Third Quarter 2024 Corporate Update November 7, 2024

Forward-Looking Statements This press release contains forward-looking statements, including statements about the continued expansion of PureCycle’s business plan, the expected time of commercial sales, the commercialization of Ironton operations, the expected increase in production of the Ironton operations, the planned compounding operations, the sourcing of materials, and planned future updates. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements generally relate to future events or PureCycle’s future financial or operating performance and may refer to projections and forecasts. Forward-looking statements are often identified by future or conditional words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions (or the negative versions of such words or expressions), but the absence of these words does not mean that a statement is not forward-looking. The forward-looking statements are based on the current expectations of PureCycle’s management and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of this press release. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section entitled “Risk Factors” in each of PureCycle’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and PureCycle’s Quarterly Reports on Form 10-Q for various quarterly periods, those discussed and identified in other public filings made with the Securities and Exchange Commission by PureCycle and the following: PCT's ability to obtain funding for its operations and future growth and to continue as a going concern; PCT's ability to meet, and to continue to meet, applicable regulatory requirements for the use of PCT’s ultra-pure recycled (“UPR”) resin in food grade applications (including in the United States, Europe, Asia and other future international locations); PCT's ability to comply on an ongoing basis with the numerous regulatory requirements applicable to the UPR resin and PCT’s facilities (including in the United States, Europe, Asia and other future international locations); expectations and changes regarding PCT’s strategies and future financial performance, including its future business plans, expansion plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and PCT’s ability to invest in growth initiatives; the ability of PCT’s first commercial-scale recycling facility in Lawrence County, Ohio (the “Ironton Facility”) to be appropriately certified by Leidos, following certain performance and other tests, and commence full-scale commercial operations in a timely and cost-effective manner or at all; PCT’s ability to meet, and to continue to meet, the requirements imposed upon it and its subsidiaries by the funding for its operations, including the funding for the Ironton Facility; PCT’s ability to minimize or eliminate the many hazards and operational risks at its manufacturing facilities that can result in potential injury to individuals, disrupt its business (including interruptions or disruptions in operations at its facilities), and subject PCT to liability and increased costs; PCT’s ability to complete the necessary funding with respect to, and complete the construction of, (i) its first U.S. multi-line facility, located in Augusta, Georgia, and (ii) its first commercial-scale European plant located in Antwerp, Belgium, in a timely and cost-effective manner; PCT’s ability to procure, sort and process polypropylene plastic waste at its planned plastic waste prep facilities; PCT’s ability to maintain exclusivity under the Procter & Gamble Company license; the implementation, market acceptance and success of PCT’s business model and growth strategy; the success or profitability of PCT’s offtake arrangements; the ability to source feedstock with a high polypropylene content at a reasonable cost; PCT’s future capital requirements and sources and uses of cash; developments and projections relating to PCT’s competitors and industry; the outcome of any legal or regulatory proceedings to which PCT is, or may become, a party including the securities class action and putative class action cases; geopolitical risk and changes in applicable laws or regulations; the possibility that PCT may be adversely affected by other economic, business, and/or competitive factors, including interest rates, availability of capital, economic cycles, and other macro-economic impacts; turnover in employees and increases in employee-related costs; changes in the prices and availability of labor (including labor shortages), transportation and materials, including inflation, supply chain conditions and its related impact on energy and raw materials, and PCT’s ability to obtain them in a timely and cost-effective manner; any business disruptions due to political or economic instability, pandemics, armed hostilities (including the ongoing conflict between Russia and Ukraine and the conflict in the Middle East); the potential impact of climate change on PCT, including physical and transition risks, higher regulatory and compliance costs, reputational risks, and availability of capital on attractive terms; and operational risk.

We Achieved 3 Key Milestones in Q3 1MM 200K 10K/hr lbs. of Feedstock in a week lbs of Feedstock in 24hrs Feedstock rates in lbs Overview Operations Market Finance

PCT Highlights Operations Achieved all three production milestones Significant progress on rates, uptime and reliability Current Ironton production is exclusively from PCR feedstock Co-product 2 (CP2) improvements implemented and recovery rates have reached up to 15K lbs/day Denver, PA PreP facility is online and producing high yield PP bales at designed rates Compounding operations are running reliably and producing multiple product grades Commercial Secured multiple new customer approvals for PCT resin in defined customer applications Continue to trial new applications for commercial ramp-up into 2025 Strong trial feedback for numerous customer applications in film, fiber and injection molding Margin opportunities for compounding operations continues to look positive Finance Sold $22.5MM of Ironton revenue bonds Raised $90MM through the sale of preferred and common equity as well as warrants Currently positioning company to begin financing growth initiatives with Ironton’s progress Overview Operations Market Finance

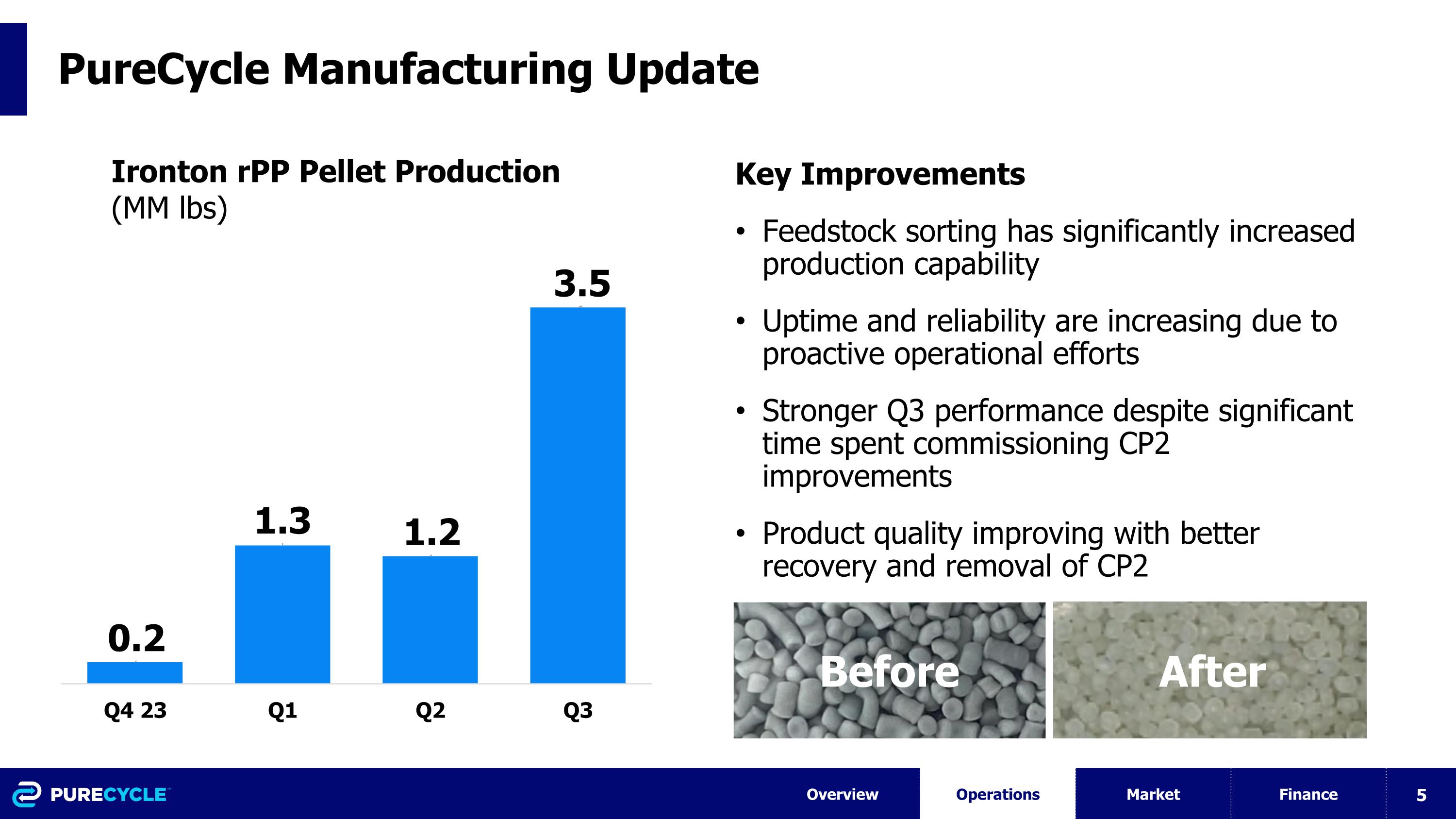

PureCycle Manufacturing Update Overview Operations Market Finance Ironton rPP Pellet Production (MM lbs) Key Improvements Feedstock sorting has significantly increased production capability Uptime and reliability are increasing due to proactive operational efforts Stronger Q3 performance despite significant time spent commissioning CP2 improvements Product quality improving with better recovery and removal of CP2 Before After

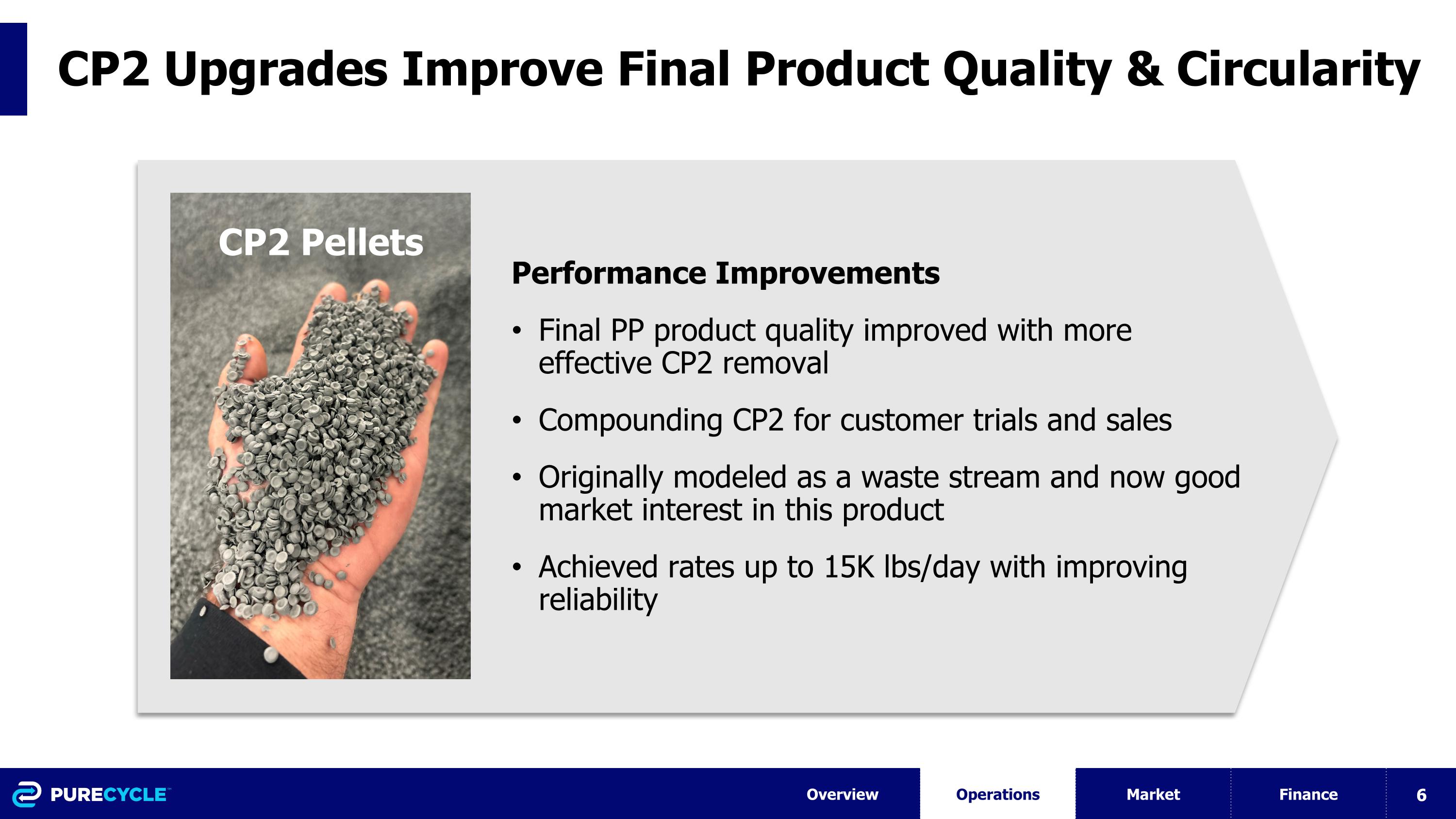

CP2 Upgrades Improve Final Product Quality & Circularity Performance Improvements Final PP product quality improved with more effective CP2 removal Compounding CP2 for customer trials and sales Originally modeled as a waste stream and now good market interest in this product Achieved rates up to 15K lbs/day with improving reliability Overview Operations Market Finance CP2 Pellets

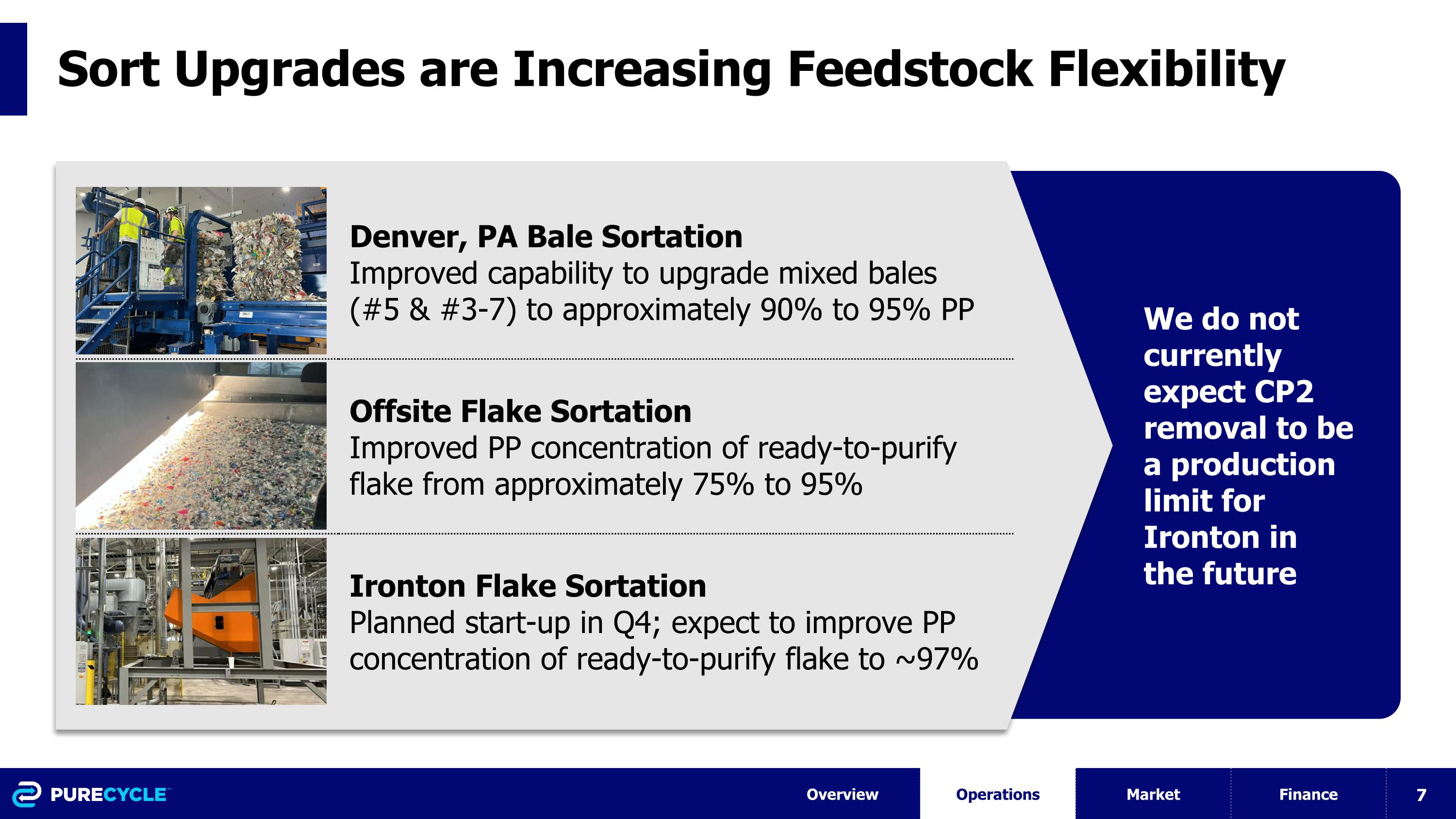

Denver, PA Bale Sortation Improved capability to upgrade mixed bales (#5 & #3-7) to approximately 90% to 95% PP Offsite Flake Sortation Improved PP concentration of ready-to-purify flake from approximately 75% to 95% Ironton Flake Sortation Planned start-up in Q4; expect to improve PP concentration of ready-to-purify flake to ~97% Sort Upgrades are Increasing Feedstock Flexibility We do not currently expect CP2 removal to be a production limit for Ironton in the future Overview Operations Market Finance

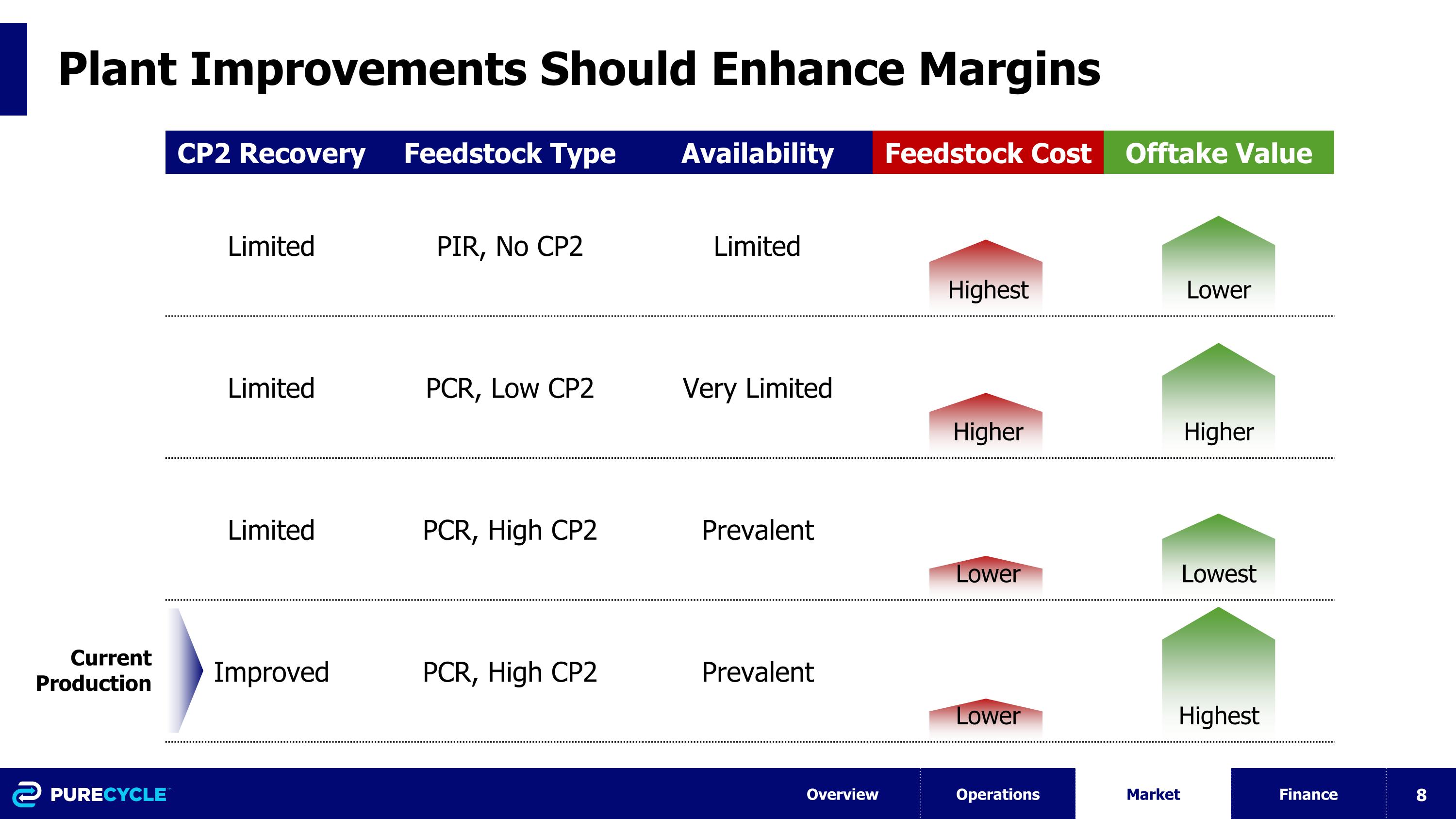

Plant Improvements Should Enhance Margins Overview Operations Market Finance CP2 Recovery Feedstock Type Availability Feedstock Cost Offtake Value Limited PIR, No CP2 Limited Highest Lower Limited PCR, Low CP2 Very Limited Higher Higher Limited PCR, High CP2 Prevalent Lower Lowest Improved PCR, High CP2 Prevalent Lower Highest Current Production

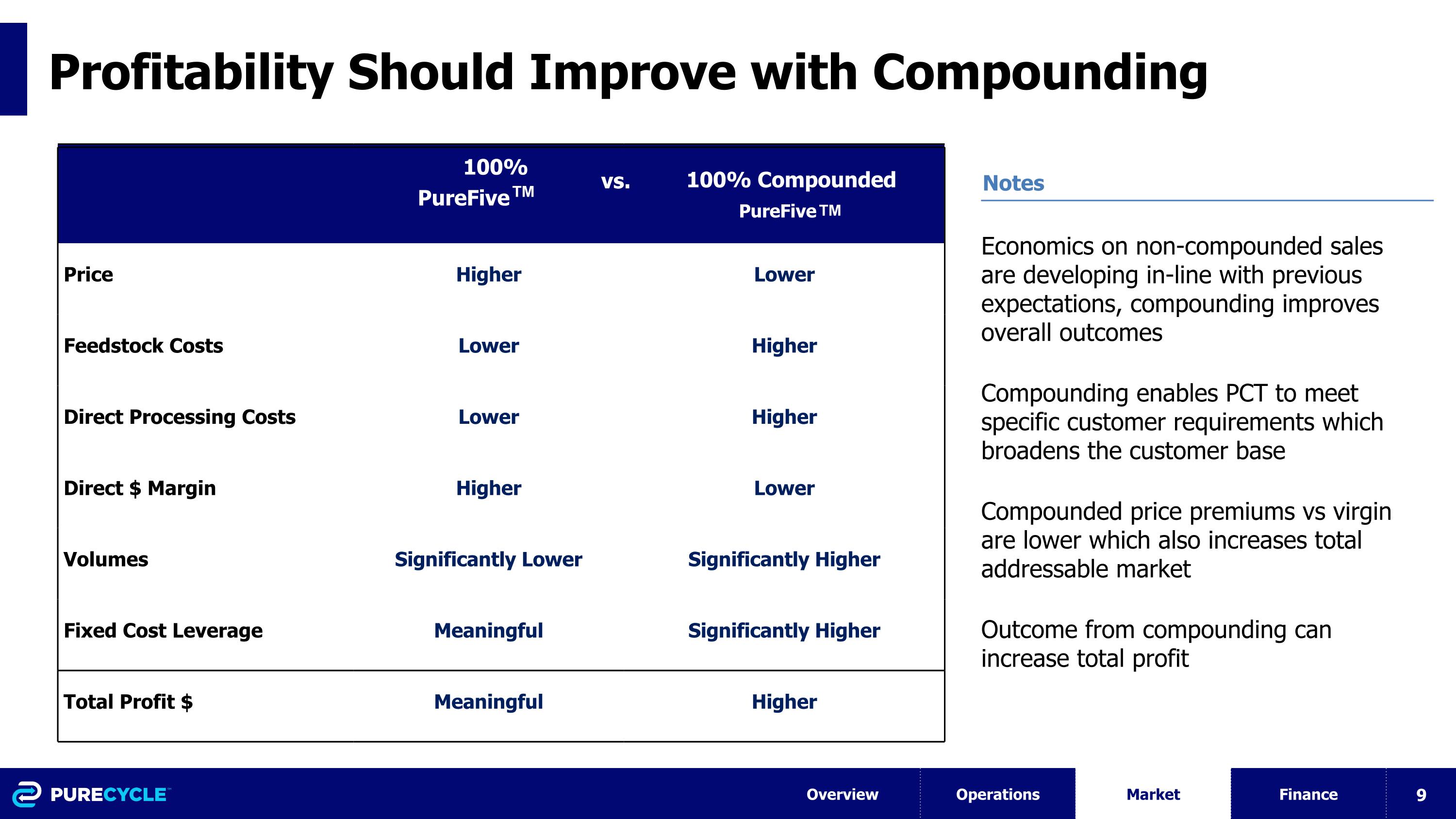

Profitability Should Improve with Compounding Notes Economics on non-compounded sales are developing in-line with previous expectations, compounding improves overall outcomes Compounding enables PCT to meet specific customer requirements which broadens the customer base Compounded price premiums vs virgin are lower which also increases total addressable market Outcome from compounding can increase total profit Overview Operations Market Finance vs 100% PureFive™ 100% Compounded PureFive™ Price Higher Lower Feedstock Costs Lower Higher Direct Processing Costs Lower Higher Direct $ Margin Higher Lower Volumes Significantly Lower Significantly Higher Fixed Cost Leverage Meaningful Significantly Higher Total Profit $ Meaningful Higher vs.

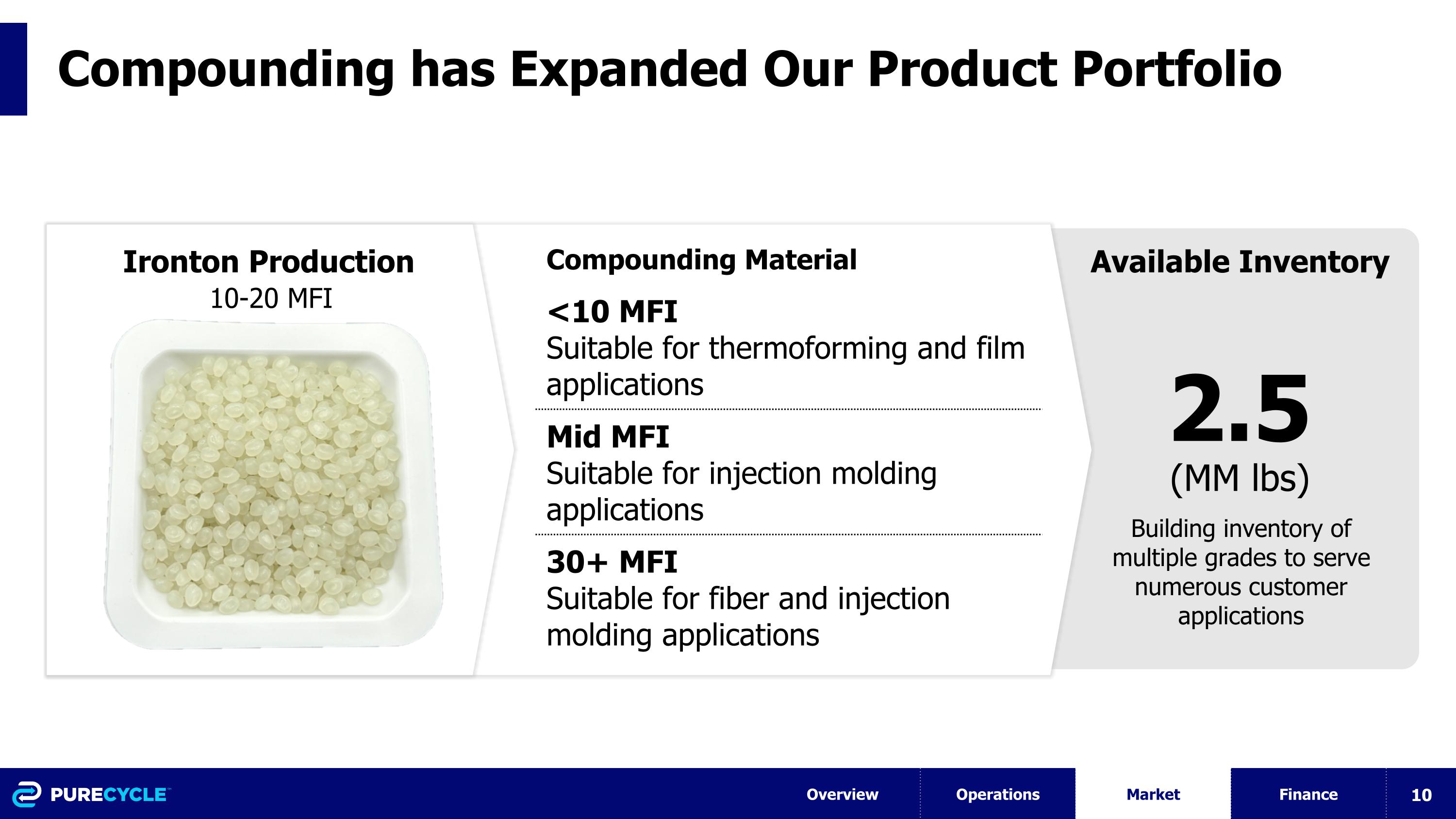

Compounding has Expanded Our Product Portfolio Overview Operations Market Finance Ironton Production Compounding Material <10 MFI Suitable for thermoforming and film applications Mid MFI Suitable for injection molding applications 30+ MFI Suitable for fiber and injection molding applications Available Inventory (MM lbs) Building inventory of multiple grades to serve numerous customer applications 2.5 10-20 MFI

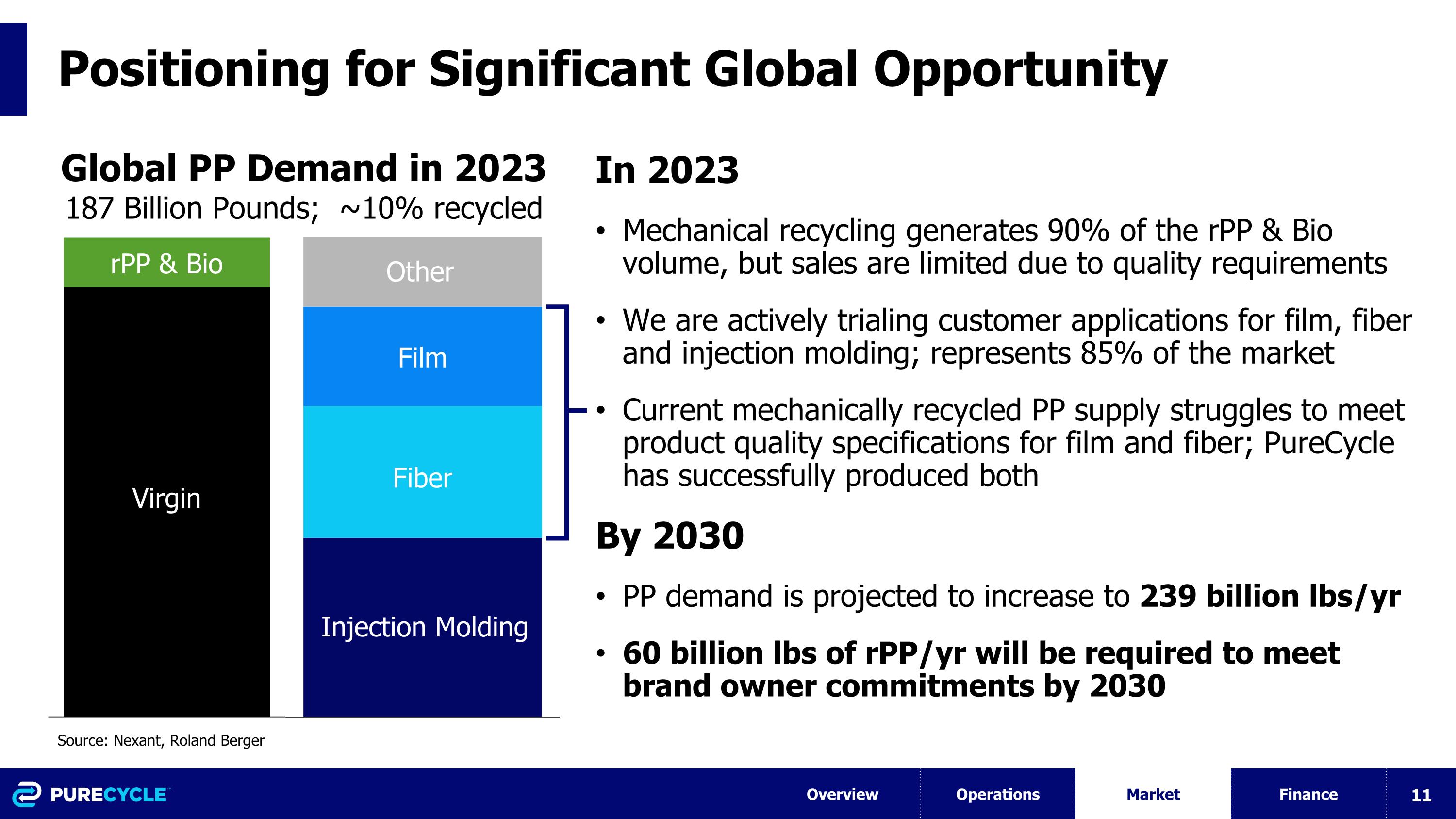

Positioning for Significant Global Opportunity In 2023 Mechanical recycling generates 90% of the rPP & Bio volume, but sales are limited due to quality requirements We are actively trialing customer applications for film, fiber and injection molding; represents 85% of the market Current mechanically recycled PP supply struggles to meet product quality specifications for film and fiber; PureCycle has successfully produced both By 2030 PP demand is projected to increase to 239 billion lbs/yr 60 billion lbs of rPP/yr will be required to meet brand owner commitments by 2030 Source: Nexant, Roland Berger Injection Molding Fiber Film Other Global PP Demand in 2023 187 Billion Pounds; ~10% recycled Virgin rPP & Bio Overview Operations Market Finance

What Our Partners Say “These fabrics perform exactly the same as those manufactured with virgin polypropylene fiber, making them nearly plug and play for our customers. We see an endless number of applications where PureCycle’s resin can be easily incorporated into the textile, transforming the fabric into a sustainable solution without any compromises." Ron Sytz, Owner "I've had great success running PureCycle resin. We’ve been able to produce finer, more delicate filaments for the apparel markets all the way up to thicker filament for the industrial markets. PureCycle resin is showing that it can compete on equal footing with virgin polypropylene." John Garner, Sales Director “It’s been great to hear about the progress in Ironton and with compounding. We’re excited to see that PureCycle has built up their inventory, because this will allow us to begin offering our customers a souvenir cup that includes recycled content.” Erik Johnson, Product Director "We're excited to finally partner with somebody who can repeatedly deliver a post-consumer recycled polypropylene that can be turned into a sustainable fiber for our customers. We've tested PureCycle's material under various operating conditions with good success. We're in the beginning stages of development, but I see this is as a strong growth opportunity for our company." John Parkinson, CEO Overview Operations Market Finance

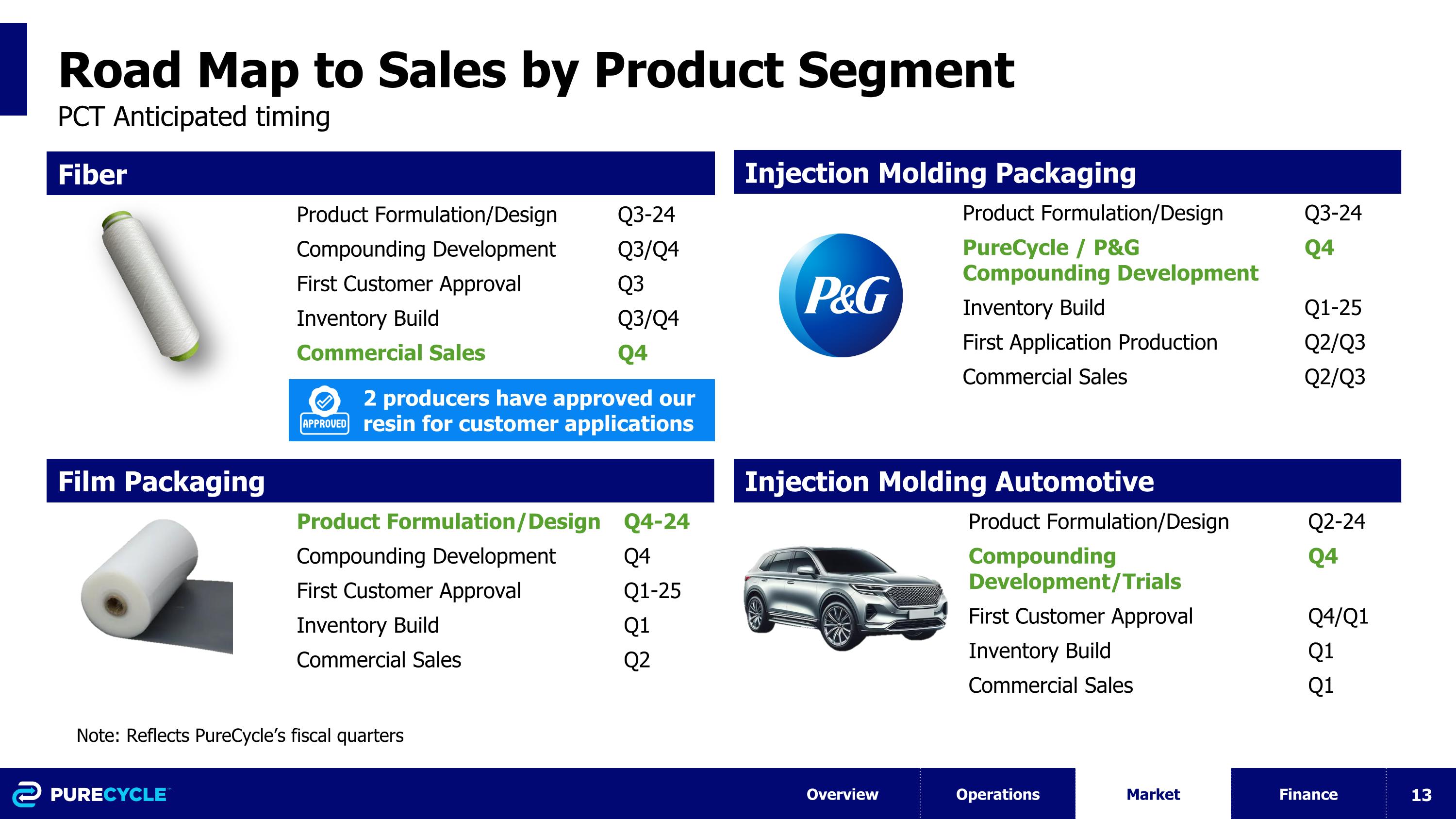

Film Packaging Product Formulation/Design Compounding Development First Customer Approval Inventory Build Commercial Sales Q4-24 Q4 Q1-25 Q1 Q2 Fiber Product Formulation/Design Compounding Development First Customer Approval Inventory Build Commercial Sales Q3-24 Q3/Q4 Q3 Q3/Q4 Q4 Road Map to Sales by Product Segment Injection Molding Automotive Product Formulation/Design Compounding Development/Trials First Customer Approval Inventory Build Commercial Sales Q2-24 Q4 w Q4/Q1 Q1 Q1 Injection Molding Packaging Product Formulation/Design PureCycle / P&G Compounding Development Inventory Build First Application Production Commercial Sales Q3-24 Q4 1 Q1-25 Q2/Q3 Q2/Q3 2 producers have approved our resin for customer applications Overview Operations Market Finance Note: Reflects PureCycle’s fiscal quarters PCT Anticipated timing

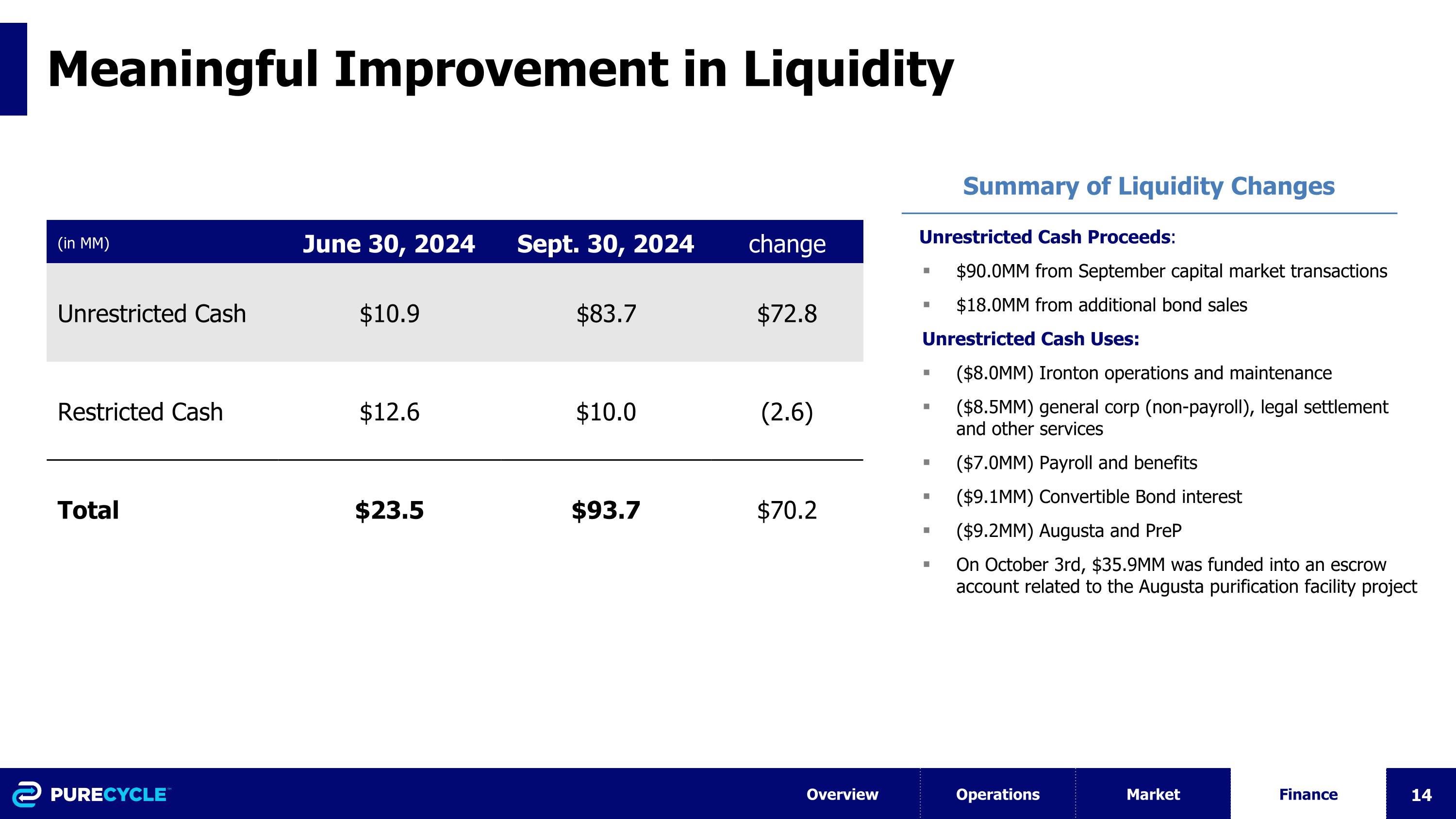

Meaningful Improvement in Liquidity Summary of Liquidity Changes (in MM) June 30, 2024 Sept. 30, 2024 change Unrestricted Cash $10.9 $83.7 $72.8 Restricted Cash $12.6 $10.0 (2.6) Total $23.5 $93.7 $70.2 Overview Operations Market Finance Unrestricted Cash Proceeds: $90.0MM from September capital market transactions $18.0MM from additional bond sales Unrestricted Cash Uses: ($8.0MM) Ironton operations and maintenance ($8.5MM) general corp (non-payroll), legal settlement and other services ($7.0MM) Payroll and benefits ($9.1MM) Convertible Bond interest ($9.2MM) Augusta and PreP On October 3rd, $35.9MM was funded into an escrow account related to the Augusta purification facility project

Third Quarter 2024 Corporate Update November 8, 2024