pure Planet Limited Use M echanically recycled polypropylene ( rPP ) is grey or black, odorous and non - food grade which results in limited consumer applications < 1% Recycling Rate Less than 1% of PP is collected and mechanically recycled today vs. nearly 20% of polyethylene terephthalate (PET) 1 Strong Market for PP Represents 28% of the world’s polymer demand with over 160 billion pounds produced annual ly 2 New Ideas, Technologies, and Partnerships are Needed to Solve This Global Problem

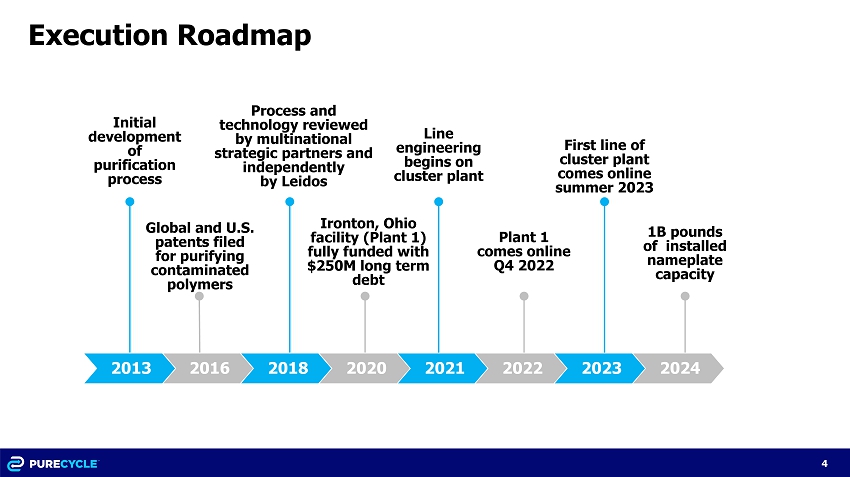

4 4 Execution Roadmap 2016 2018 2020 2021 2022 2023 Initial development of purification process Line engineering begins on cluster plant Plant 1 comes online Q4 2022 Ironton, Ohio facility (Plant 1) fully funded with $250M long term debt Global and U.S. patents filed for purifying contaminated polymers Process and technology reviewed by multinational strategic partners and independently by Leidos 2013 2024 First line of cluster plant comes online summer 2023 1B pounds of installed nameplate capacity

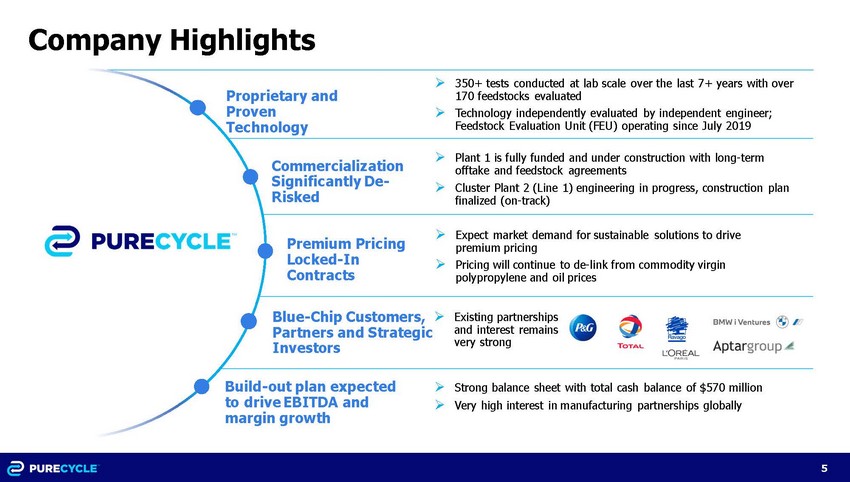

5 5 Build - out plan expected to drive EBITDA and margin growth Blue - Chip Customers, Partners and Strategic Investors Commercialization Significantly De - Risked Premium Pricing Locked - In Contracts Proprietary and Proven Technology Company Highlights »

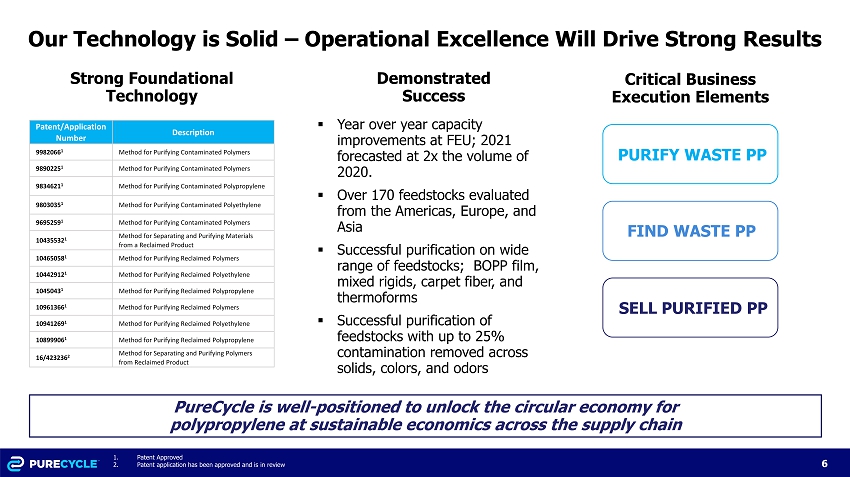

6 6 Our Technology is Solid – Operational Excellence Will Drive Strong Results FIND WASTE PP PURIFY WASTE PP SELL PURIFIED PP Patent/Application Number Description 9982066 1 Method for Purifying Contaminated Polymers 9890225 1 Method for Purifying Contaminated Polymers 9834621 1 Method for Purifying Contaminated Polypropylene 9803035 1 Method for Purifying Contaminated Polyethylene 9695259 1 Method for Purifying Contaminated Polymers 10435532 1 Method for Separating and Purifying Materials from a Reclaimed Product 10465058 1 Method for Purifying Reclaimed Polymers 10442912 1 Method for Purifying Reclaimed Polyethylene 1045043 1 Method for Purifying Reclaimed Polypropylene 10961366 1 Method for Purifying Reclaimed Polymers 10941269 1 Method for Purifying Reclaimed Polyethylene 10899906 1 Method for Purifying Reclaimed Polypropylene 16/423236 2 Method for Separating and Purifying Polymers from Reclaimed Product Strong Foundational Technology Critical Business Execution Elements PureCycle is well - positioned to unlock the circular economy for polypropylene at sustainable economics across the supply chain Demonstrated Success ▪ Year over year capacity improvements at FEU; 2021 forecasted at 2x the volume of 2020. ▪ Over 170 feedstocks evaluated from the Americas, Europe, and Asia ▪ Successful purification on wide range of feedstocks; BOPP film, mixed rigids, carpet fiber, and thermoforms ▪ Successful purification of feedstocks with up to 25% contamination removed across solids, colors, and odors 1. Patent Approved 2. Patent application has been approved and is in review

7 7 PURIFY WASTE PP Construction of Ironton Facility (Plant 1) is On Track Q1 2021 Operational Accomplishments ▪ Final engineering and procurement activities are on track, utilities purchased, and purification engineering at 90% review ▪ Plant 1 is on track for entering operations in Q4 2022; overall cost & schedule remain on track ▪ Accelerated U.S. cluster strategy while continuing to pursue European strategy ▪ Cluster plant is on schedule; line engineering and site selection is in progress (as planned) ▪ Developing digital framework to optimize plant operations and accelerate growth Warehouse Prep On Track Excavation Nearly Complete Procurement & Engineering KPIs On Track Digital Foundation Prep

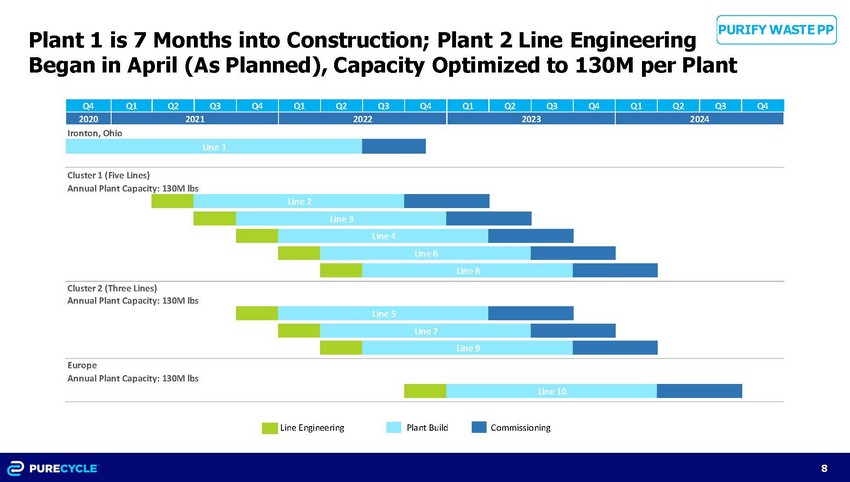

8 8 PURIFY WASTE PP Plant 1 is 7 Months into Construction; Plant 2 Line Engineering Began in April (As Planned), Capacity Optimized to 130M per Plant Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2020 Ironton, Ohio Cluster 1 (Five Lines) Annual Plant Capacity: 130M lbs Cluster 2 (Three Lines) Annual Plant Capacity: 130M lbs Europe Annual Plant Capacity: 130M lbs Line Engineering Plant Build Commissioning Line 7 Line 9 Line 10 Line 2 Line 3 Line 4 Line 6 Line 8 Line 5 2021 2022 2023 2024 Line 1

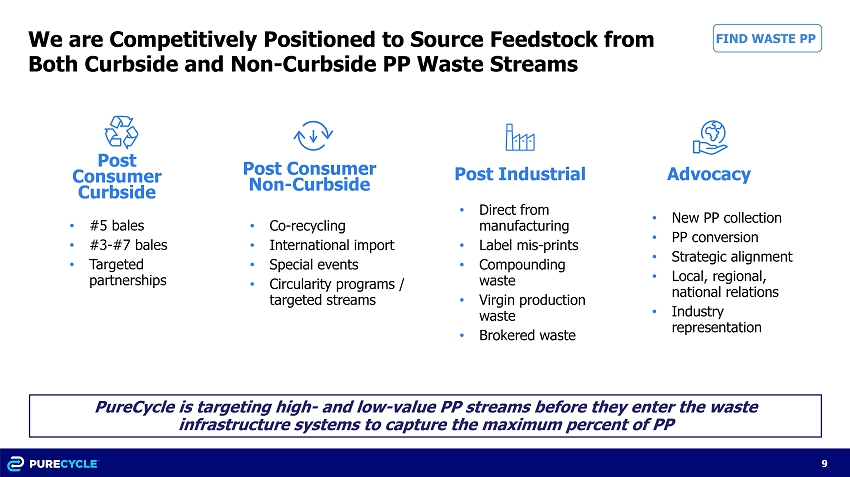

9 9 We are Competitively Positioned to Source Feedstock from Both Curbside and Non - Curbside PP Waste Streams Post Industrial Advocacy Post Consumer Non - Curbside Post Consumer Curbside FIND WASTE PP PureCycle is targeting high - and low - value PP streams before they enter the waste infrastructure systems to capture the maximum percent of PP • Direct from manufacturing • Label mis - prints • Compounding waste • Virgin production waste • Brokered waste • New PP collection • PP conversion • Strategic alignment • Local, regional, national relations • Industry representation • Co - recycling • International import • Special events • Circularity programs / targeted streams • # 5 bales • #3 - #7 bales • Targeted partnerships

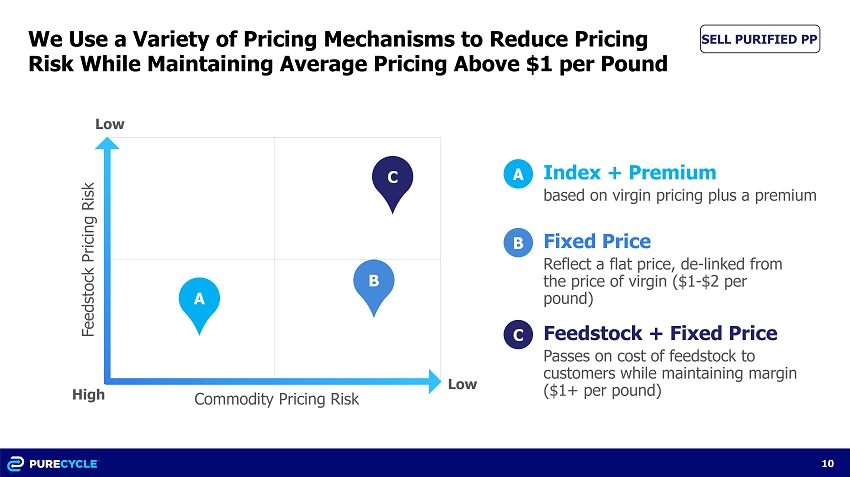

10 10 B C A Feedstock Pricing Risk Commodity Pricing Risk Low Index + Premium based on virgin pricing plus a premium A High Low B Fixed Price Reflect a flat price, de - linked from the price of virgin ($1 - $2 per pound) C Feedstock + Fixed Price Passes on cost of feedstock to customers while maintaining margin ($1+ per pound) We Use a Variety of Pricing Mechanisms to Reduce Pricing Risk While Maintaining Average Pricing Above $1 per Pound SELL PURIFIED PP

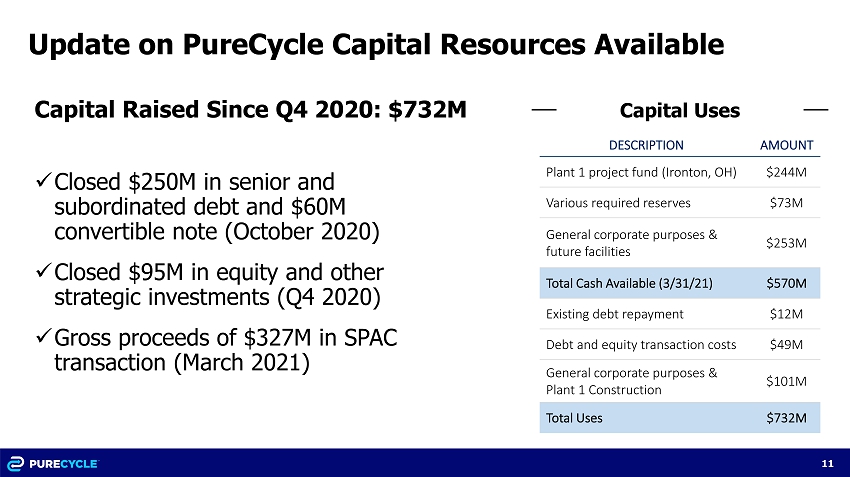

11 11 Update on PureCycle Capital Resources Available x Closed $250M in senior and subordinated debt and $60M convertible note (October 2020) x Closed $95M in equity and other strategic investments (Q4 2020) x Gross proceeds of $327M in SPAC transaction (March 2021) DESCRIPTION AMOUNT Plant 1 project fund (Ironton, OH) $244M Various required reserves $73M General corporate purposes & future facilities $253M Total Cash Available (3/31/21) $570M Existing debt repayment $12M Debt and equity transaction costs $49M General corporate purposes & Plant 1 Construction $101M Total Uses $732M Capital Uses Capital Raised Since Q4 2020: $732M

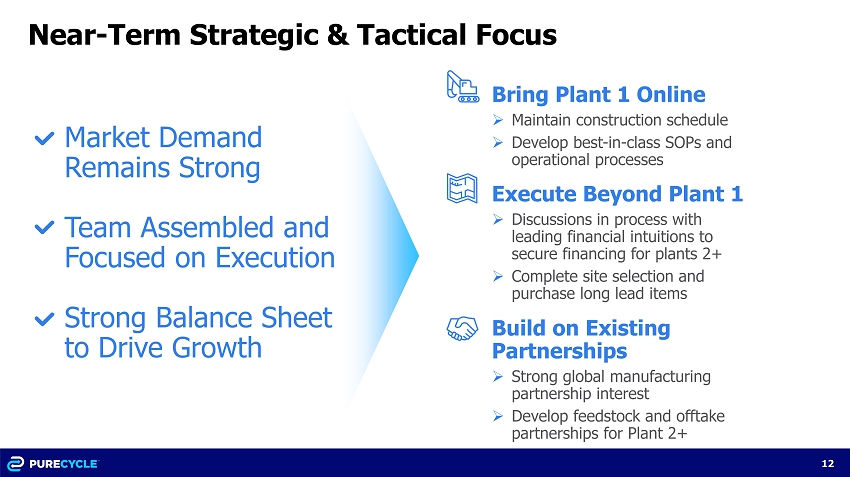

12 12 Near - Term Strategic & Tactical Focus Bring Plant 1 Online » Maintain construction schedule » Develop best - in - class SOPs and operational processes Execute Beyond Plant 1 » Discussions in process with leading financial intuitions to secure financing for plants 2+ » Complete site selection and purchase long lead items Build on Existing Partnerships » Strong global manufacturing partnership interest » Develop feedstock and offtake partnerships for Plant 2+ Market Demand Remains Strong Team Assembled and Focused on Execution Strong Balance Sheet to Drive Growth