As filed with the U.S. Securities and Exchange Commission on March 8, 2021

Registration No. 333-251034

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3

to

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

ROTH CH ACQUISITION I CO. PARENT CORP.*

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 5093 | 86-2293091 | ||

| (State

or other jurisdiction of incorporation or organization) |

(Primary

Standard Industrial Classification Code Number) |

(I.R.S.

Employer Identification No.) |

888 San Clemente

Drive, Suite 400

Newport Beach, CA 92660

(949) 720-5700

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Gordon Roth

Roth CH Acquisition I Co.

888 San Clemente Drive, Suite 400

Newport Beach, CA 92660

(949) 720-5700

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

Mitchell Nussbaum, Esq. Norwood P. Beveridge, Esq. Loeb & Loeb LLP 345 Park Avenue New York, NY 10154 Phone: (212) 407-4000 |

Joel T. May, Esq. Patrick S. Baldwin, Esq. Jones Day 1420 Peachtree Street, N.E., Suite 800 Atlanta, Georgia 30309 Tel: (404) 581-8967 |

Approximate date

of commencement of proposed sale to public:

From time to time after the effective date hereof.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Non-accelerated filer ☒ | Smaller reporting company ☒ | |

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Security Being Registered(1) | Amount

Being Registered(2) | Proposed Maximum Offering Price Per Security | Proposed Maximum Aggregate Offering Price | Amount

of Registration Fee | ||||||||||||

| Shares of Common Stock, $.001 par value (“Common Stock”) | 25,000,000 | $ | 10.45(3) | $ | 261,250,000(2) | $ | 28,502.38(4) | |||||||||

| (1) | All securities being registered will have been issued by Roth CH Acquisition I Co. Parent Corp. (“ParentCo”), a Delaware corporation and wholly-owned subsidiary of Roth CH Acquisition I Co., a Delaware corporation (“ROCH”), in connection with ROCH’s previously announced initial business combination (the “Business Combination”) with ParentCo, Roth CH Merger Sub LLC (“Merger Sub LLC”), Roth CH Merger Sub Corp. (“Merger Sub Corp”) and PureCycle Technologies LLC (“PCT”), pursuant to which ParentCo will have issued the shares of ParentCo Common Stock registered hereunder to certain institutions and accredited investors of ROCH in exchange for shares of ROCH common stock purchased by such investors in a transaction exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | Pursuant to Rule 416 under the Securities Act, the registrant is also registering an indeterminate number of additional shares of common stock that may become issuable as a result of any stock dividend, stock split, recapitalization or other similar transaction. |

| (3) | Pursuant to Rule 457(c) under the Securities Act, and solely for the purpose of calculating the registration fee, the proposed maximum offering price is $10.45, which is the average of the high and low prices of shares of ROCH common stock on the Nasdaq Capital Market on November 23, 2020 (such date being within five business days of the date that this registration statement was filed with the U.S. Securities and Exchange Commission (the “SEC”)). |

| (4) | Previously paid. |

* Prior to effectiveness, the name of ParentCo changed to PureCycle Technologies, Inc.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

EXPLANATORY NOTE

This registration statement registers the resale of securities originally issued in a private placement in connection with the consummation of the proposed business combination (the “Business Combination”) by and among Roth CH Acquisition I Co. (“ROCH”), Roth CH Acquisition I Co. Parent Corp. (“we,” “us,” “our” or “ParentCo”), a wholly owned subsidiary of ROCH, Roth CH Merger Sub LLC (“Merger Sub LLC”), Roth CH Merger Sub Corp. (“Merger Sub Corp”) and PureCycle Technologies LLC (“PCT”). The shares of ParentCo common stock covered by this registration statement did not vote at the special meeting of ROCH’s stockholders held to approve the Business Combination, and will not receive any proceeds from the trust account established in connection with ROCH’s initial public offering in the event ROCH does not consummate an initial business combination by the deadline in its amended and restated certificate of incorporation.

The information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED MARCH 8, 2021 |

PURECYCLE TECHNOLOGIES, INC.

25,000,000 Shares

Common Stock

This prospectus relates to the resale from time to time of certain shares of common stock issued pursuant to the terms of those certain subscription agreements entered into (the “PIPE Investment”) in connection with the proposed business combination (the “Business Combination”) by and among Roth CH Acquisition I Co. (“ROCH”), Roth CH Acquisition I Co. Parent Corp. (“we,” “us,” “our,” or “ParentCo”), a wholly owned subsidiary of ROCH, Roth CH Merger Sub LLC (“Merger Sub LLC”), Roth CH Merger Sub Corp. (“Merger Sub Corp”) and PureCycle Technologies LLC (“PCT”) pursuant to the Agreement and Plan of Merger dated as of November 16, 2020, as amended from time to time (the “Merger Agreement”).

In connection with the Business Combination, Merger Sub Corp merged with and into ROCH (the “RH Merger”), with ROCH surviving the RH Merger as a wholly-owned subsidiary of ParentCo (the “ROCH Surviving Company”); simultaneously with the RH Merger, Merger Sub LLC merged with and into PCT (the “PCT Merger”), with PCT surviving the PCT Merger as a wholly-owned subsidiary of ParentCo (the “Surviving Company”); following the PCT Merger, ParentCo contributed to the Surviving Company the proceeds of the PIPE Investment, other than the par value of the ROCH common stock which have been disbursed to ROCH, and, within two days following the closing of the Business Combination, ROCH Surviving Company will acquire, and ParentCo will contribute to ROCH Surviving Company all of the common units of the Surviving Company directly held by ParentCo after the PCT Merger (the “ParentCo Contribution”), such that, following the ParentCo Contribution, Surviving Company shall be a wholly-owned subsidiary of the ROCH Surviving Company.

Upon closing of the Business Combination, the name of ParentCo changed to PureCycle Technologies, Inc. In connection with the closing of the Business Combination, the currently issued and outstanding shares of ROCH’s common stock, par value $0.0001 per share (“Common Stock”), was exchanged, on a one-for-one basis, for shares of ParentCo common stock, par value $0.001 per share (“ParentCo Common Stock”). Accordingly, all references in this prospectus to “ParentCo Common Stock” refer to shares of ParentCo Common Stock issued at the closing of the Business Combination in exchange for all issued and outstanding shares of Common Stock of ROCH.

As described herein, the selling securityholders named in this prospectus or their permitted transferees (collectively, the “Selling Stockholders”), may sell from time to time up to 25,000,000 shares of ParentCo Common Stock that will be issued to certain institutions and accredited investors in connection with the closing of the PIPE Investment and Business Combination.

We will bear all costs, expenses and fees in connection with the registration of the ParentCo Common Stock and will not receive any proceeds from the sale of the ParentCo Common Stock. The Selling Stockholders will bear all commissions and discounts, if any, attributable to their respective sales of the ParentCo Common Stock.

Upon the consummation of the Business Combination, ParentCo’s Common Stock, warrants and units will have been approved for listing on the Nasdaq Capital Market (“Nasdaq”) under the symbols “PCT,” “PCTTW” and “PCTTU,” respectively.

We are an “emerging growth company” as defined under the U.S. federal securities laws and, as such, have elected to comply with certain reduced public company reporting requirements.

Investing in our common stock is highly speculative and involves a high degree of risk. See “Risk Factors” beginning on page 23.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2021

Table of Contents

You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with information different from or in addition to that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

In this prospectus, we rely on and refer to information and statistics regarding our industry. We obtained this statistical, market and other industry data and forecasts from publicly available information. While we believe that the statistical data, market data and other industry data and forecasts are reliable, we have not independently verified the data.

Unless otherwise stated in this prospectus, the terms, “we,” “us” or “our” refer to Roth CH Acquisition I Co., a Delaware corporation, prior to the consummation of the Business Combination and Roth CH Acquisition I Co. Parent Corp., a Delaware corporation renamed PureCycle Technologies, Inc., from and after the consummation of the Business Combination. Further, in this document:

• “Authority” means the Southern Ohio Port Authority, the issuer of the Revenue Bonds.

• “Board” means the board of directors of ROCH.

• “Business Combination” means the transactions contemplated by the Merger Agreement.

• “Certificate of Incorporation” means ROCH’s Amended and Restated Certificate of Incorporation.

• “Closing Date” means date of the consummation of the Business Combination.

• “Code” means the Internal Revenue Code of 1986, as amended.

• “Combined Company” means ParentCo and its consolidated subsidiaries after the Business Combination.

• “Common Stock” means the shares of common stock, par value $0.0001 per share, of ROCH.

• “Continental” means Continental Stock Transfer & Trust Company, ROCH’s transfer agent.

• “Convertible Notes” means the $60.0 million in aggregate principal amount of PCT’s 5.875% Convertible Senior Secured Notes due 2022.

• “Effective Time” means the time at which the Business Combination becomes effective.

• “Equity Plan” means the PureCycle Technologies, Inc. 2021 Equity and Incentive Compensation Plan.

• “Exchange Act” means the Securities Exchange Act of 1934, as amended.

• “First Tranche Notes” means the $48.0 million in aggregate principal amount of Convertible Notes issued on October 7, 2020.

• “GAAP” means accounting principles generally accepted in the United States of America.

• “Guarantor Liquidity Account” means the liquidity reserve held by U.S. Bank, as Escrow Agent, under an Escrow Agreement dated October 7, 2020 in connection with the Guaranty.

• “Guarantor Liquidity Reserve Amount” means the $50 million to be fully funded by PCT into the Guarantor Liquidity Account by January 31, 2021.

• “Guaranty” means that certain Guaranty of Completion, dated as of October 7, 2020, by and between PCT and UMB Bank, N.A., entered into in connection with the Revenue Bonds.

• “Initial Stockholders” means the officers and directors of ROCH and certain other stockholders who acquired shares of ROCH prior to the IPO.

2

• “IPO” refers to the initial public offering of 7,500,000 ROCH Units consummated on May 7, 2020 and includes the partial exercise of the underwriters’ over- allotment option in connection therewith.

• “Loan Agreement” means that certain Loan Agreement, dated as of October 1, 2020, by and between the Authority and Purecycle Ohio, entered into in connection with the Revenue Bonds.

• “Magnetar Guarantors” means the Combined Company and each subsidiary of the Combined Company that is a direct or indirect parent of PCT.

• “Magnetar Indenture” means that certain indenture, dated as of October 7, 2020, by and between PCT and U.S. Bank National Association, as trustee and collateral agent pursuant to which the Convertible Notes were issued.

• “Magnetar Investors” means certain funds managed by Magnetar Capital LLC or its affiliates that purchased the Convertible Notes.

• “Magnetar Registration Rights Agreement” means that certain Registration Rights Agreement, dated as of October 28, 2020, by and between PCT and the Magnetar Investors entered into in connection with the Convertible Notes.

• “Merger Agreement” means that certain Agreement and Plan of Merger, dated as of November 16, 2020, by and among ParentCo, ROCH, Merger Sub LLC, Merger Sub Corp and PCT, as may be amended.

• “Merger Sub Corp” means Roth CH Merger Sub Corp., a Delaware corporation and wholly-owned subsidiary of ParentCo.

• “Merger Sub LLC” means Roth CH Merger Sub LLC, a Delaware limited liability company of which ParentCo is the sole member.

• “Note Purchase Agreement” means that certain Note Purchase Agreement, dated as of October 6, 2020, by and among PCT and the Magnetar Investors, entered into in connection with the Convertible Notes.

• “Organizational Documents” means certificate of incorporation and bylaws.

• “ParentCo” means Roth CH Acquisition I Co. Parent Corp., a Delaware corporation and wholly-owned subsidiary of ROCH, prior to the consummation of the Business Combination.

• “PCT” means PureCycle Technologies LLC, a Delaware limited liability company.

• “PCT Units” means, collectively, the Class A Units, Class B preferred Units, Class B-1 preferred Units and Class C Units of PCT.

• “PCT Unitholders” means the current holders of PCT Units.

• “Phase I Facility,” “Feedstock Evaluation Unit,” and “FEU” each refer to the pilot line which PCT uses to screen potential feedstock sources.

• “Phase II Facility” and “Plant 1” each refer to PCT’s first commercial-scale plant in Ironton, Ohio.

• “PIPE Investment” means the purchase by certain institutions and accredited investors of 25,000,000 shares of Common Stock, which will be exchanged for shares of ParentCo Common Stock in the Business Combination, for an aggregate of $250,000,000 in a private placement intended to close immediately prior to the closing of the Business Combination.

• “Private Shares” means the shares of Common Stock underlying the ROCH Units issued in a private placement.

3

• “Private Units” means the 265,500 units of ROCH sold to the Initial Stockholders upon consummation of the IPO, consisting of one Private Share and three quarters of one Private Warrant to purchase a share of Common Stock at an exercise price of $11.50.

• “Private Warrant” means a warrant underlying the Private Units to purchase one Private Share at an exercise price of $11.50 in a private placement transaction.

• “Project” refers to the Phase I Facility and Phase II Facility together.

• “Project site” refers to the location of the Project.

• “Proxy Statement/Prospectus” refers to the proxy statement/prospectus sent to holders of Common Stock in connection with the Special Meeting.

• “Public Shares” means the registered shares of Common Stock underlying the ROCH Units sold in the IPO.

• “Public Stockholders” means holders of Public Shares.

• “Public Warrant” means a registered warrant to purchase a share of Common Stock at an exercise price of $11.50.

• “Purecycle Ohio” means Purecycle: Ohio LLC, a Delaware limited liability company and an indirect, wholly owned subsidiary of PCT.

• “Revenue Bonds” means, collectively, the Series 2020A Bonds, Series 2020B Bonds, and Series 2020C Bonds.

• “Revenue Bonds Trustee” means UMB Bank, N.A., as trustee under the indenture relating to the Revenue Bonds.

• “ROCH Units” means the 7,650,000 registered units sold by ROCH in connection with its IPO and the partial exercise of the underwriters’ over-allotment option, consisting of one Public Share and three quarters of one Public Warrant to purchase a share of Common Stock at an exercise price of $11.50.

• “SEC” means the U.S. Securities and Exchange Commission.

• “Second Tranche Notes” means the additional $12.0 million of aggregate principal amount of Convertible Notes issued to the Magnetar Investors on December 29, 2020.

• “Securities Act” means the Securities Act of 1933, as amended.

• “Series 2020A Bonds” or “the Senior Bonds” means the tax-exempt senior secured bonds in the aggregate principal amount of $219.6 million.

• “Series 2020B Bonds” or “the Tax-Exempt Subordinate Bonds” means the tax-exempt subordinate secured bonds in the aggregate principal amount of $20.0 million.

• “Series 2020C Bonds” or “the Taxable Subordinate Bonds” means the taxable subordinate secured bonds in the aggregate principal amount of $10.0 million.

• “sinking fund redemption amounts” means periodic payments reflecting the Authority’s obligation to mandatorily redeem a portion of the Revenue Bonds from time to time.

• “Special Meeting” means the special meeting of the stockholders of ROCH held on March 16, 2021, at which the stockholders of ROCH, among other things, voted to approve the Business Combination.

• “Trust Account” means the trust account of ROCH that holds the proceeds of the IPO in accordance with that certain Investment Management Trust Agreement between Continental Stock Transfer & Trust Company and ROCH.

4

cautionary statement on forward-looking statements

This prospectus contains forward-looking statements, including statements about the anticipated benefits of the Business Combination, and the financial condition, results of operations, earnings outlook and prospects of ROCH, ParentCo and/or PCT and may include statements for the period following the consummation of the Business Combination. Forward- looking statements appear in a number of places in this prospectus, including, without limitation, in the sections entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Description of PCT Business.” In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements are based on the current expectations of the management of ROCH, ParentCo and PCT as applicable and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in “Risk Factors,” those discussed and identified in public filings made with the SEC by ROCH and ParentCo and the following:

| • | PCT's ability to meet, and to continue to meet, applicable regulatory requirements for the use of PCT’s UPRP in food grade applications; |

| • | PCT's ability to comply on an ongoing basis with the numerous regulatory requirements applicable to the UPRP and PCT’s facilities; |

| • | expectations regarding PCT’s strategies and future financial performance, including its future business plans, expansion plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and PCT’s ability to invest in growth initiatives; |

| • | PCT’s ability to scale and build Plant 1 in a timely and cost-effective manner; |

| • | the implementation, market acceptance and success of PCT’s business model and growth strategy; |

| • | the success or profitability of PCT’s offtake arrangements; |

| • | PCT’s future capital requirements and sources and uses of cash; |

| • | PCT’s ability to obtain funding for its operations and future growth; |

| • | developments and projections relating to PCT’s competitors and industry; |

| • | the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement; |

| • | the outcome of any legal proceedings that may be instituted against ROCH or PCT following announcement of the Merger Agreement and the transactions contemplated therein; |

5

| • | the ability to recognize the anticipated benefits of the Business Combination; |

| • | unexpected costs related to the Business Combination; |

| • | limited liquidity and trading of ROCH’s securities; |

| • | geopolitical risk and changes in applicable laws or regulations; |

| • | the possibility that ROCH and/or PCT may be adversely affected by other economic, business, and/or competitive factors; |

| • | operational risk; and |

| • | risk that the COVID-19 pandemic, and local, state, and federal responses to addressing the pandemic may have an adverse effect on ROCH’s or PCT’s business operations, as well as ROCH’s or PCT’s financial condition and results of operations. |

Should one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of ROCH and PCT prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

All subsequent written and oral forward-looking statements concerning the Business Combination or other matters addressed in this prospectus and attributable to ROCH, PCT or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this proxy statement. Except to the extent required by applicable law or regulation, ROCH and PCT undertake no obligation to update these forward-looking statements to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated events.

6

This summary highlights information related to the Business Combination and the business of PCT appearing elsewhere in this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in shares of ParentCo Common Stock and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. Before you decide to invest in ParentCo Common Stock, you should read the entire prospectus carefully, including “Risk Factors” beginning on page 23 and the financial statements and related notes included in this prospectus.

This prospectus includes trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included in this prospectus are the property of their respective owners.

The Parties to the Business Combination

Roth CH Acquisition I Co.

Roth CH Acquisition I Co., or ROCH, is a blank check company incorporated in Delaware and formed for the purpose of entering into a merger, share exchange, asset acquisition, stock purchase, recapitalization, reorganization or other similar business combination with one or more businesses or entities. Although ROCH is not limited to a particular industry or geographic region for purposes of consummating an initial business combination, ROCH focused its search on businesses that have their primary operations in the business services, consumer, healthcare, technology or wellness sectors.

ROCH’s units, common stock, and warrants trade on NASDAQ under the symbols “ROCH.U,” “ROCH” and “ROCH.W,” respectively. At the Closing, the outstanding shares of ROCH Common Stock will have been exchanged for shares of ParentCo Common Stock.

The mailing address of ROCH’s principal executive office is 888 San Clemente Drive, Suite 400, Newport Beach, CA 92660, and its telephone number is 949-720-5700.

PureCycle Technologies LLC

PureCycle Technologies LLC, or PCT, is commercializing a patented purification recycling technology (the “Technology”), originally developed by The Procter & Gamble Company (“P&G”), for restoring waste polypropylene into resin with near-virgin characteristics. PCT refers to this resin as ultra-pure recycled polypropylene (“UPRP”), which has nearly identical properties and applicability for reuse as virgin polypropylene. PCT has a global license for the technology from P&G. PCT intends to build its first commercial-scale plant in Ironton, Ohio (referred to herein as “Plant 1” or the “Phase II Facility”), which is expected to have nameplate capacity of approximately 107 million pounds/year when fully operational. Production is expected to commence in late 2022 and the plant is expected to be fully operational in 2023. PCT has secured and contracted all of the feedstock and product offtake for this initial plant. PCT’s goal is to create an important new segment of the global polypropylene market that will assist multinational entities in meeting their sustainability goals, provide consumers with polypropylene-based products that are sustainable, and reduce overall polypropylene waste in the world’s landfills and oceans.

The mailing address of PCT’s principal executive office is 5950 Hazeltine National Drive, Suite 650, Orlando, Florida 32822, and its telephone number is 877-648-3565.

Roth CH Acquisition I Co. Parent Corp.

Roth CH Acquisition I Co. Parent Corp., or ParentCo, is a Delaware corporation that was incorporated on October 16, 2020 to facilitate the Business Combination. Upon consummation of the Business Combination, ParentCo’s name changed to “PureCycle Technologies, Inc.” and its common stock, warrants and units will have been approved for listing on NASDAQ under the symbols PCT, PCTTW and PCTTU, respectively.

7

The mailing address of ParentCo’s principal executive office is 5950 Hazeltine Drive, Suite 650, Orlando, FL 32822, and its telephone number is 877-648-3565.

The Special Meeting

A Special Meeting of stockholders of ROCH was held at 10:00 a.m., Eastern standard time, on March 16, 2021 to approve the Business Combination and related matters (collectively, the “Proposals”). At the Special Meeting of stockholders of ROCH, the ROCH stockholders approved the Business Combination and all matters relating thereto.

Terms of the Business Combination

The Business Combination was structured as a “double dummy” transaction, pursuant to which:

| (a) | Each of ParentCo, Merger Sub Corp and Merger Sub LLC are newly formed entities that were formed for the sole purpose of entering into and consummating the transactions set forth in the Merger Agreement. |

| (b) | At Closing, each of the following transactions occurred in the following order: (i) ParentCo completed the RH Merger, with ROCH surviving the RH Merger as a wholly-owned subsidiary of ParentCo (the “ROCH Surviving Company”); (ii) simultaneously with the RH Merger, ParentCo completed the PCT Merger with PCT surviving the PCT Merger as a wholly-owned subsidiary of ParentCo (the “Surviving Company”); and (iii) following the PCT Merger, ParentCo contributed to the Surviving Company the proceeds of the PIPE Investment, other than the par value of the Common Stock, which have been disbursed to ROCH, and, within two days following the Closing, ROCH Surviving Company will acquire, and ParentCo will contribute to ROCH Surviving Company (the “ParentCo Contribution”) all common units of the Surviving Company directly held by ParentCo after the PCT Merger, such that, following the ParentCo Contribution, Surviving Company shall be a wholly-owned subsidiary of the ROCH Surviving Company. |

The Aggregate Consideration payable to the members of PCT in connection with the Business Combination consists of the Closing Share Consideration, the Contingency Consideration and the assumption of all indebtedness of PCT as of the Closing Date (the “Assumed Indebtedness”), including indebtedness related to (a) the Revenue Bonds and (b) the Convertible Notes and other indebtedness used to fund the construction of an industrial process facility in Ironton, Ohio (collectively, the “Construction Indebtedness”).

(a) The Closing Share Consideration

The Closing Share Consideration for PCT Unitholders is the number of shares of ParentCo Common Stock, par value $0.001 per share equal to the quotient of: (a) $835,000,000 divided by (b) $10.00, subject to adjustment as set forth in Section 2.3 of the Merger Agreement. Common Stock, Public Warrants and ROCH Units issued and outstanding immediately prior to the consummation of the Business Combination were exchanged for ParentCo Securities on a one-for-one basis, as were ROCH’s outstanding warrants and units.

(b) Contingency Consideration

PCT Unitholders will be issued up to 4,000,000 additional shares of ParentCo Common Stock if certain conditions are met. Each of the “First Level Contingency Consideration” and “Second Level Contingency Consideration” is equal to 2,000,000 shares of ParentCo Common Stock. The PCT Unitholders will be entitled to the First Level Contingency Consideration, if after six months after the Closing and prior to or as of the third anniversary of the Closing, the closing price of the ParentCo Common Stock is greater than or equal to $18.00 over any 20 trading days within any 30-trading day period. The PCT Unitholders will be entitled to the Second Level Contingency Consideration upon the Phase II Facility becoming operational, as certified by Leidos Engineering, LLC (“Leidos”), an independent engineering firm, in accordance with criteria established in connection with the incurrence of the Construction Indebtedness.

Upon the first Change in Control (as defined in the Merger Agreement) to occur during the Earnout Period (as defined in the Merger Agreement), if the price per share paid or payable to the stockholders of ParentCo in connection with such Change in Control is equal to or greater than $18.00, ParentCo will issue 2,000,000 shares of ParentCo Common Stock. Upon the first Change in Control (substituting “80%” for “50%” in the definition thereof) to occur during the Earnout Period, if the price per share paid or payable to the stockholders of ParentCo in connection with such Change in Control is equal to or greater than $10.00 per share, ParentCo will issue 2,000,000 shares of ParentCo Common Stock.

8

Other Agreements Relating to the Business Combination

Investor Rights Agreement

At the Closing of the transactions contemplated by the Merger Agreement, ParentCo, certain PCT Unitholders representing at least 70% of PCT’s outstanding membership interests and certain stockholders of ROCH (including certain ROCH officers, directors and sponsors) entered into an investor rights agreement (the “Investor Rights Agreement”), which is a closing condition of the parties to consummate the Business Combination. Pursuant to the Investor Rights Agreement, such PCT Unitholders have agreed to vote in favor of two board designees nominated by a majority of such stockholders of ROCH for a period of two years following the Closing Date (the “IRA Designees”), provided that in the event a majority of the holders of the Pre-PIPE Shares (as defined below) choose to select one of the IRA Designees, the majority of such stockholders of ROCH will select one of the IRA Designees and such holders of the Pre-PIPE Shares will select the other. Pursuant to these provisions, ROCH has designated Mr. Fernando Musa to assume a seat on the Combined Company’s board of directors upon the consummation of the Business Combination and the holders of the Pre-PIPE Shares have designated Mr. Jeffrey Fieler to assume the other seat as an IRA Designee upon such consummation. The holders of the Pre-PIPE Shares may continue to select an IRA Designee until they no longer hold 10% or more of the outstanding Combined Company’s Common Stock. Such PCT Unitholders have also agreed, subject to certain limited exceptions, not to transfer ParentCo Common Stock received in the Business Combination except as follows:

| • | From and after the six-month anniversary of the Closing Date, each Founder (as defined in the Investor Rights Agreement) may sell up to 20% of such Founder’s ParentCo Common Stock and each PCT Unitholder that is not a Founder may sell up to 33.34% of such PCT Unitholder’s ParentCo Common Stock. |

| • | From and after the one-year anniversary of the Closing Date, each Founder may sell up to an additional 30% of such Founder’s ParentCo Common Stock and each PCT Unitholder that is not a Founder may sell up to an additional 33.33% of such PCT Unitholder’s ParentCo Common Stock. |

| • | From and after the Phase II Facility becoming operational, as certified by Leidos, an independent engineering firm, each Founder may sell up to an additional 50% of such Founder’s ParentCo Common Stock and each PCT Unitholder that is not a Founder may sell up to an additional 33.33% of such PCT shares of ParentCo Common Stock; provided that, in the case of Procter & Gamble, such lock-up will terminate in any event no later than April 15, 2023. |

The Investor Rights Agreement also contains registration rights in favor of the PCT Unitholders and such ROCH stockholders which (in the case of the ROCH stockholders) are intended to replace the registration rights granted to them at the time of ROCH’s IPO.

Subscription Agreements and PIPE Registration Rights Agreement

In connection with the Business Combination, certain institutions and accredited investors (each a “Subscriber”) (i) have purchased prior to the date of the Merger Agreement membership units of PCT at an effective price per ParentCo Common Stock of approximately $8.35 per share for an aggregate cash amount of approximately $60 million (the “Pre-PIPE Shares”) in a private placement (the “Pre-PIPE Placement”) and (ii) have committed to purchase, on a transitory basis simultaneously with the consummation of the Business Combination, shares of Common Stock at a purchase price of $10.00 per share for an aggregate cash amount of $250 million (the “PIPE Shares”) in a private placement (for purposes of this section, the “PIPE Placement”), all of which were exchanged for ParentCo Common Stock in connection with the closing of the Business Combination. Certain offering related expenses are payable by ROCH and PCT, including customary fees payable to the placement agents: Roth Capital Partners, LLC (“Roth”), Craig-Hallum Capital Group LLC (“C-H”) and Oppenheimer & Co. Inc. (“Oppenheimer”). Byron Roth, Gordon Roth and Aaron Gurewitz, the Chairman and Chief Executive Officer, Chief Financial Officer and Chief Operating Officer and Head of Equity Capital Markets, respectively, at Roth, and Rick Hartfiel and John Lipman, the Managing Partner and Head of Investment Banking and Partner and Managing Director of Investment Banking, respectively, at C-H, are either officers or directors (or both, in the case of Byron Roth and John Lipman) of ROCH. While no direct compensation arrangements regarding such individuals have been entered into regarding such fees, these executives may benefit indirectly from any such amounts payable to their respective organizations. Such commitments have been made by way of certain subscription or unit purchase agreements (collectively, the “Subscription Agreements”), by and among each Subscriber and PCT or ROCH, as the case may be. The purpose of the sale of the Pre-PIPE Shares and the PIPE Shares is to raise additional capital for use in connection with the PCT business and the Business Combination and, in the case of the PIPE Shares, to meet the minimum cash requirements provided in the Merger Agreement. The Subscription Agreements for the PIPE Placement were entered into contemporaneously with the execution of the Merger Agreement and the proceeds were deposited into escrow by the Subscribers and released to ParentCo (other than the par value of the PIPE Shares, which will be released to ROCH) in connection with the issuance of ParentCo Common Stock as part of the RH Merger concurrent with the closing of the Business Combination.

9

The closing of the sale of PIPE Shares (the “PIPE Closing”) was contingent upon the substantially concurrent consummation of the Business Combination. The PIPE Closing occurred simultaneously with the consummation of the RH Merger. The PIPE Closing was subject to customary conditions, including:

| • | ParentCo’s initial listing application with NASDAQ in connection with the Business Combination shall have been approved and, immediately following the Closing of the Business Combination, ParentCo shall satisfy any applicable initial and continuing listing requirements of NASDAQ and ParentCo shall not have received any notice of non-compliance therewith, and the ParentCo Common Stock shall have been approved for listing on NASDAQ; |

| • | all representations and warranties of ROCH and the Subscriber contained in the relevant Subscription Agreement shall be true and correct in all material respects (other than representations and warranties that are qualified as to materiality or Material Adverse Effect (as defined in the Subscription Agreements), which representations and warranties shall be true in all respects) at, and as of, the PIPE Closing; |

| • | as of the Closing Date, there has been no material adverse change in the business, properties, financial condition, stockholders’ equity or results of operations of ROCH and its subsidiaries taken as a whole since the date of the Subscription Agreement (other than the election by holders of the ROCH Class A Common Stock to exercise redemption rights in connection with the special meeting of ROCH’s stockholders to approve the Business Combination); and |

| • | all conditions precedent to the closing of the Business Combination, including the approval by ROCH’s stockholders, shall have been satisfied or waived. |

Pursuant to the Subscription Agreements and PIPE Registration Rights Agreement, ROCH agreed to file (at ROCH’s sole cost and expense) a registration statement registering the resale of the ParentCo Common Stock issuable in respect of the Pre-PIPE Shares and the PIPE Shares, of which registration statement this prospectus forms a part (the “PIPE Resale Registration Statement”), with the SEC no later than the 10th calendar day following the date ROCH first files the Proxy Statement/Prospectus with the SEC. ROCH will use its commercially reasonable efforts to have this PIPE Resale Registration Statement declared effective on the Closing Date of Business Combination but no later than the 60th calendar day following the Closing Date (or, in the event the SEC notifies ROCH that it will “review” this PIPE Resale Registration Statement, the 90th calendar day following the date thereof) (the “Effectiveness Date”).

Under certain circumstances, additional payments by ROCH or ParentCo (as applicable) may be assessed with respect to the Pre-Pipe Shares and PIPE Shares in the event that (i) this PIPE Resale Registration Statement has not been filed with the SEC by the Closing Date; (ii) this PIPE Resale Registration Statement has not been declared effective by the SEC by the Effectiveness Date; (iii) this PIPE Resale Registration Statement is declared effective by the SEC but thereafter ceases to be effective or is suspended for more than fifteen (15) consecutive calendar days or more than an aggregate of twenty (20) calendar days (which need not be consecutive calendar days) during any 12-month period; or (iv) ROCH or ParentCo (as applicable) fails for any reason to satisfy the current public information requirement under Rule 144(c) under the Securities Act and the Pre-Pipe Shares and PIPE Shares are not then registered for resale under the Securities Act during the period commencing from the twelve (12) month anniversary of the closing and ending at such time that all of the Pre-Pipe Shares and PIPE Shares may be sold without the requirement for ROCH or ParentCo (as applicable) to be in compliance with Rule 144(c)(1) under the Securities Act and otherwise without restriction or limitation pursuant to Rule 144 under the Securities Act. The additional payments by ROCH or ParentCo (as applicable) will accrue on the applicable Pre-Pipe Shares and PIPE Shares at a rate of 1.0% of the aggregate purchase price paid for such shares per month, subject to certain terms and limitations (including a cap of 6.0% of the aggregate purchase price paid for such shares pursuant to the Subscription Agreements).

10

Founder Support Agreement

In connection with the execution of the Merger Agreement, certain of the Initial Stockholders entered into the Founder Support Agreement with ROCH, ParentCo, and PCT, pursuant to which such Initial Stockholders agreed to vote an aggregate of 1,861,987 shares of Common Stock beneficially owned by them, representing approximately 19% of ROCH’s outstanding shares, in favor of each of the Proposals, to use their reasonable best efforts to take all actions reasonably necessary to consummate the Business Combination and to not take any action that would reasonably be expected to materially delay or prevent the satisfaction of the conditions to the Business Combination set forth in the Merger Agreement. In addition, such Initial Stockholders also agreed that they would not sell, assign or otherwise transfer any of the Insider Shares (as defined therein) unless the buyer, assignee or transferee executes a joinder agreement to the Founder Support Agreement. We agreed that we would not register any sale, assignment or transfer of such Insider Shares on our transfer ledger (book entry or otherwise) that is not in compliance with the Founder Support Agreement.

Company Support Agreement

In connection with the execution of the Merger Agreement, PCT Unitholders representing 74.78% of the voting issued and outstanding Company LLC Interests entered into the Company Support Agreement with ROCH, ParentCo, and PCT, pursuant to which such PCT Unitholders agreed to vote all LLC Interests beneficially owned by them in favor of each of the Proposals, to use their reasonable best efforts to take all actions reasonably necessary to consummate the Business Combination and to not take any action that would reasonably be expected to materially delay or prevent the satisfaction of the conditions to the Business Combination set forth in the Merger Agreement. In addition, such PCT Unitholders also agreed that they would not sell, assign or otherwise transfer any of the Company LLC Interests held by them, with certain limited exceptions, unless the buyer, assignee or transferee executes a joinder agreement to the Company Support Agreement.

11

Ownership Structure

The following diagram illustrates the ownership structure of ROCH, ParentCo, Merger Sub LLC, Merger Sub Corp and PCT after the Business Combination after giving effect to redemptions received on or prior to the Closing Date.

12

13

Anticipated Accounting Treatment

The Business Combination will be accounted for as a “reverse recapitalization” in accordance with GAAP. Under this method of accounting ROCH will be treated as the “acquired” company for financial reporting purposes. This determination is primarily based on the fact that subsequent to the Business Combination, the PCT Unitholders are expected to have a majority of the voting power of the Combined Company, PCT will comprise all of the ongoing operations of the Combined Company, PCT will comprise a majority of the governing body of the Combined Company, and PCT’s senior management will comprise all of the senior management of the Combined Company. Accordingly, for accounting purposes, the Business Combination will be treated as the equivalent of PCT issuing shares for the net assets of ROCH, accompanied by a recapitalization. The net assets of ROCH will be stated at historical costs. No goodwill or other intangible assets will be recorded. Operations prior to the Business Combination will be those of PCT.

14

SELECTED HISTORICAL FINANCIAL INFORMATION OF ROCH

ROCH’s balance sheet data as of December 31, 2020 and 2019 and statement of operations data for the year ended December 31, 2020 and for the period from February 13, 2019 (inception) through December 31, 2019 are derived from ROCH’s audited financial statements included elsewhere in this prospectus.

The historical results of ROCH included below and elsewhere in this prospectus are not necessarily indicative of the future performance of ROCH. You should read the following selected financial data in conjunction with the financial statements and the related notes appearing elsewhere in this prospectus.

Year

ended | For the Period from February 13, 2019 (inception) through December 31, 2019 | |||||||

| Formation and operating costs | $ | 1,097,684 | 1,594 | |||||

| Loss from operations | (1,097,684 | ) | — | |||||

| Other income | ||||||||

| Interest income | 35,131 | — | ||||||

| Net loss | (1,062,553 | ) | (1,594 | ) | ||||

| Weighted average shares outstanding – basic and diluted | 2,533,092 | 1,875,000 | ||||||

| Basic and diluted net loss per common share | $ | (0.42 | ) | (0.00 | ) | |||

| As

of December 31, | ||||||||

| Balance Sheet Data: | 2020 | 2019 | ||||||

| Trust Account | $ | 76,535,131 | $ | — | ||||

| Total assets | 76,842,150 | 280,908 | ||||||

| Total liabilities | 3,404,610 | 257,502 | ||||||

| Common stock subject to possible redemption | 68,437,530 | — | ||||||

| Stockholders’ equity | 5,000,001 | 280,908 | ||||||

15

SELECTED HISTORICAL FINANCIAL INFORMATION OF PCT

The information presented below is derived from PCT’s audited consolidated financial statements included elsewhere in this prospectus for the fiscal years ended December 31, 2020, 2019 and 2018 and the balance sheet data as of December 31, 2020, 2019 and 2018.

The historical results presented below are not necessarily indicative of the results to be expected for any future period. You should read carefully the following selected information in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and PCT’s historical consolidated financial statements and accompanying footnotes, included elsewhere in this prospectus.

| For

the Years Ended December 31 | ||||||||||||

| (in thousands) | 2020 | 2019 | 2018 | |||||||||

| Statement of Operations Data | ||||||||||||

| Revenue | $ | — | $ | — | $ | — | ||||||

| Costs and Expenses | ||||||||||||

| Operating Costs | 8,603 | 5,966 | 1,222 | |||||||||

| Research and Development | 648 | 526 | 786 | |||||||||

| Selling, General and Administrative | 39,525 | 11,478 | 2,097 | |||||||||

| Total Operating Costs and Expenses | 48,776 | 17,970 | 4,105 | |||||||||

| Interest Expense | 7,954 | 1,012 | — | |||||||||

| Other Expense, net | 111 | 330 | — | |||||||||

| Net Loss | $ | (56,841 | ) | $ | (19,312 | ) | $ | (4,105 | ) | |||

| Net Loss per Unit(1) | $ | (22.02 | ) | $ | (8.42 | ) | $ | (1.86 | ) | |||

| As of December 31, | ||||||||||||

| (in thousands) | 2020 | 2019 | 2018 | |||||||||

| Balance Sheet Data | ||||||||||||

| Cash and Cash Equivalents | $ | 64,492 | $ | 150 | $ | 101 | ||||||

| Working Capital(2) | 34,752 | (7,622 | ) | (4,226 | ) | |||||||

| Total Assets | 404,127 | 33,281 | 25,738 | |||||||||

| Total Liabilities | 296,228 | 30,901 | 19,544 | |||||||||

| Total Members’ Equity | 107,899 | 2,380 | 6,194 | |||||||||

(1) PCT follows the two-class method when computing net loss per common units when units are issued that meet the definition of participating securities. The two-class method requires income available to common unitholders for the period to be allocated between common and participating securities based upon their respective rights to receive dividends as if all income for the period had been distributed. The two-class method also requires losses for the period to be allocated between common and participating securities based on their respective rights if the participating security contractually participates in losses. As holders of participating securities do not have a contractual obligation to fund losses, undistributed net losses are not allocated to Class B Preferred Units, Class B-1 Preferred Units and Class C Units for purposes of the loss per unit calculation.

(2) PCT defines working capital as total current assets minus total current liabilities.

16

SUMMARY UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

The following summary unaudited pro forma condensed combined financial information (the “Summary Pro Forma Information”) gives effect to the Business Combination. The Business Combination will be accounted for as a reverse recapitalization in accordance with U.S. GAAP. Under this method of accounting, ROCH will be treated as the “acquired” company for financial reporting purposes. Accordingly, the Business Combination will be reflected as the equivalent of PCT issuing stock for the net assets of ROCH, accompanied by a recapitalization whereby no goodwill or other intangible assets are recorded. Operations prior to the Business Combination will be those of PCT. The summary unaudited pro forma condensed combined balance sheet data as of December 31, 2020 gives effect to the Business Combination as if it had occurred on December 31, 2020. The summary unaudited pro forma condensed combined statement of operations data for the year ended December 31, 2020 give effect to the Business Combination as if it had occurred on January 1, 2020.

The Summary Pro Forma Information has been derived from, and should be read in conjunction with, the more detailed unaudited pro forma condensed combined financial information of the post-combination company appearing elsewhere in this prospectus and the accompanying notes to the unaudited pro forma condensed combined financial information. The unaudited pro forma condensed combined financial information is based upon, and should be read in conjunction with, the historical financial statements and related notes of ROCH and PCT for the applicable periods included in this prospectus. The Summary Pro Forma Information has been presented for informational purposes only and is not necessarily indicative of what the Combined Company’s financial position or results of operations actually would have been had the Business Combination been completed as of the dates indicated. In addition, the Summary Pro Forma Information does not purport to project the future financial position or operating results of the Combined Company.

The unaudited pro forma condensed combined financial information has been prepared using the assumptions below with respect to the potential redemption into cash of Common Stock:

| • | Assuming Minimum Redemptions: This presentation assumes that no public stockholders of ROCH exercise redemption rights with respect to their Public Shares for a pro rata share of the funds in the Trust Account. |

| • | Assuming Maximum Redemptions: This presentation assumes that stockholders holding 6.8 million of the Public Shares will exercise their redemption rights for their pro rata share (approximately $10.00 per share) of the funds in the Trust Account. This scenario gives effect to public share redemptions for aggregate redemption payments of $68.4 million using a per share redemption price of $10.00 per share. The Merger Agreement includes as a condition to closing the Business Combination that, at the closing, ROCH will have a minimum of $250.0 million in cash comprising (i) the cash held in the Trust Account after giving effect to ROCH share redemptions and proceeds from the PIPE Investment and (ii) a minimum of $5.0 million of net tangible assets. Additionally, this presentation also contemplates that ROCH’s initial stockholders have agreed to waive their redemption rights with respect to their Founder Shares, Private Shares and Public Shares in connection with the completion of a Business Combination. |

| As of the Closing Date of the Business Combination, ROCH received redemption requests from the holders of an aggregate of shares of Common Stock. | ||

17

| Summary Unaudited

Pro Forma Condensed Combined Statement of Operations Data Year Ended December 31, 2020 (in thousands except share and per share data) | Pro

Forma Combined (Assuming No Redemption) | Pro

Forma (Assuming | ||||||

| Revenue | $ | — | $ | — | ||||

| Net loss per share – basic and diluted | $ | (0.50 | ) | $ | (0.53 | ) | ||

| Weighted-average common shares outstanding – basic and diluted | 118,328,000 | 111,484,247 | ||||||

| Summary

Unaudited Pro Forma Condensed Combined Balance Sheet Data as of December 31, 2020 (in thousands) | Pro

Forma Combined (Assuming No Redemption) | Pro

Forma (Assuming | ||||||

| Total assets | $ | 714,035 | $ | 645,597 | ||||

| Total liabilities | $ | 295,100 | $ | 295,100 | ||||

| Total stockholders’ equity | $ | 418,935 | $ | 350,497 | ||||

18

The following table sets forth summary historical comparative share information for ROCH and PCT and unaudited pro forma condensed combined per share information after giving effect to the Business Combination. The pro forma book value information reflects the Business Combination as if it had occurred on December 31, 2020. The weighted average shares outstanding and net earnings per share information reflect the Business Combination as if they had occurred on January 1, 2020.

The unaudited pro forma condensed combined earnings per share information should be read in conjunction with, the historical financial statements and related notes of ROCH and PCT for the applicable periods included in this prospectus. The unaudited pro forma condensed combined earnings per share information has been presented for informational purposes only and is not necessarily indicative of what the Combined Company’s results of operations actually would have been had the business combination been completed as of the dates indicated. In addition, the unaudited pro forma combined book value per share information does not purport to project the future financial position or operating results of the post-combination company.

The unaudited pro forma condensed combined financial information has been prepared using the assumption below with respect to the potential redemption into cash of common stock:

| • | Assuming Minimum Redemptions: This presentation assumes that no public stockholders of the Company exercise redemption rights with respect to their public shares for a pro rata share of the funds in the Trust Account. |

| • | Assuming Maximum Redemptions: This presentation assumes that stockholders holding 6.8 million of the Company’s public shares will exercise their redemption rights for their pro rata share (approximately $10.00 per share) of the funds in the Trust Account. This scenario gives effect to public share redemptions for aggregate redemption payments of $68.4 million using a per share redemption price of $10.00 per share. The Merger Agreement includes as a condition to closing the Business Combination that, at the closing, ROCH will have a minimum of $250.0 million in cash comprising (i) the cash held in the Trust Account after giving effect to ROCH share redemptions and proceeds from the PIPE Investment and (ii) a minimum of $5.0 million of net tangible assets. Additionally, this presentation also contemplates that ROCH’s initial stockholders have agreed to waive their redemption rights with respect to their Founder Shares, Private Shares and Public Shares in connection with the completion of a Business Combination. |

| Combined Pro Forma | PureCycle

Equivalent Per Share Pro Forma (2) | |||||||||||||||||||||||

| PCT

(Historical) | ROCH

(Historical) | Pro Forma Condensed

| Pro Forma Condensed | Pro Forma Condensed | Pro Forma Condensed | |||||||||||||||||||

| As of and for the year ended December 31, 2020 | ||||||||||||||||||||||||

| Book Value per share (1) | $ | 39.51 | $ | 1.97 | $ | 3.54 | $ | 3.14 | $ | 38.20 | $ | 33.88 | ||||||||||||

| Weighted average shares outstanding of common stock – basic and diluted | 2,731,045 | 2,533,092 | 118,328,000 | 111,484,247 | 29,468,097 | 27,332,175 | ||||||||||||||||||

| Net income per share of Class A common stock – basic and diluted | $ | (22.02 | ) | $ | (0.42 | ) | $ | (0.50 | ) | $ | (0.53 | ) | $ | (5.38 | ) | $ | (5.71 | ) | ||||||

(1) Book value per share = (Total equity)/(Common shares outstanding).

(2) The equivalent pro forma basic and diluted per share data for PCT is calculated based on an expected exchange ratio of 10.79 under both the no redemption and maximum redemption scenarios that is inherent in the Business Combination.

19

The Offering

| Issuer | Roth CH Acquisition I Co. Parent Corp. renamed PureCycle Technologies, Inc. upon consummation of the Business Combination. | |

| Shares that may be offered and sold from time to time by the Selling Stockholders named herein | 25,000,000 shares of ParentCo Common Stock. | |

| ParentCo Common Stock to be issued and outstanding after the consummation of the Business Combination (assuming no redemptions and excluding shares issuable upon exercise of outstanding warrants)(1) | 118,328,000 shares | |

| Use of proceeds | All of the shares of ParentCo Common Stock offered by the Selling Stockholders pursuant to this prospectus will be sold by the Selling Stockholders for their respective accounts. We will not receive any of the proceeds from these sales. | |

| NASDAQ Capital Market symbol | “PCT” | |

| Risk Factors | Investing in ParentCo Common Stock involves a high degree of risk. See “Risk Factors” beginning on page 23 and the other information in this prospectus for a discussion of the factors you should consider carefully before you decide to invest in ParentCo Common Stock. |

(1) Represents the number of shares of ParentCo Common Stock outstanding at Closing assuming that none of ROCH’s public stockholders exercised their redemption rights in connection with the Special Meeting. Excludes 4,000,000 shares of ParentCo Common Stock which may be issued to the current owners of PCT subject to the achievement of certain stock price targets and upon commissioning of an industrial facility in Ironton, Ohio.

20

Our business is subject to a number of risks and uncertainties, including those highlighted in the section entitled “Risk Factors” immediately following this summary. Some of these principal risks include the following and may be further exacerbated by the COVID-19 pandemic:

| • | Risks Related to PCT’s Business |

| • | PCT is an early commercial stage emerging growth company with no revenue, and may never achieve or sustain profitability. |

| • | PCT’s business is not diversified. |

| • | The License Agreement sets forth certain performance targets which, if missed, could result in a termination or conversion of the license granted under the License Agreement. |

| • | PCT’s outstanding secured and unsecured indebtedness (including at the Project level), ability to incur additional debt and the provisions in the agreements governing PCT’s debt, and certain other agreements, could have a material adverse effect on PCT’s business, financial condition, results of operations and prospects. |

| • | PCT’s projections are subject to significant risks, assumptions, estimates and uncertainties. As a result, PCT’s projected revenues, expenses and profitability may differ materially from expectations. |

| • | PCT’s business, financial condition, results of operations and prospects may be adversely affected by the impact of the global outbreak of COVID-19. |

| • | Construction of the Phase II Facility may not be completed in the expected timeframe or in a cost-effective manner. Any delays in the construction of the Phase II Facility could severely impact PCT’s business, financial condition, results of operations and prospects. |

| • | Initially, PCT will rely on a single facility for all of its operations. |

| • | There is no guarantee the Technology is scalable to commercial-scale operation. |

| • | PCT may be unable to sufficiently protect its proprietary rights and may encounter disputes from time to time relating to its use of the intellectual property of third parties. |

| • | PCT may not be successful in finding future strategic partners for continuing development of additional offtake and feedstock opportunities. |

| • | PCT’s failure to secure waste polypropylene could have a negative impact on PCT’s business, financial condition, results of operations and prospects. |

| • | Because PCT’s global expansion requires sourcing feedstock and supplies from around the world, including Europe, changes to international trade agreements, tariffs, import and excise duties, taxes or other governmental rules and regulations could adversely affect PCT’s business, financial condition, results of operations and prospects. |

| • | The market for UPRP is still in the development phase and the acceptance of UPRP by manufacturers and potential customers is not guaranteed. |

| • | Certain of PCT’s offtake agreements are subject to index pricing, and fluctuation in index prices may adversely impact PCT’s financial results. |

| • | Competition could reduce demand for PCT’s products or negatively affect PCT’s sales mix or price realization. |

| • | PCT may not be able to meet applicable regulatory requirements for the use of PCT’s UPRP in food grade applications, and, even if the requirements are met, complying on an ongoing basis with the numerous regulatory requirements applicable to the UPRP and our facilities will be time-consuming and costly. |

| • | The operation of and construction of the Project is subject to governmental regulation. |

21

| • | Risks Related to Human Capital Management |

| • | PCT is dependent on management and key personnel, and PCT’s business would suffer if it fails to retain its key personnel and attract additional highly skilled employees. |

| • | While ROCH and PCT work to complete the business combination, management’s focus and resources may be diverted from operational matters and other strategic opportunities. |

| • | PCT’s management has limited experience in operating a public company. |

| • | Risks Related to the Combined Company’s Common Stock |

| • | There can be no assurance that the Combined Company’s Common Stock will be approved for listing on NASDAQ upon the Closing, or if approved, that the Combined Company will be able to comply with the continued listing standards of NASDAQ. |

| • | The exercise of registration rights may adversely affect the market price of the Combined Company’s Common Stock. |

| • | Future offerings of debt or offerings or issuances of equity securities by the Combined Company may adversely affect the market price of the Combined Company’s Common Stock or otherwise dilute all other stockholders. |

| • | General Risk Factors |

| • | Each of ROCH and PCT have incurred and will incur substantial costs in connection with the Business Combination and related transactions, such as legal, accounting, consulting and financial advisory fees. |

| • | The Combined Company is an emerging growth company, and the Combined Company cannot be certain if the reduced reporting requirements applicable to emerging growth companies will make its shares less attractive to investors. |

| • | Following the consummation of the Business Combination, the Combined Company will incur significant increased expenses and administrative burdens as a public company. |

22

Upon consummation of the Business Combination, the resulting Combined Company will be subject to a number of risks. You should carefully consider the following risk factors, together with all of the other information included in this prospectus, before you decide whether to invest in ParentCo Common Stock. Following the closing of the Business Combination, the market price of the Combined Company’s common stock could decline due to any of these risks, in which case you could lose all or part of your investment. In assessing these risks, you should also refer to the other information included in this prospectus, including the consolidated financial statements of ROCH and PCT and the accompanying notes. The Combined Company’s business, financial condition or results of operations could be affected materially and adversely by any of the risks discussed below.

Risks Related to PCT’s Business

Risks Related to PCT’s Status as an Early Commercial Stage Emerging Growth Company

PCT is an early commercial stage emerging growth company with no revenue, and may never achieve or sustain profitability.

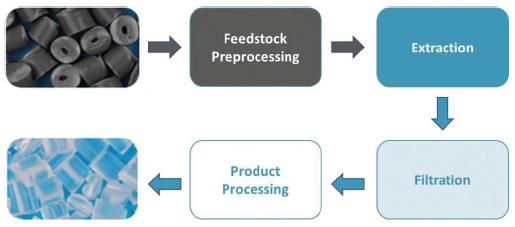

PCT is commercializing a recycling technology that was developed by The Procter & Gamble Company (“P&G”). P&G granted PCT a worldwide license under an Amended and Restated Patent License Agreement dated July 28, 2020, between P&G and PCT (the “License Agreement”) for a proprietary process of restoring waste polypropylene into ultra-pure recycled polypropylene (“UPRP”) through an extraction and filtration purification process (the “Technology”).

PCT relies principally on the commercialization of UPRP as well as the Technology and related licenses to generate future revenue growth. To date, such products and services have delivered no revenue. Also, UPRP product offerings and partnering revenues are in their very early stages. PCT believes that commercialization success is dependent upon the ability to significantly increase the number of production plants, feedstock suppliers and offtake partners as well as strategic partners that utilize UPRP and the Technology via licensing agreements. PCT is an early commercial stage emerging growth company that evaluates various strategies to achieve its financial goals and commercialization objectives on an ongoing basis. In this regard, PCT’s production methodology designed to achieve these objectives, including with respect to future plant size, capacity, cost, geographic location, sequencing and timing, is subject to change as a result of modifications to business strategy or market conditions. Furthermore, if demand for UPRP and the Technology does not increase as quickly as planned, PCT may be unable to increase revenue levels as expected. PCT is currently not profitable. Even if PCT succeeds in increasing adoption of UPRP products by target markets, maintaining and creating relationships with existing and new offtake partners, feedstock suppliers and customers, and developing and commercializing additional plants, market conditions, particularly related to pricing and feedstock costs, may result in PCT not generating sufficient revenue to achieve or sustain profitability.

PCT’s business is not diversified.

PCT’s initial commercial success depends on its ability to profitably operate the solid waste disposal facility and Feedstock Evaluation Unit (the “FEU” or the “Phase I Facility”) and its ability to complete construction and profitably and successfully operate its first commercial scale recycling facility (the “Phase II Facility” and, together with the Phase I Facility, the “Project”). The Project is located in Lawrence County, Ohio. Other than the future production and sale of UPRP, there are currently no other lines of business or other sources of revenue. Such lack of diversification may limit PCT’s ability to adapt to changing business conditions and could have an adverse effect on PCT’s business, financial condition, results of operations and prospects.

The License Agreement sets forth certain performance and pricing targets which, if missed, could result in a termination or conversion of the license granted under the License Agreement.

Pursuant to the License Agreement, P&G has granted PCT a license to utilize certain P&G intellectual property. The intellectual property is tied to the proprietary purification process by which waste polypropylene may be converted to UPRP, referred to as the Technology. The License Agreement sets forth certain performance targets for the Phase II Facility which, if missed, could result in a termination of the license granted under the License Agreement (if PCT is unable to make UPRP at certain production volumes and at certain prices within a certain time frame). The License Agreement also sets forth certain performance and pricing targets for the Phase II Facility which, if missed, could result in conversion of the license to a non-exclusive license (if PCT’s UPRP is unable to meet certain purification thresholds within a certain period of time after the start of the Project or PCT is unable or unwilling to provide P&G with UPRP at certain prices from the first plant). In the event the License Agreement is terminated or converted to a non-exclusive license, this could have a material adverse effect on PCT’s business, financial condition, results of operations and prospects.

23

PCT’s outstanding secured and unsecured indebtedness (including at the Project level), ability to incur additional debt and the provisions in the agreements governing PCT’s debt, and certain other agreements, could have a material adverse effect on PCT’s business, financial condition, results of operations and prospects.

As of December 31, 2020, after giving pro forma effect to the transactions contemplated by the Merger Agreement, the offering of the Revenue Bonds, and the issuance of $60 million of the Convertible Notes, PCT had total consolidated debt of $312.0 million, including $306.5 million of secured indebtedness (including $235.0 million of indebtedness at the Project level) and $5.5 million of unsecured indebtedness. PCT’s debt service obligations could have important consequences to the Combined Company for the foreseeable future, including the following: (i) PCT’s ability to obtain additional financing for capital expenditures, working capital or other general corporate purposes may be impaired; (ii) a substantial portion of PCT’s cash flow from operating activities must be dedicated to the payment of principal and interest on PCT’s debt, thereby reducing the funds available to us for PCT’s operations and other corporate purposes; and (iii) PCT may be or become substantially more leveraged than some of its competitors, which may place PCT at a relative competitive disadvantage and make us more vulnerable to changes in market conditions and governmental regulations.

PCT is required to maintain compliance with certain financial and other covenants under its debt agreements. There are and will be operating and financial restrictions and covenants in certain of PCT’s debt agreements, including the Loan Agreement and the indenture governing PCT’s Convertible Notes, as well as certain other agreements to which PCT is or may become a party. These limit, among other things, PCT’s ability to incur certain additional debt, create certain liens or other encumbrances, sell assets, and transfer ownership interests and transactions with affiliates of PCT. These covenants could limit PCT’s ability to engage in activities that may be in PCT’s best long-term interests. PCT’s failure to comply with certain covenants in these agreements could result in an Event of Default (as defined therein) under the various debt agreements, allowing lenders to accelerate the maturity for the debt under these agreements and to foreclose upon any collateral securing the debt. An Event of Default would also adversely affect PCT’s ability to access its borrowing capacity and pay debt service on its outstanding debt, likely resulting in acceleration of such debt or in a default under other agreements containing cross-default provisions. Under such circumstances, PCT might not have sufficient funds or other resources to satisfy all of its obligations. In addition, the limitations imposed by PCT’s financing agreements on its ability to pay dividends, incur additional debt and to take other actions might significantly impair PCT’s ability to obtain other financing, generate sufficient cash flow from operations to enable PCT to pay its debt or to fund other liquidity needs. Such consequences would adversely affect PCT’s business, financial condition, results of operations and prospects.

PCT’s projections are subject to significant risks, assumptions, estimates and uncertainties. As a result, PCT’s projected revenues, expenses and profitability may differ materially from expectations.

In connection with the Business Combination, the ROCH Board of Directors considered, among other things, internal financial forecasts for the post-Business Combination company. They speak only as of the date made and will not be updated. These financial projections are subject to significant economic, competitive, industry and other uncertainties, including availability of capital, and may not be achieved in full, at all or within projected timeframes. For example, the financial projections provided to the ROCH Board of Directors are derived in part from PCT’s projections of future UPRP production volumes. Those future production volumes include volumes associated with both current and projected feedstock sources. Projected feedstock sources and associated future production volumes and related future cash flows are inherently more uncertain than those related to current volumes, and the impact of that uncertainty increases for periods further from the date of this proxy statement/prospectus. Further, as a result of unprecedented market disruption resulting from the global coronavirus (COVID-19), these projections are even more uncertain in terms of reflecting actual future results. In addition, the failure of PCT’s business to achieve projected results could have a material adverse effect on the Combined Company’s share price and financial position following the Business Combination.

24

Risks Related to PCT’s Operations

PCT’s business, financial condition, results of operations and prospects may be adversely affected by the impact of the global outbreak of COVID-19.

The United States is being affected by the COVID-19 pandemic, the full effect of which on global financial markets as well as national, state and local economies is unknown. There can be no assurances as to the materiality, severity and duration of negative economic conditions caused by the pandemic.